Bitcoin (BTC) price has rebounded above the $37,500 mark on Friday as markets recovered from the shock leadership upheaval at Binance. On-chain analysis explores how the BTC price rebound could evolve into a prolonged price rally.

BTC price is back on an upward trajectory, shaking off the initial bearish reaction to the shock ouster of Binance founder Changpeng Zhao. Vital on-chain movements suggest the recent market shake-up could drive Bitcoin’s price to a new 2023 peak.

Investors Have Moved BTC Worth $300 Million From Market Supply

Bitcoin price wobbled to a weekly low of $35,800 as markets surrendered to a wave of fear, uncertainty, and doubt (FUD) in the wake of CZ’s exit on Wednesday. However, the pioneer cryptocurrency has since rebounded 6% to reclaim $37,800 by Thursday.

Away from the sensational media headlines, recent on-chain data trends show that BTC investors have started making strategic bullish moves.CryptoQuant’s exchange reserves charts show that investors shifted 8,606 BTC into long-term storage since the news broke on Wednesday.

The chart below shows the total Bitcoin deposits across crypto exchanges, which stood at 2,039,470 BTC as of November 20. But investors have since moved 8,606 BTC off exchanges, bringing the total market supply down to 2,030,864 BTC.

Exchange reserve is an on-chain metric that tracks the total supply currently deposited in exchange-hosted BTC wallets. Logically, a decline in exchange supply implies a drop in the number of coins readily available to be traded on the markets.

With Bitcoin’s price currently hovering around $37,500, the 8,606 BTC removed from exchanges is worth approximately $322 million. As market demand steadied, this has put upward pressure on Bitcoin price.

Notably, crypto whales and sophisticated high net-worth investors are known to opt for cold storage. Hence, if Blackrock’s recent meeting with the Security and Exchange Commission (SEC) and Grayscale’s new BTC Spot ETF prospectus attract more whales to buy Bitcoin, the exchange supply could drop even further.

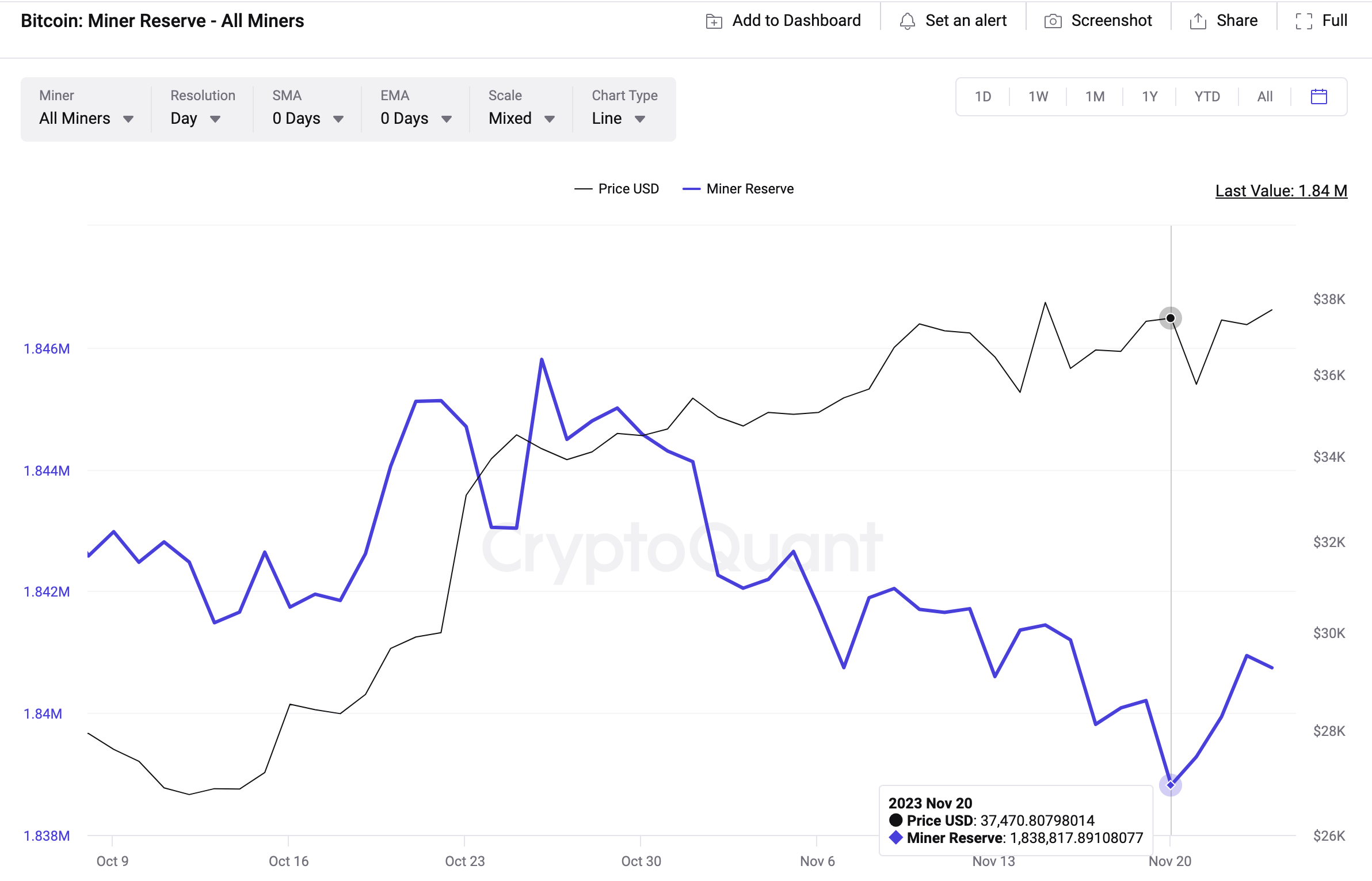

Miners Have Accumulated BTC Worth $72M in the Last 3 Days

Bitcoin miners’ recent bullish disposition is another key factor that has driven BTC price recovery after the turbulence that heralded Changpeng Zhao’s exit. As the BTC price spiraled toward $35,800 on Wednesday, the miners began accumulating their block rewards rather than panic-sell.

