Since forking from Bitcoin in 2017, Bitcoin Cash (BCH) has built a reputation as a fast and cheap network. BCH has been consistently a top-20 cryptocurrency with a multi-billion dollar market cap. But what makes Bitcoin Cash more than just a spinoff riding on Bitcoin’s coat tails? More importantly, should you buy bitcoin cash (BCH) as an investment? In this guide, we’ll analyze the BCH ecosystem to determine if it has long-term value beyond riding on Bitcoin’s fame.

Do you want to buy BCH? Use and test these exchanges

Best for beginners and advanced crypto traders

Secure exchange with high deposit & withdrawal limits

Best for demo and spot trading

Our methodology for selecting exchanges to purchase BCH

In this guide, BeInCrypto highlighted a number of platforms where users can buy Bitcoin Cash. Each platform underwent an extensive testing period of six months. YouHodler, Kraken, OKX, Binance, Coinbase, Kucoin, and Bitstamp were selected based on their established reputations, stringent security protocols, and other vital factors.

YouHodler: YouHodler is an E.U. and Swiss regulated exchange that became popular for offering crypto loans. Fees on YouHodler differ by payment method and typically range between 0 to 4.5% for deposits.

• Crypto loans

• Earn interest on idle crypto

• Cloud miner

Kraken: Founded in 2011 and based in the U.S., Kraken is known for its adherence to regualtion, being one of the first exchanges to offer a proof of reserves. Kraken Pro, at the lowest tier, offers a maker fee of 0.16% and a taker fee of 0.26%.

• Staking

• Derivatives

• Advanced trading interface

OKX: OKX is a globally used exchange, that offers a tiered trading fee schedule. The maker fee is 0.08, while the taker fee is 0.1. OKX also publishes a proof of reserves and provides two funds for backstops to give customers a sense of safety.

• Earn interest on crypto

• Derivatives

• Wallet

Binance: An obvious choice for purchasing BCH, as Binance is the largest exchange by 24-hour trading volume. The maker and taker fees for spot trading start at 0.1%. The exchange also employs a proof of reserves for customer assurances.

• Staking

• Derivatives

Coinbase: Coinbase is a U.S. based exchange that has become known for its adherence to regulations in relevant jurisdictions. It is a publicly traded company that publishes financial statements on a quarterly basis.

• Staking

• Earn-to-learn

• Subscription for lower fees

Kucoin: Kucoin is an exchange that serves a global community of users. The exchange publishes a proof of reserves and provides a safety fund for liquidations to ensure the safety of the platform’s assets.

• Derivatives

• Staking

• NFTs

Bitstamp: Bitstamp is a Europe based exchange that was founded in 2011. The exchange has more than 50 licenses in multiple countries and hold both ISO/IEC 27001 and SOC2 Type 2 certifications.

• Lending

• Staking

• Advanced trading

Learn more about BeInCrypto’s methodology verification here.

What is Bitcoin Cash?

Bitcoin Cash (BCH) emerged in August 2017 from a hard fork in the Bitcoin network. This split was motivated by longstanding disagreements within the bitcoin community around addressing scalability challenges related to transaction speeds and costs.

The core objective was to increase the block size from Bitcoin’s 1 MB limit to 32 MB for Bitcoin Cash, enabling quicker and cheaper transactions. While bitcoin has evolved into more of a store of value, bitcoin cash aims to fulfill the original peer-to-peer electronic cash vision that inspired bitcoin’s creation by becoming practical everyday money.

As both a payment network and cryptocurrency, Bitcoin Cash operates using the BCH coin as its primary transactional unit. It employs a decentralized model with a public distributed ledger where transactions are verified and transmitted across its peer-to-peer network before being added to the blockchain.

Similar to Bitcoin, Bitcoin Cash uses the proof-of-work consensus mechanism to immutable record transactions on the blockchain once validated. With its lower fees and faster settlement times, Bitcoin Cash seeks to stand out as a more usable alternative for daily transactions compared to Bitcoin.

How does Bitcoin Cash work?

When a BCH transaction occurs, network nodes verify it against the blockchain’s history. Validated transactions are then grouped into blocks using Merkle trees. Meanwhile, network nodes perform intensive hash computations on these blocks, and once a block is successfully mined, it is broadcast to the Bitcoin Cash network and added to the blockchain.

