When investing in crypto, HODLing and taking profit is only half the battle. You must also pay taxes so that you can keep those hard-earned gains. Whether you are a resident of the U.K., a citizen, or just generally interested in the nation’s tax law, read on in this guide on how crypto is taxed in the United Kingdom. Here’s what you need to know.

History of taxes in the United Kingdom

Great Britain has unique taxes, especially when it comes to crypto. Income tax was first introduced in 1799 as a measure to cover the enormous costs of the Napoleonic Wars. As the conflict protracted, the tax on people’s earnings became entrenched, never to recede again but only to increase over time.

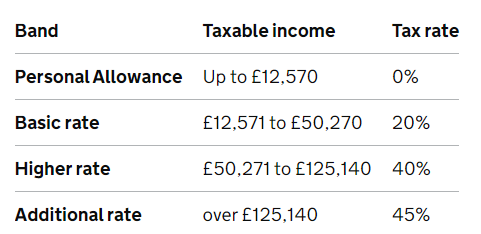

Like in most countries, income tax eventually became progressive — increasing with the level of income. In the current year, the minimal personal allowance before taxation occurs is £12,570. This includes crypto received as a salary, mining, airdrops, or DeFi rewards.

Beyond that level, there are three tax brackets in the U.K. These are:

- Personal allowance tax rate of 0% up to £12,570

- Basic tax rate of 20% up to £12,571 to £50,270

- Higher tax rate of 40% up to £50,271 to £125,140

- Additional tax rate of 45% beyond £125,141

Of course, a wide range of tax relief options and allowances can be taken advantage of, so you are not hit with the full brunt of taxation.

For example, Marriage Allowance (which also applies to civil partnerships) allows you to free up £1,260 of your personal allowance to your partner. However, such conditions only apply if your income level is under the minimum for taxes to hit — £12,570.

Such conditions are interspersed throughout the tax law, which brings us to the issue: how should you prepare for trading with cryptoassets in the U.K.?

UK’s classification of cryptocurrencies

Bitcoin’s trading launch took place in 2010. The U.K.’s authorities took eight years to tax gains from such virtual currency assets. In December 2018, HMRC — Her Majesty’s Revenue and Customs — issued a comprehensive guideline on taxing cryptoassets for individuals. A few updates later, here is the current state of cryptoassets taxation:

As you may already know, the U.K. doesn’t consider cryptocurrencies as currencies or legal tender. Hence, the name — cryptoassets.

This means that individuals and businesses can trade with three types of these tokens: exchange, utility, and security. However, each type of cryptoasset can be taxed differently, not based on its definition, but based on its use scenarios.

Nonetheless, when one thinks of cryptocurrencies or crypto assets, these are all exchange tokens: Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Litecoin (LTC), etc.

It’s my ambition to make the UK a global hub for cryptoasset technology, and the measures we’ve outlined today will help to ensure firms can invest, innovate and scale up in this country.

We want to see the businesses of tomorrow – and the jobs they create – here in the U.K., and by regulating effectively we can give them the confidence they need to think and invest long-term.

Rishi Sunak as Chancellor of the Exchequer, 2022 | HM Treasury

Legally defined in the U.K., these exchange tokens are all crypto coins that are designed to be used for payments, utilizing blockchain, which is DLT — Digital Ledger Technology. The underlying value of exchange tokens is based on their usage instead of on centralized institutions.

UK’s tax treatment of cryptocurrencies

Now that we know how cryptocurrencies are classified in the U.K., it’s easy to figure out how they are taxed. In almost all cases, individuals holding cryptoassets are subject to Capital Gains Tax (CGT).

You must only pay capital gains tax on total gains in excess of the annual exempt threshold.

Whether receiving cryptoassets as airdrops, from mining, as transaction confirmation, or from employers, all such tokens are hit by CGT in addition to National Insurance contributions.

CGT is around 10% to 20% on crypto asset gains, depending on your income bracket. Be warned, though, this may change according to the Principal of Hillier Hopkins, the long-standing Chartered Accountants firm:

“HMRC sees cryptocurrencies not as a currency but as investment assets and as such are subject to capital gain tax. The huge increases in Bitcoin in recent weeks will see HMRC take a keen interest where investors choose to cash-in on that growth.”

Principal of Hillier Hopkins, Chartered Accountants

Instead of CGT, income tax would only apply to businesses that generate trading profits in cryptoassets. This can go from 0% to 45%, depending on the income level and specific region.

However, it is extremely rare for HMRC to assess an individual’s crypto asset activity to apply income tax. This is reserved for professional traders and businesses.

Moreover, trading in cryptoassets is treated differently from gambling. With that out of the way, here is how different crypto asset activities are taxed:

- Capital Gains Tax (CGT): This is a tax on the profit (or gain) you make when you sell, give away, exchange, or dispose of something (an ‘asset’) that has increased in value.

- Income Tax: This is a tax on your income. However, not all types of income are taxable, and you’re also not taxed on all of your income.

- The key distinction is that Capital Gains Tax is levied on the profits from the sale of cryptoassets, while Income Tax is levied on your regular income, such as wages, pensions, and interest.

- The Annual Exemption (£6,000) relates specifically to Capital Gains Tax and applies to the profits from the sale or disposal of assets.

- The Personal Allowance (£12,570) relates to Income Tax and applies to your income from various sources.

- Both these allowances are adjusted from time to time. They are designed to provide relief for taxpayers by only taxing income or gains above these thresholds.

