The United States Department of Justice (DOJ) hit KuCoin with an indictment on March 26, 2024. The crypto exchange and its founders are accused of acting as a money transmitter without a license, plus skipping out on anti-money laundering (AML) rules. The news stirred panic among users, with many withdrawing funds in haste amid questions about KuCoin’s legal status.

The severity of the charges, along with KuCoin’s legal tussles across various jurisdictions, raises the question — is KuCoin safe? This guide takes an in-depth look at KuCoin’s legal status and security features to help you decide.

KEY TAKEAWAYS

• KuCoin’s legal troubles worsened in 2024 after being served a DOJ indictment for violating U.S. regulations.

• KuCoin’s CEO downplayed the legal challenges, calling them typical hurdles in an evolving industry.

• The exchange has a history of operating in regulatory grey areas in some jurisdictions.

• BYDFi, Coinbase, and Kraken offer secure and reliable alternatives for users considering a switch from KuCoin.

- Overview of KuCoin’s legal status in 2024

- KuCoin legal status: CEO responds

- KuCoin’s brush with regulators

- KuCoin legal status in 2024

- Comparing crypto’s legal status across jurisdictions

- The role of DeFi in crypto regulation

- KuCoin’s approach to security

- Top KuCoin alternatives

- BYDFi

- Coinbase

- Kraken

- KuCoin legal status: Future outlook

- Frequently asked questions

Overview of KuCoin’s legal status in 2024

Being a fast-growing business in an industry full of regulatory ambiguity, KuCoin has faced its share of hurdles over the years. Things are particularly heating up in 2024 as it finds itself at the center of several legal challenges across different jurisdictions.

US crackdown

In the United States, KuCoin faces serious legal actions under the Bank Secrecy Act for failing to establish an adequate anti-money laundering (AML) program. The DOJ alleges that the exchange failed to verify its customers’ identities and did not report suspicious activities.

According to U.S. prosecutors, this alleged lack of compliance allowed suspicious and criminal funds worth over $5 billion to flow through KuCoin. Consequently, KuCoin co-founders Chun Gan (also known as “Michael”) and Ke Tang (also known as “Eric”) now face charges, including operating without a license and violating the Bank Secrecy Act.

These charges raise concerns about KuCoin’s deliberate targeting of U.S. customers despite non-compliance with U.S. laws.

UK warning list: Operating without FCA registration

Across the pond, the UK’s Financial Conduct Authority (FCA) added KuCoin to its crypto warning list in October 2023. The regulatory body highlighted the exchange’s lack of registration and stated that the inclusion is part of its broader crackdown on unregistered crypto companies targeting UK consumers.

It underscored that the move serves as a reminder about the importance of adhering to regulations in that market.

Other legal/regulatory troubles

Adding to its woes, KuCoin was forced to pay a hefty settlement in New York for operating illegally in the state. This stemmed from KuCoin’s failure to register as a securities and commodities broker-dealer and misleading users about its services.

The settlement required the company to return over $150 million to New York investors and prohibited further security and commodities within the state.

KuCoin legal status: CEO responds

Panicked users started offloading their funds from the exchange and started looking for KuCoin alternatives shortly after the DOJ indictment. Despite these challenges, KuCoin’s CEO, Johnny Lyu, downplayed the legal issues, citing typical growing pains in a rapidly evolving industry.

Lyu emphasized the industry’s shift towards compliance and standardization and pointed to KuCoin’s recent registration with India’s Financial Intelligence Unit as an example of its commitment.

Shortly after the news about the DOJ indictment broke in March 2024, Lyu took to X (formerly Twitter) and assured users that their funds were safe.

KuCoin’s brush with regulators

Even prior to 2024, KuCoin didn’t have the smoothest of rides with certain regulators. While the company managed to stay afloat — in fact, very comfortably so — it has definitely ruffled some feathers.

Let’s quickly walk through some of KuCoin’s past regulatory run-ins to give you a sense of the challenges they’ve faced.

Offering unregistered securities (Ontario, Canada)

In 2021, the Ontario Securities Commission (OSC) made it mandatory for crypto exchanges to register with respective provinces.

Despite this, KuCoin continued to offer services to its customers in the Ontario province despite not being registered. This landed the company in hot water with the OSC.