Now, each new block contains a hash of the previous block, chaining them together. This makes unauthorized tampering of any block extremely difficult, as it would require changing all subsequent blocks. By chaining blocks this way, Bitcoin Cash achieves immutable transactions on its public blockchain. For those out of the loop, you could think of the Bitcoin Cash blockchain as a lock chain securing transaction history. Each new block added is like adding a new lock to the chain. This way, altering any block requires breaking the full chain.

Just like Bitcoin, all BCH transactions are pseudonymous. The blockchain does not directly associate coins with user identities. Instead, transactions refer to unspent outputs from previous transactions, which are locked via scripts. Only matching unlocking scripts can unlock them for future transactions.

The Bitcoin Cash network is a voluntary, decentralized structure where nodes broadcast transactions, validate them, and share messages on a best-effort basis. Consensus is achieved through proof-of-work (PoW), with the longest chain of blocks considered valid. This ensures transactions are verifiable and permanent once added.

In all, Bitcoin Cash utilizes enlarged block sizes to accelerate transaction verification. This approach reduces fees while enabling faster and more practical daily transactions.

Bitcoin cash price prediction

Although Bitcoin Cash distinguishes itself with larger block sizes and quicker adjustments, it hasn’t quite matched the reputation or widespread adoption of the original Bitcoin. Nonetheless, BCH continues to be a notable player in the cryptocurrency space. Our bitcoin cash price prediction suggests that BCH could be worth up to $428.20 in 2025 and $1252.52 in 2030.

Bitcoin Cash vs. Bitcoin

Here’s a quick Bitcoin Cash vs. Bitcoin comparison. Bitcoin Cash was created to solve Bitcoin’s scaling challenges. It has larger 32MB blocks versus Bitcoin’s 1MB blocks. This means Bitcoin Cash can handle way more transactions per block, making the network much faster with lower fees. So Bitcoin Cash can work better for everyday purchases, such as buying coffee.

Bitcoin is considered “digital gold” — it’s more of a store of value now, not used as much for transactions. But Bitcoin Cash is trying to make good on the original Bitcoin vision of super fast and cheap “peer-to-peer electronic cash” that anyone can use.

The networks also have different development teams with different ideas for the future and differing views on how to scale the networks. Bitcoin’s team is taking a slow and steady approach, while the Bitcoin Cash team is focused on pursuing upgrades that can make transactions lightning-fast and super cheap on the blockchain itself.

The bottom line is that Bitcoin Cash has bigger blocks and lower fees so that it can work better for payments. Bitcoin is slower and more expensive per transaction, but some see it as a more valuable investment — “digital gold.”

How to buy bitcoin cash

There are plenty of crypto exchanges supporting bitcoin cash. The procedures for buying BCH securely are pretty much the same across these platforms, except for a few minor differences here and there. We are going to demonstrate the step-by-step procedure using Binance as an example. Here’s how you can buy Bitcoin Cash on Binance.com.

Create your Binance account

Visit Binance.com or download the app and sign up for a free account. You’ll need to provide some basic personal details during registration.

