QuickSwap is a DEX that operates on the Polygon network, a layer-2 scaling solution for Ethereum, that allows users to trade cryptocurrencies at low costs. So, how does it work, and what makes it so unique? Find the answer to these questions and more in this QuickSwap guide.

KEY TAKEAWAYS

• QuickSwap is a Uniswap clone and decentralized exchange on the Polygon network.

• It provides liquidity mining, yield farming, and staking rewards through its native QUICK token.

• QuickSwap’s community-driven governance model ensures that users have a role in the platform’s growth.

• Unique features like Dragon Lair and Dragon Syrup allows users to earn additional income.

What is QuickSwap?

QuickSwap is a Polygon automated market maker (AMM) that allows users to trade directly from their wallets by interacting with smart contracts on Ethereum, X Layer, Polygon, and other EVM-compatible blockchains. What sets QuickSwap apart is its super fast transaction speed and lower gas fees.

The DeFi solution uses automated liquidity pools to reward users. It boasts a wide range of ERC-20 tokens, and users can easily transfer their assets to the Polygon network using Polygon Bridge. With over 100 tokens available for trading and around 200 liquidity pools, QuickSwap offers diverse investment opportunities.

Additionally, users can take advantage of farming pools to earn on the proof-of-stake protocol while supplying assets for lending. QuickSwap also offers more than 80 farming pools.

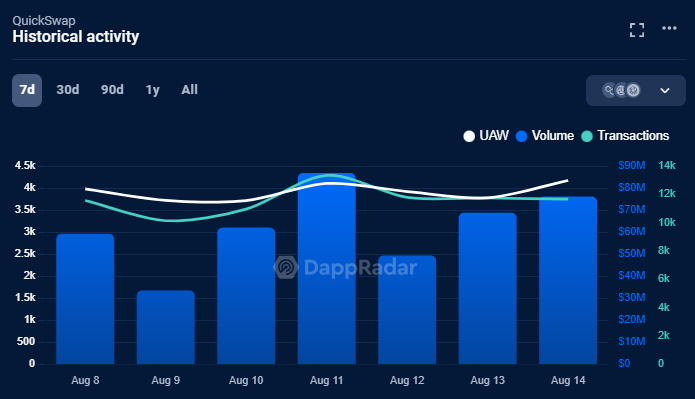

It introduced its native token QUICK in February 2021. According to DappRadar data, the DEX has a total value locked of over $73.9 million and a 7-day transaction volume of $76.1 million as of Aug. 16, 2024.

Behind the speed: origin, team, and roadmap

QuickSwap launched in October 2020. The platform’s community-focused governance structure speaks to the team’s commitment to building a DEX that is accessible to everyone. With 96.75% of the token supply reserved for the community and the remaining 3.25% for the team, token holders carry significant voting power over the network, and stakers are able to earn revenue from trading fees.

QuickSwap’s decision to fork the code behind Uniswap, a battle-tested DEX that processes millions of dollars worth of crypto volume on a daily basis, has proven wise. By utilizing an automated market-making system, QuickSwap can provide a seamless trading experience for its users without changing the underlying code.

In addition to the automated market-making system, QuickSwap boasts innovative features such as Dragon Lair and Dragon Syrup. With Dragon Lair, users earn protocol fees by staking their QUICK tokens. Dragon Syrup allows stakers of dQUICK to earn additional yields from projects that are traded on QuickSwap as well.

QuickSwap’s team

The QuickSwap team comprises accomplished crypto professionals, including co-founders Roc Zacharias, Sameep Singhania, and Nick Mudge. Together, they bring a wealth of knowledge and expertise to the development and success of QuickSwap. The Matic Foundation also provides comprehensive technical and advisory support to the QuickSwap team.

How does QuickSwap work?

First and foremost, the process of swapping tokens is intuitive: users must select the input and output tokens, specify the input amount, and the protocol will calculate the output token amount.

With a few clicks, users are able to execute the swap and receive the output token directly into their wallet. QuickSwap goes beyond token swapping, offering additional features such as staking, farming, and providing liquidity.