Fined and banned, but still operating (Ontario, Canada)

In response, the OSC made it clear that it wasn’t going to let KuCoin slide. The regulators took their case to the Ontario Capital Markets Tribunal. Yet KuCoin completely ignored the whole ordeal.

As a result, the tribunal slammed the firm with a $2 million fine and an official ban from operating in Ontario.

“Foreign crypto asset trading platforms that want to operate in Ontario must play by the rules or face enforcement action. [….] The outcomes announced today should serve as a clear indication that we refuse to tolerate non-compliance with Ontario securities law.”

– Jeff Kehoe, Director of Enforcement at the OSC at the time (2022)

Once again, reports emerged that KuCoin simply told its Ontario users they could keep using the platform as if nothing had happened. If anything, this fiasco once again highlighted the challenges of regulating crypto businesses — especially those based in and operating from other jurisdictions.

Operating without registration (Netherlands)

The Dutch Central Bank (DNB) also slapped the company on the wrist for operating in the Netherlands without proper legal registration. This meant KuCoin wasn’t following the country’s Anti-Money Laundering and Anti-Terrorist Financing regulations —which, needless to say, didn’t reflect well on the company.

The DNB warned that KuCoin’s services for exchanging crypto and holding user funds were illegal. Similar to the situation in Ontario, there’s no record of any penalties or forced closure, but the episode placed a question mark on KuCoin’s compliance in the Netherlands.

Crackdown by South Korea

It wasn’t just Canada and the Netherlands that had issues with KuCoin. South Korea’s Financial Intelligence Unit (FIU) also took aim at the exchange. The regulator accused KuCoin, along with 15 other crypto exchanges, of violating the country’s Financial Information Act.

As per the FUI, KuCoin had been offering crypto services to South Koreans without following any of the local regulations. The FIU also requested that KuCoin’s website and mobile app be blocked in South Korea.

The takeaway

While KuCoin has rightfully earned a spot as a leading crypto exchange, the company has a demonstrable history of operating in a regulatory grey area in some jurisdictions.

KuCoin legal status in 2024

As one of the top crypto exchanges with a global footprint, KuCoin is in what can be best described as a regulatory mess. Regulatory framework varies drastically from country to country, and in many places, it is practically nonexistent.

Of course, this is not a problem exclusive to KuCoin. Any crypto exchange operating on a global scale has to deal with uncertainties constantly.

On its part, to stay compliant, KuCoin has to constantly adapt its services to fit local laws. Take India, for example. KuCoin became the first major crypto exchange to register with the country’s Financial Intelligence Unit (FIU). In doing so, it demonstrated a commitment to playing by the rules in specific markets.

However, such commitment to compliance can also mean limitations in some cases. For instance, in places like the US, China, and Singapore, local financial regulations restrict the services KuCoin can offer.

A significant part of the company’s ongoing negotiations with regulators is its attempt to overcome such restrictions and limitations.

AML and KYC: KuCoin plays by the rules (well, mostly)

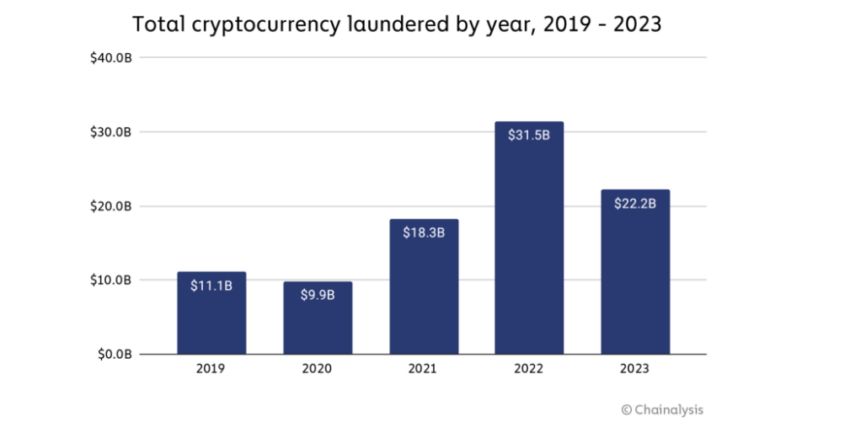

As a major player in the crypto space, KuCoin is obligated to fight money laundering and know who its customers are. This is especially important now, with major economies tightening the screws on AML and KYC compliance.

