Non-KYC crypto exchanges offer users the ability to buy, sell, and trade cryptos without undergoing identity verification processes. This unique feature has made them particularly appealing to individuals who prioritize their privacy and seek to anonymous crypto trading.

Here’s our top selection of crypto exchanges without KYC that will help preserve your anonymity when trading cryptocurrency in 2025.

- What are the best no-KYC crypto exchanges?

- 1. StealthEX

- 2. BingX

- 3. BYDFi

- 4. BloFin

- 5. CoinEx

- 6. ProBit Global

- 7. dYdX

- 8. Kraken

- 9. Margex

- 10. MEXC

- 11. Apex

- 12. PancakeSwap

- 13. Gate.IO

- 14. Changelly

- 15. Bisq

- 16. Bitfinex

- Top no-KYC exchanges compared

- What is KYC?

- Why use a non-KYC crypto exchange?

- Is there a way to buy crypto without KYC?

- How to pick a no-KYC exchange

What are the best no-KYC crypto exchanges?

1. StealthEX

StealthEX is a global no-KYC exchange that allows you to swap and purchase over 1,500 assets. StealthEX operates through a network of liquidity providers to offer customers the best exchange rate. You can also purchase crypto with a credit card and without registering an account. Lastly, StealthEX also has an affiliate program and Swapping API that users can integrate into their services.

- Does not require a registered account

- Supports more than 1,500 assets

- Operates though a network of liquidity providers to offer the best exchange rate

- Limited features beyond buying and swapping

2. BingX

BingX is also a great choice as a no-KYC crypto exchange, as it offers a fully functional spot and derivative markets with a wide selection of over 250 cryptocurrencies. You can use it to convert crypto quickly or to access the advanced trading platform with charting tools, live order books, multiple order types, and a grid trading bot.

The platform also offers a copy-trading feature that allows beginners to follow successful traders and potentially earn from their trades.

- Copy-trading feature

- Trading fees are capped at 0.2%

- Access to 24/7 live chat support for prompt assistance.

- Intuitive mobile app for convenient trading on the go.

- Lack of support for fiat currency deposits, limiting trading options to third-party purchases only.

- Limited information provided on asset cold storage and specific security measures in place.

- Crypto-to-crypto transactions restricted to USDT trading pairs

3. BYDFi

BYDFi is a Singapore-based exchange that operates in over 150 countries, offering its trading services to a global user base. While this is a no-KYC crypto exchange, the platform offers fiat deposits through third parties, which require KYC on that respective platform (Banxa, XanPool, Transak, Ramp, Paxful, Coinify and Mercuryo).

Note that the KYC process on the BYDFi platform is only required for deposits through Indonesian, Vietnamese, or Thai fiat channels. Also, these users must complete 20% of the transaction deposit amount on Lite Contracts or perpetual contracts before withdrawing.

- Crypto margin trading accounts available

- Competitive fees for trading

- More than 50 fiat currencies are accepted

- No crypto staking feature offered

- Absence of phone customer support

- No advanced trading features

4. BloFin

This fast-growing crypto exchange offers premium perpetual and futures trading services with over 350 USDT-M trading pairs, covering Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and various altcoins, along with up to 150X leverage.

The comprehensive ecosystem includes spot trading, copy trading, crypto buying, wealth management, educational resources, API access, and more, all accessible right from your phone. Users can seamlessly transition between the mobile app and web platform for uninterrupted trading, even on the go.

- Over 350 USDT-M contracts, 230 spots

- Low futures and spot trading fees

- Low trading minimums

- Unavailable in many countries

5. CoinEx

CoinEx is a centralized exchange (CEX) that has a host of products. Alongside its trading platform, the platform offers a spectrum of services, encompassing a mining pool, cryptocurrency wallet, proprietary blockchain, and an ecosystem-focused investment platform.

Utilizing an internally developed proprietary trading engine, the platform boasts a user-centric approach, capable of efficiently managing up to 10,000 transactions per second (TPS). Founded in 2017, CoinEx stands as a CEX located in Hong Kong, but serves a global class of customers.

