Stellar is an open-source platform developed by the Stellar Development Foundation (SDF) to improve financial inclusion and simplify cross-border payments. Stellar offers a peer-to-peer network for faster transactions and affordable money transfers. Here’s what to know about the project in 2025.

KEY TAKEAWAYS

➤ Stellar facilitates fast and low-cost cross-border payments for individuals and small businesses.

➤ XLM serves as a bridge asset for seamless currency conversions on the Stellar network.

➤ Stellar’s unique consensus protocol ensures high scalability and low energy consumption for transactions.

➤ The nonprofit organization behind Stellar aims to create a global blockchain network where financial services are accessible to everyone, especially those in underserved markets.

A quick overview of Stellar

Stellar serves as an open financial network where users can issue, transfer, and trade digital representations of various assets, including fiat and cryptocurrencies. The platform promotes interoperability between traditional finance and blockchain technology by connecting these different asset types.

XLM, the native asset on the Stellar network, plays a key role by enabling quick transaction settlements and acting as a reserve asset that protects network integrity. At the same time, it also facilitates smooth currency conversions.

The unique structure of the Stellar network empowers individuals and institutions to perform a range of financial activities — including remittances, micropayments, and asset issuance without relying on intermediaries.

The Stellar team

- Joyce Kim and Jed McCaleb founded the Stellar Development Foundation was created in 2014.

- McCaleb was involved in the creation of the now-defunct Mt. Gox exchange and the decentralized file-sharing network eDonkey.

- Most notably, McCaleb helped co-found Ripple Labs, the parent company of blockchain-based global payment network Ripple. However, he fell out with his co-founders, as they differed in philosophy and how they preferred to stir the Ripple ship. He eventually left to set up Stellar with a team of intelligent minds.

- Some other notable team members include Nicolas Barry, their Chief Technology Officer, and David Mazières, a Computer Science professor at Stanford University.

Stellar Consensus Protocol

The Stellar Consensus Protocol (SCP) is one of Stellar’s most distinguishable properties. While popular cryptocurrencies like Bitcoin use proof-of-work (PoW) to reach consensus, Stellar uses the SCP.

Stellar originally started with the Ripple Consensus Algorithm (RPCA). The RPCA was a Practical Byzantine Fault Tolerant (PBFT) algorithm that ensures a distributed system can continue operating even if some nodes fail to communicate or act dishonestly.

The RPCA worked like this:

1. A central authority chooses a predefined set of validators

2. The validators govern the system by agreeing on the state of the network and other aspects such as transaction validation.

3. Once 66% of validators reach a consensus, it is recorded on the blockchain.

This way, things can run as long as the malicious actors on the network don’t make it to 34%.

However, due to limitations in the RPCA, Stellar adopted the SCP in 2015, which uses the Federated Byzantine Agreement Protocol to achieve consensus.

The SCP allows nodes to reach an agreement on the state of the network without relying on a central authority. Unlike PoW, where miners must use computational power to validate transactions, SCP nodes operate independently while forming agreements through quorum slices.

This enables the Stellar network to achieve consensus more quickly and with lower energy consumption.

Types of protocol

The Stellar Consensus Protocol consists of two main sub-protocols: the ballot protocol and the nomination protocol.

For each consensus slot, the nomination protocol proposes candidate values that the network can consider. Once nodes agree that the nomination protocol has converged, the ballot protocol begins.

Here, a ballot is tied to the candidate value, and nodes either commit to or abort the value, leading to a finalized decision. This dual protocol structure ensures that consensus is achieved even in the presence of potential malicious actors.

Quorums and Quorum Slices

- A quorum is a set of nodes that are required to reach an agreement in a distributed system. When nodes try to reach an agreement, they communicate and agree to implement an update. Once a threshold of nodes has been met, the node is implemented.

- Quorum slices, however, are subsets of a quorum that can convince particular nodes to form an agreement. Thus, a node can rely on several sets of nodes and their statements. A node could depend on several slices for information, and the trust needed can be built based on external information.

