Buying low and selling high is the most vanilla BTC trading strategy ever. But what if we told you that there is another way around it? You can first sell BTC high and then buy BTC low. Simply put, you can short bitcoin.

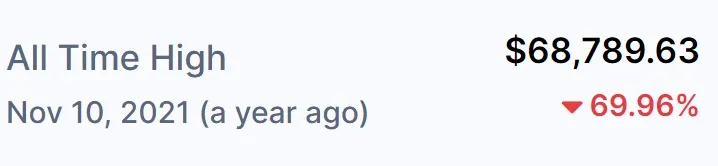

Shorting a crypto asset means that traders expect the same to go down in time, maybe even crash. And while buying and selling bitcoins is a tried and tested approach, shorting bitcoins is a good way to use a dipping market to your advantage. Still, not every trader likes shorting. However, in 2022, when most cryptos have retraced a lot from their all-time highs, betting on specific assets to go down isn’t such a bad option.

Then again, there is much more to shorting or short selling than what meets the eye. Stay with us as we discuss everything about short-selling BTC throughout this discussion.

In this guide:

What is shorting bitcoin?

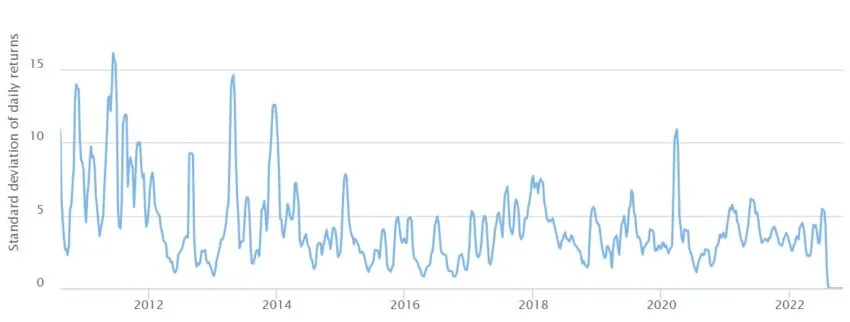

Shorting bitcoins means selling BTC at a specific price — market or limit — and eventually buying the same at a lower price. The buy low-sell high concept still holds but in reverse. Short selling is an investment strategy where the trader expects BTC prices to go down but still wants to profit from it. Furthermore, shorting is a common investment method in the traditional asset markets. Its popularity in the crypto space can be attributed to the volatility surrounding the realm.

Simply put, more volatility means more shorting opportunities.

How does shorting bitcoin work?

Shorting, as an investment principle, is no different for bitcoin. It applies to any and every tradable asset. However, with crypto being the focal point of this discussion and BTC being the most dominant crypto, this discussion requires additional detailing.

If you are looking to short-sell bitcoin, you must first borrow BTC from the relevant platforms to open a short position. Borrowing in this context is termed “margin.” Once you have the borrowed BTC on you, consider selling it at a price and buying it back later — closing the position and making money from the buying and selling difference.

Why borrowing, you ask? Here is why:

You cannot short-sell the assets you own. If you do, you are simply “selling” them and closing out every opportunity to buy them back when the prices drop. That is why almost every short-selling gig requires borrowing of some kind.

You can have accounts on multiple exchanges and brokerage platforms to check how much BTC you can borrow. Note that borrowing would require some form of collateral and incur interest. However, shorting using derivates can also work if you want to avoid trading BTC directly. We will discuss all of that in the upcoming sections.

