In August 2022, the U.S. government took an unprecedented step as it moved to crack down on privacy-preserving crypto technology. New rules from the U.S. Treasury banned U.S. citizens from using Tornado Cash. The service utilizes a type of cryptographic technology that severs the observable link between those sending and receiving cryptocurrency.

As a result, cryptocurrency users who prioritize privacy are thus scrambling to look for Tornado Cash alternatives. Before examining some of these, it is first useful to explore why crypto users might want to use services like Tornado Cash in a world where absolutely transparent blockchains dominate.

- Not everyone wants full blockchain transparency

- Why might users want to stay anonymous?

- What is Tornado Cash?

- The U.S. government cracks down on Tornado Cash

- Trouble worsens for Tornado Cash

- Crypto censorship issues challenge decentralization

- Are privacy coins the solution?

- Tornado Cash alternatives

- Comparing the leading privacy platforms: Alternatives to Tornado Cash

- What is the best Tornado Cash alternative?

- Frequently asked questions

Not everyone wants full blockchain transparency

Many of the widely used blockchains contain a publicly accessible record of the entire history of all the transactions made by all users that have ever existed. Essentially, these blockchains are completely transparent. Anyone with an internet connection can view the current balance and transaction history of all the Polygon and Litecoin network users that have ever existed.

Crypto users interact with the network via wallets, each with a publicly known address. Creating a wallet doesn’t require a user to input any personal information, but these wallets aren’t necessarily anonymous. Rather, these wallets are referred to as pseudo-anonymous. In the case of Ethereum, a user may choose to link their personal identity to their wallet publicly.

Many do this using the very popular Ethereum Name Service (ENS) application, which switches their wallet’s public address into a custom username. However, many Ethereum users might wish to keep their identity and transaction history on the blockchain anonymous. These users risk being “outed” — i.e., their real-world identity could be linked to their wallet’s public address against their consent. Bitcoin users and the users of other completely transparent blockchains face the same risks.

Why might users want to stay anonymous?

It’s easy to forget for those living in free, democratic Western countries that not everyone in the world is lucky enough to share their freedoms. Bitcoin and Ethereum users in authoritarian countries may want to use the network to support/donate to causes that could land them in hot water with the government. For such users, maintaining anonymity can be very important.

There are many good personal reasons to maintain anonymity over your transaction history. Most people would probably be uncomfortable with the idea of everyone knowing their entire life’s history (or near enough) of political donations, charitable affiliations, and health expenditures, for example.

Of course, not all users want to maintain anonymity on the blockchain for honest reasons. Criminals looking to launder the proceeds of their illicit activities are increasingly looking to crypto. As a result, there is a significant desire among Ethereum network users for the ability to interact with the blockchain anonymously. Here is where applications such as Tornado Cash come in.

What is Tornado Cash?

Tornado Cash is an open-source Decentralized Application (DApp) running on the Ethereum network that enables users to move their crypto assets between wallets anonymously. It uses a group of mostly immutable smart contracts that run on the Ethereum blockchain. The smart contracts were first deployed back in 2019.

Smart contracts power each of the dozens of individual pools in Tornado Cash. When users transfer their crypto into one of these pools, the pool generates a unique piece of information called a proof of deposit. Users can use this information to withdraw their deposit into a different wallet. This cryptographic technology is referred to as zero-knowledge proof. One of this cryptographic concept’s most commonly used implementations is the zk-SNARK.

By using zk-SNARK technology, Tornado Cash pool smart contracts don’t generate any information on the blockchain that directly links a depositing wallet with a withdrawing wallet. Zk-SNARK-based applications only allow users to withdraw the tokens they deposited into the smart contract. There is no “crypto mixing” — i.e., the jumbling of cryptocurrencies into the same wallet with users withdrawing different tokens than those they deposited.

Another important feature of the protocol is that it is fully non-custodial. Throughout the whole process of using Tornado Cash, the user is the only one with the information that provides access to their crypto. That includes when their assets have been deposited into the Tornado Cash pool smart contract.