Features of QuickSwap

QuickSwap has quite a few features that are common for DEXs. These include token swaps, liquidity mining, and yield farming. It also has a few not-so-common features like a fiat on-ramp and boosted yields via the Dragon’s Lair pool.

Swap tokens

With QuickSwap, you can easily trade any pair of ERC-20 tokens. Additionally, the platform allows you to trade cryptocurrencies directly from your digital wallet without depositing your assets into a centralized exchange. As the only person who can access your assets during a trade, you have full control and protection over your funds.

Liquidity pools and mining

Liquidity mining rewards users who provide liquidity with QUICK tokens. Users can create better swap conditions for themselves and the community by locking more tokens within liquidity pools. Note that QuickSwap also offers distributed management to its users, giving them greater control over their investments.

Did you know? QuickSwap was the first decentralized exchange on the Polygon network to offer liquidity mining incentives to its users.

With QuickSwap, anyone can become a liquidity provider (LP). To become an LP, you need to deposit equal amounts of each token in the pool, and you’ll receive pool tokens in return. Note that these tokens are your pool share, which you can redeem for the underlying tokens at any time.

The QuickSwap liquidity pool’s total liquidity, denoted as (k), is calculated by multiplying the amount of (x) by the amount of (y). The key concept of QuickSwap is that ‘k’ must always remain constant, so the pool’s total liquidity formula is simply (x) multiplied by (y) equals (k).

When someone trades, they incur a 0.3% fee. The protocol automatically adds this to the reserves. This fee goes into the liquidity pool, making (k) bigger. The bigger (k) gets, the more valuable the pool becomes. This increase in value benefits liquidity providers (LPs), who can withdraw their share of the pool’s value whenever they want by burning their pool tokens.

Yield farming

“QuickSwap offers a number of stable-stable pools where LPs can earn over 14% APY & balance risk of Impermanent Loss, as per the DEX’s Twitter announcement.

When you provide liquidity to Quickswap’s trading pairs, you can earn a 0.25% fee on trades proportional to your pool share. This means that the more liquidity you provide, the greater your share of the pool and the more trading commissions you can earn. Furthermore, users can deposit LP tokens to earn additional rewards.

Dragon’s Lair

Dragon’s Lair is a single staking pool for QUICK tokens. You can stake your QUICK to receive dQUICK and earn your share of 0.04% of all trading fees. In addition to trading, users can earn passive income on QuickSwap by staking their QUICK tokens in Dragon’s Syrup Pools.

These pools offer a finite number of rewards in participating tokens, which expire after reaching a limit. While most Syrup Pools have exhausted their rewards for old QUICK tokens, users can still participate by staking new QUICK tokens.

Buy crypto with fiat

Quickswap also allows users to purchase crypto directly with Apple Pay, bank transfer & credit cards. This feature is a step towards improved web3 accessibility, helping users purchase crypto assets quickly and easily with their preferred payment method.

Analytics and historical data

Quickswap also offers analytics and historical data for users to learn about the platform’s performance over time. Users can find trends and patterns and better comprehend the price changes of various cryptocurrencies, liquidity pools, and trading pairs.

Pros and cons of QuickSwap

QuickSwap offers advantages and disadvantages to traders, investors, and other users. Here are a few that you may want to take into consideration.

| Pros | Cons |

|---|---|

| No registration required | Risk of impermanent loss |

| Users can expect a high level of privacy from the network | No KYC can be a con for some |

| Swap ERC-20 tokens | May be difficult for beginners |

| The network offers lightning speeds | |

| Intuitive and user-friendly design | |

| Users can earn crypto with liquidity mining | |

| Users can buy MATIC directly using their U.S. debit/credit card or Apple Pay. |

