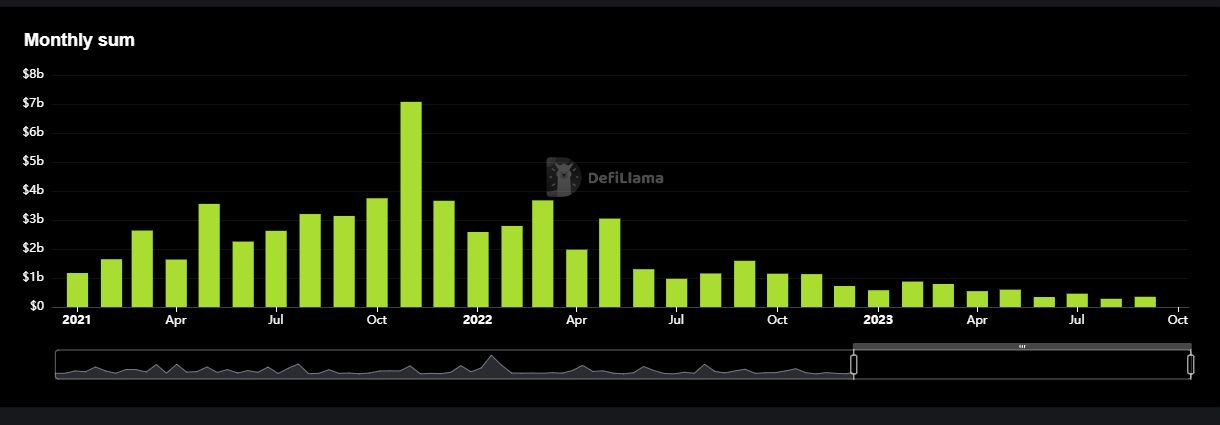

Venture capital funding for crypto and web3 startups continues to dry up as the bear market blues deepen. September’s VC funding report is out, and it comes as no surprise that figures are little changed from the previous month.

On October 2, industry analyst WuBlockchain released its September crypto venture capital funding report. Citing RootData statistics, it reported a total of 77 publicly announced investment projects in the crypto VC sector for the month.

Crypto VC Funding Flat

The number of crypto investment projects is slightly higher than in August, when there were 75. However, the figure is down 44% from September 2022, which had 138 projects raising funds.

The total funding raised in September was $510 million, according to the report. This is a 24% decrease compared to August, which had $670 million.

Infrastructure projects were dominant, accounting for approximately 30% of the financing in September. Furthermore, the second-highest category was DeFi projects, accounting for around 22%.

The largest investment deal for the month was Bitmain, which announced that it would provide 27,000 S19J XP miners to bankrupt Core Scientific. These would be in exchange for $231 million in cash and $539 million worth of Core Scientific common stock.

Other significant crypto venture funding rounds included Proof of Play ($33 million), Bastion ($25 million), Story Protocol ($25 million), and Supra ($24 million).

According to DeFiLlama, crypto funding climbed to $353 million in September, up 25% from August figures. However, investments have fallen 78% from the same month in 2022, when investors put $1.59 billion into the sector.

Web3 Funding Woes

According to Crunchbase, Web3 startups raised $1.3 billion in the third quarter, down from around $2 billion in both Q1 and Q2.

On average, Web3 startups raised more than $8 billion in every quarter between Q3 2021 and Q2 2022, reported TechCrunch.

Moreover, the $4.5 billion that crypto startups raised in Q3 2022 was more than triple the amount raised in Q3, 2023.

The trend is still down for Web3 and crypto venture funding, but large sums are still being invested. Bear markets are for building and the savvy investor knows that markets are cyclical and things will turn around again soon.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.