Litecoin (LTC) prices have stagnated within the narrow $61 to $65 range over the past month. Can the long-term holders’ returning to action drive Litecoin price into a recovery phase?

Over the last two months, Litecoin’s major stakeholders dialed down their trading activity as the perennial LTC “post-halving decline” ran its course again. However, a vital on-chain indicator now suggests LTC could be on the verge of a recovery breakout.

Long-term Investors are Buying Unusually Large Amounts of Litecoin

The Litecoin network executed its 3rd halving event on August 2, 2023. The landmark event saw miners’ block rewards cut from 12.5 LTC to 6.25 LTC.

Litecoin prices have been in a steep decline since the halving, as predicted by a recent Beincrypto report. However, after a 46% price decline in the last three months, this crucial on-chain indicator suggests LTC has reached a turning point.

According to Glassode, Litecoin HODLer’s Net-Inflow metric has uncovered how long-term investors on the network started buying unusually larger amounts of LTC around October 5.

The chart below shows that Litecoin long-term HOLDers’ added at least 400,000 LTC to their cumulative balances in 5 consecutive days between October 13 and October 17.

A closer look at the historical trends shows that the 413,949 LTC added on October 15 is the highest since June 2021.

The Holder’s Net-Inflow metric assesses the daily growth in the quantity of LTC coins held in the wallets of investors who have maintained their unmoved balances for at least one year.

An increase in the HODLer’s Net-Inflows typically implies a growing accumulation trend among long-term investors with confidence in the cryptocurrency.

This could potentially reduce the amounts in the hands of short-term traders. With fewer coins readily available to be traded on exchanges, a significant uptick in demand could rapidly propel LTC prices into the recovery phase.

In affirmation of this stance, the long-term holders’ net inflows surpassed 400,000 LTC on the last three occasions, and prices skyrocketed by at least 25% within the next 30 days.

That bullish scenario has played out in October 2020, June 2021, and February 2022, respectively. If history repeats itself for a fourth consecutive year, LTC investors can anticipate a $76 price territory retest in the coming weeks.

Read More: 9 Best Crypto Demo Accounts For Trading

Short-Term Traders Still Appear Unconvinced of the Recovery Mission

Long-term investors have started buying the dip to position for the next LTC price rally. However, that optimism has not gained traction among Litecoin day traders yet.

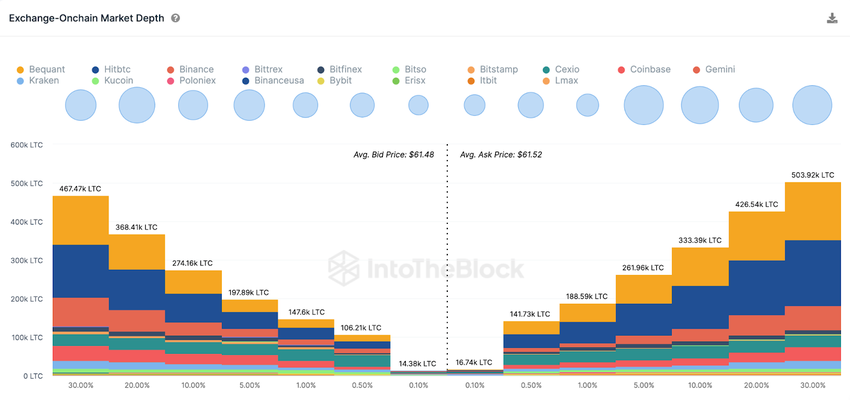

The latest aggregate data from 18 prominent Crypto Exchanges, including Binance and Coinbase, shows that sellers are still dominant. The Aggregregate Order Books chart below shows traders have placed orders to sell 2.2 million LTC coins. Meanwhile, that surpasses the current market demand with only 1.6 million LTC purchase orders active.

The Aggregate Exchange Order Books chart depicts the price distribution of current active buy/sell orders placed across recognized cryptocurrency exchanges.

As seen above, the sell orders for Litecoin far exceed market demand by 800,000 LTC. This suggests that LTC day traders are still unconvinced of an instance price recovery.

In conclusion, the day traders may hold back the Litecoin price recovery in the short term. But if the long-term HODLers continue buying, it’s only a matter of time before the day traders mirror their confidence.

LTC Price Prediction: $76 is the Historical Price Target

From an on-chain perspective, Litecoin price looks set to rebound by at least 25% and reclaim $75 as observed in each of the last three occasions, the HODLer’s daily netflows crossed 400,000 LTC.

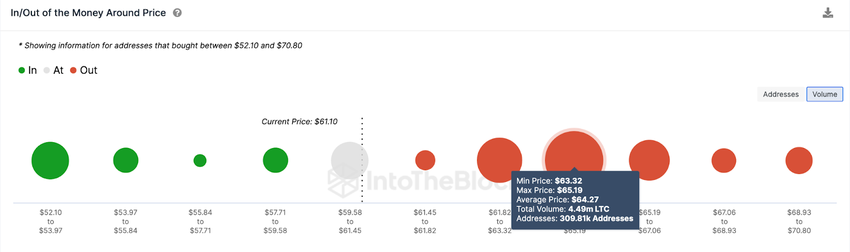

The Global In/Out of the Money data, which groups all current Litecoin holders by their entry price distribution, also confirms this bullish forecast. It shows that the giant sell-wall at $65 is the major obstacle blocking the $75 level.

As depicted below, 309,810 addresses had bought 4.49 million LTC at the maximum price of $65.19. Considering this is the current largest cluster of LTC investors, they could pose strong resistance.

But if the long-term holders keep buying, they could propel the Litecoin price recovery toward $75 for the first time since August.

But on the flip side, the bears could push for a bearish LTC price reversal below $50. However, the bulls could mount an initial buy-wall at $52 in that case. At that zone, 267,000 addresses had bought 179,000 ETH at the minimum price of $52

But if the bears flip that support level, an LTC price decline toward $50 could be on the cards.