QuickSwap token $QUICK

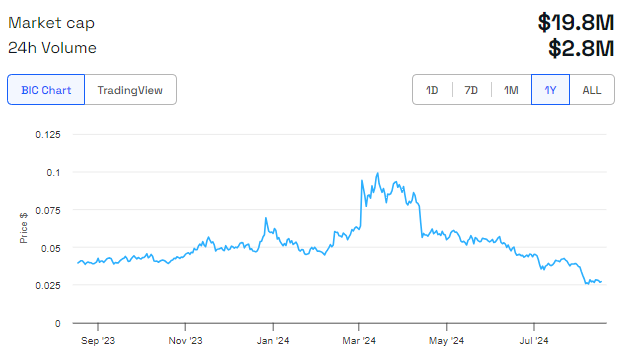

QUICK is the native currency of Quickswap. The ERC-20 token runs on the Polygon Network.

Tokenomics

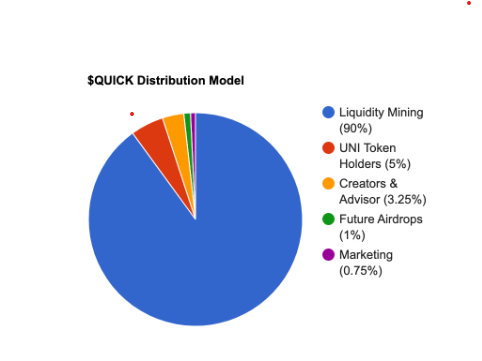

The team released the QUICK token without pre-mining or sales to ensure community governance and sustainable growth. 90% of 1 million tokens were allocated to the governance treasury for liquidity mining, with decreasing distribution over the next four years. The daily distribution of the tokens is split among applicable pools. However, community governance can decide the treasury token distribution.

Distribution

The token distribution model of QuickSwap is designed to drive growth and user engagement. It includes 3.25% reserved for founders and advisors, 5% distributed to UNI token holders, and 1% to MATIC stakers. Additionally, 0.75% is allocated to targeted marketing campaigns. QuickSwap’s pools received higher rewards in the first year to honor Uniswap and grant its community significant governance powers. QUICK holders can use their tokens to create and vote on proposals governing QuickSwap.

QUICK token uses

The QUICK token has several uses. Here is a brief list of some of the most popular ones.

- Liquidity provision: Users can provide liquidity and earn fees.

- Yield farming: Users can earn dQUICK tokens as rewards for yield farming.

- Governance: Token holders have voting rights.

- IDO participation: Users can participate in initial DEX offerings.

- Crypto exchange trading: QUICK tokens can be traded on various crypto exchanges.

- Staking: Users can stake QUICK tokens for additional rewards via Dragon’s Lair for Old QUICK or Dragon’s Syrup Pools for New QUICK.

Staking QUICK

Users can stake QUICK tokens for additional rewards via Dragon’s Lair. To stake QUICK, click on the “Manage” button and select “Deposit.” If your wallet is already connected to QuickSwap, you can skip this step. Otherwise, you will be prompted to connect a wallet. You can also connect MetaMask, the most popular wallet, and other wallets such as Trust Wallet.

dQUICK

dQUICK, or Dragon’s Quick, is another token utilized on the QuickSwap platform. It is distributed to users who stake their QUICK tokens in the “Dragon’s Lair” pool. This token rewards borrowing and lending on the platform, and the longer QUICK is staked in the Dragon’s Lair pool, the greater the amount of QUICK returned upon unstaking and withdrawal.

A fast and affordable alternative to Uniswap

While Uniswap, one of the prominent decentralized exchanges, has revolutionized token trading on Ethereum, its high transaction fees coupled with congestion have made it impractical for many users, especially beginner traders. On the contrary, QuickSwap offers a fast and efficient alternative. As an open-source protocol, QuickSwap — the Uniswap of layer-2 — also scores well on transparency and accountability.

Frequently asked questions

What is QuickSwap exchange?

How do I use QuickSwap exchange?

Does QuickSwap require KYC?

What are the benefits of using QuickSwap?

What network is QuickSwap?

The information provided in this article is not financial advice and is intended for informational purposes only. Financial investments carry inherent risks, including the potential loss of money.

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.