Coinbase is one of the biggest cryptocurrency exchanges in the world by trading volume. But is Coinbase the right exchange for you as a user? In this detailed Coinbase review, we evaluate this U.S.-specific exchange across a wide range of parameters to answer this question.

KEY TAKEAWAYS

➤ Coinbase is very user-friendly, making it an exceptional choice for users who are new to crypto.

➤ The exchange prioritizes security and compliance, adhering to regulations and acquiring licenses in relevant jurisdictions.

➤ Coinbase provides an array of features with over 240 cryptocurrencies, staking, and tools on Coinbase Pro and Coinbase Advanced.

➤ While it provides a comprehensive platform, the fees on Coinbase are higher when compared to other exchanges.

Coinbase at a glance: Our overall rating

As a top-of-the-line centralized exchange, Coinbase has rightfully earned its reputation. Known for its security and adherence to regulation, it is a top-tier option if you value security. This, along with its suite of products and affinity for innovation, in terms of offerings, one can’t go wrong when choosing Coinbase.

| Criteria | Security | Customer support | Fees | Assets | Products | BeInCrypto score |

| Score | 5/5 | 3/5 | 4/5 | 4/5 | 5/5 | 4.2 |

What is Coinbase?

What started as a simple platform to facilitate the buying and selling of Bitcoin, Coinbase, has evolved into one of the largest global exchanges. Let us learn more about its history and background:

Background and growth

Coinbase is the brainchild of Brian Armstrong and Fred Ehrsam. As of now, Brain Armstrong is the firm’s acting CEO. It was in July 2012 when it all started out of San Francisco, California. Over the years, Coinbase graduated from being a standard trading platform for BTC transactions to quickly hosting over 1 million wallets in 2013.

Brian Armstrong on X:

By 2014, Coinbase was already in Europe, expanding its services at a clip. And in 2015, it became a U.S.-regulated, full-fledged exchange. By 2020, the exchange had introduced staking, and in 2021, Coinbase moved up to the ladder with its NASDAQ listing as COIN. COIN offered the additional credibility that users were seeking.

In 2022 came the advanced Pro platform. 2023 was all about “Base” — Coinbase’s Ethereum-secured layer-2 (L2) ecosystem. Base Chain became the second-largest Ethereum L2 in 2024 by TVL. This was on the heels of leveraging its affiliation with USDC and using Base to process Coinbase payments.

Understanding the Base blockchain

With centralized exchanges receiving a lot of flak post the FTX collapse, even Coinbase decided to hop on board the decentralized bandwagon, courtesy of the layer-2 solution, Base. With Base, it becomes easier for Coinbase users to experience DApps in an open-source environment.

Interested in using the Base blockchain? You can now bridge your assets from the Ethereum mainnet to the Base layer-2.

Base integrates Coinbase’s offerings, assets, and user base while having Ethereum as the base layer. No pun intended!

What can I trade on Coinbase?

On Coinbase, over 240 cryptocurrencies and 500+ trading pairs are at your disposal. Additionally, for those seeking advanced trading tools, options like Coinbase Pro and Coinbase Advanced are available. Keep in mind, however, that trading fees on Coinbase can range from 0 to 0.60%.

Where is Coinbase available?

Coinbase serves customers across several regions, including the U.S., Canada, the United Kingdom, and Europe. Additionally, in the U.S., the platform’s cash balance feature is accessible only in states that have granted Coinbase the necessary licensing, deemed no license necessary, or where such licenses aren’t yet issued pertaining to Coinbase’s operations.

Coinbase in numbers

As mentioned previously, Coinbase enjoys the second rank among global crypto exchanges. The ranking is in terms of the trust factor. As of December 2024, the platform has over 108 million registered users, driving high trade volume.

Plus, the exchange has over $130 billion worth of assets on its platform and has an operational spread of over 100+ countries.