Pick your purchase method

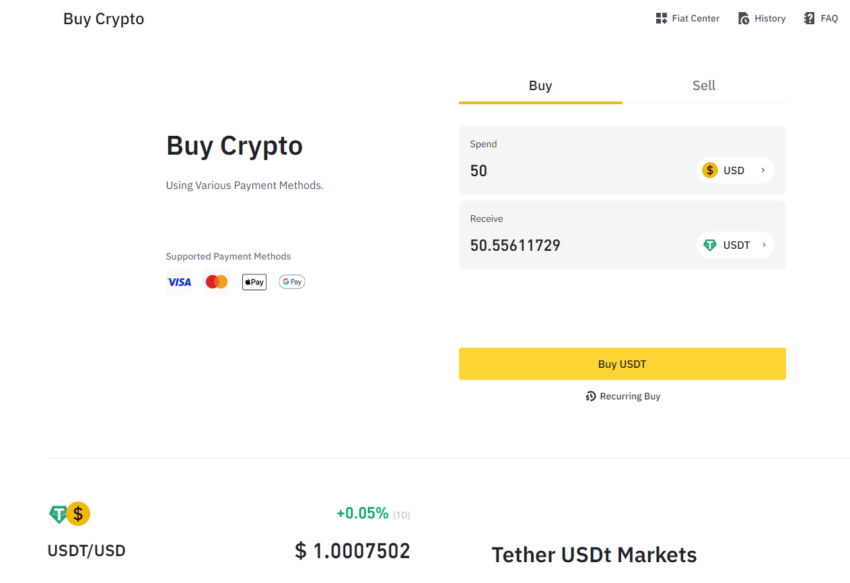

Once your account is ready, hover over “Buy Crypto” on the Binance website to see your BCH buying options. For simplicity, consider buying a stablecoin like USDT first, then use that to get BCH.

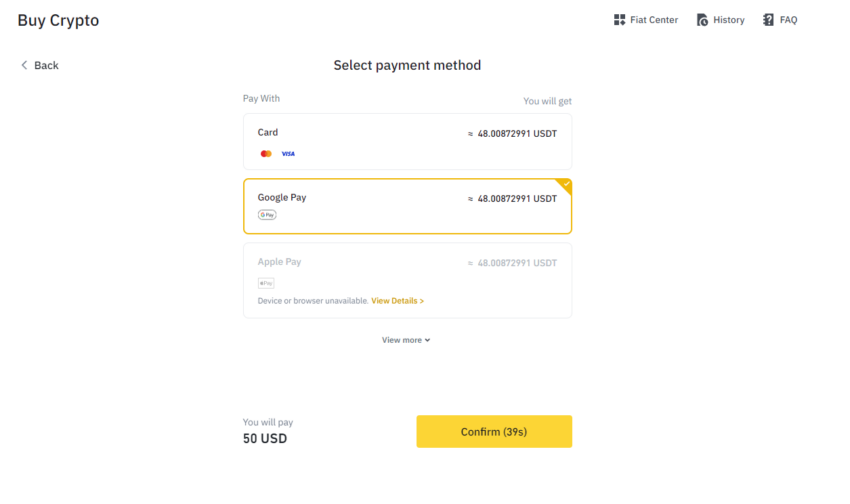

You can choose:

- Credit/debit card: Easy for new users, accepts Visa and Mastercard.

- Bank deposit: Transfer funds from your bank account.

- Third-party payments: Check the FAQ for supported third-party options in your country.

Review fees and confirm the order

Before finalizing, carefully review any fees and payment details. You’ll have a minute to confirm your BCH order at the current price. The payment options may vary depending on the jurisdiction you are in. Note that after Binance deducts fees, the amount of USDT you will receive will be less than what you paid for (and saw on the previous screen).

Store or trade your BCH

Now that you’ve bought BCH, you can keep it in your Binance account if you’re looking to trade or transfer it to your personal crypto wallet for safer storage.

Where to buy bitcoin cash

Here are five reputable platforms where you can buy bitcoin cash:

Binance

Binance’s wide selection of BCH pairs, including BCH/USDT and BCH/BTC, provided us with diverse trading options. We found this variety especially useful for leveraging market movements and hedging strategies. The platform’s ease of use and robust infrastructure also ensured smooth and secure BCH transactions, enhancing our overall trading experience.

Coinbase

Coinbase offered us a seamless and secure way to trade Bitcoin Cash, particularly with its straightforward interface. Its BCH/USD and BCH/EUR pairs were particularly useful for direct fiat transactions. The platform’s strong regulatory compliance in the U.S. market gave us additional confidence in the safety and legality of our trades.

Kraken

Kraken’s strength in offering a variety of fiat pairs for Bitcoin Cash trading, like BCH/USD and BCH/EUR, stood out in our experience. The platform’s reputation for security and comprehensive market analytics tools enabled us to make informed trading decisions with BCH. Kraken’s long-standing presence in the market added a layer of reliability that we valued.

KuCoin:

Our experience with KuCoin for buying and trading Bitcoin Cash was notable for its access to a wide range of cryptocurrencies, including emerging tokens. KuCoin’s loyalty program added an extra dimension to our trading as it brought along rewards that complemented our investment activities. The platform’s loyalty program was an added perk, enhancing the overall value of our trading activities.