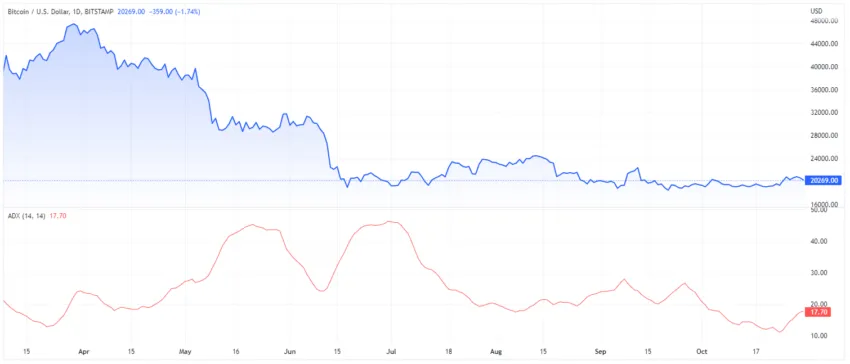

BTC down by over 70% from its all-time high. Fancy shorting???

Benefits of shorting bitcoin

Before we delve into the details, let us first look at the perks of short-selling BTC:

Loss hedging

A bear market is never kind to short to mid-term investors. If they need money, they might even have to free up some capital at a loss. Shorting can work as a hedge at this time, allowing short to mid-term investors to hedge losses by riding the dip.

Beating the volatility

A volatile market isn’t all bad. If you know the tricks of the trade — in the literal sense — you can beat the bear market volatility at the BTC counter by buying when the prices drop and selling when the prices surge. Shorting just gives you another idea to use the volatility to your advantage. However, in this case, it is important to be able to time the market to perfection.

Better valuation

Despite the underlying risks, short selling is a good way to reset an overvalued market. Short sellers play a role in increasing the supply of BTC, which lowers the price and brings the same to the “fair price” territory. While this allows the short seller to make profits, it also allows investors to get hold of BTC at a decent “buying” price.

Low capital requirement

You do not require a lot of capital for short-selling bitcoin. Depending on the brokerage platform you choose, you can get a 2x, 3x, or even 5x margin. This approach lets you maximize the earning potential, regardless of the market situation.

Shorting bitcoin: the risks involved

Shorting bitcoin is a good way to weather the bear market headwinds. However, there are a handful of risks that you must consider before proceeding:

Limitless losses

When you buy an asset and sell it later, you do have the option of limiting your losses. For instance: if you buy 1 BTC at $18,000, expecting it to go up, and it drops to $17,000 — you end up losing $1,000. However, with short selling, you can spiral into the limitless loss territory as you are using your capital (BTC here) to borrow more for trading.

Consider this: you sell 5 BTC at $18,000 each, considering you have 5x leverage and you use 1 BTC as collateral. Now the price starts ballooning and reaches $30,000 within a few days. This means you are now staring at a loss of 5 x $12,000 = $60,000. That’s the Limitless Loss exposure we were talking about.

Most brokerage firms liquidate assets and close your open sell position once the asset price increases and reaches a specific stop-loss value.

Margin interest

Remember margin? Well, a brokerage firm or an exchange doesn’t let you borrow BTC from the goodness of their hearts. You need to pay a margin interest, which can be hourly or daily, depending on the platform of choice.

The longer you keep the short position open, the higher the cumulative margin interest.

Ways to short bitcoin: here are 6 of them

Now that you are aware of the short-selling perks and risks, here are the actual techniques to execute this standard investment procedure:

1. Margin trading

Margin trading is arguably the most common short-selling technique. As a trader, you can go about margin trading by borrowing bitcoin from a brokerage firm, selling the same, and then buying the BTC at a time when it’s trading low. You make a profit by simply pocketing the difference. Where there are several other shorting-based trading strategies, margin trading is the most straightforward one. And it works for other digital assets as well.

2. Futures market

If you do not want to trade BTC directly, the bitcoin futures market is worth considering for short selling. In a futures market, you sign a contract as a buyer or seller, becoming obligated to buy or sell the asset at a predetermined price — at a given date. If you are a buyer, you sign the contract with a seller and vice versa.

If you are looking to short bitcoin — believing that BTC prices will go down in the future — you can sell a futures contract. When BTC prices drop, you buy BTC at a lower price and sell it to the buyer at a higher price (predefined in the contract as the settlement price).