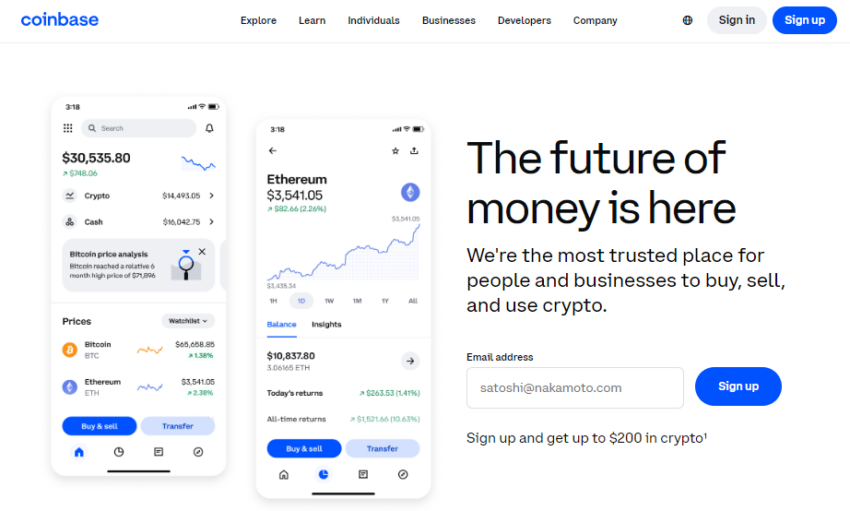

How to sign up with Coinbase in 2024?

The setup process is simple. In short, you simply need to:

- Navigate to the website and sign up

- Complete KYC

- Once approve, you’re in!

Here’s the process in a little more detail, step by step.

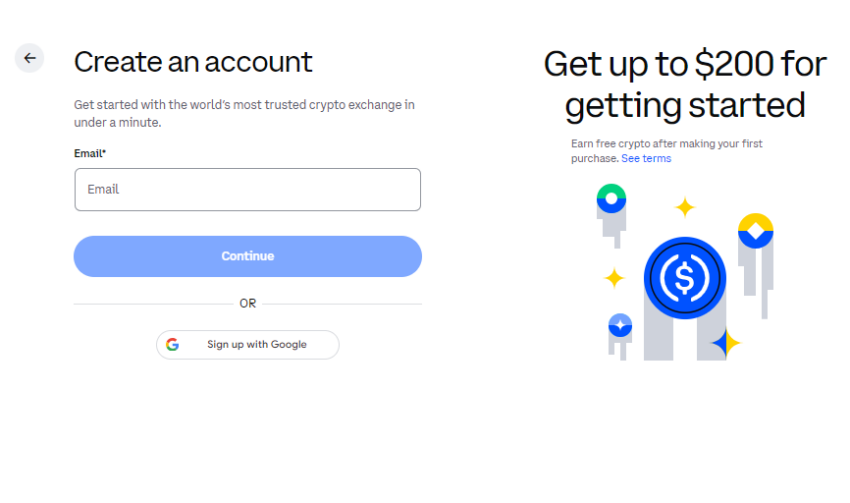

1. Go to the Coinbase website and hit “sign up,”

2. Enter the email or sign in with Google.

3. Fill in your name and password, and supply the KYC documents to kickstart the process. You can explore the nifty sign-in options on the web interface or get started directly on the mobile app.

If you have a Coinbase account and are a pro trader, you can hop onto the Coinbase Pro or the Coinbase Advanced for an amplified trading experience. The tools are best-in-class, and you get access to every exchange-specific crypto asset with the TradingView connect.

Do note that Coinbase Advanced is a step ahead of the Coinbase Pro, which is also a step ahead of the vanilla Coinbase account.

Another element amplifying the user experience is Coinbase Learn — a section loaded with Crypto basics, tutorials, newsletter access, crypto tips, and more.

Another element of the user-experience segment has to be the country-specific features that Coinbase offers and the unified portfolio manager that helps track assets, holdings, and other forms of crypto exposure.

Welcome offer/bonus

As stated previously, Coinbase also has a learn-to-earn program. In this program, you can receive cryptocurrencies by completing learning tasks. The exchange also allows you to receive Bitcoin via its partner program.

Lastly, you can also receive rewards when you complete certain tasks. Some of these tasks include signing up or making your first trade. However, these incentives may be limited by geographic location.

