Bitcoin ETFs have been around for some time now. But discussions have taken off after the formal SEC approval of the much-anticipated spot ETFs. With 11 Bitcoin Spot ETFs up for grabs, discussing what these and others signify is more than appropriate. A Bitcoin ETF is essentially a conduit allowing traditional investors to have some exposure to BTC — as futures contracts, as a spot or tradable BTC, as companies with exposure to mining setups, and more.

Throughout this piece, we will unpack everything about Bitcoin ETFs, including spot ETFs, futures ETFs, miner ETFs, and international ETFs. After reading through this guide, you should be able to make a call about investing in a Bitcoin ETF or simply sticking to the tried-and-tested Bitcoin — the one Satoshi Nakamoto came up with.

- What is an ETF?

- What is a spot Bitcoin ETF?

- Types of Bitcoin ETFs

- Is owning a Bitcoin ETF the same as owning Bitcoin?

- Pros and cons of Bitcoin ETFs

- How does a Bitcoin ETF work?

- Choosing the right Bitcoin ETF

- Are Bitcoin ETFs a good investment?

- Bitcoin ETFs, BTC, or both: Which should you get?

- Frequently asked questions

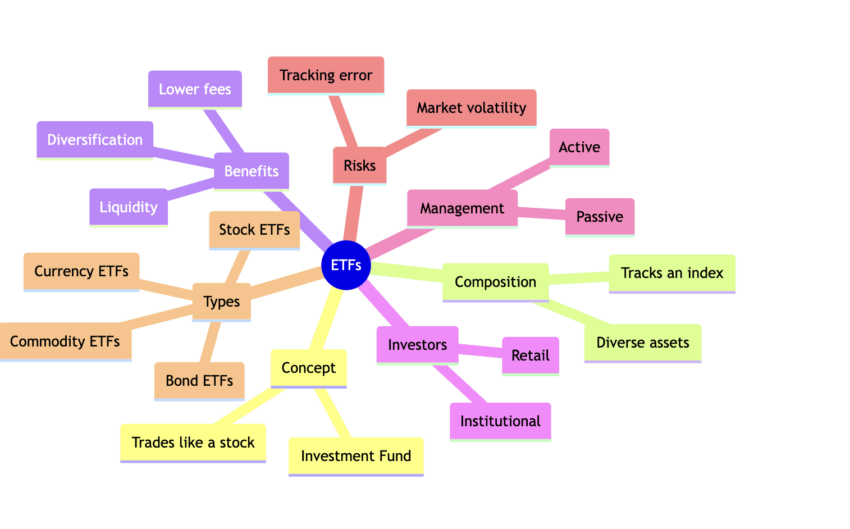

What is an ETF?

An ETF stands for an Exchange Traded Fund that gives you exposure to a diverse selection of assets without needing to own the asset(s) directly. The prices of the ETFs derive their highs and lows from the prices of the underlying assets.

A simpler way of understanding an ETF would be to look at a fruit basket with all the exotic fruits, ensuring that you do not need to shop for each fruit individually.

Traditional ETFs are known for their risk management traits and their ability to help users with portfolio diversification.

What is a Bitcoin ETF?

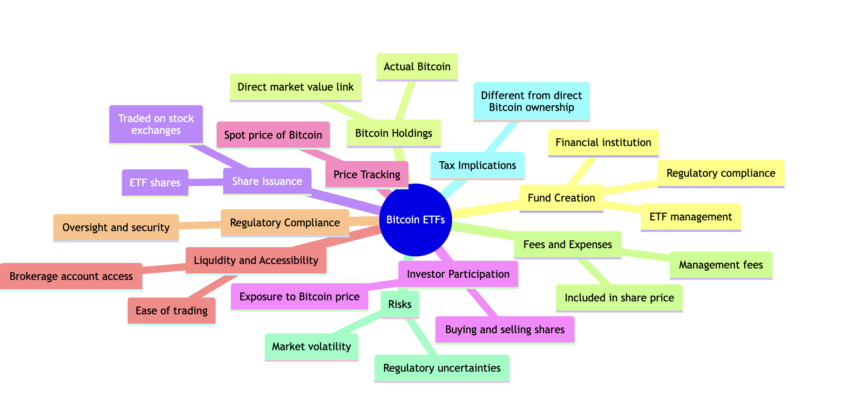

Like a legacy ETF, a Bitcoin ETF gives exposure to some kind of Bitcoin-native feature or functionality. The now-approved spot Bitcoin ETFs (as of mid-January 2024) are directly invested in BTC and track the asset’s actual price. Similarly, there are Bitcoin Futures ETFs, where the ETFs are invested in Bitcoin futures; strategy ETFs, where the ETFs are invested in companies holding BTC; and more.