According to on-chain data pulled from IntoTheBlock, Bitcoin miners have increased their cumulative reserves by a whopping 1,927 BTC within the last 3 days.

The miner reserves chart below clearly illustrates how the Bitcoin network validators increased their holdings from billion to 1,838,817 BTC to 1,840,744 between November 20 and November 24.

Miners Reserve metric tracks the trading activity and sentiment among the blockchain network’s node validators. Valued at the current Bitcoin price of $37,500, the newly acquired 1,927 million coins are worth $72.3 million.

Strategic investors often interpret it as a bullish signal when miners accumulate block rewards during volatile market conditions. It indicates that the miners are looking to hold out for future gains rather than sell at the current prices. It also allays fears that the current market FUD could impact the fundamentals of the project significantly.

If strategic investors buy into the miners’ bullish disposition, the Bitcoin price rally could accelerate toward $40,000 in the days ahead.

Read More: Best Upcoming Airdrops in 2023

BTC Price Prediction: Can it Finally Reclaim $40,000?

From an on-chain standpoint, the rapid $300 million exchange outflows and miners’ $72.3 million accumulation are major drivers behind the ongoing Bitcoin price recovery. With these indicators still trending bullish, it sets the stage for further BTC upside.

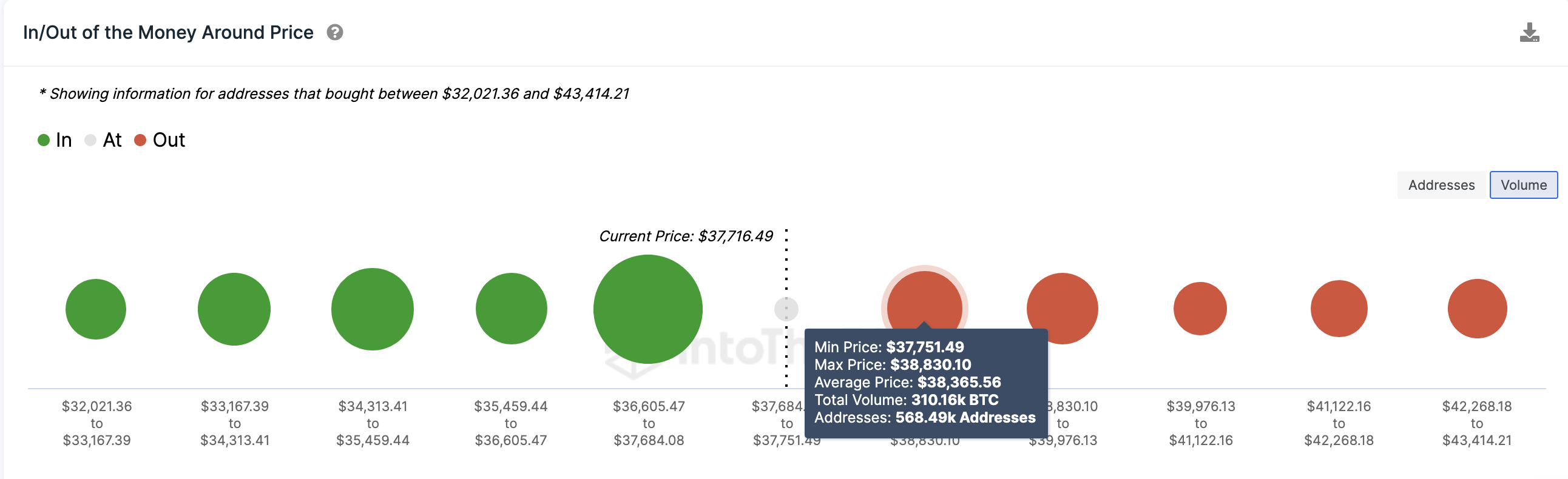

The Global In/Out of the Money (GIOM) data, which groups the current Bitcoin holders according to their entry prices, also confirms this positive price forecast.

However, it shows that the bulls must scale the initial resistance sell-wall around $38,000 to remain in control. As depicted below, 568,490 addresses had bought 310,160 BTC at the average price of $38,300. They could start selling once the Bitcoin price approaches its break-even point.

But if those investors HODL out for more gains, they could trigger a prolonged price rally toward $40,000 as predicted.

Alternatively, the bears could regain market control if another negative event sends the BTC price spiraling below $35,000. But, in that case, the 2.35 million Bitcoin addresses that bought 867,030 BTC at the maximum price of $36,600 could mount a resistance wall. But if those investors show resilience, BTC price will likely avoid a major downswing, as observed earlier this week.

Read More: Best Crypto Sign-Up Bonuses in 2023

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.