In June 2023, the exchange announced that it was enhancing its Customer Identification and Verification Program to further strengthen its ability to combat financial crimes like money laundering and terror funding. The new rules were officially implemented on July 15, 2023.

Under these requirements, all new users had to undergo a mandatory KYC process in order to access KuCoin’s full suite of services.

Comparing crypto’s legal status across jurisdictions

The ambiguity surrounding crypto is such that it’s difficult to capture the full scope of the challenges in a nutshell. However, here’s a brief account of the status of the asset class in major economies so we can glimpse the broader picture.

The US: A work in progress

The U.S. is still figuring things out. In 2022, the country opened the door to more regulations, but the fight between regulators, investors, and the crypto industry itself shows it’s a work in progress. There have been some wins for crypto, though.

The SEC finally approved the first Bitcoin ETFs in January 2024, but Chair Gary Gensler warns this isn’t a free pass for all digital assets. The U.S. is likely to continue wrestling with how to balance innovation with consumer protection.

China: A total crypto crackdown

China takes a hard stance. The country banned crypto businesses in 2021 and shut down Bitcoin mining entirely. This strict approach reflects China’s concerns about financial stability and capital flight.

Canada: Leading the charge

Canada was the first country to approve a Bitcoin ETF and requires crypto trading platforms to register with provincial regulators. The government also taxes crypto like other commodities. This approach has made Canada a destination for crypto businesses seeking a welcoming regulatory environment.

The UK: Getting serious

The U.K. recognized crypto as a regulated financial instrument in 2022. Crypto exchanges and custodians must comply with anti-money laundering (AML) rules and report suspicious activity.

The U.K. also taxes crypto gains, but the rate depends on your activity. The UK’s evolving regulations aim to strike a balance between encouraging innovation and mitigating financial risks.

Japan: A progressive approach

Japan sees crypto as legal property and requires exchanges to register with the Financial Services Agency (FSA). The country even has its own crypto exchange association.

Crypto gains are taxed as miscellaneous income. Japan’s focus on fostering a legitimate crypto market has positioned the country as a leader in Asia.

Australia: Another balancing act

Australia considers crypto property and taxes it accordingly. Exchanges need to register and follow AML rules. Australia has also banned privacy coins and is exploring a potential central bank digital currency (CBDC).

Singapore: A crypto hub (with caveats)

Singapore is another country where crypto is treated as property and not legal tender. Exchanges are licensed and regulated. The country discourages public advertising of crypto services and requires stablecoin issuers to meet specific criteria. While capital gains aren’t taxed, companies dealing regularly in crypto are taxed on their profits.

Put simply, Singapore’s regulations aim to create a safe space for crypto businesses but concurrently enforce limitations to prevent excessive speculation.

South Korea: Taking control

South Korea requires crypto exchange registration and banned privacy coins in 2021. The Korean government has also established a legal framework for virtual assets to outline their uses and user protection measures.

South Korea’s regulations are tuned to protect investors and prevent illegal activities involving cryptocurrencies (such as terror funding).

India: Not exactly a crypto-friendly country

India hasn’t legalized or banned crypto yet. There’s a proposed bill to outlaw private cryptocurrencies, but it’s still up in the air as of 2024. The government does, however, tax crypto gains quite heavily.

India’s cautious approach reflects the nation’s concerns about financial stability and the potential misuse of cryptocurrencies.

Did you know: India’s crypto regulation is rooted in the belief that cryptocurrencies are a legal grey area vulnerable to money laundering and tax evasion. The Reserve Bank of India has adopted a strict stance on the issue, citing financial risks and national security concerns.

European Union: A patchwork of regulation

Crypto is generally legal in the E.U., but regulations and taxes vary widely by country. New AML rules have tightened reporting requirements, and a MiCA framework implemented in July 2023 brought more consumer protection and licensing requirements to the crypto industry.

The E.U. is working towards a more harmonized approach to crypto regulations, but individual member states still have some leeway.

The role of DeFi in crypto regulation

Decentralized finance (DeFi) cuts out the middleman for loans, investments, and other financial services, laying the foundation for a new and more democratic form of the current financial order.

This shift towards a more “do-it-yourself” financial system has regulators around the world scratching their heads. DeFi presents exciting opportunities — like making it easier to track money laundering — but also challenges, like how to enforce existing rules in a system with no central authority.

But can DeFi be regulated without killing the positives it brings? Regulators are grappling with this challenge as they look to protect consumers without stifling innovation.