With a crypto ETF, a regular user can get exposure to all the underlying components of the corresponding ETFs without having to go into technical elements of futures contracts, companies with BTC exposure, or even timing the market, as for the spot Bitcoin products.

Why there was a need for a Bitcoin ETF, preferably a spot crypto ETF?

Owning a Bitcoin or some of it is something many people dream of. Yet, navigating the exchange UI and wallet elements like private keys and seed phrases can be roadblocks to quick adoption. A BTC ETF eliminates these entry barriers. An ETF is a singular and regulated route to invest in Bitcoin; the user can buy an ETF, giving funds to the company issuing it, which buys BTC on your behalf. This simple yet effective approach aims to make BTC more accessible to even the legacy investors, who are more familiar with the traditional instruments like stocks and more.

Simply put, a BTC ETF aims to bridge the gap between the crypto world and the traditional financial realm. Also, Bitcoin ETFs, apart from the spot ones, are more useful to users who prefer exposure to the crypto derivates market, as hopping onto the crypto futures trading platforms might need additional technical skills and insights. Buying futures ETFs, like the ones from BITO, ensures that the ETF holders handle the crypto futures trading platforms on your behalf.

What is a spot Bitcoin ETF?

The concept of a spot Bitcoin ETF is simple — an ETF that tracks the spot price of Bitcoin. Issuers offering spot BTC ETFs hold Bitcoin physically as an underlying asset. Therefore, if you invest in a spot Bitcoin ETF, the investment performance of each share of your ETF holdings is linked directly to the price movement of Bitcoin.

Another way of looking at a spot Bitcoin ETF is as an investment fund trading on stock exchanges. You can think of it as a stock that any standard user can purchase, eventually gaining exposure to BTC.

Did you know? The price of a Spot Bitcoin ETF isn’t equal to one BTC. Instead, the listing price of ETF varies per issuer based on the fees charged, the nature of BTC holding custodians, exchanges listing them, and more. For instance, the ARKB or the ARK21Shares Bitcoin ETF closed for $43.86, per the Cboe U.S. Exchange listing data.

The significance of the spot ETF

The most important significance of a spot BTC ETF is its accessibility. This move opened Bitcoin to a larger audience who were previously uncomfortable using exchanges.

This move legitimizes the presence of BTC in traditional investment markets and can potentially attract more institutional investors in crypto futures and spot markets, acting within the regulatory framework.

History of ETF progress

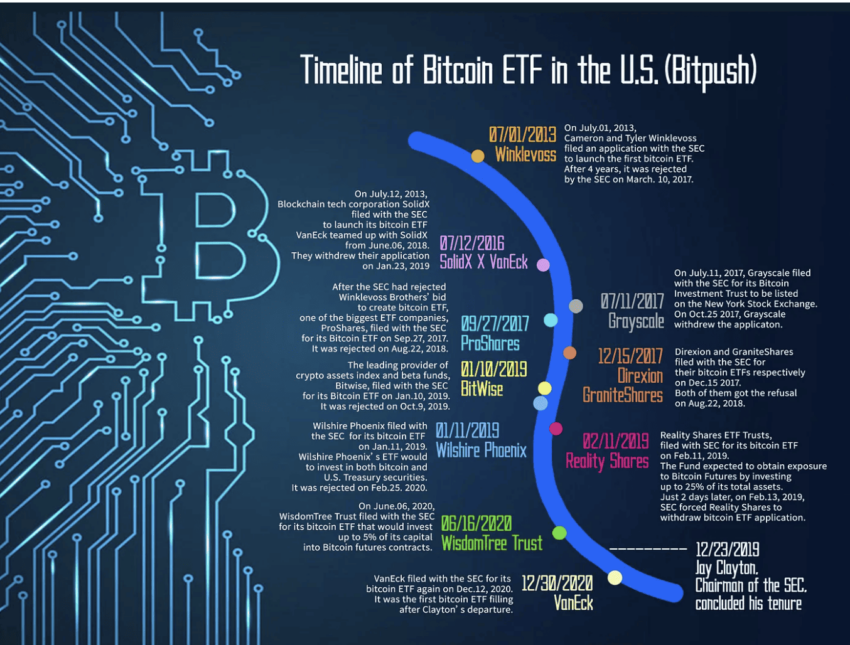

The approval of the spot BTC ETFs didn’t happen overnight. Over the years, Bitcoin ETF evangelists saw rejections, partial approvals, and more to finally see the spot products receiving mainstream acknowledgment. Here is how the history panned out:

2013: The Winklevoss Twins applied for the first Bitcoin ETF proposal

2017: The list of proposals continued, and the SEC continued to reject them, citing liquidity and market manipulation concerns.