How does Coinbase compare to others?

Here are some of the top exchanges that might be worth looking at, apart from Coinbase:

| Platform | Crypto | Fees | Availability |

|---|---|---|---|

| Coinbase | 240+ | 0-0.6% | 100+ |

| Binance | 500+ | 0.1% | 100+ |

| Kraken | 200+ | 0.25% (maker)/0.40%(taker) | 190+ |

| Bitstamp | 80+ | 0.30% (maker)/0.40%(taker) | 100+ |

| Crypto.com | 21+ | N/A | 100+ |

| Gemini | 80+ | $0.99-$2.99 or 1.49% | 60+ |

Here’s a quick look at each key competitor.

Binance

It offers a more diverse selection of cryptocurrencies. Additionally, high-volume crypto traders can enjoy lower fees. And yes, Binance offers an extensive palette of retail-focussed derivatives to trade.

Kraken

This security-focused exchange relies extensively on cold storage options to store user funds. As compared to Coinbase, there are more advanced trading options and tools to work with.

Bitstamp

This is one of the oldest and most reputable exchanges. It even offers futures and margin trading services as well as a more competitive fee structure.

Crypto.com

Like Coinbase, Crypto.com offers staking and crypto-focused debit cards. The trading platform is more interactive, and Crypto.com’s fee structure is more accommodating.

Gemini

When comparing Gemini vs. Coinbase, it’s clear the former focuses much more on crypto education, offering access to a wide range of tutorials, glossary items, and more.

Features and tools from Coinbase

Coinbase is a reliable and easy-to-navigate crypto exchange for beginners. With over 500 trading pairs/markets, the buying and selling access is the primary feature. To access this, you are required to create an account.

Staking services

Coinbase’s staking-as-a-service offering is a reliable earning plan for someone looking to park their crypto for decent yields. The staking coffers offer flexible redemptions, allow you to manage holdings from a single interface, and let you start for as little as one pound.

Mobile functionality

Mobile trading functionality is less of a feature and more of a user-specific flexibility. You can download the Android or the iOS application, depending on your preferences. Once you log in using your Coinbase credentials, you can get access to trading charts, tools, and other resources, just like you would on the web version.

Debit cards

Coinbase even issues Visa-like debit cards for you. You can either use the card to pay in cash or crypto — with every spend translating into some sort of crypto reward. This is one of the ways to earn free crypto. The card itself is easy to fund, doesn’t have hidden fees tied to it, and even lets you choose the crypto you want the rewards to be in.

Choice of wallets

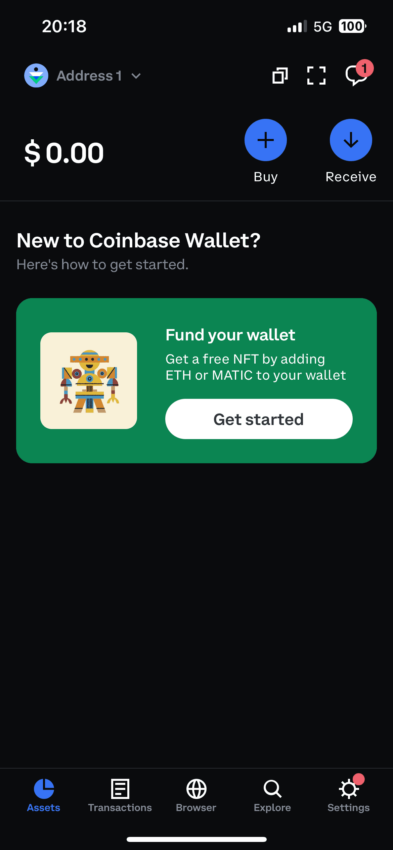

At Coinbase, you get a choice of crypto wallets with which to work with. Firstly, there is the standard Coinbase exchange wallet, which is a custodial entity in control of the platform.

Then there is the self-custody Coinbase Wallet — a nifty enhancement that lets you trade, swap, and buy crypto. This wallet type doesn’t require a primary Coinbase account and can even store NFTs.