Mining

You have already heard of Bitcoin using up as much electricity as a country. Depending on the time you’ve seen such a headline, the comparative country could range from Argentina to Switzerland. This enormous energy expenditure is expanded on the so-called mining.

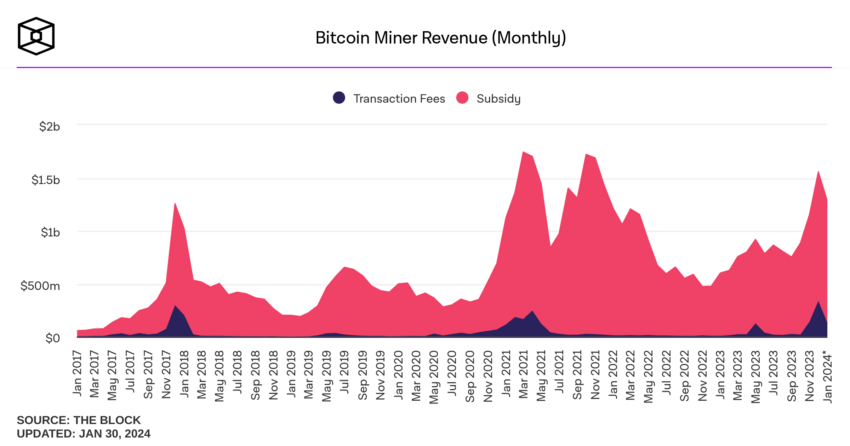

These computers are called mining rigs, and recipients of mining rewards are called miners. Just for the month of January, Bitcoin miners received over $1 billion in mining earnings. Although each Bitcoin halving reduces mining rewards, the skyrocketing Bitcoin price more than makes up for it.

Accordingly, cryptocurrency mining in the U.K. is treated in two layers:

- If miners keep mining rewards, they have to pay CGT.

- If miners don’t engage in trading, they have to pay a crypto tax on the income from their mining rewards.

On top of that, fees or rewards for mining are subject to income tax with regard to their risk, organization, degree of activity, and commerciality.

Of course, if these fees gain in value from the time of acquisition, they will be subject to CGT. Conversely, the accrued value will be counted for trading use cases.

Airdrops

Fintech companies often resort to airdrops — free token distribution into users’ wallets to increase awareness and usage of new tokens.

More often, users have to commit to some microtask — tweeting, following, registering, etc. — to receive these airdrops.

If airdrops are released freely, without requiring anything in return, they are exempt from income tax. On the other hand, if wallet holders are expected to perform some service for received airdrops, they are subject to a crypto income tax. This can be either miscellaneous or as trade receipts.

Predictably, once you sell airdropped tokens, you must pay CGT. This applies even when the airdrop was not subject to income tax. As with mining, income tax precedes CGT when the value change is calculated.

U.K. crypto tax law compared to the E.U.

The European Union is still not unified enough to view it as a monolithic body. Many member-states have their own taxes on crypto.

Accordingly, E.U. taxation may vary widely. For example, Germany (if under 600 Euro) and Slovenia don’t tax Bitcoin transactions, except for VAT in some cases.

Likewise, Malta has become a haven for cryptocurrency transactions due to its policy not to charge income or gain taxes on isolated transfers. Crypto exchanges and day traders are taxed in Malta, falling under the general corporate income tax rate of 35%. Portugal is another E.U. nation without specific cryptocurrency taxation laws.

On the other hand, Romania charges a 10% tax on all cryptocurrency earnings above €126 annually.

Do you need to declare your cryptoassets?

When your cryptoasset activity can be subjected to CGT, it has to be declared to HMRC.

However, only when these conditions apply:

- If the crypto asset gains fall above the Capital Gains Annual Exemption

- If the total gains — disposal value summed up — are 4X higher than the Capital Gains Annual Exemption

Disposal value is calculated by including selling and exchanging cryptoassets, using them as payments and as gifts to non-partners/spouses.

In addition, charity donations are exempt from CGT unless they fall under “tainted donation” or if the difference between charity donation and crypto asset acquisition is high enough to constitute a gain.

Do you need an accountant?

An accountant will tell you what you should already know by reading to this point. The nature of using your cryptoassets will determine whether they are liable for taxes on crypto in the form of CGT or/and income tax. This is easy to follow for infrequent crypto traders, as almost always CGT will be applicable.

However, if the bulk of your income comes from frequent trading with multiple types of cryptoassets and acquisition in multiple ways, it may be best practice to seek advice from a professional accountant. At least briefly, until you are completely familiar with the process.

No doubt, a professional accountant will take care of:

- Proper reporting of all your trading activity when it needs to be reported

- Seeking tax exemptions

- Determining if CGT and/or income tax applies

Therefore, you should balance out the cost of hiring an accountant with the value of activity you generate with cryptoassets.

Streamline your tax calculation

Crypto taxes are as important as any other type of tax. Therefore, be sure to check the status of your crypto asset activity with official governmental portals. You may also choose to avoid the high cost of professional accountants by using software services such as Crypto Tax Calculator, which is designed specifically for HMRC tax laws in the U.K. Whichever route you choose, compliance is key.

Frequently asked questions

Do I need to pay taxes on cryptocurrency in the U.K.?

How does the U.K. classify crypto assets?

Do you pay taxes on crypto gifts?

Are staking and lending taxed in the U.K.?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.