- Trust is set within the node’s config file, thus making it possible for a dynamic formation of quorum slices and, eventually, decentralization.

- Traditional Byzantine Agreements require that all nodes accept the same slices, as opposed to discerning where the information is coming from—as such, distinguishing between quorums and slices is impossible. This means that a closed and permissioned member access to the network is required.

- Quorums intersect if they share a node. They’re also responsible for ensuring that their quorum slices don’t violate any quorum intersections. When quorums don’t intersect, the phenomenon is known as disjoint quorums. These are bad quorums, and they can lead to contradictory statements that ultimately put the consensus in jeopardy.

Ripple vs. Stellar

| Feature | Ripple | Stellar |

|---|---|---|

| Founders | Chris Larsen, Jed McCaleb | Jed McCaleb, Joyce Kim |

| Launch year | 2012 | 2014 |

| Primary use case | Cross-border payments for financial institutions | Affordable payments and financial inclusion for individuals |

| Target audience | Banks and large financial institutions | Individuals, remittance services, and small businesses |

| Native token | XRP | XLM (Lumens) |

| Consensus mechanism | Ripple Protocol Consensus Algorithm (RPCA) | Stellar Consensus Protocol (SCP) |

| Transaction speed | 3-5 seconds | 3-5 seconds |

| Transaction fees | Very low (0.00001 XRP) | Very low (0.00001 XLM) |

| Decentralization level | Less decentralized due to validator control | More decentralized with open validator access |

| Partnership focus | Major financial institutions and banks | FinTech companies, NGOs, and remittance providers |

| Protocol code | Closed-source | Open-source |

| Primary competitor | SWIFT and traditional banking systems | Ripple and other low-cost remittance solutions |

| Unique feature | Built-in anti-spam mechanism and ledger balance requirements | Anchors and bridge assets for seamless currency conversion |

| Foundation/organization | Ripple Labs | Stellar Development Foundation (SDF) |

| Supply cap | 100 billion XRP | 50 billion XLM |

| Use in asset issuance | Limited support for asset issuance | Strong support for creating and issuing digital assets |

Stellar vs. Bitcoin

| Feature | Stellar | Bitcoin |

|---|---|---|

| Founders | Jed McCaleb and Joyce Kim | Satoshi Nakamoto |

| Launch year | 2014 | 2009 |

| Primary use case | Facilitating cross-border payments and asset transfers | Peer-to-peer digital currency |

| Consensus mechanism | Stellar Consensus Protocol (SCP) | Proof-of-Work (PoW) |

| Transaction speed | 3-5 seconds | 10 minutes on average |

| Transaction fees | Very low (0.00001 XLM) | Variable and can be high depending on network congestion |

| Energy efficiency | The general public and investors | High energy consumption due to mining operations |

| Supply cap | 50 billion XLM | 21 million BTC |

| Decentralization level | More decentralized due to multiple validators | Highly decentralized but controlled by large mining pools |

| Target audience | Individuals, remittance services, and small businesses | General public and investors |

| Smart contracts | Limited support for smart contracts | No native support |

| Foundation/organization | Stellar Development Foundation (SDF) | None (Bitcoin is fully community-driven) |

| Unique feature | Supports anchors and token issuance for assets | Serves as a store of value and medium of exchange |

| Scalability | Highly scalable with over 1,000 transactions per second | Limited scalability with around 7 transactions per second |

Institutions that partnered with Stellar

In its mission to boost the adoption of its network and its digital asset, the Stellar Development Foundation has teamed up with some notable partners, as can be viewed on the Foundation’s “Projects” page. They include

1. Tempo: Stellar partnered with the French money transfer service provider, which now serves as the Stellar network’s Euro anchor.

2. IBM: The IBM partnership is most likely Stellar’s most high-profile alliance. Announced in October 2017, it sees Stellar help the tech giant to optimize its cross-border transactions. The deal also includes a network of banking institutions that will move money across borders with XLM.