Some risks exist, such as if the prices increase, you are forced to buy BTC at a higher price than the settlement price. In this case, you might lose money. Therefore, it is important to exhibit caution.

3. Binary options trading

While the futures market comes with obligated contracts, you can short-sell BTC by opting for non-obligated, Binary options trading. For the unversed, binary options are derivatives where traders bet on future prices of the underlying asset — BTC in this case.

A strike price (predetermined price) is set, either for buying or selling BTC in the future. Contracts that let you buy BTC at a lower strike price are termed Call options. Similarly, contracts that let you sell BTC at a higher strike price are called put options.

4. Inverse ETPs

A standard/ traditional exchange-traded product or ETP is meant to accommodate long derivatives — the ones that are buy-friendly. Inverse ETPs are just the opposite and are linked inversely to BTC prices. For instance, if the price of BTC falls — preferable for short sellers — the associated inverse ETP starts rising in value.

5. Bitcoin CFDs

A CFD or Contract for Difference is a specialized investment product that works more like a futures contract. No typical buying and selling is involved. Instead, traders get into a contract — betting on BTC’s opening and closing prices after a given timeframe. Every settlement contract has an opening price and a closing price. It is the difference that is the profit.

In the case of CFDs, bitcoin prices are tracked using another crypto or standard fiat currency.

6. Standard short-selling bitcoin assets

Short-selling bitcoin assets are like selling the assets you are holding on an exchange or in your wallet. However, you need to open a new position for selling, which might require moving to a new wallet or an order type. Simply selling the held BTC will feel like a standard buy-sell-trade.

This approach comes with an advantage. You can hold your position without having to worry about the margin interest.

Tools/strategies for short-selling bitcoin

With the advantages, risks, and techniques related to short selling covered, it’s time to focus on the key tools that can sharpen your sell-first-buy-later skills:

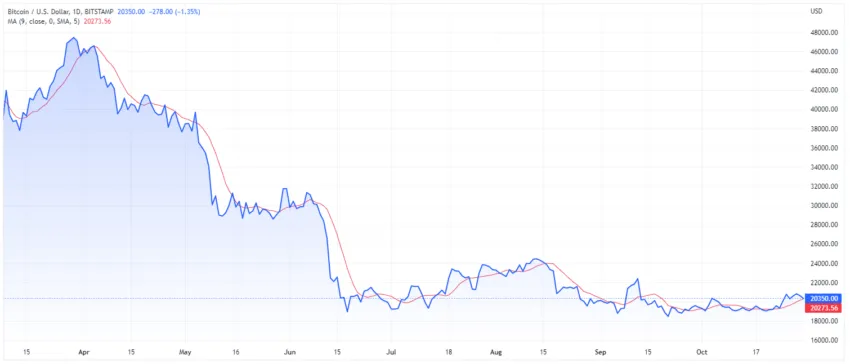

Technical analysis

Short selling is all about timing the market. And for that, you have to be a pro at reading the price charts. Analyzing the historical price action, pairing indicators to preempt trends, and checking the candlesticks patterns are some of the tried and tested ways to forecast dips and selling opportunities.

While there are a handful of resources, here are a few that stand out:

1. RSI

Relative Strength Index, or the RSI, is a standard momentum indicator that helps you gauge trend reversal at BTC or any other crypto asset’s counter. If the BTC price keeps making higher highs while the RSI makes lower highs, you might expect the prices to dip. RSI indicator also helps determine the overbought and oversold regions related to a crypto asset.

2. Bollinger bands

Bollinger Bands are statistical momentum indicators that use standard deviation to determine the highs the lows BTC has been touching in a given time period. When the upper and lower Bollinger Bands squeeze, you might expect a short-term burst in price action, direction notwithstanding.

3. MAs

Moving averages, or MAs, are tools for smoothing out the price data over a given time period. MAs can be simple or exponential and give an idea about the price trends. Plus, moving average crossovers are great for forecasting price reversals.

