Exchange-traded cryptocurrency notes, or crypto ETNs, are ideal for traditional investors looking for easy crypto market access, diversification seekers, risk-averse individuals, and tax-conscious investors. Those keen on learning about crypto without the complexity of direct ownership can also benefit from it.

But what exactly are cryptocurrency exchange-traded notes (ETNs), and how are they different from other exchange-traded products (ETPs)? This guide takes an in-depth look at this financial product and determines whether it can be a healthy investment choice.

- What are crypto ETNs?

- How do crypto ETNs work?

- The benefits of investing in crypto ETNs

- The risks of investing in crypto ETNs

- Crypto ETNs vs. ETFs: What’s the difference?

- How to invest in crypto ETNs

- The top crypto ETNs

- The London Stock Exchange reveals regulated crypto ETNs

- Tax implications for crypto ETN Investors

- Crypto ETNs: The present and predicted path

- Frequently asked questions

What are crypto ETNs?

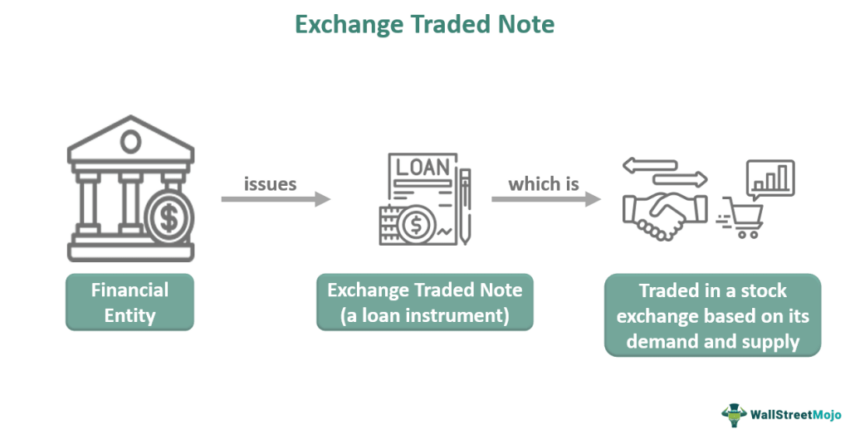

Crypto ETN, short for Cryptocurrency Exchange-Traded Notes, is a financial instrument that tracks the price of a specific cryptocurrency or a basket of cryptocurrencies, much like its cousins, the ETFs (Exchange-Traded Funds). However, the resemblance ends there.

An ETN is essentially an unsecured debt note issued by a financial institution. This means you are not directly owning a piece of the cryptocurrency itself but rather a promise from the bank. The bank guarantees to pay you the performance of the crypto (minus fees) when the ETN matures.

One of the biggest draws of crypto ETNs is their accessibility. Unlike cryptocurrencies, ETNs trade on major stock exchanges just like traditional stocks. This accessibility makes buying and selling digital assets somewhat easier and more practical.

For instance, with crypto ETNs, you can gain exposure to crypto while avoiding the complexities of exchanges and digital crypto wallets. That makes them a far easier solution for investors interested in crypto but wary of the accompanying technical challenges.

That said, you should remember that the simplicity of ETNs comes with its share of risks. For instance, you should always carefully evaluate the credit risk of the issuing institution. Since crypto ETNs are unsecured, if the issuer’s creditworthiness dips or the issuer goes bankrupt in a worst-case scenario, you could suffer significant losses. But before we get into these aspects, let’s look at how crypto ETNs work.

How do crypto ETNs work?

So, here is how it works — when you buy a crypto ETN, you’re not receiving actual cryptocurrencies. Instead, you acquire a piece of paper from the issuer — let’s say, a bank. The bank promises to track the performance of a cryptocurrency or a bunch of them. You could think of it as a bet with a bank on how well Bitcoin, Ethereum, or any other digital currency does. If your chosen crypto soars, your ETN’s value climbs. If it tanks, your ETN’s value drops accordingly.

In general, crypto ETNs are listed on stock exchanges where they are traded like shares. This means you can buy or sell them through regular investment accounts.

Here’s a breakdown of how crypto ETNs operate:

Issuance

A financial institution issues a crypto ETN that tracks the performance of a specific cryptocurrency or a basket of cryptocurrencies. This institution commits to matching the ETN’s performance to the corresponding crypto asset(s).