- Proof of reserves

- Multiple products, including Futures and Earn features for idle assets

- 10,000 transactions per second

- Not available in U.S.

- Payouts in native CET token

6. ProBit Global

ProBit Global was founded in 2017 and is based in Seoul, South Korea. The crypto exchange has over 3 million users, more than 800 altcoins, and over 1,000 markets to choose from for trading.

Users need only an email for the sign up process without KYC on ProBit Global. This Level 1 account has a daily withdrawal limit of up to $5,000. If you decide to KYC and upgrade to a Level 2 account, your withdrawal limit will increase to up to half a million dollars. You will also gain access to potentially lucrative initial exchange offerings (IEO).

ProBit Global also supports over 40 languages, and a multitude of payment methods, including Apple/Google Pay, bank transfers, debit/credit, and more. The trading fees are some of the lowest in the industry. Moreover, when you stake PROB, the platform’s native token, you can enjoy further trading discounts.

- Supports multiple languages and countries

- Over 800 cryptocurrencies and more than 1,000 markets

- Users can buy crypto with a near endless number of payment methods

- Available on Android and iOS

- Low withdrawal limits for unverified users

7. dYdX

dYdX is a decentralized exchange built on the Ethereum blockchain. It enables users to trade ERC-20 tokens and ETH through smart contracts. It prioritizes user privacy by operating as a non-KYC exchange, ensuring that personal information is not required.

The platform boasts high liquidity thanks to its utilization of margin trading. However, it’s important to note the potential risk of liquidation associated with margin trading. To access dYdX, users must possess an Ethereum-compatible wallet. Furthermore, it’s worth mentioning that the exchange offers a limited selection of trading pairs.

- Offers low fees, particularly beneficial for average users

- Utilizes Zk-rollups technology, enhancing scalability and efficiency

- Opportunity to earn interest through lending activities

- Limited number of assets available for swaps

- Interest rates offered may vary, depending on your trading volume.

- Fiat deposits are available through third party which require KYC

8. Kraken

Kraken is a worldwide crypto exchange offering four user verification levels: Starter, Express, Intermediate, and Pro. You can use Kraken as a no-KYC crypto exchange if you stick to the Starter verification level, which only requires your email, name, date of birth, phone number, and physical address. No documents, such as ID, proof of address, or a selfie, are needed.

Your account can withdraw up to $5,000 in crypto in a 24-hour window for the Starter verification level, which can be considered a no-KYC level. The deposits are unlimited for the Starter level.

However, it’s important to note that depending on your country of residence, certain restrictions may apply regardless of the verification level. These restrictions could impact your ability to deposit or withdraw cryptocurrency or cash.

- A wide range of digital assets

- Low fees for Pro users

- Limited funding options

- Starter level can’t use credit/debit card for funding

- Not available in all U.S. states

9. Margex

Margex is a cryptocurrency trading platform operating from its base in Seychelles; it boasts several notable attributes. Specifically, it stands out with an impressive average execution time of just eight milliseconds.

Furthermore, it maintains a substantial order book, aggregating a total worth exceeding $40,000,000, sourced from a network comprising over 12 liquidity providers. Its capacity to handle up to 100,000 transactions per second (tps) is equally remarkable.

- Mobile support

- Low fees

- Fast execution

- Multiple order types

- Low minimum deposit

- Restrictions based on regions

- No native fiat support

10. MEXC

MEXC offers a wide range of unique trading products and crypto financial services. With over 2600 coins, it surpasses many other centralized exchanges.

Traders can trade on spot, margin, and ETF markets, including the ability to take 3X long and short positions on various coins. The platform has a native token, MX, and holders have multiple benefits, including fee reductions, project voting, lottery bonuses, and more. MEXC also offers a user-friendly mobile app, which is available for both iPhone and Android devices.