3. SatoshiPay: Stellar and SatoshiPay announced their partnership in 2017, with the latter explaining that it would use XLM as the underlying cryptocurrency ledger of its nano payment system.

Some other partners include Flutterwave, HTC Exodus, The White Company, Ownbit, Cowrie, and Curv.

How to use Stellar

Stellar Payment Network

While Stellar operates on a decentralized channel, it’s worth noting that it’s not as decentralized as Bitcoin or other networks based on proof-of-work mechanisms.

The creators pre-mined Stellar Lumens (XLM) and claim it maintains decentralization while improving efficiency and reducing latency. However, they sacrificed some decentralization to achieve these improvements.

Users on the Stellar network use Lumens to cover transaction fees and facilitate currency conversions.

The team created Lumens to support effective remittances and cross-border payments. While Ripple targets banks and financial institutions with XRP, Lumens focuses on helping individuals with everyday transfers.

To maintain its network and prevent ledger spam, Stellar requires users to pay a small transaction fee and maintain the minimum account balance, which is currently set at 1 XLM.

Anchors and credit

Anchors are entities on the Stellar network that can hold a deposit and issue credits into the network for those credits. Stellar has described these entities as the bridge between different currencies and the network.

Anchors usually back assets that don’t originate on the Stellar network. These assets themselves are usually called redeemable or tethered assets. They take the assets’ deposits, issue credits to the corresponding accounts, and they provide withdrawals by taking the credits they give a user and crediting their wallet account.

The entire mechanism of Stellar is heavily dependent on anchors, and trust is required if they will be able to perform their two most important duties – holding and issuing credits to users.

Understanding XLM: Stellar’s native asset

XLM, also known as Lumens, is the native asset of the Stellar network. It was designed to facilitate fast and cost-effective currency transfers. At the same time, it also serves as a bridge currency that allows users to exchange various digital and fiat currencies without relying on multiple currency pairs.

This feature enables hassle-free transactions across borders and makes Stellar an attractive option for remittances, micropayments, and transfers in emerging markets.

Key use cases

- Currency conversion: XLM streamlines cross-border transactions by acting as a mediator between currencies, ensuring efficient exchanges.

- Transaction fees: The network uses a minimal transaction fee (0.00001 XLM) to prevent spam, enhancing the security and reliability of Stellar’s operations.

- Network integrity: XLM maintains a minimum balance requirement (currently 1 XLM) for accounts, supporting the network’s scalability and efficiency.

Tokenomics

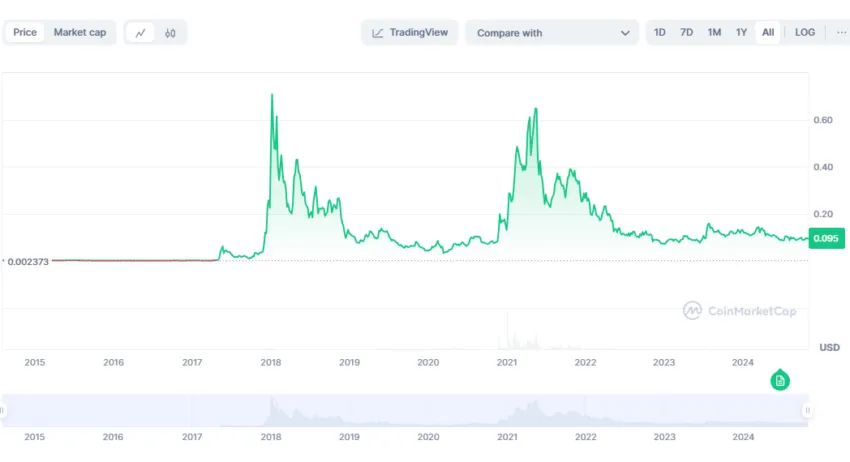

Stellar initially issued 100 billion XLM, with supply adjustments over time. In 2019, the Stellar Development Foundation (SDF) burned 50 billion XLM, leaving a fixed supply of 50 billion. Of this, roughly 20 billion XLM circulates in the market, while the SDF holds the remaining tokens for ecosystem development and operational support.