Regulatory approval

The newly issued ETN may undergo regulatory scrutiny before being listed on an exchange. This ensures the issuer has taken all necessary steps to safeguard investors’ interests per the existing regulatory framework.

Listing

The ETN, once approved by regulators, is then listed on a stock exchange. The process is hardly any different from how exchanges list shares of a company. Anyone with a brokerage account can buy and sell these crypto ETNs without owning and managing the corresponding cryptocurrencies directly.

Trading begins

Investors can buy and sell the ETN through the stock exchange, just like they would with stocks. The price of the ETN fluctuates based on supply and demand, as well as changes in the value of the underlying cryptocurrencies it tracks.

Leverage and shorting

Certain ETNs may come with leverage, which magnifies the returns (both positive and negative) of the underlying assets. This can be a tempting way to amplify potential profits but remember, it also amplifies potential losses. Some may also allow for shorting, which lets investors bet against the underlying crypto without short-selling the actual coins.

Maturity

Unlike ETFs, ETNs have a maturity date. When this date arrives, investors must return their ETN shares to the issuing institution. In exchange, they receive a payout that reflects the performance of the underlying digital asset(s).

It is worth mentioning here that with crypto ETNs, there’s an obvious trade-off between fees and control. While ETNs charge annual fees, storing crypto in your wallet can incur similar costs. Transaction fees, network fees, and even wallet security can add up.

Conversely, ETNs might not perfectly track the underlying asset due to a combination of factors. For instance, their price is influenced by both the cryptocurrency itself and the supply and demand for the ETN itself, which can lead to minor tracking errors. That said, on average, ETNs have minimal tracking errors compared to other comparable financial tools.

The benefits of investing in crypto ETNs

Crypto ETNs offer several benefits, including:

- Simplified investment: ETNs allow you to invest in digital assets without buying them directly. This frees you from additional tasks like setting up a wallet, managing your private keys, and keeping your funds safe from malicious elements.

- Easy access: Because ETNs are traded publicly on stock exchanges, they allow for convenient buying and selling through your existing brokerage account.

- Easy diversification: Crypto ETNs can track specific indexes with the promise of paying the index’s return rather than investing in the underlying crypto(s). This approach makes it easier for investors to diversify their portfolios and try new asset classes.

- Low tracking error: Unlike some ETFs that require rebalancing to match an index (potentially causing tracking errors), ETNs aim to mirror the return of the underlying cryptocurrency directly. This minimizes the difference between the ETN’s performance and the index it tracks.

- Potential tax advantages: Depending on where you live, crypto ETNs may be taxed as capital gains. This could lead to lower tax bills compared to how cryptocurrencies are taxed in some jurisdictions (e.g., as properties).

The risks of investing in crypto ETNs

Crypto ETNs may seem like a near-perfect investment vehicle for risk-averse investors and diversification seekers, but they pose risks, too. Having said that, you should be prepared for the following risk factors:

- Issuer risk: As an investor, you should always be aware that crypto ETNs are unsecured debt obligations of the issuing financial institution. So, regardless of how established the issuer is, there is always the possibility — however small — that they may default on their repayment.

- No underlying asset ownership: ETNs are more like unsecured bonds — owning them is nothing like owning the cryptocurrency they track. Your investment relies solely on the issuer’s ability to repay, not on ownership of the underlying assets.

- Limited liquidity: Although traded publicly, many ETNs have low trading volumes. This can make it difficult to sell your ETN quickly, especially during periods of low market activity or unexpected events.

Crypto ETNs vs. ETFs: What’s the difference?

ETNs are basically like promises from a bank (the issuer). The bank asks you to invest with them and promises that they will pay you back based on how a certain cryptocurrency performs through a set period. ETFs, on the other hand, are more like baskets full of goodies. Instead of promises, they hold the underlying crypto(s) and stocks of companies that developed them.

So, ETNs let you gamble on crypto prices, while ETFs give you a piece of the actual crypto (directly or indirectly). Both involve market risk, but ETNs add another layer: the bank’s trustworthiness. If the bank runs into trouble, your ETN investment may go bust. This additional risk factor means investing in ETNs can be more uncertain than other options.

