This year seems to be the one that will see the launch and mainstreaming of NFTs – non-fungible tokens. Just within a single-month’s span, many expensive NFT series drastically expanded marketplace activity.

What was once a combined trading volume from multiple NFT marketplaces, is now achieved on single ones. Here are some examples:

- Rarible’s trading traffic went up by 260%, accounting for $23 million of the trading volume.

- SuperRare did even better with a 322% increase in trading at $32 million worth of digital collectibles.

- Axie Marketplace, the home to eponymous game Axie Infinity, increased its trading volume by 143%, settling at $2.9 million worth of animated gaming NFTs.

- AtomicMarket currently holds the top spot for NFT marketplaces, in terms of rapid, near-600% growth and $2.2 million in trading volume.

- OpenSea remains the top NFT marketplace in terms of total trading volume last month, at $94 million and a 240% rise.

An Overview of the NFT Scene

Overall, with the combined assets of NFT game collectibles and digital artwork collections, the NFT market capitalization has grown considerably since its $338 million estimate in 2020. This alone is a huge leap from 2019, representing a 400% growth. Most of the NFT marketplaces are still powered by the Ethereum blockchain, but other protocols are slowly penetrating. Among the top ones are WAX, Waves, EOS, and FLOW.

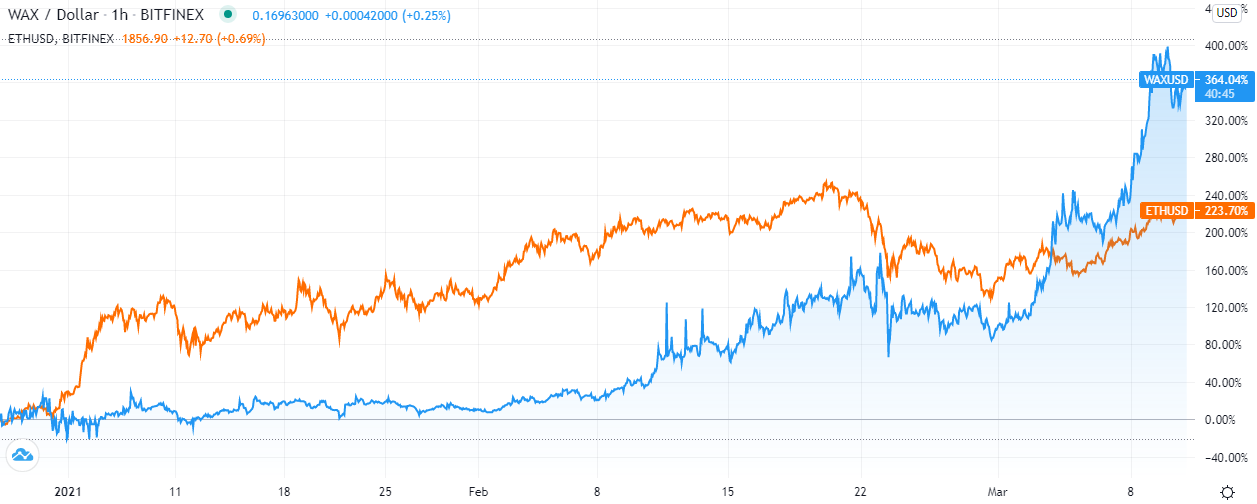

WAX is leading the charge as an ETH alternative with the AtomicMarket — an aggregator of NFT markets sharing liquidity pools. Standing for Worldwide Asset eXchange, WAX was specifically developed as a decentralized blockchain protocol for swapping assets in the video gaming and entertainment industry.

Accordingly, the WAX (WAXP) token even outpaced ETH in growth during the last few months.

WAX has a somewhat complicated tokenomics consisting of three types of tokens: WAXP, WAXE, and WAXG. WAXG is a governance token, while WAXE is an Ethereum-compliant utility token. WAXP serves as a bridge token to convert into WAXE for staking purposes.

Thankfully, with a MetaMask wallet and any of the decentralized exchanges (DEX) like Uniswap, users can easily swap ETH for WAX to participate in one of six WAX-powered NFT marketplaces.