The U.S. government cracks down on Tornado Cash

In August 2022, the U.S. Treasury’s Office of Foreign Asset Control (OFAC) announced that it was sanctioning the privacy-focused Tornado Cash protocol. According to a statement released by the Under Secretary of the Treasury for Terrorism and Financial Intelligence, Tornado Cash has failed to impose effective AML practices to prevent illicit fund flows.

The statement added that the protocol had also failed to implement basic risk management protocols. The U.S. Treasury published a list of numerous now-blacklisted Tornado Cash smart-contract wallet addresses on its website. The OFAC’s new sanctions on U.S. citizens and entities ban them from interacting with the protocol.

Those breaking the sanctions will be regarded as criminal offenders and face large fines or jail time of up to 30 years. According to OFAC, Tornado Cash smart contracts have been laundering over $7 billion in illicit funds since the protocol’s launch in 2019. These include a $600 million heist conducted by the North Korean Lazarus Group and a $100 million robbery of the cross-chain Horizon bridge.

The crackdown on Tornado Cash has faced heavy criticism from members of the crypto community, who argue that the restrictions violate the right to privacy.

Trouble worsens for Tornado Cash

Last 2023 has been tumultuous for Tornado Cash after the U.S. Treasury’s stringent actions against them in 2022. The platform’s co-founders, Roman Storm and Roman Semenov, found themselves deep in legal hot water.

Accusations of laundering a staggering amount exceeding $1 billion were levied against them, with a notable chunk allegedly connected to the Lazarus Group, backed by North Korea. While U.S. officials successfully detained Roman Storm, Roman Semenov, hailing from Russia, is still evading capture.

The duo faced serious allegations, including conspiracy to launder money, breaching sanctions, and running an unauthorized money transfer service. The indictment also points fingers at them for purportedly overlooking crucial KYC and AML measures, painting Tornado Cash as a sanctuary for “invisible and confidential financial dealings.”

The Treasury’s assertion, which ties Tornado Cash to a potential laundering of up to $7 billion, especially with the Lazarus Group, has only added to the platform’s troubles. Support for the Tornado Cash founders surged, with demonstrations cropping up in Amsterdam’s streets and online.

Tensions escalated in a U.S. courtroom when the founder of Tornado Cash, Roman Storm, was declared not guilty. With the case under Judge Katherine Polk Failla, who’s also a key figure in the Coinbase vs. U.S. SEC dispute, the crypto community is holding its breath, awaiting the verdict and pondering its ripple effects on the broader industry.

Crypto censorship issues challenge decentralization

Despite significant pushback from some elements of the cryptocurrency community, others seem to be “falling in line.” 51% of Ethereum transaction blocks were determined to be OFAC-compliant. In other words, the validators of these blocks can censor Ethereum transactions.

But how is this possible in a supposedly censorship-resistant blockchain network? Ethereum’s recent transition from proof-of-work to proof-of-stake created a larger pool of network validators. Many validators use Maximum Extractible Value (MEV) boost relay software to maximize their yields.

Four of the top seven MEV-boost relay software providers censor transactions in line with OFAC requirements. Ethereum validators using this censorious software now account for most of the network’s validators. Unsurprisingly, for many critics of Ethereum’s shift to proof-of-stake who warned about the heightened risks of censorship, recent developments warrant an “I told you so.”

Other elements of the crypto space also seem to be caving into U.S. government pressure. In response to OFAC sanctions on Tornado Cash, Circle Internet Financial, the issuer of stablecoin USDC, froze $75K of funds held by users linked to the privacy protocol. Big players in the DeFi space are also taking steps to censor wallets linked with Tornado Cash. For example, Uniswap and Aave both blocked wallets linked to the sanctioned protocol.

Recent developments concern those hoping that the emergent crypto ecosystem would resist the government’s heavy hand. However, those seeking to protect their crypto privacy still have many alternative options.

Are privacy coins the solution?

One such alternative is to transact using cryptocurrency networks that were specifically built with absolute user anonymity in mind. The open-source cryptocurrency network uses privacy-enhancing technology that obscures trading addresses, transaction amounts, transaction histories, and account balances.