2018-2020: The rejections kept piling up, but the interest grew.

2021: The first Bitcoin futures ETF, the one from ProShares, was approved. The ticker symbol was BITO, which began trading and allowed users to gain exposure to Bitcoin futures.

2021-2023: Other futures ETFs were approved, including those from VanEck, Valkyrie, and others. Talks about an impending spot Bitcoin ETF approval became louder.

2024: 11 spot Bitcoin ETFs were approved, marking a watershed moment in the history.

Other elements of the ETF history:

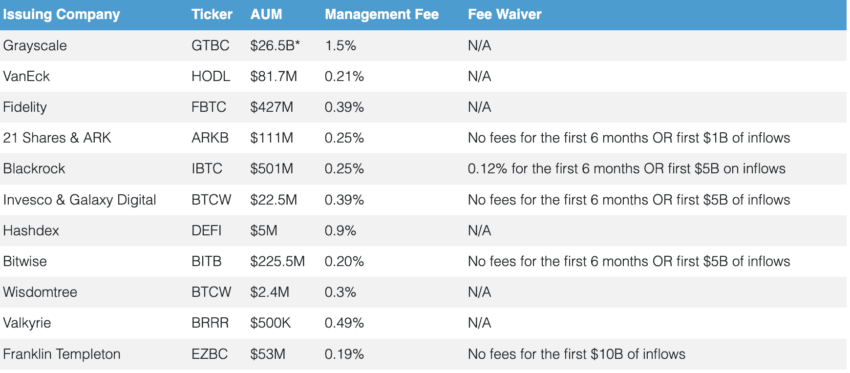

Listed and approved ETFs as of January 2024

With the history covered, here is a list of all the approved spot ETFs:

- ARK 21Shares Bitcoin ETF (ARKB)

- Bitwise Bitcoin ETF (BITB)

- Blackrock’s iShares Bitcoin Trust (IBIT)

- Franklin Bitcoin ETF (EZBC)

- Fidelity Wise Origin Bitcoin Trust (FBTC)

- Grayscale Bitcoin Trust (GBTC)

- Hashdex Bitcoin ETF (DEFI)

- Invesco Galaxy Bitcoin ETF (BTCO)

- VanEck Bitcoin Trust (HODL)

- Valkyrie Bitcoin Fund (BRRR)

- WisdomTree Bitcoin Fund (BTCW)

Do note that these are just the recently approved spot ETFs. Other ETFs also exist, which we will discuss shortly.

Also, a spot ETF-related analysis by 10x research suggests that the spot price of BTC might drop to $38,000, led by continued sell-off and concerns related to bearish RSI levels. This is where a Dollar Cost Averaging approach to hoard BTC might be a good investment move.

“Bitcoin unchanged from a week ago. Seems everybody wanted to sell BTC into the approval spike. ETH is rallying as people are taking off the long BTC vs short ETH trade. Also, crypto equities have sold off since the end of Dec. maybe shows a lack of TradeFi crypto FOMO.”

Markus Thielen, CEO of 10x Research: X

Types of Bitcoin ETFs

As mentioned, spot BTC ETFs aren’t the only available varieties. Many other types of BTC ETFs allow exposure to some other exclusive element of Bitcoin’s existence. These include the following:

Bitcoin futures ETFs

These ETFs invest in BTC futures contracts and are prone to rollover costs. Some of the notable examples include Valkyrie’s Bitcoin Strategy (BTF) and ProShares Bitcoin Strategy ETFs (BITO). These funds have a lower expense ratio or underlying charges compared to Bitcoin futures trading fees.

While Bitcoin futures can also be traded on the best Bitcoin futures trading sites like MEXC or OKX, these ETFs attract lower fees and minimize market tracking hassles. They also employ built-in risk management in futures trading. Futures ETFs are meant for users who prefer cryptocurrency derivatives trading over spot trading and want exposure to Bitcoin options or futures trading without the associated complexities.