The Coinbase Wallet is more like a one-stop solution for your crypto. You can choose assets to buy, send, bridge, receive, and more. And if you have crypto sitting on your Coinbase account — ETH and MATIC — you can use the wallet to generate passive yield.

And finally, there is the Coinbase DApp wallet, meant for ERC-20 tokens and other Ethereum-native decentralized activities. It is better to use this wallet to pay for developer fees and indulge in other web3-specific activities.

NFT marketplace

Coinbase has a full-fledged NFT marketplace where you can mint NFTs, explore the collections, shop for them, and sell by listing. To simply use this on the web version, you must connect your compatible wallet to Coinbase.

The marketplace allows you to choose from a wide range of popular NFTs to buy and sell. You can search through NFTs by genre, with categories including sports, music, art, and more.

Web3 gateway

Interested in exploring web3 without creating an exchange account? Coinbase lets you do so, allowing you to access the self-custody, decentralized Coinbase Wallet and customize the profile using your ENS name. And by ENS name, we mean the .eth domain. Once you become a part of Coinbase’s web3 conglomerate, you can connect with other .eth profiles.

The secret hack to using the ENS-led web3 getaway is to click on any profile to check out the assets and NFT holdings of the same. You can use each interface as a blockchain explorer to check the activity of the concerned profile.

Coinbase private client

If you are a high net-worth investor, Coinbase lets you experience customized support. From a dedicated team and investment recommendations to a secure and compliant interface with access to sophisticated trading tools, the Private Client functionality is one of Coinbase’s highlights.

Rewards

Coinbase also has a Learning Rewards program for the crypto-curious. This enlightening move recommends courses for you and even rewards you with course-specific tokens in return.

Coinbase lending

If you are holding Bitcoin and in need of some cash, Coinbase’s lending functionality may offer an option. Coinbase lets you borrow up to 40% of the BTC’s value, all while instantly crediting the sum to your bank or PayPal account. Your BTC works as collateral, remains safe, and appreciates (or depreciates) as per market conditions. Once you repay, you simply need to pay the entire lent sum back while paying the 8.7% APR interest on a monthly basis.

Coinbase business

While most of the enlisted features are for retail traders and investors, Coinbase has a separate offering for business. With Coinbase’s business suite, institutional investors can embed crypto payments into their modus operandi, access derivatives in the form of crypto futures trading, list digital assets on Coinbase, experience curated brokerage options, and explore other solutions like hedge funds.

“Coinbase really is leading the way. What they have built is astonishing…and what they are still building is even more incredible.”

Raoul Pal, founder of Real Vision: Twitter

DApp access via mobile

Coinbase offers one-of-a-kind DApp access, letting you interact with web3 applications via mobile or the Coinbase Wallet. You can access DApps on the Ethereum network, BNB chain, and other ecosystems via your mobile app.

Developer access

Coinbase has a separate suite for developers interested in building on top of it. These include cloud-based tools, APIs, resources to offer wallet-as-a-service to clients, dedicated resources to build in Base, testnet access and faucets, and other features.

And that sums up nearly everything Coinbase has to offer to its users. Let us now move further and explore other aspects of this exchange.

Coinbase fee structure

Coinbase’s tiered fee structure relies on the maker-taker model. For instance, if you place a market or, rather, an immediate order, you are the taker, whereas if you place a limit order, you become the maker. As the taker takes liquidity away from the order book, the trading fee thresholds are higher than that of the maker.

At Coinbase, taker fees are set at 0.05% to 0.60%, and maker fees are set at 0 to 0.40% depending on the tier.

But that’s just the spot trading fees. Like any other exchange, to trade cryptocurrencies or use any other crypto service on Coinbase, you must be aware of other fee structures as well. These include:

- Coinbase borrow: In case you fail to repay the loan and Coinbase needs to sell the BTC collateral, per the loan agreement, a 2% transaction fee is also deducted.

- Coinbase staking: While there are no staking or unstaking charges, the exchange charges anything between 25% to 35% on the rewards as performance fees.

- Deposit and withdrawal: Electronic fund transfers in either case are free. However, Wire transfers in USD are charged at $10 for deposits and $25 for USD.