Unlike with Bitcoin and Ether, it is impossible to trace where an individual Monero token has been in the past, adding another layer of censorship resistance to the network. For example, merchants accepting Bitcoin and Ethereum could refuse to accept tokens that have passed through suspicious addresses. This would be impossible on the Monero network, as it is impossible to know where coins have been in the past.

ZCash is also a privacy coin that uses a zk-SNARK security protocol to ensure that transactions are completely anonymous. That means that like with Monero, a ZCash user’s transaction history and current balance cannot be observed by others.

However, the most popular privacy coins do not run on smart-contract-enabled blockchains. While this is ok if they wish to function as Bitcoin alternatives with more privacy, it limits their scope to add utility to the DeFi ecosystem.

In that regard, it is understandable that cryptocurrency users may still wish to transact and interact with non-privacy-focused smart-contract-enabled blockchains like Ethereum. But with Ethereum-based Tornado Cash under assault from U.S. regulators, what options do these users have to protect their privacy?

Tornado Cash alternatives

Numerous alternatives to Tornado Cash are available for users seeking different options. Below is a compilation of the leading alternatives.

1. UniJoin

UniJoin is a crypto mixing service that claims to “make your crypto finances untraceable.” The application helps its users regain crypto anonymity by mixing their crypto in a pool with other users before returning untraceable coins. To do so, UniJoin uses CoinJoin technology, which it says provides the highest quality and most optimized mixing method.

Crypto mixing services like UniJoin differ from applications that use zk-SNARK technology to obscure transactions. Users of UniJoin will likely receive different tokens from those that they deposited. This is not the case for users of zk-SNARK applications. Given that Tornado Cash is an Ethereum-based crypto mixing service like UniJoin, they have long been viewed as important Tornado Cash alternatives for those looking to obscure Bitcoin transactions.

Features

UniJoin claims that simplicity of use is one of the strengths of its platform and service. Users are only a few clicks away from conducting their crypto activities anonymously. The platform allows its users to perform a variety of functions.

Users can store their untraceable crypto coins in a wallet after mixing. Alternatively, users can use the platform to purchase goods and services and to send crypto to others. Users have the option to schedule transactions to occur with a delay to boost anonymity.

UniJoin says its platform enables users to invest in digital assets in places where crypto is banned. The crypto mixing service claims not to log user activity to protect anonymity. UniJoin supports Tor (network).

Functionality

While Tornado Cash just facilitates anonymous blockchain transactions, UniJoin offers additional functionality. For example, users can use UniJoin to purchase goods and services online directly.

Disadvantages

UniJoin is centralized

Unlike Tornado Cash, Unijoin is a centralized middleman. Most of the Tornado Cash pools are immutable, meaning no one can edit how they function. By contrast, UniJoin functions according to the discretion of its development team.

UniJoin takes custody

During the mixing process, Unijoin takes custody of your crypto assets. Tornado Cash users never lose custody of their assets.

2. Coinomize

Coinomize is a Bitcoin mixer. Like UniJoin, it uses CoinJoin technology to protect user anonymity whilst transacting on the Bitcoin blockchain.

Features

Coinomize claims on its website that using its platform is 100% anonymous, as they do not store any logs or data on users after mixing. Like UniJoin, Coinomize users can customize a delay in their transaction in order to boost anonymity.

Coinomize users can send crypto anonymously to up to five different addresses. Unlike on other platforms, users can customize the fees that they pay. Users can also customize how long the mixing process should take. Coinomize says on its website that more fees and a longer mixing time boost anonymity.

Benefits

Easy to use, highly rated service

Like UniJoin, Coinomize is an easy-to-use alternative to Tornado Cash. It only takes a few simple steps on the Coinomize website for users to start mixing their Bitcoin.

Disadvantages

Minimum transaction amount

The minimum deposit to use Coinomize is 0.0015 BTC per added output address. This is fairly low, but if the Bitcoin price were to surge back to fresh record highs, this could quickly shoot towards $100, assuming Coinomize doesn’t alter its minimum deposit amount.

Only Bitcoin

Coinomize is centralized and takes custody during mixing

Like UniJoin and unlike Tornado Cash, Coinomize is a centralized service provider and takes custody of your crypto during the mixing process.

