Chainlink (LINK), ImmutableX (IMX), NEO, KAVA, and MultiversX (EGLD) are all altcoins that have interesting developments lined up in December, which could affect their price.

The month of November was bullish for the cryptocurrency market. This was especially visible in the first half of the month. The five altcoins below could draw even more attention in December.

Chainlink (LINK) Staking Allows Early Entry

- Price: $14.79

- Market Cap: $8,235 billion

- Rank: #12

Chainlink Staking v0.2 launched this year. The priority migration was on Nov. 28, only available for existing v0.1 LINK stakers. Early access-eligible addresses will be able to stake on Dec. 7 while staking will be opened to the public on Dec. 11.

Staking v0.2 will build upon the existing foundation from v0.1, providing greater flexibility, improved security, a dynamic reward mechanism, and modular architecture.

The LINK price has fallen since reaching a high of $16.58 on Nov. 11. The decrease led to a low of $12.86 six days later.

The price has increased since, in a movement supported by the Relative Strength Index (RSI). Market traders use the RSI as a momentum indicator to identify overbought or oversold conditions and to decide whether to accumulate or sell an asset.

Readings above 50 and an upward trend indicate that bulls still have an advantage, whereas readings below 50 suggest the opposite.

The RSI bounced at 50, creating a hidden bullish divergence (green), considered a sign of trend continuation.

If the LINK price continues to increase, the next resistance will be at $18.30, created by the resistance trend line of an ascending parallel channel. An upward movement of 22% is required to reach it.

Despite this bullish LINK price prediction, a close below the November 17 low of $12.86 (red) will invalidate the bullish count. In that case, the LINK price can fall by 27% to the channel’s support trend line.

Read More: Best Upcoming Airdrops in 2023

ImmutableX (IMX) Releases New Mainnet

- Price: $1.28

- Market Cap: $1,606 billion

- Rank: #39

ImmutableX launched its zkEVM Testnet in August, aiming to become the home of gaming on Ethereum. More than 50 games have already committed to building on the zkEVM. The Testnet upgraded from Polygon Edge to Geth in November, and the mainnet will launch in December.