A Brief Recap on NFTs

Just as Decentralized Finance (DeFi) protocols mimic the financial products of banks — borrowing and lending — so do NFTs mimic the world of art galleries, shops, and museums. But, without any costly and risky mediators.

This is possible with smart contracts (dApps), originally born on Ethereum. This type of programmable blockchain can serve a wide range of, you guessed it, decentralized applications. In other words, NFT marketplaces are dApps that make the entire NFT economy happen by connecting an NFT creator directly with a buyer. This makes it much easier for both parties to enter the market, thus breaking down the usual barriers to entry.

NFTs themselves are a type of tokens — ERC-721 — that are non-divisible or non-fungible, hence the name. Their value comes from the assurance of blockchain technology that each NFT cannot be counterfeited. Moreover, its entire transaction history is traceable and verifiable as a completely digital asset, be it artwork, music, video, animation, gaming asset, etc.

As you can see from Google Trends, NFT interest worldwide has spiked tremendously since February.

Given that more and more people value digital assets over physical ones; from books, games, and music to cryptocurrencies, it was quite predictable that the NFT market would explode.

With the following top 11 most expensive NFTs sold, you will see they are highly speculative assets, just like traditional artwork. Meaning, the notoriety of the NFT creator is the key factor in determining their value. In conjunction, their memetic/cultural potential also raises the likelihood of their value appreciation.

Top 11 Most Expensive NFT Sales

On NFT marketplaces, you can list your creations to be sold in three ways: collections, unique, or multiple copies. Therefore, we are counting collections as single or multiple NFT packages, instead of ranking just single NFT pieces within collections.

Additional note: the ranking is based on the current ETH price.