Lack of functionality

Coinomize is very simple. It mixes Bitcoins and sends them to a new address. Unlike UniJoin, it does not offer alternative services, such as the ability to use the service to shop anonymously online.

3. MixBTC

MixBTC is a Bitcoin mixer or tumbler. The application allows users to anonymize their Bitcoin transactions in much the same way as Coinomize and UniJoin do.

Features

MixBTC has a simple and intuitive user interface. Users only need to enter the Bitcoin wallet address that they want to anonymously send crypto to, indicate what fee they wish to pay for the service and schedule the transaction delay. As is the case with other crypto mixing services, boosting the service fee and time delay will boost the anonymity of the transaction. MixBTC claims not to keep any logs of user information.

Benefits

Easy to use

MixBTC is very simple to use and intuitive. That means beginners will likely find it easy to get started.

Disadvantages

Only Bitcoin

As the name implies, MixBTC is only focused on providing a Bitcoin mixing service. That means it offers little utility to the users of other cryptocurrencies.

MixBTC is centralized

Like UniJoin and Coinomize, MixBTC is a centralized middleman. It functions according to the discretion of its development team.

MixBTC takes custody

During the mixing process, MixBTC takes custody of your crypto assets. Tornado Cash users never lose custody of their assets.

4. 0xMonero

0xMonero is a privacy-focused, mineable, multi-chain ERC-20 token built on top of the Ethereum network. The Ethereum-based version of the Monero alternative was launched in 2020. Given it runs on top of the Ethereum blockchain, it is compatible with Ethereum’s large ecosystem of DApps and wallets. 0xMonero’s creators are a combination of Monero founders and investors.

Features

0xMonero’s creators built the Ethereum-based alternative to overcome several problems that they deemed blocking Monero’s path toward mainstream acceptance. These include difficulties using/trading Monero, the coin’s infinite potential supply, the coin’s delisting on most major exchanges, and the coin’s lack of smart-contract functionality.

0xMonero’s creators say that the new Ethereum-based iteration of the coin solves many of these problems. The total supply of 0xMR is restricted to 18.4 million. The 0xMR team says its wallets are easier to use, that the cryptocurrency is easy to mine, is much more scalable, is smart-contract compatible, and cannot be banned or delisted.

Benefits

Easy to buy and use

Anyone already using the Ethereum network can easily get hold of and transact using 0xMR tokens. Many think this makes the token easier to use and trade than Monero, which is difficult to buy and trade on many exchanges.

0xMR can’t be ruled as a security

Given that 0xMR was fairly launched (i.e., there was no pre-mine for early investors), it cannot be ruled as a security by the SEC.

0xMR is decentralized

0xMR is an immutable smart contract running on top of the Ethereum network and is managed by a decentralized community. There is no company or foundation that could be targeted to hobble its operation.

No 0xMR pre-mine

For investors, the fact that 0xMR was launched without the allocation of tokens to pre-release investors should be a confidence booster. Pre-release crypto investors have been known in the past for dumping their tokens when they hit certain price targets, triggering rapid bear markets in many new cryptocurrencies.

Non-custodial

When transacting with 0xMR to maintain anonymity, there is no need to give over custody of your crypto assets.

Disadvantages

Users must trade 0xMR tokens if they want privacy

Many cryptocurrency users would prefer to trade and transact in the major and most widely known coins like Bitcoin and Ethereum. Not many cryptocurrency users know about 0xMR at the moment and might prefer to use some of the crypto mixers listed above.