- Yield earning opportunities

- Extensive selection of coins and trading pairs

- Derivative instruments

- Advanced charting and trading tools for in-depth analysis and strategy development

- The wide range of offerings may make the platform complex to navigate and understand for some users

- Smaller liquidity compared to competitors due to the absence of partnerships

- The founding team and executives don't have a very interactive presence

- Flat fee schedule may not be as flexible or tailored to specific trading needs

11. Apex

Apex is a great option for a no-KYC crypto exchange because it is a non-custodial trading platform with limitless cross-margined perpetual contracts.

The platform uses the order book model, combining the security and transparency of decentralized exchanges (DEX) with the speed and usability of centralized exchanges (CEX). Apex has low fees and great leverage and offers instant settlement for amplified earnings and optimized trade sizes. It aims to become the bridge between order book trading and permissionless trading.

- ApeX Pro DEX offers low maker and taker fees of 0.02% and 0.05%, respectively, with zero network charges.

- Users have the potential to earn rewards through staking, referrals, trade-to-earn incentives, and more.

- There are no minimum investment requirements, no KYC (Know Your Customer) or signup requirements. The user interface is designed to be user-friendly, taking inspiration from Bybit.

- The ApeX Pro DEX is a non-custodial platform developed and backed by Bybit

- Limited trading pairs compared to other platforms

- The platform is not available for traders in the United States

- Lower leverage than competitors

- Withdrawals from ApeX Pro DEX can take up to found hours for slow withdrawals with a $1 fee over layer-2 (L2), while fast withdrawals incur a $5 fee

12. PancakeSwap

Pancakeswap is one of the most popular decentralized exchanges on the BNB blockchain. It is a fork of Uniswap and has since been added to the platform in its V2 and V3 versions of the decentralized application. Pancakeswap was created in 2020 by a group of anonymous developers. It uses an automated market maker (AMM) mechanism to source user liquidity. Pancakeswap is active on the BNB chain, EVM-compatible blockchains, layer 2’s, and even the Aptos blockchain. The DEX allows you to spot trade, trade derivatives, earn, and bridge assets.

- One of the low fee crypto exchanges, making it more affordable for trading activities

- Large user base and active community

- Supports trading of a huge variety of cryptocurrencies

- Offers derivatives, providing additional trading opportunities for users

- Has a bridge for moving between chains

- Restricted in certain geographic locations

- Some assets may have limited liquidity

13. Gate.IO

With over 1,700 cryptocurrencies available for trading, Gate.io stands out for its vast selection, including top market cap coins and less common tokens that are difficult to find on other exchanges. The platform supports approximately 50 fiat currencies and provides a feature-rich trading experience while maintaining reasonable trading fees, with the highest fee capped at 0.2%. Customers can also explore other options to reduce costs, such as utilizing Gate.io’s utility token.

Gate.io operates in over 200 countries, catering to many users worldwide. However, certain advanced features may only be available in some countries, including the United States.

- Wide variety of cryptocurrencies available for trading

- Accepts approximately 50 fiat currencies for easy trading

- Offers advanced trading features for experienced users

- Low fee crypto exchange

- Uncertain regulatory status in some U.S. states

- Not so user-friendly interface

- High deposit fees may deter some users

14. Changelly

Changelly is a fantastic instant exchange platform that offers quick and secure cryptocurrency transactions without requiring the complicated KYC verification process. With Changelly, you can easily exchange one cryptocurrency for another in just a few simple steps. Within 30 minutes or even less, your new crypto will be safely stored in your wallet.

What’s great about Changelly is that they prioritize the security of your funds. They don’t store your money, ensuring that your assets remain protected. On this platform, you have the flexibility to trade over 400 different cryptocurrencies at fixed or floating rates. Additionally, you can even purchase cryptocurrencies using more than 90 fiat currencies.

- User-friendly interface

- No hidden fees

- Offers both fixed and floating rates

- No built-in wallet

- Depending on the specific crypto you’re purchasing, they have different partners, which may ask for a KYC verification

15. Bisq

Bisq stands out as a well-known decentralized exchange that prioritizes decentralization and user ownership. Its key perks include increased privacy, lower fees, and maintaining control over your crypto assets.