As of Oct. 30, 2024, XLM is the 30th-largest cryptocurrency by market cap ($2.82 billion).

The best Stellar wallets

1. Ledger Nano S

The Ledger Nano S is a hardware wallet. This means it’s off-grid and can work without an Internet connection, to some extent. The Nano S is a cut above the rest of the pack, thanks to an amalgamation of expansive asset support, innovative design, and a great price.

The wallet supports XLM along with other popular digital assets like Bitcoin, Ether, Litecoin, and XRP.

The Nano S can easily synchronize with the Stellar Account Viewer, offering convenience and security. You can read more about the Ledger Nano S here.

2. Atomic Wallet

Atomic is a custody-free, multi-currency wallet that supports over 300 digital assets. This wallet allows you to exchange, manage, and purchase XLM in a secured environment.

Atomic supports most operating systems, including macOS, Windows, and Linux. There’s also an Android and an iOS app for mobile devices.

Atomic makes use of on-device intelligence and stores all private keys on your device. You also get a password and a 12-word mnemonic seed phrase.

There’s also an in-app buy option on the Atomic Wallet. Powered by Simplex, the wallet allows you to buy Stellar Lumens and other digital assets using a credit card in a few clicks. Fees for the transactions are charged at 2 %.

3. Stellar Desktop Client

The Stellar Desktop Client is a versatile wallet. It functions as both a hot and cold wallet, depending on your Internet connection.

The wallet comes with an easy-to-use desktop platform, and it also allows you to either create a new wallet or restore an old one, and it’s protected by a password that is generated and stored on your computer.

Being a desktop wallet, we strongly advise you to keep your passwords in a secure location or away from your computer to prevent malicious attackers from stealing your funds.

4. Stronghold Wallet

Stronghold is a multi-currency wallet that runs on the Stellar blockchain. It describes its walls as the on-ramp and off-ramp of the Stellar network for XLM. By being housed in the Stellar network, the wallet is touted as a legitimate secure place to keep your assets.

5. Guarda Wallet

The Guarda wallet is a multi-platform, non-custodial wallet that supports the trading of Lumens and other top cryptocurrencies. It features cryptocurrency trading capabilities and custom fees and is generally seen as an all-encompassing wallet by all standards.

It’s available on desktop, web, and mobile. There’s also a special extension for the Google Chrome browser.

The wallet also provides exchanges’ features, and users can also use debit cards to make Lumens purchases straight from the wallet. On Guarda, you can also choose to either create a new wallet or import your existing wallet to the software.

6. Lobstr Wallet

The Lobstr Wallet was created as a for-Stellar wallet only. Jed McCaleb created it in line with Stellar’smission to bank the unbanked.

The wallet has been touted as one of the safest and most secure wallet options for XLM, and it was one of the very first ways to purchase XLM when the latter was first developed. It is currently available on iOS, Android, and as a web-application.

Lobstr operates on the Stellar network and has received an endorsement from Stellar itself. The wallet stores coins directly on the network to ensure stringent security. It also protects private keys, but users cannot recover them if lost.This essentially means that losing your private key is tantamount to losing your funds entirely.

Stellar in 2025

Stellar was designed to offer a more efficient and accessible solution for cross-border payments. Despite facing challenges such as limited adoption and marketing, the platform has established partnerships with major companies, which contributed to its growth and reputation. Although Stellar and its native cryptocurrency XLM have not achieved the same level of popularity as some competitors, it remains one of the top blockchain projects with a solid foundation for future development.

Frequently asked questions

What is Stellar Lumens?

How does Stellar Lumens work?

What are the benefits of Stellar Lumens?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.