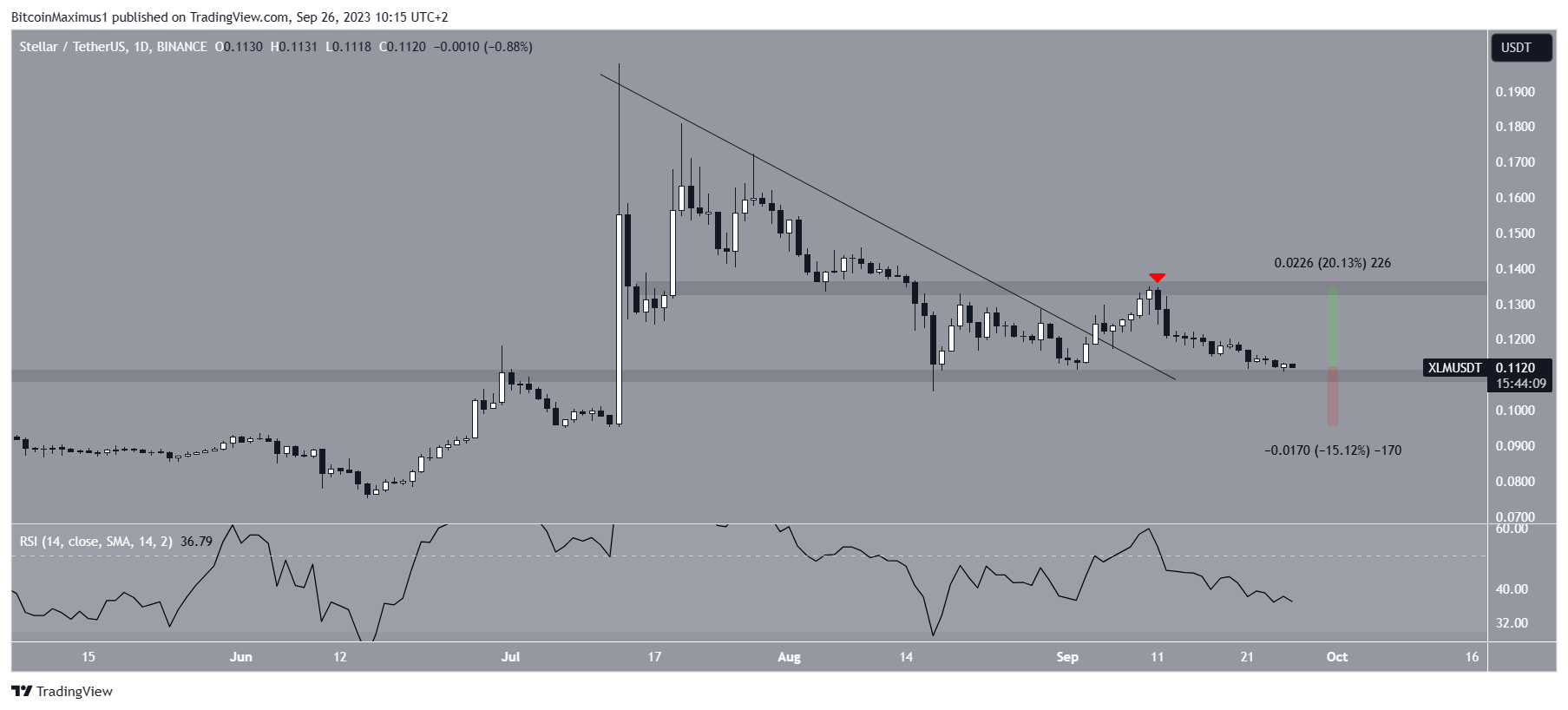

The Stellar (XLM) price is trading close to the point of convergence between a descending resistance trendline and a long-term horizontal support area.

The support area has been in place since April, while the descending resistance line has sloped the decrease since July.

Stellar Returns to Long-Term Support

The daily time frame technical analysis for Stellar shows that the price has decreased below a descending resistance trendline since July 13.

The decrease culminated with a low of $0.105 on August 17. While the price bounced afterward, it failed to break out from the trendline. Rather, it was rejected on September 11 (red icon) and resumed its previous descent.

Currently, the XLM price trades inside the $0.110 horizontal support area. This is an important area since it has intermittently acted as both resistance and support since April 2022.

Combined with the descending resistance trendline, the area creates a descending triangle, considered a bearish pattern.

The daily RSI is undetermined. Traders use this momentum indicator to assess whether a market is overbought or oversold. This determines whether to accumulate or sell an asset.

An RSI reading that exceeds 50 in an uptrend is generally perceived as an encouraging sign for bulls, whereas a reading falling below 50 is interpreted as bearish.

The indicator is below 50 and falling, both considered signs of a bearish trend. Therefore, the RSI suggests the cryptocurrency will break down further.

XLM Price Prediction: Will Bearish Pattern Lead to Breakdown?

Since the descending triangle is considered a bearish pattern, an eventual breakdown from it is the most likely future price scenario.

Besides the triangle, analysts consider it bearish that the increase on August 17 occurred within an ascending parallel channel (white).

Since channels usually contain corrective movements, an increase inside a channel means the trend is bearish.

If the cryptocurrency closes below $0.110, it will confirm the breakdown from the bearish XLM pattern. A decrease that travels the entire triangle’s height (black) will take the price just below the $0.076 horizontal support area.

This would be a drop of 35%, measuring from the current price.

Despite this bearish XLM price prediction, a breakout from the descending resistance trendline will mean that the trend is still bullish.

In that case, a 20% increase to the $0.140 resistance will likely be the future price outlook.

Interested in AI Trading? 9 Best AI Crypto Trading Bots to Maximize Your Profits

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.