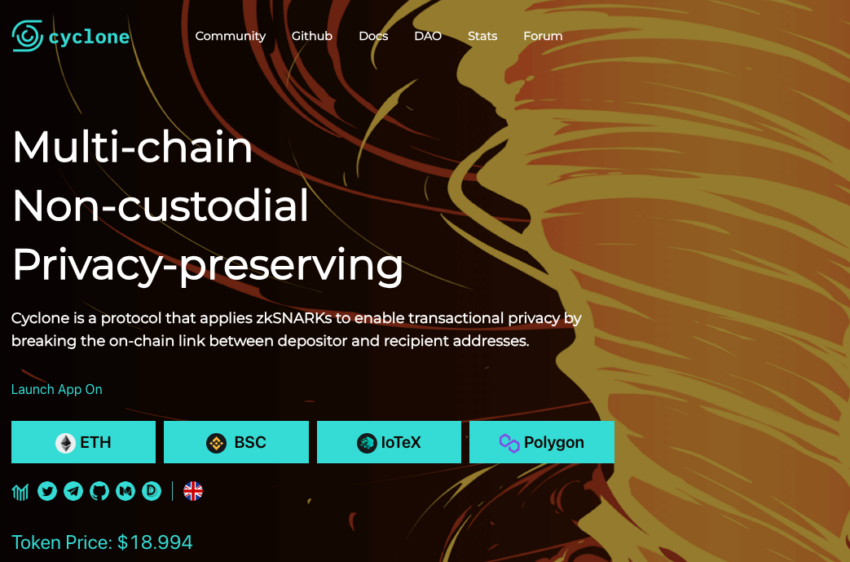

5. Cyclone Protocol

Cyclone Protocol is a cross-chain, non-custodial, universal privacy-preserving protocol. The protocol uses zk-SNARK cryptography to break the link between depositor and recipient addresses.

Features

Cyclone’s code is, in large part, based on Tornado Cash. The protocol was first launched on the IoTeX blockchain but now also has smart contract pools running on Ethereum, BNB Chain, and a few other Ethereum Virtual Machine (EVM) compatible blockchains. Like Tornado Cash, users never give up cryptocurrency custody while using a Cyclone Protocol to obscure a cryptocurrency transaction.

Benefits

Similar to Tornado Cash

Cyclone Protocol is a smart contract that functions in a very similar way to Tornado Cash. For users of Tornado Cash searching for a similar alternative with very similar characteristics, Cyclone Protocol may be a good option.

Cross-chain functionality

Unlike Tornado Cash, Cyclone Protocol has inbuilt cross-chain functionality and operates across multiple major blockchains.

Decentralized governance

Unlike crypto mixers like UniJoin and Coinomize, Cyclone Protocol is governed by a Decentralized Autonomous Organization (DAO), meaning it is decentralized. Cyclone’s DAO lives on the IoTeX blockchain.

Non-custodial process

Using Cyclone Protocol to conduct anonymous crypto transactions does not require the user to hand over custody of their cryptocurrency.

Disadvantages

New protocol risks

While Cyclone Protocol is built using audited code, its website warns potential users that it is still an experimental software and users should use the protocol at their own risk. In other words, Cyclone Protocol cannot guarantee to its users that the code behind its smart contracts will execute properly.

6. Messier 87

Messier 87 is a platform that develops crypto/DeFi applications across multiple major blockchains. Its stated aim is to “further public adoption of DeFi by developing a wide range of decentralized applications that provide consumers & businesses with the tools necessary to replace fiat currencies with cryptocurrencies.

Messier has developed an application called “Horizon,” a decentralized anonymous payments system. Its current form is based on the Tornado Cash base code and utilizes the same zk.SNARK technology ensures that all transactions that occur through the app are shielded.

However, given recent events with the sanctioning of Tornado Cash, Messier 87 has decided to rebuild Horizon from the ground up, so it is no longer based on the Tornado Cash code. When the application is rereleased, it will contain additional features that will enable it to better prevent illicit and high-risk activity from taking place on the platform.

Features

Messier 87’s Horizon application allows users to send cryptocurrency to one another in a way that is not publicly viewable like a normal blockchain transaction. The company says that, at launch, the Ethereum version of its app will support ETH, USDC, M87, SHIB, Verse, Hex, and Cult. Over time, token support will be expanded.

Benefits

Less likely to be censored like Tornado Cash

Given the steps that Messier 87 is taking to rebuild the anonymous Horizon payments application that allows it to prevent better illicit activity, as well as assist law enforcement in cracking down on illicit activities, the application is much less likely to end up being censored, as happened to Tornado Cash.

Multi-chain functionality

With the upcoming re-release version of Horizon set to run on multiple blockchains, this should boost its usability beyond that of solely Ethereum-based Tornado Cash.

Non-custodial process

Messier 87’s Horizon application is blockchain smart contract-based, meaning that users will not need to give over custody of their cryptocurrency.