Some of the best Bitcoin futures ETFs, which can simplify BTC futures trading for beginners, include BITO, BITI (a short Bitcoin ETF), XBTF, BTF, MAXI, and BITS.

Also, you can consider these ETFs as the futures trading for beginners guide as users can see the result and price moves but do not have to worry about the trading regulations or futures trading strategies.

Bitcoin miner ETFs

These ETFs focus on companies that mine Bitcoin. Factors relevant to the mining industry, related technology, energy costs, and more influence the price of these ETFs. Some of the more popular examples include the Viridi Cleaner Energy Crypto-Mining & Semiconductor ETF.

Leveraged or Inverse ETFs

These are complex financial products that either provide multiplied price exposure or exposure to the short bets placed on the price of BTC. One of the most popular examples has to be the ProShares Short Bitcoin Strategy (BITI).

Hybrid ETFs

These ETFs, including the likes of Bitwise 10 Crypto Index Fund, offer exposure to BTC and other assets like other crypto assets and stocks. Hybrid ETFs allow users to diversify their holdings without having to buy each asset individually.

International ETFs

While much talk is focused on U.S.-specific ETFs, several international ETFs have existed for some time. These include the Purpose Bitcoin ETF (BTCC), which is based out of Canada and has been around since February 2021. The ETF is listed on the Toronto Stock Exchange.

If you look at Europe, there is the Jacobi FT Wilshire Bitcoin ETF, which came through in August 2023 and is available to trade. Latin America has the QR Asset Management Bitcoin ETF (QBTC11), whereas Asia-Pacific has the CSOP Asset Management ETF, and Australia has the Global X 21Shares Bitcoin ETF (EBTC).

Comparative analysis of BTC ETFs

Now that we know how each ETF works, let us compare each. As Bitcoin futures ETFs have been hogging the limelight, it is appropriate to pit them first against the spot ETFs.

Bitcoin futures ETFs vs. spot ETFs

BTC futures ETFs like the XBTF and BITO are available on the Bitcoin futures exchanges. Investments here are limited to futures contracts and are aligned with short Bitcoin ETF and leverage trading approaches. They do not track the spot price of Bitcoin.

Futures ETFs carry lower fees than margin trading in crypto via exchanges. Also, as they are linked to the crypto derivatives market and bring in the concept of standard and perpetual futures contracts, they carry the standard futures market risks. These include rollover costs, tracking errors, and counterparty risks.

Spot ETFs closely track the Bitcoin price and offer a more direct investment option than the crypto derivatives market. Also, unlike cryptocurrency derivatives trading, the funds issuing spot ETFs actually hold Bitcoin physically. With spot ETFs, you need not be aware of BTC futures market analysis or margin trading in crypto. What you invest is physically backed by the relevant quantity of BTC.

Is owning a Bitcoin ETF the same as owning Bitcoin?

Even though spot BTC ETFs track the actual price of BTC, owning them isn’t the same as owning BTC. Owning Bitcoin gives you direct ownership of digital gold, allowing you to trade 24/7. Actual Bitcoin can be traded across futures exchanges, including those offering spot trading. With access to Bitcoin, you can indulge in margin trading in crypto via leverage trading and using collateral.

Simply put, if you are an experienced crypto trader interested in navigating the waters of direct Bitcoin options trading or cryptocurrency derivatives trading, owning Bitcoin makes more sense. Spot ETFs will be preferable for individuals who want exposure to BTC but on traditional stock trading platforms. However, spot ETFs come with built-in fees, something that can be avoided when buying and holding actual BTC, depending on the exchange you are purchasing from.

Pros and cons of Bitcoin ETFs

Before we analyze the modus operandi of Bitcoin ETFs, it is appropriate to list the associated pros and cons:

Pros

- Easy to access

- Comes with regulatory oversight

- Allows for diversification

- Boasts high liquidity as compared to actual assets

- Boasts tax efficiency as with most ETFs

- Has institutional and mainstream appeal

- Doesn’t require you to worry about futures trading regulations and strategies

- Even sees institutional investors in crypto futures via these ETFs

- Lower charges than the standard Bitcoin futures trading fees

Cons

- Futures ETFs can have tracking errors.

- Centralized control

- Not available 24×7

- Prone to systemic banking risks

- Reliant on the custodian who holds BTC

How does a Bitcoin ETF work?

Let us now delve deeper into how these BTC ETFs work. We shall not just discuss how spot Bitcoin ETFs work but focus on the very foundation of every type of Bitcoin ETF.

