Tellor (TRB) price bounced back to reclaim the $40 territory on Wednesday, September 20, after a major retracement at the weekend. An intricate combination of on-chain and derivatives market indicators provides insights into the possibility of TRB price reclaiming the $50.

Tellor (TRB) is a decentralized oracle protocol that provides blockchain infrastructure to integrate off-chain data into on-chain smart contracts. As investors switched focus to the Real World Assets (RWA) sector this month, TRB, Chainlink (LINK), and other big players in the decentralized oracles projects have scored significant gains.

Can TRB bulls ride the TWA wave to reclaim the $50 territory?

Tellor Speculative Traders are now scaling down their Activity?

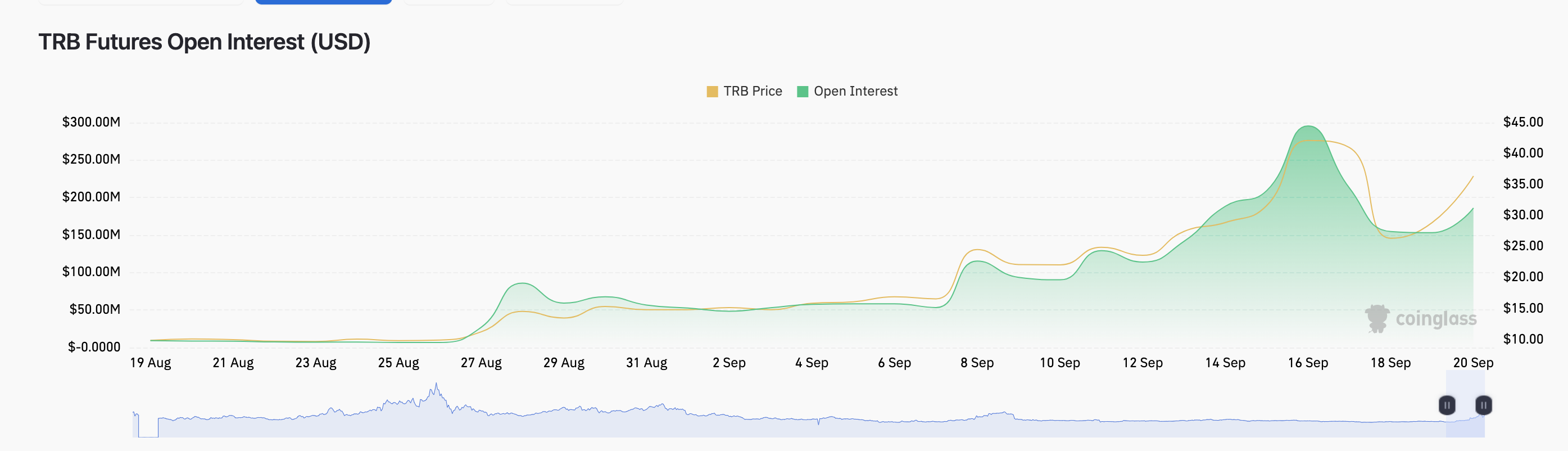

Last week, Beincrypto analysis raised concerns that speculative activity from short-term traders is the main driver ongoing the TRB rally. Derivatives market data shows that TRB Futures speculative traders are now scaling down their activity.

Since dropping to $26 on September 18, TRB’s price has rebounded 53% to reclaim $40 on September 20. But interestingly, in the derivatives markets, futures traders have only increased Capital Inflows by 21% during that period.

Indicatively, TRB Open Interest stood at $154 million when the price retraced on September 18. But as of September 20, it has only increased to $184 million.

While the 21% bump in Open Interest is a sizable increase, it pales significantly compared to the 53% Tellor price bounce.

Open Interest sums up the total value of active derivatives contracts for an asset. An uptrend in Open Interest is a bullish signal, indicating that traders are increasing their capital inflows.

However, when the percentage price increase exceeds the rate at which new investors and fresh Capital Inflows enter the market, it raises a few red flags that could cause the price rally to be short-lived.

Read More: Best Upcoming Airdrops in 2023

Chiefly, it could mean that the current Tellor rally is being driven by short sellers rushing to cover their positions due to the rapid price increase.