Crypto ETN vs. ETF in a nutshell:

| ETN | ETF | |

| Structure | Acts like a debt investment. Investors don’t actually own a piece of the underlying asset. It’s more about the promise or “IOU” from the issuer. | ETFs mirror mutual funds. Investors own the underlying crypto(s), even if indirectly. |

| Return | Potential for payouts at maturity, and there’s a chance it could be called (bought back by the issuer) before then. | Delivers periodic dividends based on the volume of assets you own, reflecting your chunk of the pie. |

| Taxation | You are off the hook for taxes until the very end — either when you cash out at maturity or decide to sell off the ETN. | You’ll need to pay taxes on any dividends you receive each year, so make sure to settle annually for your earnings. |

How to invest in crypto ETNs

It goes without saying that proper research is crucial before you dip your toes in crypto ETNs — in any asset class, for that matter. It’s important to understand how they fit your investment goals. Here are some key questions to consider before diving in:

- Alignment with goals: Does an ETN help you achieve your desired investment outcomes?

- Underlying asset knowledge: Do you grasp the underlying asset or index the ETN tracks, and what’s your outlook for it?

- Default risk: Are you comfortable with the potential loss of your entire investment if the issuing bank defaults?

- Tax efficiency: Is an ETN the most tax-friendly option for your investment strategy?

You can typically purchase ETNs directly from the issuing institution or through an online brokerage. Financial institutions often issue them at $50 per share (or a comparable price), with the secondary market price fluctuating based on the underlying asset or index value.

The top crypto ETNs

If you’re unsure which crypto ETN you should try out, here are some top options you could consider:

1. SBTC 21Shares Short Bitcoin ETP

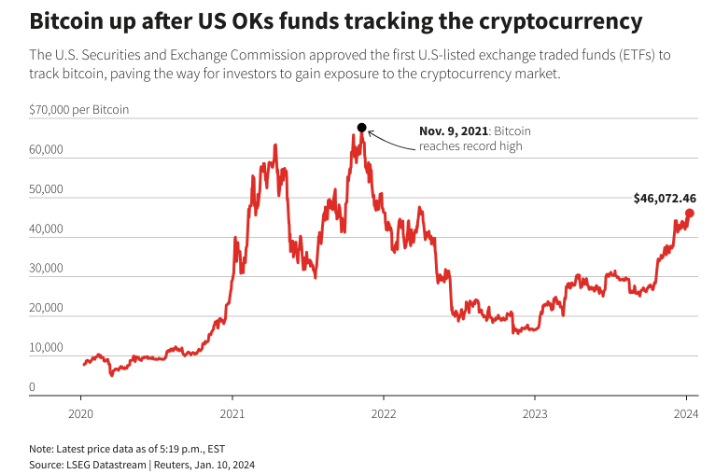

21Shares, known for its wide range of crypto-based investments, offers a top-performing Bitcoin ETN: the SBTC Short Bitcoin ETP. This product is designed for investors who think Bitcoin’s price might dip, allowing them to profit from that movement.

Tradable globally in USD on major exchanges like Euronext Amsterdam and SIX Swiss Exchange, the SBTC ETP lets you jump on the Bitcoin rollercoaster without actually owning any coins. 21Shares doesn’t stop at Bitcoin, though. They also offer ETNs for other popular cryptos like Ethereum, Polkadot, and even Ripple’s XRP.

2. WisdomTree Bitcoin

WisdomTree, a Wall Street investment firm, offers a smooth entry into Bitcoin with its WisdomTree Bitcoin ETP. Real Bitcoin backs it, so you get a piece of the action. You can trade it in USD on major exchanges like Euronext, SIX, and Frankfurt’s Stock Exchange. Depending on where you live, you might need a broker to jump in.

3. VBTC VanEck Bitcoin ETN

VanEck, a big investment player since 1955, backs the VBTC ETN with real Bitcoin (100% collateralized, to be exact). It tracks the MVIS Cryptocompare Bitcoin VWAP Close Index super closely, so you’re basically mimicking Bitcoin’s price movements.