4. Standard deviation

Short selling requires a good grasp of market volatility. The standard deviation indicator helps, allowing you to forecast the most probable price moves. This tool helps select the stop loss points in case you initiate a risky margin trade.

5. ADX

Average Directional Index or ADX is a tool used for analyzing the strength of a trend. This resource is particularly helpful for reducing the short-selling risks — helping traders pinpoint the near exact moments to set up short positions.

If you are looking for the best platforms to use these tools holistically, TradingView and Cryptowat.ch are the best ones around.

Sentiment analysis

While technical tools are great for finding the right price points to sell, sentiment analysis is equally important. Sentiment analysis uses data visualization, customer insights, social media trends, and other resources to help you understand the market’s viewpoint.

At present, the Bitcoin Fear and Greed Index is the best indicator for sentiment analysis.

Fundamental analysis

Fundamental analysis is an underrated resource for finding the right crypto or even the right moment for shorting. The process involves looking at the latest global developments surrounding bitcoin — primarily positive and negative news bits regarding its adoption.

Fundamental elements like trading volumes, transactional activity, supply and demand changes, halving cycles, and more are useful when it comes to uncovering the asset-driving forces. For instance, if you suddenly see a surge in the BTC exchange inflow with the technical indicators backing a bearish development — you might be better suited to short-sell BTC.

How to short bitcoin?

Until here, we have covered almost everything there is to short-selling bitcoin. Now, we move to a step-pronged guide to show you how shorting works at an exchange:

Note: We shall only use margin trading as it is the most common and straightforward implementation of short-selling BTC.

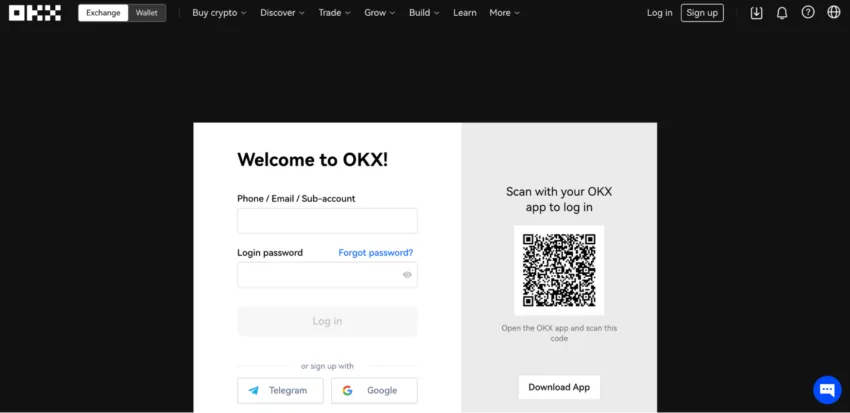

Step 1: Start by logging into your OKX account (we would be using OKX as a reference)

You can either log in using your credentials or log in using the QR code if you have the OKX mobile app installed.

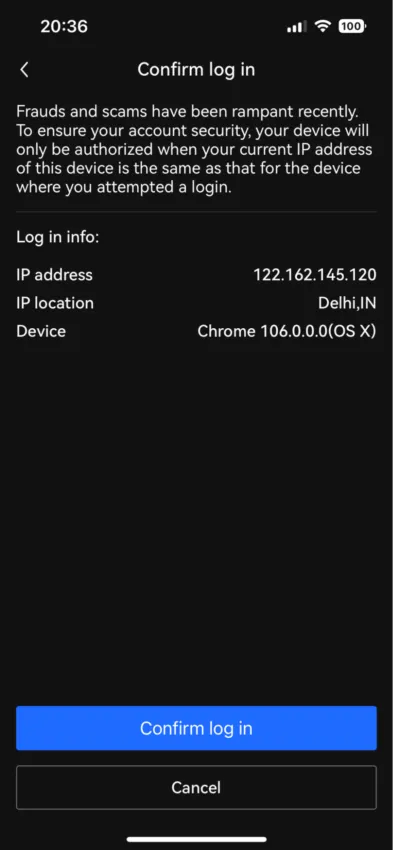

If you are logging in using the QR code, authorize the same on your mobile to gain access.