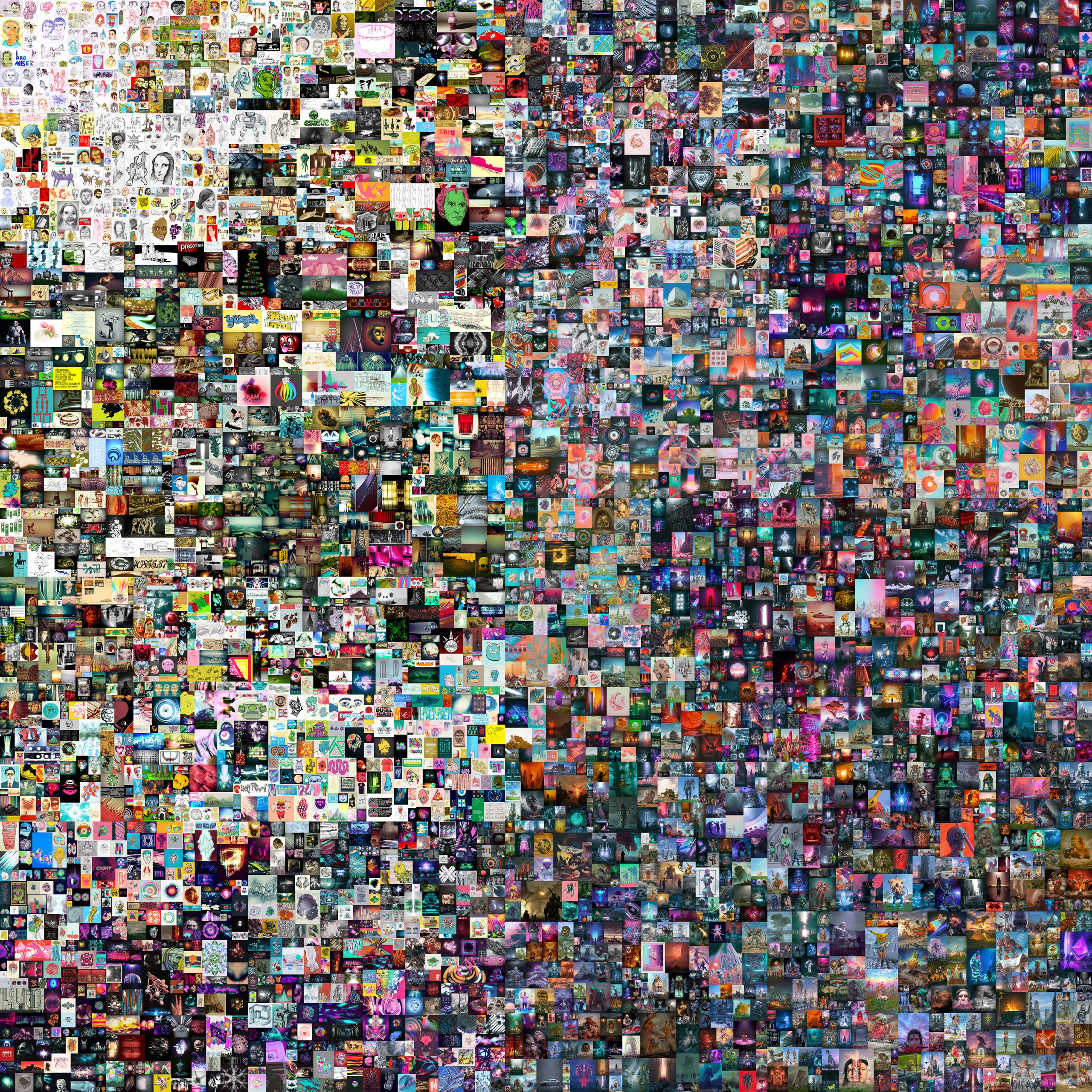

1. Beeple Collections – $69,346,250 million

NFT Marketplace: Nifty Gateway

Creator: Mike Winkelmann, aka Beeple, a graphic designer/CGI artist from Charleston, South Carolina. Also known for his thuggish, excessive vulgarity regardless of the platform he is on.

Main draw: As you can see from the video in the tweet, it is befitting that a professional artist would receive such a high price for 21 pieces of sci-fi/fantasy-themed works. Beeple has previously worked on marketing campaigns for major corporations, such as SpaceX, Coca-Cola, Apple, Samsung, and others.

In addition to sci-fi-themed art, a big engagement driver came from his Crossroad collection, prior to the presidential election. It was a dynamic NFT, permanently shifting into another state depending on if Trump loses or wins. His collections sold for 3,602.482 ETH (worth $6.8 million at press time) on Nifty Gateway.

Beeple first gained social media fame with the #everdays NFT series— a concept where he creates original artwork every day. On top of that, his political activism (anti-Trumpism specifically) won him much traction. This combo of artistic skill, ~230k followers on Twitter alone, and harnessing anti-Trump sentiment (backed by all nodes of corporate power) are key arguments to make for why collections sell like hotcakes.

Eventually, his #everydays collection titled EVERYDAYS: THE FIRST 5000 DAYS, counting 5000 days worth of digital artwork, sold for record-breaking $69 million at the prestigious auction house Christie’s on March 11, 2021. This was the first traditional auction house to sell an NFT.

2. CryptoPunk #7804 – $7.5 million (4,200 ETH)

NFT Marketplace: Larva Labs

Creator: Larva Labs, based in New York and headed by software engineers Matt Hall and John Watkinson.

Main Draw: One could say that the CryptoPunks NFT series embodies the 1980s nostalgia with its pixelated computer games. There is definitely a high degree of art and skill needed to meaningfully differentiate within the 10,000 CryptoPunks collection.

In addition to being male or female, all the CryptoPunks are humanoid, while some can be alien, ape, or even zombies.

The extremely high price for CryptoPunk #7804 can be attributed to his alien status. Only 9 aliens are present in the 10,000 collection. And as you know, what is rare becomes exceedingly valuable in the world of art.

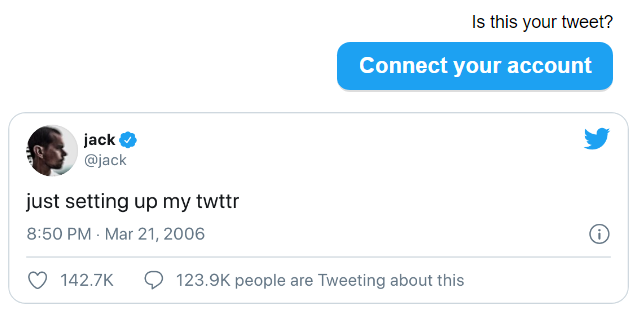

3. Jack Dorsey’s First Tweet – $2.5 million

NFT Marketplace: Valuables BY CENT

Creator: Jack Dorsey, entrepreneur, billionaire, founder and CEO of Twitter, on of the largest social media platform, and Square, a payment processor competing with PayPal.