The exchange offers various payment options, allowing you to buy crypto using U.S. dollars through cash deposits, Zelle payments, or electronic transfers. With instant approval and no geographical restrictions, Bisq ensures convenient and accessible trading for all users. By eliminating the need for depositing funds, Bisq provides users with control over their assets and emphasizes security by storing personal and banking information locally on users’ computers.

- Decentralized exchange

- Flexible payment options

- Instant approval

- No geographical restrictions

- Enhanced security

- Decentralization may not suit everyone

- Basic application interface

- Potential for fraud

16. Bitfinex

Bitfinex, established in 2012, is a well-established cryptocurrency exchange and one of the largest in terms of trading volume. It offers a wide range of cryptocurrencies, including bitcoin, ethereum, and many others.

The platform provides a user-friendly trading experience with advanced charting tools, order depth charts, and quick access to buy and sell supported currencies. Bitfinex maintains relatively low trading fees, making it cost-effective for users.

- Competitive trading fees

- Support for margin trading, derivatives, and advanced order types

- Paper trading and mobile app suitable for beginners

- History of regulatory missteps and fines

- Questionable involvement with the Tether currency

- Not available in the United States

Top no-KYC exchanges compared

| Exchange | Availability | Assets | Fees | Everywhere except U.S. and U.S.-sanctioned countries | Website |

|---|---|---|---|---|---|

| Stealthex | Global | 1,500 | Varies | Android | www.stealthex.io |

| Bydfi | E.U. &150+ | BTC & 40+ | 0.1% to 0.3% maker/taker fees | Android & iOS | www.bydfi.com |

| BloFin | 130+ | 19 (spot) & 300 perpetual contracts | 0.1% (spot), 0.02 (maker) & 0.06% (taker) futures | Android & iOS | www.blofin.com |

| CoinEx | E.U., S.I.C., and 100+ | BTC, ETH, and 700+ | 0.08%-0.2% | Android & iOS | www.coinex.com |

| ProBit Global | 190+ | BTC, ETH & 800+ | 0.03-0.02% | Android & iOS | www.probit.com |

| BingX | E.U. & 100 | BTC & 500+ | 0.05% – 0.2% | Android & iOS | www.bingx.com |

| dYdX | Global (limited) | BTC & 37+ | 0 | iOS | www.dydx.exchange |

| Kraken | U.S. &150+ | BTC & 220+ | 0.16% maker / 0.26% taker | Android & iOS | www.kraken.com |

| Margex | Everywhere except U.S. and U.S. sanctioned countries | 39 | 0.019% to 0.06% maker/taker | Android & iOS | www.margex.com |

| Changelly | EU & 150+ | BTC & 500+ | 0.25% | Android & iOS | www.changelly.com |

| ApeX | Global | BTC & 15+ | 0.02% maker / 0.05% taker | Android & iOS | www.apex.exchange |

| MEXC | U.S. & 150+ | BTC & 1600+ | 0.2% | Android & iOS | www.mexc.com |

| Pancakeswap | 100+ | 1000+ | 0.01%-0.25% | Android & iOS | pancakeswap.finance |

| Gate.io | E.U. & 180+ | BTC & 1700+ | 0.2% | Android & iOS | www.gate.io |

| Bisq | Global | BTC & 500+ | 0.65% | Android & iOS | www.bisq.network |

| Bitfinex | E.U. & 180+ | BTC & 190+ | 0.1% maker 0.2 % taker | Android & iOS | www.bitfinex.com |

What is KYC?

KYC stands for Know Your Customer. It is a process performed by financial services that handle fiat payments from their customers. Crypto businesses, known as VASPs (Virtual Asset Service Providers), have to verify the identities of their clients during the onboarding process or occasional transactions. This is done as part of the due diligence process and to ensure compliance with regulations, particularly anti-money laundering (AML) regulations.