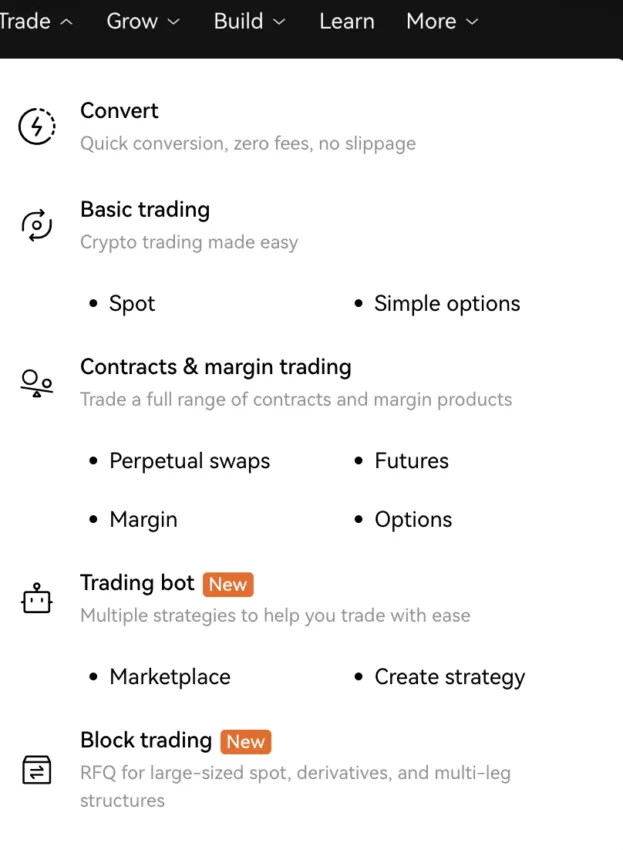

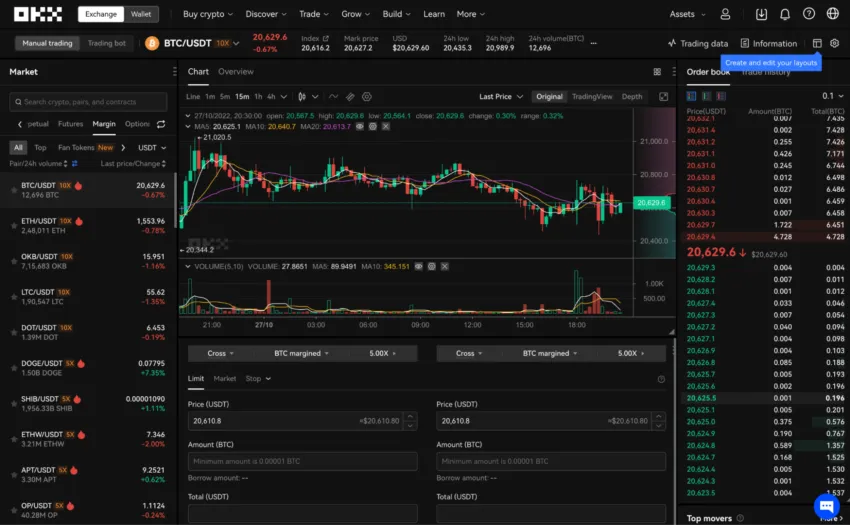

Step 2: Select the “Trade” option from the navigation panel, hover on it till you see “Margin,” and click on the Margin tab.