Without attracting new participants and sizable additional capital, it’s only a matter of time before the short-sellers run out of gas and choose to cut their losses.

Tellor’s price could again retrace sharply in the coming days if that happens.

TRB Network Struggling to Attract New Participants Amid Market Volatility

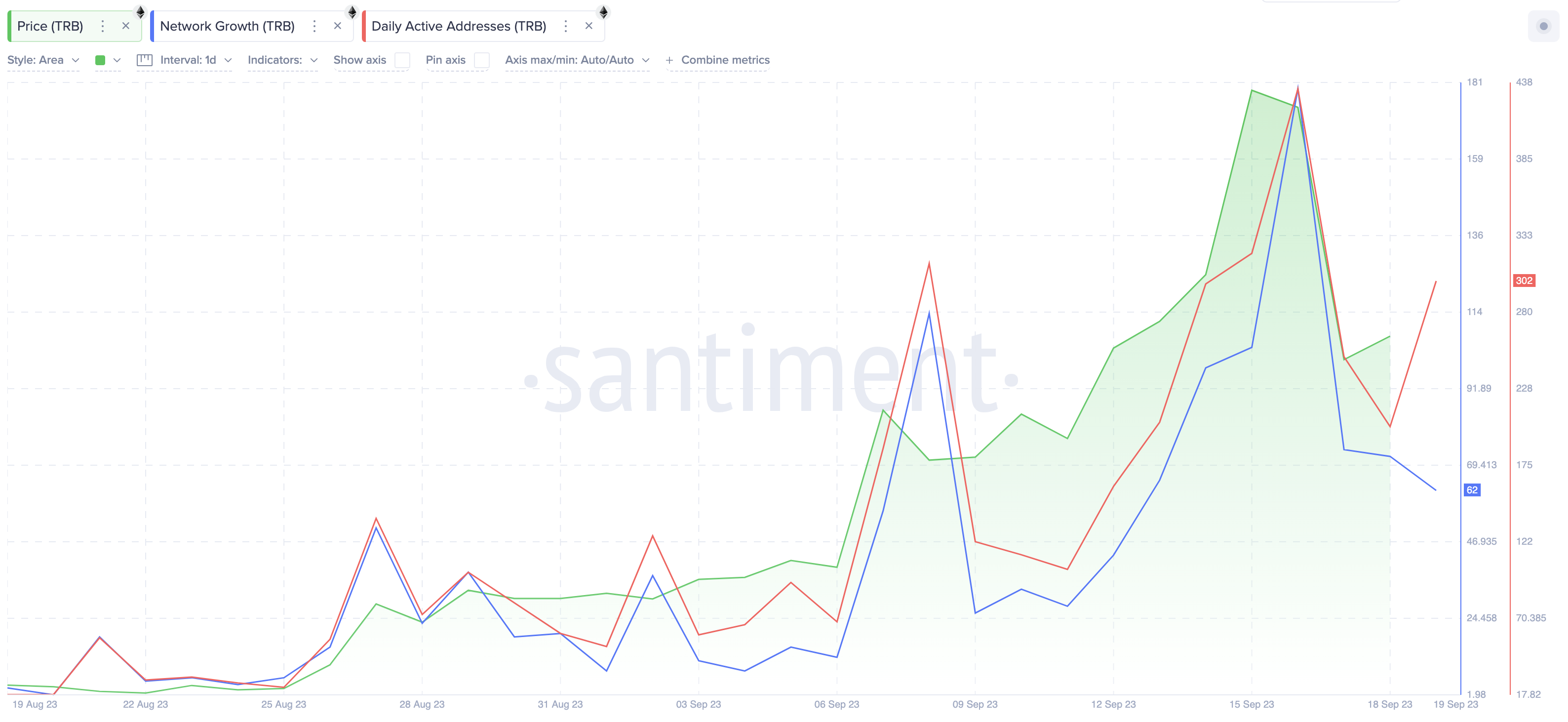

After the wild price fluctuations observed over the past few weeks, the Tellor network struggles to attract new participants. On-chain data compiled by Santiment shows that only 62 new TRB wallet addresses were created on September 20. This represents a 66% decline from the recent peak on September 19.

