The Render Token (RNDR) price broke out from a descending resistance trendline on September 9.

Today, it finally moved above the $1.85 horizontal resistance area, reaching the highest price since July.

RNDR Reaches Long-Term Resistance

The weekly timeframe technical analysis for RNDR shows that the price trades just below the $1.90 horizontal resistance area.

Initially, the price seemed to break out from the area in April. But, it failed to sustain the increase and fell below it in July.

The RNDR price broke out from a descending resistance trendline in September and has increased since. It briefly moved above the $1.90 area this week but has yet to reach a weekly close above it.

The weekly RSI gives a bullish reading. The RSI is a momentum indicator traders use to evaluate whether a market is overbought or oversold and whether to accumulate or sell an asset.

Readings above 50 and an upward trend suggest that bulls still have an advantage. Readings below 50 indicate the opposite. The RSI is above 50 and increasing (green circle), both signs of a bullish trend.

Impact of Artificial Intelligence (AI) on the Market

Render Token is one of the biggest projects that leverage AI-related technologies. While the AI sector has been booming in traditional markets, it still lags behind the cryptocurrency sector.

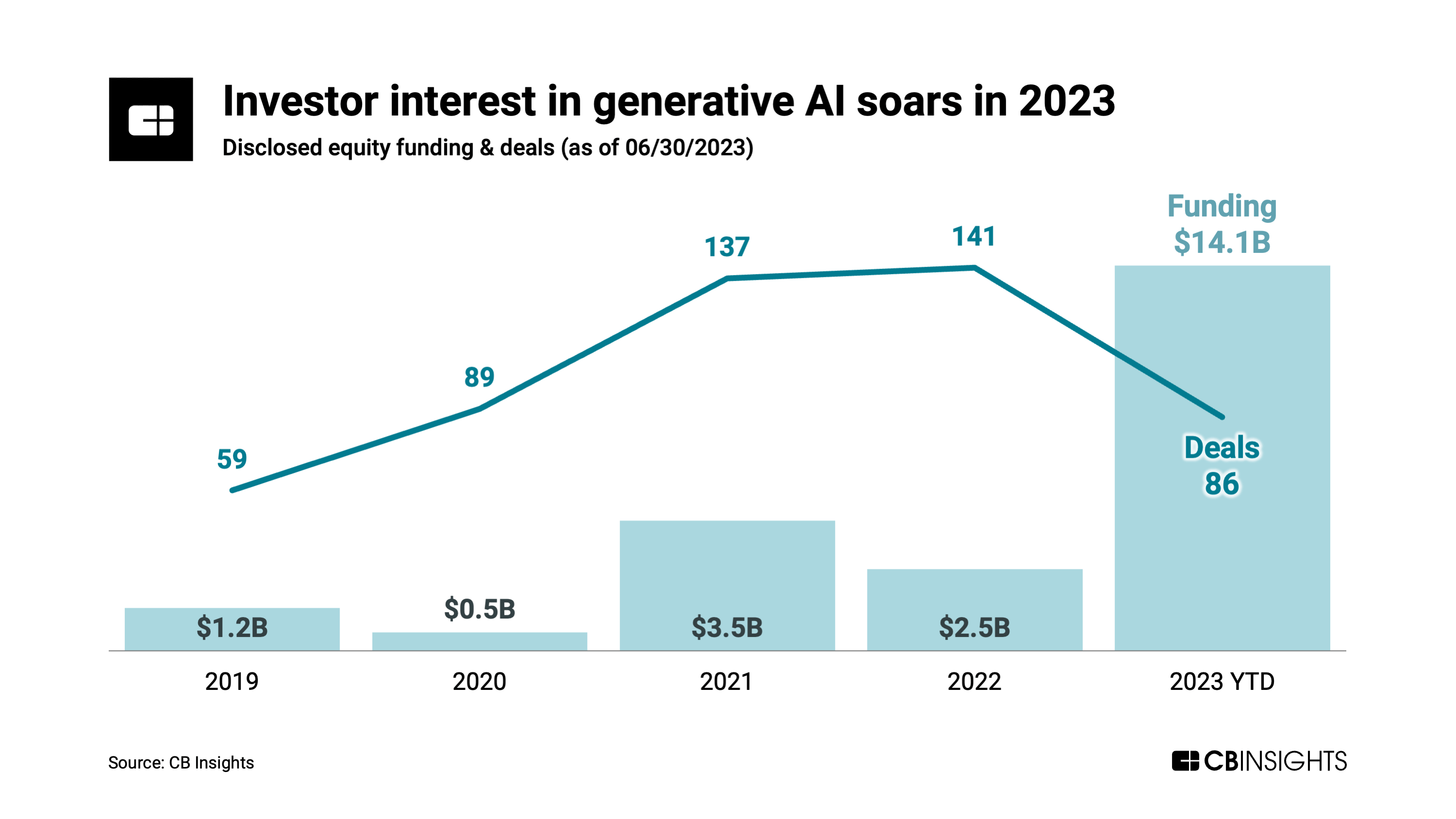

This investment is especially notable in generative AI tools such as Chat-GPT. In 2023, investments in generative AI have so far totaled $14.1 billion, dwarfing the $2.5 billion and $3.5 billion in 2022 and 2021, respectively.

Speaking to BeInCrypto, Mr. Hatu Sheikh, Co-Founder and CMO of DAO Maker stated that this is part of the reason for the decreased VC funding for crypto-related projects.

Just as the market fervor once gravitated toward trends like non-fungible tokens (NFTs) and the metaverse in 2021, the current zeitgeist centers around AI. He believes that once crypto starts gaining traction again, so will investor interest.

Read More: 9 Best Crypto Demo Accounts For Trading

Mr. Sheikh believes that a part of the reason for the AI crypto market lagging behind is that Web3 is not a strong ground for Business-to-Business (B2B) products. Rather, the main monetization lies in Business-to-Consumer (B2C).

AI products in the crypto sphere merely follow and then tokenize traditional business models. So, the main artificial intelligence product of the space will likely involve some form of gamified earn economics, and no AI crypto project is currently doing this.

Finally, he believes that crypto is now a subset of the broader financial market since the main capital inflow comes from the same institutions that operate in traditional finance. So, cryptocurrencies now follow macro trends.

Similarly to how the NFT platform boom followed a luxury brand boom, the AI token narrative boom could come after a boom in AI chips and stocks.

It is worth noting that NVIDIA, which accounts for 70% of the AI chips in the world, is trading only 10% below its all-time high of $500, reached on August 24.

RNDR Price Prediction: Has Bullish Reversal Begun?

The daily timeframe technical analysis for RNDR gives a bullish outlook. The two main reasons for this are that the price has broken out from a descending resistance trendline and reached a daily close above the $1.85 horizontal resistance area.

This is the final resistance area before $2.35 in the daily timeframe.

On top of this, RNDR has broken out from an ascending parallel channel (white), a sign associated with bullish trends. RNDR can increase by another 25% if the upward movement continues, reaching the $2.35 horizontal resistance area.

Despite this bullish RNDR price prediction, a close below the $1.85 horizontal resistance will invalidate the breakout.

In that case, a 30% drop to the $1.30 horizontal support area will be expected.