During onboarding, clients must provide certain minimum information, including their full name, residential address, and date of birth. The platform then compares this information to the government-issued documents submitted by the client. Depending on the jurisdiction, the platform may request additional personal data such as place of birth, nationality, tax code, wallet addresses, and transaction hashes.

Many crypto services rely on specialized third-party solutions to conduct the KYC process. While KYC is a great tool for helping with money laundering, it also affects everyday users who wish to preserve their anonymity.

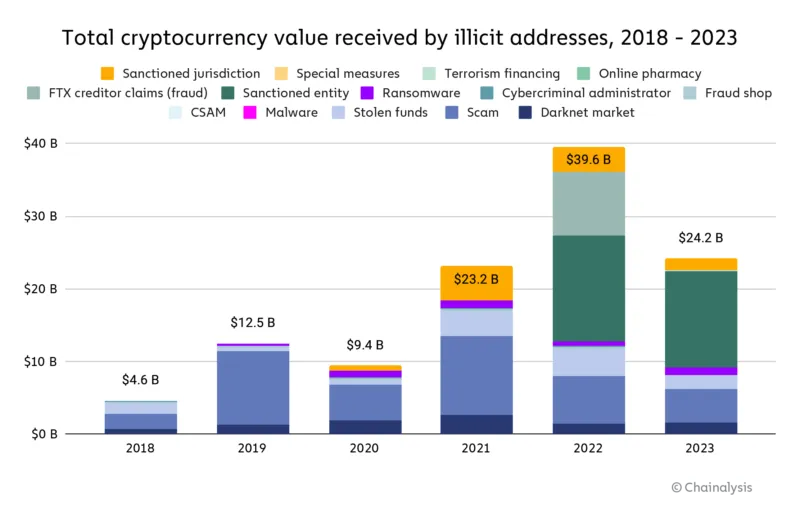

This Chainalysis crime report demonstrates the scale of the problem of criminality in crypto — the other side of the coin when it comes to KYC.

It’s not unexpected to see these trends. As anticipated, the total volume of transactions decreased following the start of the bear market, and as previously illustrated, the volume of illicit transactions experienced a slight increase. This pattern was first observed in August when it was noted that legitimate transaction volumes were diminishing at a quicker rate compared to illicit volumes.

Can’t bypass the KYC verification? If privacy is your main concern, you can also use a crypto mixer to regain privacy for your crypto funds.

Why use a non-KYC crypto exchange?

This listicle demonstrates ways to buy cryptocurrencies without undergoing Know Your Customer (KYC) verification. No-KYC crypto exchanges connect buyers and sellers directly, operating on a peer-to-peer basis without the need for intermediaries or centralized authorities.

Furthermore, transactions can often involve using crypto wallets, enhancing privacy and security for users who prefer anonymous crypto trading while participating in the cryptocurrency market.

This inclusivity opens up opportunities for users worldwide, including countries with restrictive regulations or limited access to traditional financial services.

However, it’s important to note that while no identity verification exchanges provide certain advantages, users should also consider the potential risks involved. These exchanges may have lower security standards and increased vulnerability to illicit activities. Therefore, individuals must exercise caution, conduct thorough research, and implement additional security measures to safeguard their funds and personal information.

Is there a way to buy crypto without KYC?

As demonstrated in this listicle, there are ways to buy cryptocurrencies without undergoing Know Your Customer (KYC) verification. These no-KYC top crypto exchanges typically operate on a peer-to-peer basis, connecting buyers and sellers directly without the need for intermediaries or centralized authorities. Additionally, you can buy Bitcoin anonymously through some of these platforms, further enhancing privacy.

For users seeking anonymity while partaking in the cryptocurrency market, transactions can often be conducted using anonymous crypto wallets. This approach enhances privacy and security by concealing the user’s identity and details from third parties.