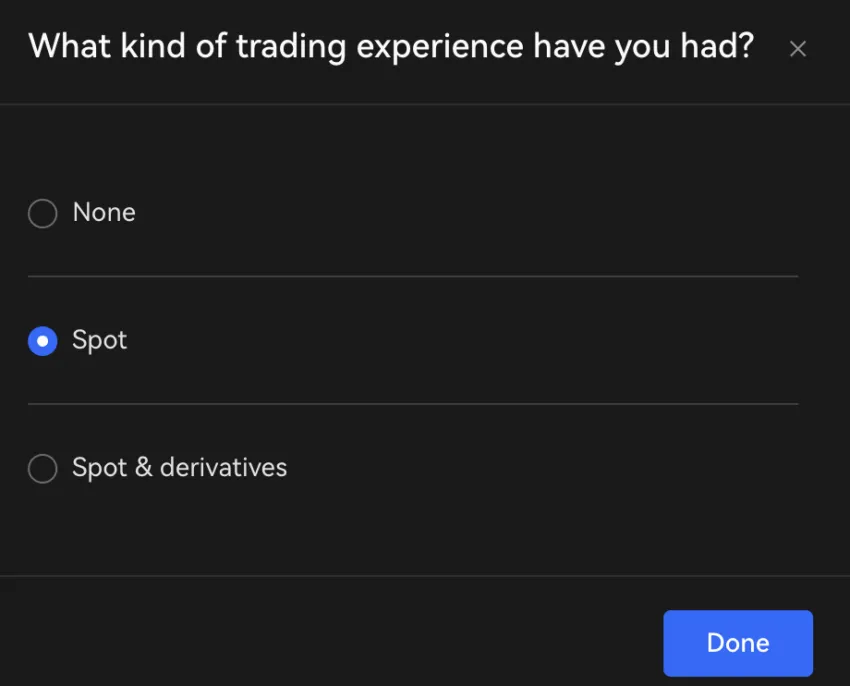

Choose “Spot” from the list of options:

You will see a Dashboard opening up with trading pairs in the top-left corner, a trading interface in the center, and the selection panel for the trading pair on the right side.

BTC/USDT is the default trading pair. However, you can choose any pair from the right side of the panel. It is ideal to choose a stablecoin as it is then easier to track prices in relation to the U.S. dollar.

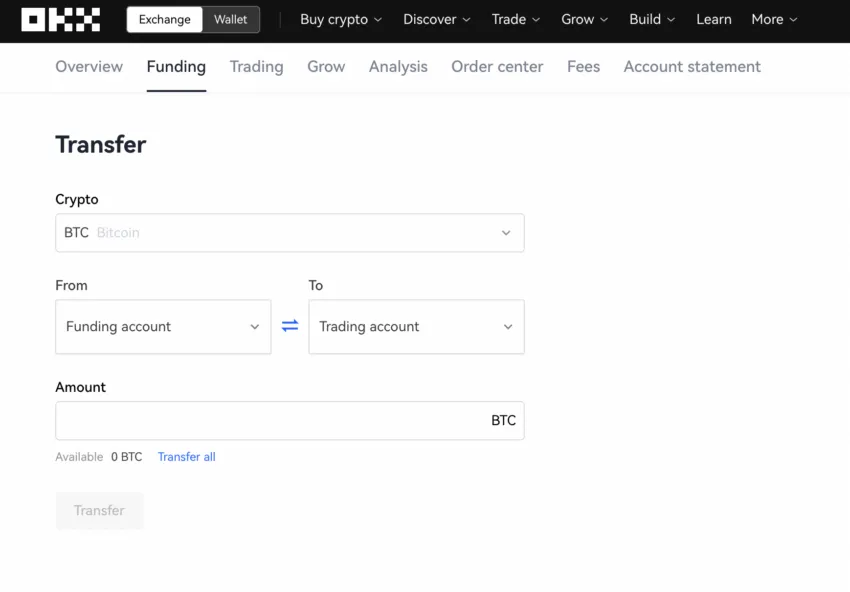

Step 3: Before you start trading, you might want to transfer funds from your funding wallet to the trading wallet.

