A report out today by Chainalysis makes grim reading for an industry trying to onboard new users.

The 2023 Crypto Crime Report suggests that in 2022, approximately 25% of all new crypto tokens were pump-and-dump schemes.

Considering Chainalysis strict criteria for inclusion as a pump-and-dump, it is likely that the number is much higher.

The crypto analysis firm analyzed all tokens launched on Ethereum and BNB and in 2022. Tokens were only included if they achieved a minimum of ten swaps and four straight trading days within a week of launch. Based on those rules, the total number of tokens fell to 40,521.

After that, only tokens which saw a 90% price drop — or more — in the first week of trading qualified. Based on those parameters, 9,902, or 24%, of the 40,521 tokens worth analyzing were indicative of pump-and-dump activity.

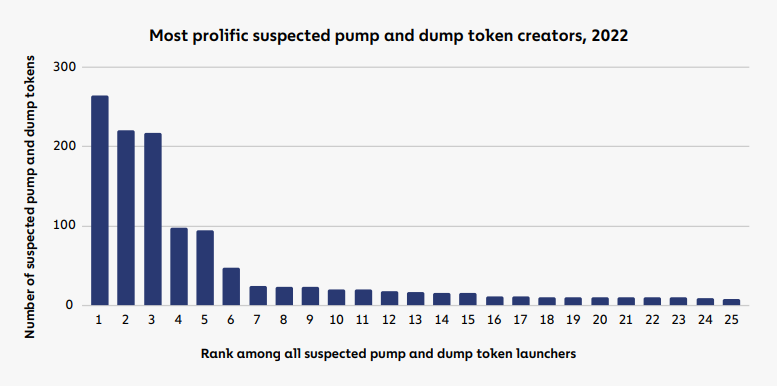

One Fraudster Could Be Behind 264 Schemes

A pump and dump in crypto is when a group of people work together to artificially inflate the price of a digital asset. They create hype and excitement before selling the asset off at a profit, leaving others with losses. It is considered a form of securities fraud and market manipulation, and is illegal in most countries.

Unfortunately, pump-and-dump schemes have become common in crypto. It’s easy for bad actors to launch a new token, control supply, and trade volume, and establish a high price. Anonymous teams make it possible for repeat offenders to carry out multiple schemes without repercussions.

Chainalysis identified one fraudster who was potentially behind up to 264 pump-and-dump schemes in 2022.

Tell-tale signs of a pump and dump include a sudden spike in hype and price, a sudden increase in trading volume, and a lack of fundamentals that would make that token worth purchasing.

You can read the full report here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.