By summing up the number of new wallet addresses, Network Growth estimates the rate at which new investors join a blockchain network. A sharp decline in Network Growth during a rally means that speculative trading among existing investors is fuelling the price increase.

Notably, the chart above also illustrates that while the Network Growth slid further on September 19, TRB daily Active Addresses (red line), i.e., the number of wallet addresses carrying out transactions, had simultaneously increased.

Considering that a similar trend is observed in the Tellor derivatives markets, this confirms the thesis that the TRB rally is driven by existing participants rather than TRB attracting new demand.

In summary, TRB must increase investor participation and capital inflow to sustain current lofty price support levels. If that does not happen it’s only a matter of time before the overvaluation bubble bursts and the TRB retraces by double-digit margins.

TRB Price Prediction: All Eyes on the $20 Support

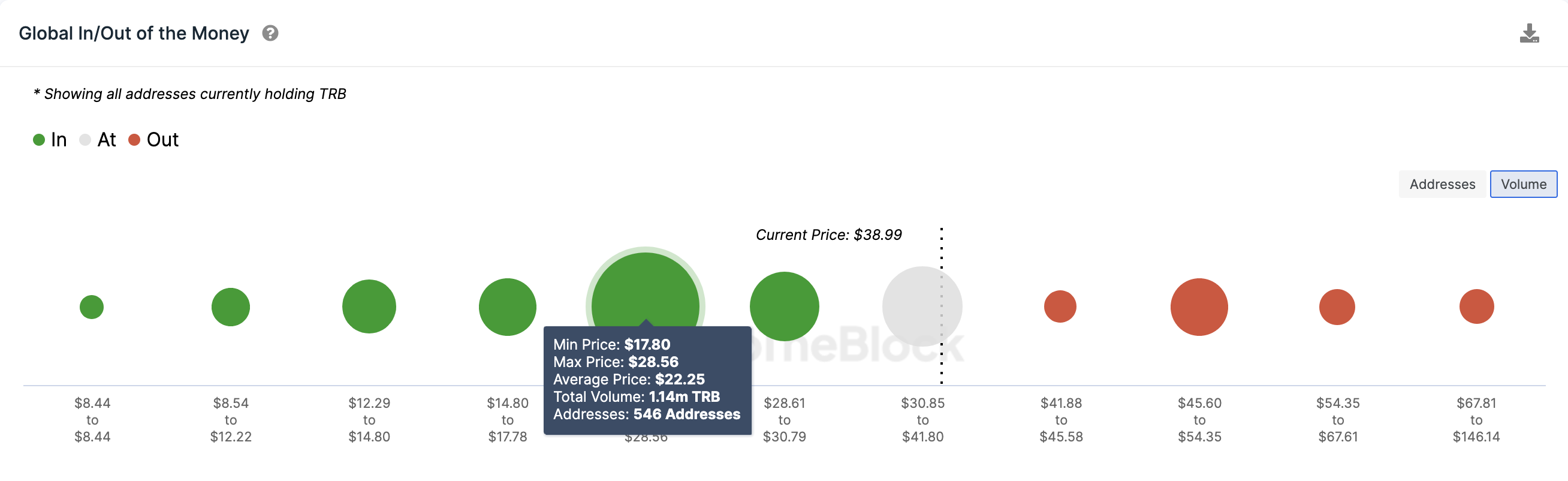

Vital insights from on-chain indicators and derivatives market data all point toward an imminent TRB price retracement. The In/Out of Money Around Price data, which depicts the purchase price distribution of current Tellor holders, also confirms it.

It vividly depicts that Tellor’s most significant support level lies around the $20 mark.

As shown below, 546 addresses had purchased 1.14 million TRB tokens at an average price of $22. Failure to attract new demand could see TRB lose the initial support level at $30, as predicted.

But conversely, if Tellor receives a significant boost in network traction and capital inflows, the rally could proceed toward $50. In that case, the 581 addresses holding 173,00 TRB bought at the average price of $50.42. They could pose significant resistance if they take profits early.

Although unlikely within the current circumstances, Tellor’s price could reclaim $50 if the bulls scale that sell-wall.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.