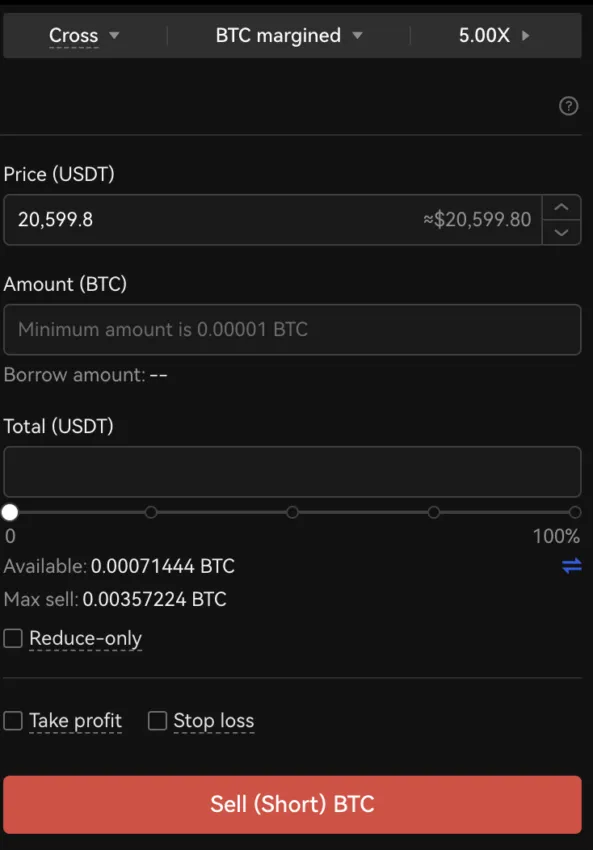

Step 4: Once done, head back to the trading dashboard, and select the “Sell (Short) BTC” option under the Cross panel. You can borrow every bit of the available funds (transferred a while back) or choose the amount of leverage to minimize the exposure.

Cross margin is more like distributed margin, with funds being shared across all open positions. An isolated margin wallet is meant for a given trading pair and must be populated for every different BTC trade.

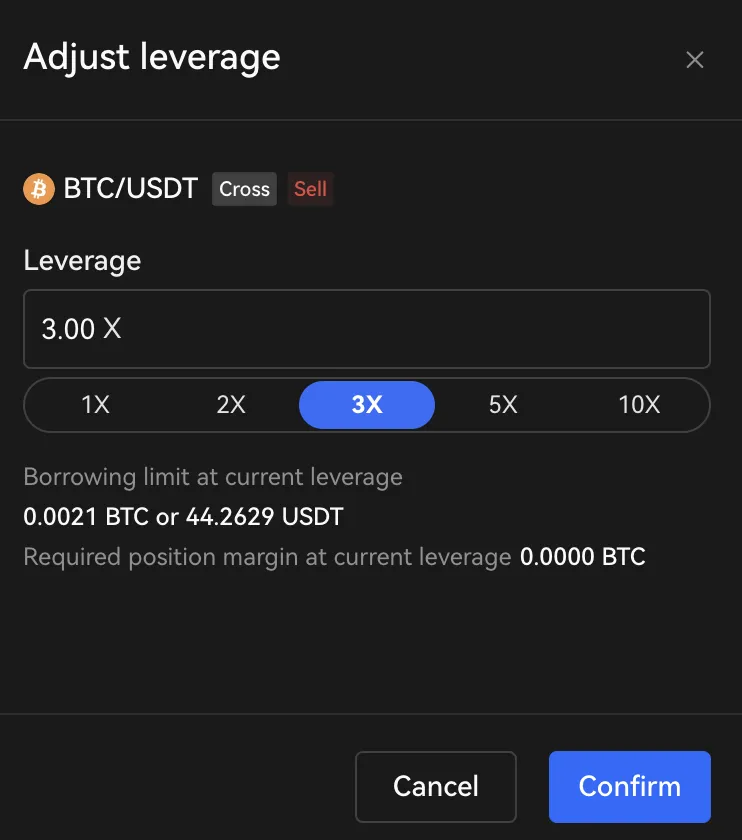

OKX offers 5X leverage by default, which might be risky to some. You can click on the 5x panel to adjust your leverage. We will move it to 3x to lower risk exposure. You will see the exact amount of funds that you can borrow against your collateral.

