Ethereum mining is a thing of the past. If you are new to crypto, then you have missed out on it. But that doesn’t mean that you can’t learn about it. Find out what it was, how it worked, and more in this guide on Ethereum mining pools.

Got something to say about mining pools or anything else? Write to us or join the discussion in our Telegram channel. You can also catch us on Tik Tok, Facebook, or Twitter.

- How the Merge changed Ethereum Mining

- Top four reasons users mined Ethereum

- 1. Ethereum is a value layer

- 2. ETH mining was worthwhile

- 3. Ethereum mining rigs don’t cost an arm and a leg

- 4. You could use mining pools for ETH

- What were the top 4 Ethereum mining pools to join?

- There are still other mining opportunities

How the Merge changed Ethereum Mining

Ethereum is a virtual machine allows you to build smart contracts and applications with some level of complexity. However, it is also a distributed database called a blockchain, and blockchain’s need bootstrapping and Sybil resistance.

The initial mechanism that facilitated this was proof-of-work (PoW), the most popular at the time. Simply put, PoW is a mechanism that requires you to run expensive hardware to expend electricity and do a large and redundant amount of computations. After this, you get the right to update the blockchain and receive coins by mining blocks.

This process makes it expensive to attack the network and rewards those that maintain the network. However, the Ethereum roadmap always suggested that it would move from PoW to proof-of-stake (PoS).

This meant that instead of running expensive hardware to gain the right to update the blockchain, you would now have to use your coins as collateral to gain the right.

This transition was completed on September 15, 2022 in an event called the Merge. The Merge made Ethereum mining obsolete. This means that you can no longer mine Ethereum to earn Ether, the native cryptocurrency to the Ethereum blockchain.

Top four reasons users mined Ethereum

In the dynamic realm of the crypto community, where decentralized finance (DeFi) is reshaping how we think about financial transactions, Ethereum mining stood out as a topic of growing interest.

It was more than just a process; it was a way to actively engage with the forefront of blockchain technology. For those within the crypto community, mining Ethereum was not just about the potential earnings; it was also about being a part of a revolutionary movement in DeFi. With this in mind, let’s delve into the top four reasons users mined Ethereum.

1. Ethereum is a value layer

Many people saw and still see Ethereum as a value layer and a way to bootstrap their projects — be it decentralized applications or layer-2 networks. Whether using the Ethereum blockchain for security or Ether as a utility token, this created a high demand, ultimately creating an arms race to mine Eth to capture this value.

The performance of Polygon (MATIC) serves as a key indicator of Ethereum’s valuation, which looks to be quite promising. Utilizing the layer-2 ethereum sidechain, Polygon offers transaction fees that are a fraction of Ethereum’s current gas fees. This efficiency has boosted Polygon’s popularity in the blockchain sphere, with its token, MATIC, experiencing notable growth in value.

For Ethereum holders, this increased demand for affordable yield farming is advantageous. However, the situation is different for Ethereum miners. With Ethereum’s ongoing transition towards a model similar to Polygon’s, traditional mining pools might become obsolete.

Nonetheless, Ethereum’s roadmap is subject to changes, as seen in the past with Vitalik Buterin’s adjustments. This scenario highlights the ever-changing dynamics of the crypto world, presenting evolving opportunities for both mining and investment.

2. ETH mining was worthwhile

Because Ethereum mining had a lower barrier to entry compared to Bitcoin, it rbecame profitable. That is, providing you had suitable Ethereum mining hardware and a relatively cheap source of electricity. If you are not sure that your situation fits these requirements, there is still time to obtain ETH on a crypto exchange like StormGain and wait for a substantial return on your investment.

3. Ethereum mining rigs don’t cost an arm and a leg

Unlike Bitcoin that requires dedicated ASIC rigs and mining hardware to achieve worthwhile profitability, Ethereum mining rigs were regular PCs you could build for gaming.

The only difference is that it was recommended you remove the PC case sides in order to secure maximum airflow. Outside of that, the components were pretty standard, although due to a global GPU shortage, they were rather difficult to obtain at times.

- GPU – Radeon RX series had a proven track record of cost-effectiveness for ETH mining, from RX 560 and up.

- PSU – robust and quiet power supply unit is equally important, preferably rated at Gold efficiency. For example, be quiet! Pure Base 11 series was be a solid option.

- RAM – minimum of 4 GB

- CPU – Ethereum mining was either GPU or CPU-based. The former is far more effective but presents a larger initial investment.

Many people built customized Ethereum mining rigs consisting of multiple GPUs, costing upwards of thousands of dollars. Miners would gauge where their PC stood in terms of its hash rate power, using MinerStat and selecting their GPU model.

For example, RX 590, with its MSRP price at $228, would have been able to mine $3.37 per day net profit if the electricity cost is 0.1 USD/kWh. Outside of these parameters, choosing the right mining pool was also important to get the best bang for their buck.

4. You could use mining pools for ETH

If you already have a suitable mining PC and an Ethereum wallet like MetaMask to collect your rewards, you are all set to go. All you had to do was select a mining pool.

Mining pools are groups of miners connected over the Internet that pool together their computing resources in order to increase the likelihood of mining a block.

If successful, members of the crypto community who participate in the pool split the reward based on the mining hash rate each contributes. In a large pool, your chances of mining a block increase, which is an appealing prospect for many in the crypto community.