The ultimate objective should be to build a framework that allows DeFi to grow alongside traditional finance (TradFi), all within a safe and stable environment. The silver lining is that DeFi projects and regulators have finally started talking, although demonstrable progress in this arena has been less forthcoming.

KuCoin’s approach to security

Despite some major setbacks, including a $150 million hot wallet hack, KuCoin has gradually improved its track record in terms of security. The exchange uses a multi-layered security approach to keep your crypto safe. Here’s a quick breakdown:

Account security

- Two-factor authentication (2FA): This adds an extra step to logging in, making it much harder for malicious elements to access your account.

- Strong password requirements: KuCoin doesn’t accept hacker-friendly passwords such as password123. The platform makes sure you choose a password that is tough to crack,

- Anti-phishing measures: They warn and educate you about fake websites that might try to trick you into giving away your login info.

Asset security

- Multi-signature wallets: A significant portion of user funds may be stored in multi-signature wallets. For those out of the loop, these wallets require multiple private keys for authorization, significantly lowering vulnerability to unauthorized access.

- Cold storage: A substantial amount of user funds might be held in cold storage. This means the funds are offline and not connected to the internet, which significantly reduces vulnerability to online attacks.

- Address whitelisting: This feature allows users to restrict withdrawals to pre-approved addresses, thereby minimizing the risk of funds being sent to unauthorized accounts.

Data security

- Encryption: KuCoin claims to have state-of-the-art encryption to protect your data.

- Regular security audits: They regularly check their defenses for weaknesses. Conducting regular penetration testing and security audits helps identify and address vulnerabilities in the platform’s security posture.

Room for improvement

Some crucial details around KuCoin remain undisclosed. The exchange could increase transparency regarding the specific cybersecurity regulations it adheres to and details on its security practices (e.g., types of encryption used) to improve in that aspect. Doing so could further strengthen user confidence, as would the involvement of independent third-party security audits.

Top KuCoin alternatives

We have rounded up a few leading KuCoin competitors just in case you are considering switching exchanges:

BYDFi

BYDFI is a strong KuCoin alternative due to its comprehensive set of crypto trading pairs, including a wide range of altcoins. The platform offers an intuitive user interface paired with advanced trading tools and features that meet the needs of traders of all experience levels. Additionally, BYDFI maintains stringent security and offers competitive trading fees along with frequent promotional offers.

- A wide range of cryptocurrency trading pairs

- Advanced trading tools and a user-friendly interface

- Stringent security measures

- Competitive trading fees and promotional offers

- Responsive customer support

- Relatively newer exchange with a shorter track record

- Limited geographical availability compared to larger exchanges

Coinbase

Coinbase offers a diverse range of crypto and fiat trading pairs. It also features an intuitive and user-friendly interface. Coinbase prioritizes stringent security protocols for ensuring the safety of user funds and offers a wide range of educational resources to help users adjust to the market effectively.

- Highly reputable and well-established exchange

- Wide selection trading pairs

- Intuitive and user-friendly design

- Stringent security protocols and asset insurance

- Educational resources for users

- Higher trading fees compared to some competitors

- Limited advanced trading features for experienced users

Kraken

Kraken stands out as a top KuCoin alternative due to its longstanding reputation and track record in the cryptocurrency industry. The exchange offers a wide selection of cryptocurrency trading pairs and maintains robust security measures, including multi-factor authentication and regular security audits.

- Longstanding reputation and track record in the industry

- Wide selection of cryptocurrency trading pairs

- Tight security measures and regular security audits

- Competitive trading fees and discounts for high-volume traders

- Comprehensive range of advanced trading features

- Less intuitive for beginner traders compared to some competitors

- Limited geographical availability in certain regions

KuCoin legal status: Future outlook

As of mid-August 2024, KuCoin has remained stable operationally despite facing legal challenges in multiple jurisdictions. However, these legal issues have significantly eroded user confidence, which was evident from a drastic drop in its trading volume following the DoJ indictment.

The accusations against the company, though serious, highlight the complex regulatory minefield that crypto exchanges regularly encounter. As such, KuCoin’s legal status and future success will depend greatly on its ability to address these challenges and find common ground with regulators.

Frequently asked questions

Is KuCoin legal?

Is KuCoin safe now?

What is the KuCoin controversy?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.