However, if you have the Coinbase One subscription, you can experience zero spot trading fees (on specific assets), a higher portion of staking rewards, and other perks.

Apart from that, Coinbase might charge network transaction fees for recovering unsupported crypto deposits, levy conversion fees depending on the liquidity of the pairs, and even include debit card issuance fees in certain cases or for certain transactions. However, the crypto exchange is known for clearly mentioning every charge.

Customer support

Coinbase is one of the few cryptocurrency exchanges to boast a robust and prompt customer service system. It leads the way with the following traits:

- Multi-channel communication

- Round-the-clock availability

- A well-stocked help center with access to FAQs, guides, and more

- Email support

- Live chat support

- Phone support (region-specific)

- Social media support (not a direct support channel

Coinbase’s support page lets you select the product and service you want assistance with, speeding up query resolution.

Coinbase’s Twitter support page:

Regulatory compliance and safety

Coinbase covers almost every U.S. state in regards to licensure. As a regulated platform, Coinbase is registered with the CFTC or the Commodity Futures Trading Commission as a Futures Commission Merchant. As an FCM, Coinbase is in the right to support margin trading.

While this seems like a positive development, it also comes amid the ongoing cold war between the exchange and the SEC, as on June 6, 2023, Coinbase was issued a Wells Notice for operating as an unregistered securities exchange. The CEX was also under fire for failing to register its newly launched staking-as-a-service program.

As far as the entire regulatory landscape goes, here are some of the additional insights you might want to consider:

- The exchange is registered with FinCEN — Financial Crimes Enforcement Network.

- With FinCE, it identifies as an MSB or Money Services Business.

- This cryptocurrency exchange also adheres to the international Anti Money Laundering and KYC regulations.

Moreover, Coinbase maintains a strict, security-adhering stance, focusing on the financial well-being of the users. Here are some of the security-specific implementations it has in place:

- Insured digital and cash balances

- Availability of vaults for crypto lock-ins

- Two-factor authentication for log-ins, courtesy of the “Security Prompt” feature

- Security notifications

- Proactive threat detection

- Hashed password management via the “bcrypt” algorithm

- Built-in phishing protection

- Address whitelisting

- Manual geographical restrictions

- Secure fund storage with a focus on cold storage options

When it comes to security standards, Coinbase is one of the more reputed cryptocurrency exchanges. The CEX is known to have a strong focus on user protection and cybersecurity.

Is Coinbase worth using?

This detailed Coinbase review does reveal the minimalist nature of the exchange. Despite some region-specific geographical restrictions, Coinbase does cover most bases where crypto trading is concerned. Furthermore, with access to a decentralized wallet, staking options, developer tools, and institutional resources, Coinbase exchange offers a rounded, intuitive, and beginner-friendly service for anyone looking to experience crypto and web3.

Disclaimer: While there are many benefits to trading and investing, it is equally as important to point out the risks. Investing and trading is inherently risky, and you could potentially lose money.

Furthermore, this Coinbase review does not constitute an official Coinbase endorsement, it is solely for informational and entertainment purposes only.

Readers should always do their due diligence, conduct their own thorough research, and consider their personal financial goals and obligations before making any investment decisions.

Frequently asked questions

Coinbase does have robust security measures in place. However, no crypto exchange is 100% safe, as hackers and unscrupulous parties are always looking to exploit user funds and the security limits of the exchange. For instance, even Coinbase was breached multiple times in 2016, 2019, 2020, and even 2021, with hackers gaining account access and stealing funds.

Coinbase is being investigated by the Securities and Exchange Commission as, according to the SEC, the exchange has allowed users to work with unregistered securities. Plus, its staking-as-a-service program, letting users earn passive income, is also on the SEC’s radar. Despite all that, Coinbase is credible and registered as an FCM.

While there are a number of reasons you might use Coinbase, some user might steer clear due to higher fees and some security concerns, courtesy of past incidents. Also, when compared to the likes of Binance, Coinbase offers a limited selection of cryptocurrencies.