Plus, you can buy and sell it on popular exchanges like XETRA, SIX, and Euronext, just like trading stocks. VanEck also offers ETNs for other hot crypto like Ethereum and Solana

4. Coinshare’s Bitcoin Tracker One

Coinshares, a digital asset pro since 2013, launched the OG Bitcoin ETN — Bitcoin Tracker One. Listed way back in 2015 on Stockholm’s NASDAQ/OMX, it was the first of its kind. Coinshares ETNs are physically backed. And if you’re in the U.S., you can grab them through any of their 25 partner brokers. Coinshare also offers ETNs on ETH, XRP, LTC, SOL, LINK, DOT, and XTZ, among others.

5. ETC Group Physical Bitcoin

ETC Group, a German investment heavyweight, offers a unique way to play the Bitcoin game with their ETC Group Physical Bitcoin. You could think of it as an ETF-ETN hybrid, backed by a fancy term called a “collateralized underwritten note.”

Additionally, it’s all under the watchful eye of the German government, which should give some extra peace of mind. You can trade it in USD on major exchanges like Aquis, Euronext Amsterdam, and SIX Swiss Exchange, among others. The platform offers ETNs for other popular cryptocurrencies, too.

The London Stock Exchange reveals regulated crypto ETNs

The London Stock Exchange (LSE) announced in late March 2024 that it’s joining the crypto ETN party by launching Bitcoin and Ether ETNs. The new financial products will be available in May 2024. However, due to U.K. regulations, they will be initially only available to institutional investors.

Applications for these ETNs open in April, with issuers needing approval from the FCA. Unlike a recent U.S. approval, these ETNs won’t be accessible to everyday investors.

“Exchanges must have the appropriate safeguards in place to ensure that the market segment is accessible to professional investors only. Exchanges must also make sure that they fully understand the nature of the risks of admitting crypto-linked instruments to trading and are satisfied that their admission to trading criteria and trading controls will adequately mitigate those risks.”

– The FCA

This move by the LSE, however, has the potential to make crypto ETNs more common and popular as a regulated investment option, even if initially limited to professional investors. It echoes the growing institutional interest in cryptocurrencies, even with stricter regulations.

Tax implications for crypto ETN Investors

Here’s a basic rundown of crypto ENT taxation — generally, the difference between what you pay when you buy the ETN and what you get when you sell it is considered a capital gain or loss. This means you only pay taxes when you sell the ETN (or when it reaches its maturity date).

However, it’s important to note that crypto tax implications can vary significantly based on your location. Therefore, consulting with a tax professional is highly recommended for further advice.

Crypto ETNs: The present and predicted path

Crypto ETNs are a relatively new twist on an old idea as it blends crypto with traditional markets. While tempting, these investments come with certain risk factors you should be aware of before spending real money on them. Ideally, you should research and consult a pro before diving in. As for its future outlook within the broader crypto market, the London Stock Exchange’s crypto ETN launch was another watershed moment for the asset class.

Increased accessibility will likely fuel industry growth and legitimacy. But amidst all these, a critical question lingers: will decentralization, a core principle of crypto, get squeezed by regulations that come along with ETNs? How we strike this balance will be crucial for shaping the future of the asset class within the broader financial market.

Frequently asked questions

Crypto ETN, short for Cryptocurrency Exchange-Traded Note, is a financial instrument that tracks the price of a specific cryptocurrency or a basket of cryptocurrencies, much like its cousins, ETFs (Exchange-Traded Funds). An ETN is an unsecured debt note issued by a financial institution. This means you are not directly owning a piece of the cryptocurrency itself but rather a promise from the bank. The bank guarantees to pay you the performance of the crypto (minus fees) when the ETN matures.

Crypto ETNs are ideal for cautious investors looking to diversify their portfolios with crypto exposure. However, there are a few key risks to consider. Unlike owning the actual cryptocurrency, ETNs are unsecured debts that financial institutions issue. This means there’s a chance, even with reputable issuers, that they could default, and you could lose your entire investment. Additionally, ETNs don’t grant ownership of the underlying asset, so your return depends solely on the issuer’s ability to pay. Finally, low trading volumes for some ETNs could make it difficult to sell them quickly when you need to.

Generally, the difference between what you pay when you buy the ETN and what you get when you sell it is considered a capital gain or loss. This means you only pay taxes when you sell the ETN (or when it reaches its maturity date). Keep in mind that each situation varies based on your location. Therefore, consulting with a tax professional is always the most reliable approach.

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.