Step 5: Once you have selected the amount to borrow against the transferred funds, you need to hit “Confirm.”

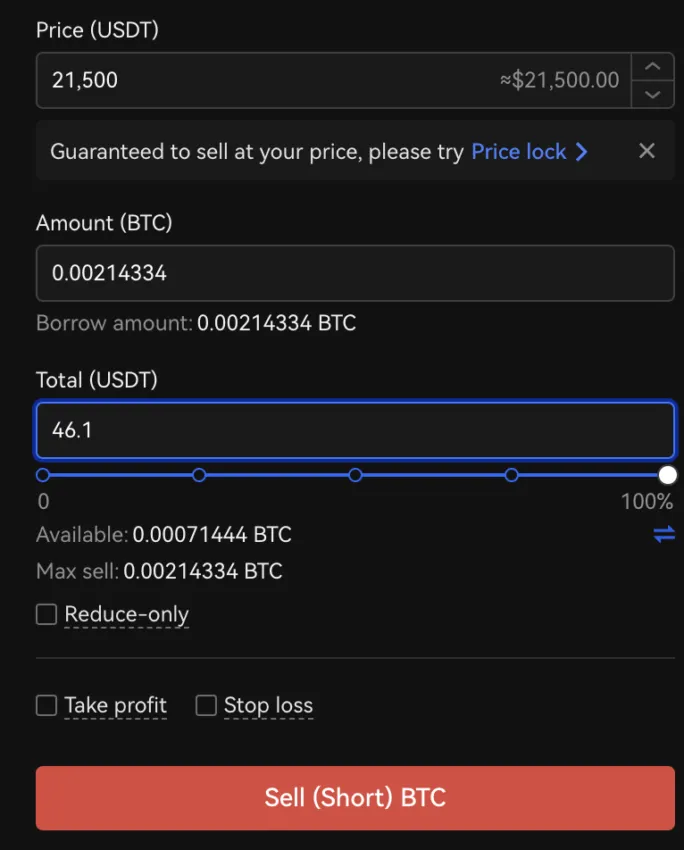

Step 6: You can select the order type from the following options: Limit and Market. Limit lets you sell at the predetermined price, whereas a Market order lets you sell immediately. We have set the limit sell at $21,500.

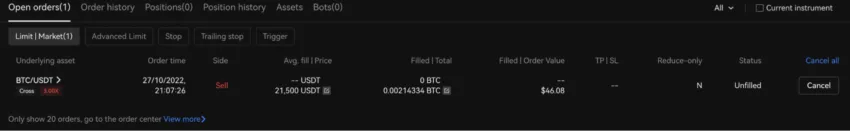

Step 7: Once you Confirm (hit the Sell Short BTC), you will see a margin short position open in your open orders. If it were a market order, it would immediately get executed.

Step 8: Once the short order is executed, you will need to buy back the shorted BTC using the Margin Buy BTC.

The long and “short” of BTC shorting

In summary, bitcoin shorting is a risky process. While leveraged margin trading does excite traders due to the high profitability, nothing beats looking at the pitfalls before proceeding. Furthermore, there is no right or wrong way to short a crypto asset — including BTC. And while margin trading and direct short-selling of assets are the most common strategies, delving into the futures and options might require some more experience.

For now, we would like you to read through the discussion in detail to understand the basic framework for shorting bitcoins. Regardless of how you approach it, always invest and trade with no more than you can afford to lose.

Frequently asked questions

What does it mean to short a bitcoin?

Is there an ETF to short Bitcoin?

What are the risks of shorting bitcoin?

How can I short bitcoin in the U.S?

Can I short bitcoin on Coinbase?

Is there any way to short bitcoin?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.