However, this also means that any reward will be smaller, as it’s distributed among a greater number of participants. Even if you ended up mining an “uncle” — a block that isn’t added to the Ethereum blockchain — it was still considered a legitimately mined block. It’s worth noting that some mining pools in the crypto community applied fees to these “uncle” blocks.

Then, there is the management fee for mining pools, usually ranging between 1% to 3%. Lastly, you had to consider if the mining pool has extra fees when paying out block rewards. This can either be the PPS (Pay-Per-Share) model or PPLNS (Pay-Per-Last N Shares).

PPS calculates the payout by dividing your hash rate power with the mining power of the Ethereum network. This results in a more stable income but with relatively higher fees.

On the other hand, PPLNS only pays out within a preset window, which can be represented as either a timeframe or a number (N). This means that the PPLNS payout model requires a mined block for rewards to be dished out.

The last payout model is called PPS+, a hybrid between the two — the reward is based on the expected mined value, but transaction fees follow the PPLNS model where fees are distributed according to each miner’s contributed hash rate.

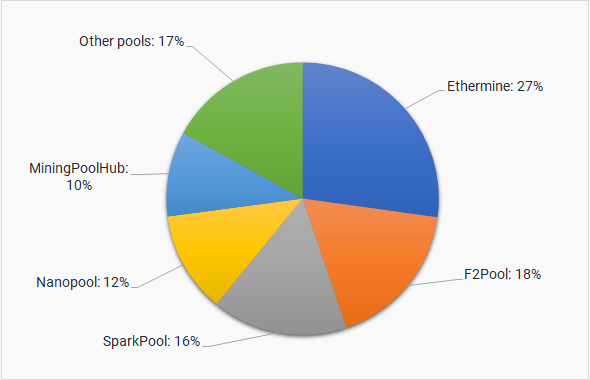

What were the top 4 Ethereum mining pools to join?

In a world of online scammers, it is always prudent to pick services with a proven track record. This especially applies when users embarked on a new venture like ETH mining. These four collaboration portals represent the best mining pools that were available, no matter your location.

- Nanopool was a mining pool that charged a 1% fee. It supported multi-asset mining, covering a range of seven cryptocurrencies. Payouts were made using the PPLNS method, with a minimum payout threshold set at 0.2 ETH.

- Ethermine, another Ethereum mining pool, imposed a 1% fee on its users. It was known for mining a portfolio of five different cryptocurrencies. The pool offered PPLNS payouts with a notably low minimum threshold of 0.05 ETH, and it also provided an option for instant payout.

- Sparkpool, previously known as ETHfans, was a mining pool with a 1% fee. It allowed for the mining of three distinct cryptocurrencies. Its payout structure followed the PPLNS model, requiring a minimum of 0.1 ETH for payouts.

- F2Pool, distinct for its slightly higher fee of 2%, was a multi-asset mining pool that supported a broad array of eleven cryptocurrencies. Similar to the others, it employed the PPLNS payout method, with a minimum payout requirement of 0.2 ETH.

It is important to note that F2Pool is still in operation, just not for ETH mining. Additionally, out of the four, only Ethermine was anonymous, meaning that you only had to download and install the mining software instead of registering an account.

There are still other mining opportunities

Although you can no longer mine Ethereum, you can still mine a host of other tokens. There are even some Ethereum forks that still support PoW mining. And if you really love canonical ETH, then you can always switch to staking on Ethereum. Whatever you do, always make sure to stay safe and do your own research.

Frequently asked questions

On September 15, 2022 the original Ethereum mainnet merged with the Beacon Chain. Therefore Ethereum 2.0 is now proof-of-stake. You can no longer mine Ethereum.

Miners can still mine Ethereum forks. Some of these include Ethereum Classic and EthereumPoW (Ethereum proof-of-sork). There are other Ethereum hard forks, such as Eth Zero, Metropolis, and Serenity; however, they have mostly been abandoned.

You can still mine Ethereum forks in mining pools. Forks like Ethereum Classic can still be mined in mining pools. However, Ethereum mainnet can no longer be mined.

As of 2025, some of the top ethereum mining pools include Slush Pool, PEGA, Binance and F2Pool. Each pool has its own fee structure, supports multiple cryptocurrencies, and employs payout models such as PPLNS, providing miners with diverse options based on their preferences and requirements.

Yes, Ethereum pool mining was deemed profitable due to the lower barrier to entry compared to bitcoin, affordable Ethereum mining rigs, and the coin’s increasing value. However, currently, Ethereum mining is no longer possible

Ethereum mining was considered more accessible and profitable than Bitcoin mining, as ethereum requires standard mining rigs, while Bitcoin demands dedicated and often expensive ASIC rigs. However, it is important to note that Ethereum mining is no longer possible as the network has transitioned from proof-of-work to proof-of-stake.

While Ethereum has transitioned to proof-of-stake and is no longer mineable, other cryptocurrencies can still be mined with the help of mining pools. It’s essential to choose reputable services with proven track records to ensure a secure and profitable mining experience.

The conclusion of Ethereum mining is attributed to the transition to a proof-of-stake model, rendering the mining of Ether unnecessary. As a result, mining equipment will become obsolete, limiting the options available to miners.

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.