There are a few allegations against Coinbase, even ones concerning its sluggish customer support. However, the SEC-led allegations took center stage as they mentioned that Coinbase allowed users to trade cryptocurrencies as unregistered securities. The main allegation is that Coinbase failed to disclose existing conflicts of interest. The SEC even mentioned that the exchange engaged in misleading practices related to marketing.

Yes, Coinbase can refund stolen funds, provided the breach that happens is a Coinbase-specific breach. In case the loss of funds isn’t due to criminal activities and is due to user negligence, there is no refund provision in play.

If you wish to go for a centralized exchange that is safer than Coinbase, Kraken makes a strong case. However, if you do not want to get into the muddy centralized waters, connecting with a DEX like Uniswap might be a good option, as they are less prone to major hacks and attacks unless the smart contract or the protocol involved is buggy.

According to consensus, Coinbase is infamous for its higher fee structure. While it offers easy crypto-specific buy and sell options, there is a lack of fancy earn plans, derivatives trading options, and other offerings for a standard retail user, making it a tad disadvantageous to the more advanced crypto evangelist.

To withdraw funds, you need to head over to the account section and select “Withdraw” from the available options. You can withdraw crypto to any external wallet on paying the network fees, or if you want to withdraw funds, you can initiate account transfers without additional charges. Coinbase also lets you withdraw funds via wire transfer, which attracts a flat $25 fee.

Yes, Coinbase does charge fees in relation to trading, withdrawals, and other activities. As for trading-related charges, there is a maker-taker model in play. Charges-wise, taker fees can range anywhere between 0.05% and 0.6%, whereas maker fees can range between 0 and 0.4%.

There are quite a few countries that have restricted Coinbase. These include the OFAC nations of Cuba, Syria, North Korea, and Crimea. In countries like India, Coinbase is still present but with restricted access. Also, Coinbase doesn’t operate in nations like Bangladesh, Nepal, and more, where an anti-crypto ecosystem exists.

Yes, Coinbase allows you to store money by letting you fund the exchange wallet. You can use PayPal, Wire transfer, or even standard bank transfers to do so. However, users transferring funds must know that they aren’t insured per the FDIC guidelines, and only if there is a Coinbase-specific breach might they have a chance of getting a refund.

ou can send money from Coinbase to your bank account via the standard bank transfer or ACH, which attracts zero charges. You can even rely on wire transfers to withdraw funds from Coinbase to your bank or even PayPal account. However, to transfer funds, you must start by linking your bank account.

Coinbase lets you deposit as low as $1 into your exchange account. Bank transfers are recommended for deposits as there are no deposit fees associated with this mode. Also, before you can deposit funds to buy crypto on Coinbase, you must get verified.

Yes, Coinbase adheres to the international Know-Your-Customer guidelines. Therefore, to register or create an account on Coinbase, you must clearly mention your identity and address-specific credentials. Once done, you need to validate the same using the required documents.

Standard bank withdrawals can take anywhere between three to five days on Coinbase. Faster withdrawals like wire transfers are executed within a few minutes to a few hours. But for that, you must pay out a withdrawal fee of $25. Crypto withdrawals are faster and depend on network congestion.

Yes, Coinbase has a mobile app. You can get it for both Android and iOS, depending on the type of ecosystem you are on. Coinbase’s mobile app offers everything that the web interface offers, but in a more sleeker manner. You can handle standard crypto trades, stake, and explore cryptos with ease using the mobile app.

No, Coinbase doesn’t have a demo account. While it offers developer-specific testnet faucets, there is no actual copy trading account or a different ecosystem for users to try out crypto trades. Neither does it offer copy trading facilities where you can copy other traders to maximize your portfolio.

Yes, Coinbase offers special bonuses when you use the Coinbase Card. This card works more like a standard Visa debit card, and you can use it to transact in crypto or in fiat. Every time you pay for something using the card, you get access to rewards in your choice of crypto.

Coinbase boasts a robust and well-rounded customer support system. Based on the region you are in, you can get access to telephonic support. Besides that, you have email support, live chat functionality, Twitter-based query resolution, and other customer support elements that can be easily accessed.

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.