No identity verification exchanges provide a solution for individuals who prioritize privacy and want to trade cryptocurrencies without disclosing personal information. Platforms like Tornado Cash enhance this privacy by enabling further anonymization of transactions. Additionally, the Railgun network employs advanced cryptographic strategies to ensure user anonymity within DeFi applications. Users can maintain anonymity and keep their personal data secure using decentralized exchanges (DEX).

In addition to non-KYC exchanges, there are also peer-to-peer trading platforms. These P2P platforms allow users to interact directly with other individuals to buy or sell cryptocurrencies without KYC verification. These platforms facilitate secure transactions between parties and often offer various payment options to accommodate different preferences. It’s important to note that while non-KYC options provide privacy advantages, users should still exercise caution.

How to pick a no-KYC exchange

Now that you know some of the best no-KYC exchanges on the market, you will need a way to choose the right exchange. Here are a few strategies to find the cream of the crop among crypto exchanges that don’t require KYC.

Additionally, anonymous crypto wallets can significantly enhance your privacy and security when transacting on these platforms. This extra step ensures that, beyond choosing a suitable exchange, your assets are kept in wallets that prioritize remaining unidentified.

@Thebitcoinway_: X

Here are the factors to consider:

1. Geographical restrictions

You should always check to see if the exchange is available in your region or jurisdiction. This will determine if you can use it at all. You should also stay wary of any local laws governing the use of no-KYC exchanges.

2. Reputation

An exchange’s reputation, regardless of KYC status, will always play a significant role in choosing whether or not you should use it. Naturally, a bad reputation means that you should avoid the exchange.

However, a bad reputation can mean a lot of things, such as:

- Multiple hacks

- Arbitrary account closures

- Too many bad customer reviews

- Market manipulation

In this scenario, your best bet is to scour social media, forums, and customer review websites to get the most accurate reputation of the exchange.

3. Security

Security is often a broadly interpreted term. In general, you need assurance that your data is not collected, your funds are safe, and your account is safe.

This means good encryption methods; the majority of the assets remain in cold storage, account protections, and protocols for handling customers’ funds. What helps give customers the assurance of safety is the transparency of these methods.

Search for any information on 2FA or multi-factor authentication. Is the platform self-custody, or does it use a web3 security company? Does the platform have crime insurance, and what are the privacy policies? These are all key considerations.

4. Liquidity and asset support

It should go without saying, but you will naturally want an exchange with deep liquidity. Using an exchange where you can’t get in or out of positions as you please wouldn’t make much sense. Secondly, you will probably want a good selection of altcoins to purchase. Naturally, when you see a token you like, or that has potential, you will want to grab it before most people catch on.

On the other hand, you may want to trade derivatives like crypto options, futures, or perpetuals. In this case, you will need both good liquidity and asset support for trading pairs. Some centralized exchanges will have liquidity providers to ensure that you are able to trade with ease. In this case, you may also want to remain aware of the low-fee crypto exchanges.

5. Customer support

Finally, excellent customer service is essential for any business. Ensure that the exchange provides prompt and helpful support. Look for services like a chatbot, customer help center, email, or phone support where you can interact with a real person.

This aspect becomes even more critical for a no-KYC exchange since customers typically have fewer assurances than they would with a KYC exchange. Effective customer service, combined with transparency, is key to preventing customers from feeling left out of the loop.

What’s the best no-KYC crypto exchange for you?

From the platforms we have listed, Bisq stands out as a decentralized exchange that offers increased privacy. Gate.io is known for its extensive selection of cryptos. These are a few examples of crypto exchanges that don’t require KYC.

Additionally, dYdX offers a decentralized trading experience for professional traders who want to unlock features such as margin trading. For beginners and altcoin traders, the MEXC crypto exchange provides a comprehensive trading platform with advanced features and a large selection of cryptocurrencies at competitive fees. Whether you’re a seasoned trader or just starting, finding the right exchange is crucial to steering the crypto market successfully. But ultimately, the best exchange for you depends on your specific requirements and preferences. Always review the terms and policies of any exchange before you register to ensure they align with your needs.