Main draw: Not technically sold yet, but how could it not be? The bidder for $2.5 million is Sina Estavi, the CEO of Bridge Oracle, a fellow technological entrepreneur with deep pockets. The NFT deserving of such an astronomical price (not even a collection) is simply the first tweet ever made.

As such, it gained value as a memento of important technological history, forever to be preserved on blockchain for future generations, but held exclusively by the lucky winner of the still-ongoing bidding war.

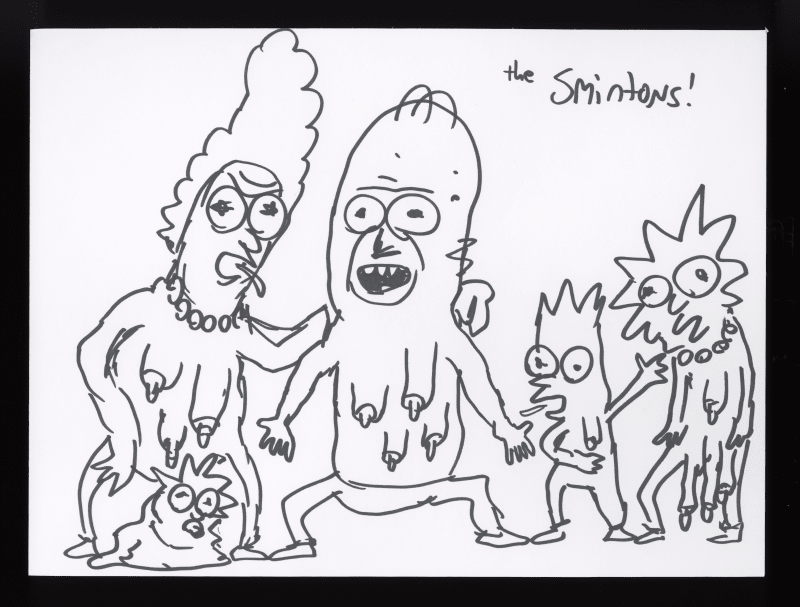

4. Rick and Morty Collection – $2.3 million (1,300 ETH)

NFT Marketplace: Nifty Gateway

Creator: Justin Roiland, the creator of the popular adult animated series Rick and Morty.

Main draw: Quite a downgrade from Beeple’s CGI art, but Rick and Morty’s cult following cannot be underestimated. The “Smintons” NFT series sold particularly well, as it was a Lovecraftian parody of the popular Simpsons animated series. Only Rick and Morty followers would understand the nuanced layers of such artistic expression!

However, some of the proceeds did end up in a good cause — aiding homeless people in Los Angeles. In addition to NFTs, some of the pieces sold as signed physical copies.

5. Land on Axie Infinity – $1.6 million (888.5 ETH)

NFT Marketplace: Axie Marketplace

Creator: Sky Mavis game studio, creators of the popular blockchain game Axie Infinity.

Main draw: Blockchain gameplay is quite unique as it can leverage tokenomics of various protocols, which translates to real money, once tokens are swapped for fiat currency. Axie Infinity is more developed than most games, with a coherent world-building and art style.

The player is mainly concerned with building kingdoms and managing vivid creatures in a fantasy realm called Lunacia. Of course, as any king knows, building a kingdom requires land acquisition, hence the buying of plots by @Its_Falcon_Time.

Considering that one could buy a luxurious mansion in the real world for that kind of money, it’s safe to say that this lucky player has riches to spare.

However, based on his tweets, he treats these virtual plot purchases as investments that will appreciate in time, counting on the game’s growing popularity.

6. CryptoPunk #6965 – $1.44 million (800 ETH)

NFT Marketplace: Larva Labs

Creator: Larva Labs, based in New York and headed by Matt Hall and John Watkinson, software engineers.