7. Spinner

Features

As is standard practice in applications that utilize zk-SNARK technology, Spinner generates a private note for a user each time they deposit into the Spinner smart contract. This private note can be used to withdraw funds into another wallet. Spinner keeps no record of wallet addresses, user accounts, or deposit amounts, ensuring full anonymity.

The smart contract’s design means it can privately handle Bitcoin transactions directly on the blockchain without the need to create a bridge. That’s because the Internet Computer-based application will be able to interact directly with the Bitcoin blockchain. It will be able to create new Bitcoin addresses and use these addresses to send/receive Bitcoin directly. Presently, the Spinner smart contract only works for Internet Computer’s native token ICP.

Benefits

Decentralization

Once Spinner smart contracts are immutable, they cannot be shut down or edited unless the Internet Computer blockchain is shut down. Bitcoin is a sufficiently decentralized cryptocurrency network that it seems unlikely that transactions linked to Spinner smart contracts could be censored. The protocol will soon be governed by a DAO, further boosting decentralization.

Better than Bitcoin mixers, perhaps

Spinner has not yet launched support for anonymous Bitcoin transactions. But assuming that it does successfully build a Bitcoin-compatible application on the Internet Computer blockchain, this could be a much better way for users to obscure transactions than traditional crypto mixing services.

Non-custodial process

As is the case with other smart contract-based crypto transaction privacy protocols, users will not need to hand over custody of their cryptocurrency while using Spinner.

Disadvantages

Still in its beta stage

Spinner is still in its beta stage. Users are thus advised only to make small deposits that they can afford to lose in case of an unforeseen bug or issue.

Only support ICP, for now

For now, given the application is still in the early stages of its development, users can only use it to obscure ICP transactions. This is the native token of the Internet Computer blockchain. But once the application does start supporting Bitcoin, it could become one of the preferred applications for obscuring BTC transactions.

Comparing the leading privacy platforms: Alternatives to Tornado Cash

| UniJoin | Coinomize | MixBTC | zk.money | 0xMonero | Cyclone Protocol | Messier 87’s Horizon | Spinner | |

| Decentralized? | No | No | No | Not yet | Yes | Yes | Not yet | Not yet |

| CoinJoin, zk-SNARK, or other | CoinJoin | CoinJoin | CoinJoin | zk-SNARK | Other | zk-SNARK | zk-SNARK | zk-SNARK |

| Anonymity guaranteed | Not necessarily | Not necessarily | Not necessarily | Yes | Yes | Yes | Yes | Yes |

| Fees beyond normal network | Yes | Yes | Yes | Yes | No | No | No | No |

| Custodial or non-custodial? | Custodial | Custodial | Custodial | Non-custodial | Non-custodial | Non-custodial | Non-custodial | Non-custodial |

| Bitcoin supported? | Yes | Yes | Yes | No | No | No | Not yet | Not yet |

| Ethereum supported? | Not yet | No | No | Yes | No | Yes | Yes | No |

| Fully operational? | Yes | Yes | Yes | Yes | Yes | Yes | No | Not fully |

| Multi-chain functionality? | No | No | No | No | No | Yes | Yes | Yes |

What is the best Tornado Cash alternative?

For users searching for Tornado Cash alternatives with similar privacy capabilities, the top choices revolve around platforms that utilize zk-SNARK technology in their smart contracts, particularly those that are either built on or compatible with the Ethereum network. zk.money and Cyclone Protocol emerge as the frontrunners, both operational and adept at concealing ETH transactions and transactions of other tokens on the Ethereum blockchain. Bitcoin users seeking to maintain privacy in their transactions have traditionally relied on Bitcoin mixers or tumblers.

However, a significant development has arrived with Spinner’s release of its zk-SNARK smart contract on the Internet Computer blockchain, which offers direct interaction with the Bitcoin blockchain. This innovative solution is a promising alternative for enhancing privacy in Bitcoin transactions.

Frequently asked questions

Is Tornado Cash legal?

Why was Tornado Cash sanctioned?

Is Tornado Cash traceable?

What is TORN?

What are Bitcoin mixers?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.