Bitstamp

Trading Bitcoin Cash on Bitstamp was a reliable experience, particularly for its focus on security and liquidity. As one of the longest-running exchanges, founded in 2011, Bitstamp has a strong foothold in the European market, which was beneficial for our Euro-centric trades. BCH trading pairs like BCH/USD and BCH/BTC were readily available, providing us with essential options for our BCH trading strategies.

All of the exchanges recommended have built solid industry reputations, have good liquidity for BCH, and strong security measures. If you want to buy bitcoin cash anonymously, you can choose a decentralized exchange (DEX) such as dYdX. The decentralized crypto derivatives exchange offers a plethora of margin trading and perpetuals options, should you also want to trade your BCH.

How to buy bitcoin cash on p2p platforms

If you’re not familiar with p2p (peer-to-peer) trading, let’s explain it using the following analogy: Say you’re at a college club fair, looking to swap your old calculus textbook for a physics textbook you need for next semester. You find another student willing to trade their physics book for your calculus book. This direct exchange between the two of you, without any intermediary, is a real-life example of a peer-to-peer transaction.

Now let’s apply this concept to cryptocurrency, specifically bitcoin cash (BCH). In P2P crypto trading, you connect directly with an individual seller offering their BCH. There are online platforms, like a digital club fair, that match buyers and sellers for this purpose. Once matched, you can trade your local currency for the seller’s BCH.

Here is how a typical P2P crypto transaction unfolds step-by-step:

- You create an account on the P2P platform

- You deposit your local currency, say $100, into your account

- The platform matches you with a seller willing to exchange BCH for your $100

- The platform holds onto the assets in escrow during the deal to prevent either party from scamming the other

- After both parties confirm, the platform releases your BCH and the seller’s $100

P2P exchanges often have lower fees and faster settlement than traditional crypto exchanges. However, some users exploit the system by initiating fraudulent chargebacks after trades to claim they never received the BCH.

When choosing between P2P and centralized exchanges, weigh the fees, speed, and security tradeoffs. P2P can be cheaper and quicker but carries higher scam risks in certain contexts. Traditional exchanges may be safer but have higher costs and delays. Your preference depends on how you prioritize convenience, price, and protection.

Bitcoin cash wallets

There are a number of different bitcoin cash wallets on the market — software, hardware, paper, web wallets, and more. Each has pros and cons you need to think about.

- Software wallets are apps on your computer or phone. They’re pretty easy to use and can be secure, but more vulnerable to hacking than some others.

- Hardware wallets are physical devices that store your BCH offline. Ther are very secure, but can be expensive and not as user-friendly.

- Paper wallets are just sheets of paper with your BCH keys on them. Super secure but also inconvenient since you can’t easily spend your BCH with just paper.

- Web wallets run on a remote server. They are convenient but less secure since the server could get hacked.

Here are a few other factors:

- Crypto wallet security should be your first priority — make sure your wallet has strong protections.

- Ease of use: if new to BCH, start simple with a non-custodial software wallet.

- Features: some wallets have extra features like two-factor authentication.

- Platforms: make sure it works on your devices.

Once you choose, you’ll need to create a BCH wallet address to send and receive funds. Just open your wallet and look for “Create New Wallet” or “Add Account” to generate your unique address. The key is finding the right fit based on your needs. Think about security, convenience, and features to pick the ideal BCH wallet for you!

As of 2023, some of the most popular BCH wallet options include Ledger Nano S Plus, Trezor Model One, Guarda, and Electron Cash, among others.

Should you buy bitcoin cash?

Bitcoin cash’s potential comes from its practical use as a payment option, which is the original crypto vision. The currency can work as everyday money — it’s fast and has very low fees, which is a must for regular purchases and payments. This gives the asset a real use case compared to some other cryptos. However, like all cryptocurrencies, the price of BCH bounces around a lot. Any investment in crypto requires significant research. Always assess your personal risk comfort level before jumping in to buy bitcoin cash.

If you believe in the vision of crypto replacing traditional currencies one day, BCH could be worth considering. Study the markets, understand the risks, and think about your financial goals first. Crypto investing isn’t for everyone. Do your homework before buying into any hype.

Frequently asked questions

Is bitcoin cash a good buy?

What is the best site to buy bitcoin cash?

What is the fastest way to buy bitcoin cash?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.