Here are the steps involved, with a brief explanation of each:

Structure and management

The fund manager behind the ETF creates the fund, holding either Bitcoin physically, the futures contracts of BTC, or the stocks of companies actively involved in Bitcoin mining. The assets held determine the risk profile and the investment strategy of the ETF.

ETF shares and Bitcoin prices

Once the underlying assets are all set, the ETF issuer issues shares, which start at zero and eventually generate liquidity as the markets start showing interest. The APs or the Authorized Participants handle the creation and redemption of ETF shares. The first set of shares is known as Creation Units. Then, the price of each share is determined, depending on the type of assets held, fees, value of futures contracts if it isn’t a spot ETF, and more. These shares are eventually made available on stock exchanges for regular, over-the-counter trading.

The flow of a cash spot ETF:

Role of Authorized Participants

APs are the bodies that create new shares by purchasing the underlying asset. They are the ones who deliver the assets to the funds in return for new shares. These shares are redeemable. This process of getting and storing assets in real time aligns the Net Asset Value or NAV of the ETF to the price of the asset. When the demand increases, these APs create new shares to meet the same.

Storage and security

While the futures contracts can be stored digitally, spot ETFs have the APs and fund managers storing actual Bitcoin using a combination of cold and hot wallets.

Investment and redemption

The process of investing in these ETF shares is simple. Investors buy and sell the shares over the counter via the brokerage accounts. And when the prices of the spot BTC or the futures contracts increase, they can redeem the same at a higher tick.

If you are wondering how a short BTC ETF works, note that it uses leverage trading principles, futures contracts, and Bitcoin options trading rules to get the inverse relationship to price.

Choosing the right Bitcoin ETF

There are quite a few Bitcoin ETFs to choose from as of mid-January 2024 — spot, futures, inverse, miner, and international. However, to choose the right one, you should consider the following variables first:

- Risk tolerance: If you have a low-risk tolerance but still want to engage with BTC ETFs, we recommend miner ETFs.

- Investment goals: For more aggressive price surges and a fast-track chance to become wealthy, spot and futures ETFs are most likely to provide.

- Diversification: This is where hybrid ETFs from Bitwise can make sense, allowing exposure to a wide range of assets, including BTC.

- Issuer reputation: If you are aware of the legacy issuers and have favorites like Grayscale., VanEck, and more, you can choose your ETF accordingly.

If you are specifically looking for spot ETF picks, the pointers to consider include:

- Expense ratio

- Liquidity

- Storage and security

- Alignment to the regulatory framework

- Higher AUM

For futures ETFs, you need to focus on the following metrics before making a purchase:

- Rollover costs when contracts expire

- The expense ratio, which is higher than spot ETFs

Are Bitcoin ETFs a good investment?

If you are invested deeply in cryptocurrencies and decentralized ecosystems, you might want to give these ETFs a pass. However, if you dread exchanges, wallets, and private keys, buying BTC ETFs over stock exchanges could be a good call. And while the spot BTC ETFs are new kids on the block, with the Bitcoin halving event due in Spring 2024, the expected price surges can push the price of the ETF shares higher.

It is worth noting that as Bitcoin is also termed digital gold, the approval of spot BTC ETF can play a role in pushing the prices of the actual asset up, per the mentioned correlation:

This presents a new angle to the ETF investment(s).

However, if you simply go by the trends, something like the ProShares Bitcoin Strategy ETF has charted a gain of 137.33% in 2023 alone and a one-year return of 110.27% as of Jan. 16, 2024. This shows ETFs can make for good investment options, provided the underlying asset also responds to price optimism.

However, regardless of which ETF you wish to invest in, it is necessary to use the right trackers for accurate crypto portfolio management.

Bitcoin ETFs, BTC, or both: Which should you get?

Bitcoin ETFs make BTC a household name. They are suitable for users who have heard good things about Bitcoin but want to steer clear of wallets, exchanges, and more. But if you still believe in the decentralized and distributed vision of Bitcoin, are interested in using BTC as a mode of payment, or are looking to use platforms like YouHodler to maximize passive earning opportunities on your holdings, simply buying Bitcoin and HODLing remains the better choice.

Frequently asked questions

Is there an ETF that holds Bitcoin?

What are the 11 bitcoin ETFs?

Does Vanguard have a Bitcoin ETF?

Does Schwab offer a Bitcoin ETF?

What is ETF in cryptocurrency?

What is the disadvantage of a Bitcoin ETF?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.