Main draw: Rarity breeds demand. Just as this is true for Bitcoin with its finite 21 million coins, so it is true for CryptoPunks NFT series. This is a collection (not a game) of 10,000 pixelated characters, which has been filling the headlines for months for its numerous NFT sales. Needless to say, each CryptoPunk is unique, from its expression and accessories to even species.

This NFT series was among the first released on the Ethereum blockchain in 2017. This one sold on February 19 for 800 ETH. However, it is now selling for almost double the price — 1500 ETH. If sold, it may top all NFTs as a single piece at $2.7 million.

7. CryptoPunk #4156 – $1.17 million (650 ETH)

NFT Marketplace: Larva Labs

Creator: Larva Labs, based in New York and headed by Matt Hall and John Watkinson, software engineers.

Main draw: Another CryptoPunk sold out of 10,000. This one belongs to the ape class.

8. CryptoPunk # 2890 – $1.09 million (605 ETH)

NFT Marketplace: Larva Labs

Creator: Larva Labs, based in New York and headed by Matt Hall and John Watkinson, software engineers.

Main draw: Another CryptoPunk sold out of 10,000. This one is a part of the alien set.

9. Dragon CryptoKitty – $1.08 million (600 ETH)

NFT Marketplace: CryptoKitties

Creator: Dapper Labs, a blockchain-based company located in Canada.

Main draw: Not necessarily an NFT series, CryptokKitties is another blockchain game. This one is reminiscent of the Tamagotchi craze before the internet went mainstream. The player collects and breeds digital crypto kittens, with each one generating unique traits and appearances based on a complex set of algorithms. Outside of collecting them, players can also breed them to randomly create new features, or “cattributes” if you will.

Given how cats are the staple of the internet and video-sharing platforms specifically, it is not surprising that a blockchain company would choose this theme. It turned out hugely successful!

10. CryptoPunk #6487 – $991,500 (550 ETH)

NFT Marketplace: Larva Labs

Creator: Larva Labs, based in New York and headed by Matt Hall and John Watkinson, software engineers.

Main draw: Another CryptoPunk sold out of 10,000. This one is not only bald but also female, one of 3840 available.

11. Hashmask #9939 – $747,797 (420 ETH)

NFT Marketplace: OpeanSea

Creator: Suum Cuique Labs, based in Zurich, Switzerland, headed by John Doe (an obvious pseudonym).

Main draw: A birth child of the lockdown era, the hashmasks NFT series is imbued with anxiety, blending abstract and tribal art. Definitely a unique art style for a more refined taste. Like CryptoPunks, it’s a collection gathered from a community of 70 artists across Europe. Accordingly, the collection is much larger than CryptoPunks, at 16,000 unique hashmasks.

Although a product of many artists, they have all agreed to draw inspiration from the work of New York-based Jean-Michel Basquiat.

Moreover, each hashmask has its own token, which allows for slight changes of the other-worldly portrait. Prospective buyers would also find hidden messages and puzzles scattered across the collection.

Notable Mentions and Conclusion

We can’t finish this ranking without mentioning the legendary Nyan Cat by Chris Torres, which was sold for 300 ETH. Another example of pop culture that merged YouTube memes with Japanese pop songs. Chris sold it within a day on Foundation platform after remastering the original GIF unleashed on YouTube in 2011. Likewise, be on the lookout for Formula 1 models, which are too high in demand. Recently, the F1 Delta Time supercar sold for 415.5 ETH.

As you can surmise, the NFT phenomenon is almost exclusively reserved for younger generations, under 50. Born or grown during the digital era, their culture may seem alien to older generations. However, it makes little sense to judge it from the external standard, just as it is useless to judge people who have bought inscrutable abstract art pieces reaching dozens of millions in price tags.

In the end, both NFT series and traditional artworks are speculative assets, counting on their own cultural ecosystems to appreciate in value. Nonetheless, with the current growth trajectory, NFTs are poised to outpace the physical alternative due to being more flexible, indestructible, easily sellable, and obtainable.

In this initial growth spurt, it would be wise to take care to see which types of collectibles tend to appreciate more, and don’t splurge more than you are willing to lose.

< Previous In Series | NFTs | Next In Series >

Frequently Asked Questions

What is an NFT?

What is Bored Apes?

What is Apecoin?

What are NFT marketplaces?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.