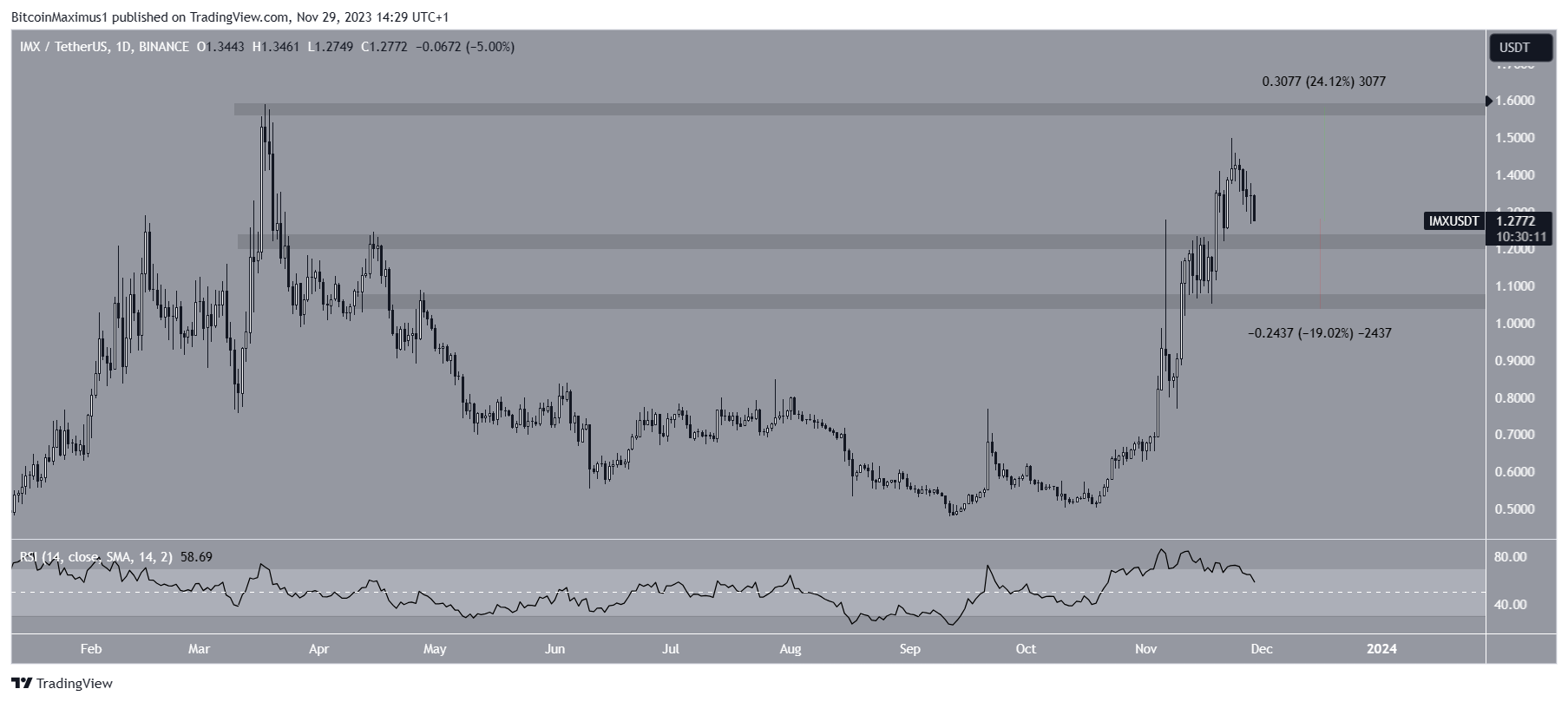

The IMX price has increased swiftly since the start of November. The price increase culminated with a high of $1.50 on November 23.

While the price fell slightly afterward, it trades above the $1.20 horizontal area, which is now expected to provide support.

If the IMX price bounces, it can increase by 24% to the next resistance at $1.60.

Despite this bullish IMX price prediction, a daily close below the $1.25 area can lead to a 20% drop to the next closest support at $1.

NEO Upgrades Mainnet

- Price: $10.84

- Market Cap: $764,286 million

- Rank: #65

NEO upgraded its testnet on Nov. 21 and will upgrade its mainnet on Dec. 4. The new upgrade will provide several improvements and optimizations.

The NEO price has increased rapidly since breaking out from a descending resistance trend line on Oct. 26. The upward movement culminated with a high of $15.46 on Nov. 5.

However, the price failed to sustain its upward movement and created several long upper wicks (red icons), considered signs of selling pressure.

Despite the decrease, the NEO price trades above the main horizontal support area at $10. If it bounces, it can move upwards by 35% and reach the $14.50 resistance area.

Despite this bullish NEO price prediction, a close below the $10 area can trigger a 30% drop to the next support at $7.50.

Read More: Best Crypto Sign-Up Bonuses in 2023

MultiversX (EGLD) Stakers Vote for Governance Proposal

- Price: $43.36

- Market Cap: $1,138 billion

- Rank: #50

EGLD stakers are voting for the first protocol governance proposal. The voting began on Nov. 23 and will continue until Dec. 3. So far, nearly 98% of the participants have voted in favor of the Sirius 1.6 Protocol upgrade, which features enhancements like optimized consensus signature checks, advanced voting, and multi-key support for chain shards.

The EGLD price broke out from a long-term descending resistance trend line in October, culminating in a high of $53.45. While the price fell afterward, it still trades inside the $43 horizontal support area. As long as it does, the trend remains bullish.

If the price resumes its ascent, it can increase by 45% and reach the next resistance at $63.

On the other hand, if EGLD closes below the $43 area, it can fall by 25% and validate the long-term descending resistance trend line.

Read More: 9 Best Crypto Demo Accounts For Trading

KAVA Concludes December Altcoins to Watch

- Price: $0.765

- Market Cap: $747,165 million

- Rank: #68

The final December altcoin is KAVA. KAVA 15 is set to launch on Dec. 15. While there is not much information regarding its upgrades, the team held an AMA on Nov. 29 to discuss new developments.

The KAVA price broke out from a descending resistance trend line on Oct. 20. It has increased swiftly since. The upward movement led to a high of $0.87 on Nov. 11.

Even though the KAVA price fell afterward, it still trades above the $0.70 horizontal support area. As long as it does, the most likely future outlook is a 30% increase to the next resistance at $1.

Despite this bullish KAVA price prediction, a close below the $0.70 area can lead to a 25% decrease to $0.57.

Read More: 9 Best AI Crypto Trading Bots to Maximize Your Profits

For BeInCrypto’s latest crypto market analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.