Frequently asked questions

A no KYC (Know Your Customer) exchange is a cryptocurrency exchange that allows users to trade cryptocurrencies without requiring them to go through the process of verifying their identity. These exchanges prioritize user privacy and anonymity by not requesting personal information such as government-issued documents or proof of address. Users can create accounts, deposit, trade, and withdraw funds without the need for KYC verification. Some of the most popular no KYC crypto exchanges are DEXs that don’t interact with fiat currencies.

Investing in cryptocurrency without completing KYC is possible through decentralized exchanges (DEXs), certain peer-to-peer (P2P) platforms, and crypto ATMs, which may allow small transactions anonymously. However, this approach often has higher risks, such as increased vulnerability to scams and limited legal protection. Always proceed with caution and conduct thorough research before investing.

Many people have a reluctance to KYC for various reasons. The most prominent reason is concerns of privacy, typically stemming from a belief of infringement on privacy rights. Additionally, many people also believe that there is a great amount of counterparty risk associated with handing over one’s personal data. This comes from the possibility of hackers stealing user’s personal data and selling it on the dark web.

Using an exchange that doesn’t require KYC verification has several limitations. Firstly, these exchanges often impose lower withdrawal and transaction limits than KYC-compliant platforms to mitigate the risk of money laundering and fraud risk. Secondly, the selection of available cryptocurrencies and trading pairs might be more limited, as some assets require adherence to regulatory standards that include KYC. Additionally, users might find reduced customer support services and fewer options for fiat currency transactions. These limitations are a trade-off for the increased privacy and reduced entry barriers provided by no KYC exchanges.

Whether you have to report your crypto transactions largely depends on your geographic jurisdiction and your crypto activities. Some countries may not require you to report, while others do. For example, in the United States you may not have to report sending crypto from one of your wallets to another, but you would report conversions into other crypto.

Whether or not non-KYC exchanges typically depends on the exchange and the security risks that you are concerned with. For example, if you have any disputes with a non-KYC exchange there may be limited legal recourse. If you are concerned with using a non-KYC exchange, it may be best to avoid using the platform. If you choose to use a non-KYC exchange, you should always do your research on the exchange’s practices.

Metamask is non-KYC. However, the default RPC provider for Metamask, Infura, does collect wallet and IP addresses. Although, you can switch to other providers that do not collect your personal information.

People that have an affinity for privacy preserving technologies like cryptocurrency tend to have a reluctance to KYC procedures. This stems from an apprehension to laws that infringe upon privacy, leading to or resulting in draconian measures. Moreover, they may also be concerned with the security of sensitive information that may be used for targeted advertising or sold to third parties, especially without consent.

No, Binance requires users to verify their identity through a process known as KYC (Know Your Customer) to use its full range of services, including trading, deposits, and withdrawals. This policy has been in place since July 2022. If you haven’t completed this verification, you’ll be limited to accessing certain features only, like NFTs, fan tokens, and gift cards.

For Ethereum (ETH) trading on non-KYC exchanges, you can use PancakeSwap, dYdX, Bisq, Changelly, ChangeNOW, MEXC, Gate.IO, and Apex. These platforms generally offer options to trade with reduced or no KYC processes, especially for small-scale transactions or where decentralized mechanisms are used.

For trading Bitcoin with fiat on exchanges that do not require KYC verification, you can use platforms such as Apex, PancakeSwap, Gate.IO, dYdX, Changelly, ChangeNOW, Bisq, and Bitfinex. These exchanges are particularly useful for those who prefer privacy and simplicity, as they allow for transactions that typically require minimal or no KYC. This would particularly benefit smaller trades or operations within decentralized frameworks.

No-KYC exchanges often have lower liquidity compared to their KYC-enforcing counterparts. This is because many institutional traders and large-scale investors prefer fully compliant platforms with regulatory standards, including thorough KYC checks. Lower liquidity can lead to larger price spreads and more volatile trading conditions, which might only be ideal for some traders.

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.