The Sandbox (SAND) price appears on the verge of reclaiming the $0.40 territory barely 24 hours after an abrupt shift in market momentum triggered a reversal to $0.36. On-chain data trends and dramatic movements in the derivative markets provide insights into SAND’s likely next price action.

SAND price rebounded 8% on Thursday after dropping to a weekly low of $0.36 after Changpeng Zhao’s exit from Binance. Here’s how the Sandbox traders’ reaction to the market volatility could impact SAND price in the day ahead.

Bullish Traders Covered Their Positions After Massive Liquidations

The leadership shuffle at Binance has triggered intense volatility across the crypto markets this week. Vital derivative market indicators show that bullish Sandbox traders have doubled down on their positions after taking a massive hit on Wednesday.

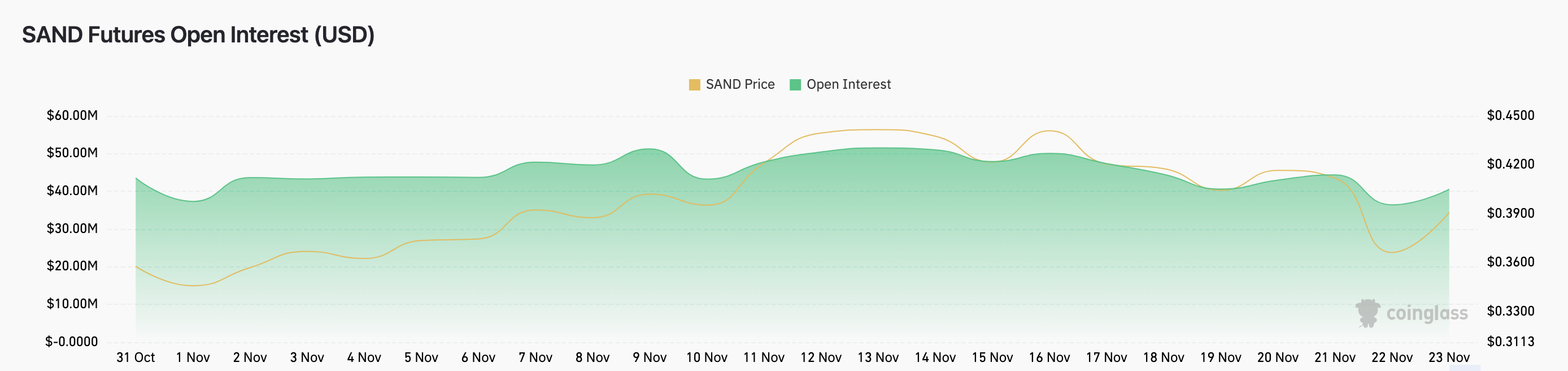

According to derivatives market tracker Coinglass, $8 million worth of SAND futures contracts were closed, amid the market downturn on Wednesday.

However, a closer look at the open interest chart shows that barely 24 hours later, the SAND derivatives market rebounded with $4 million in capital inflows. After dipping to $36.4 million on Wednesday, the SAND futures markets capital stock is now back above $40.4 million at press time on November 23.

Open Interest quantifies the total capital invested in active or outstanding Perpetual futures contracts for a specific cryptocurrency asset. Typically, an increase in open interest after a period of unusually high long liquidations can be bullish in several instances.

Firstly, it indicates that other existing long traders are choosing to double down and cover their positions in expectation of a quick bullish reversal.

An increase in open interest following a sharp price downtrend can indicate a shift in market sentiment. Traders entering new positions may believe that the market has reached a level of support or that the previous selling pressure was overdone, leading to a potential rebound.

The 8% Sandbox price rebound in the last 24 hours lends credence to this thesis. If the open interest rises, the SAND price will likely maintain the current upward trajectory.

Read more: Top 10 Metaverse Platforms To Watch Out for in 2023

The Sandbox Top Holders Have Swooped In to Avert Major Losses

As the Sandbox price slid to $0.36 on Wednesday, the largest investors within the ecosystem swooped to buy the dip. And barely 24 hours later, that seems to have played a vital role in defending the vital $0.35 support level.

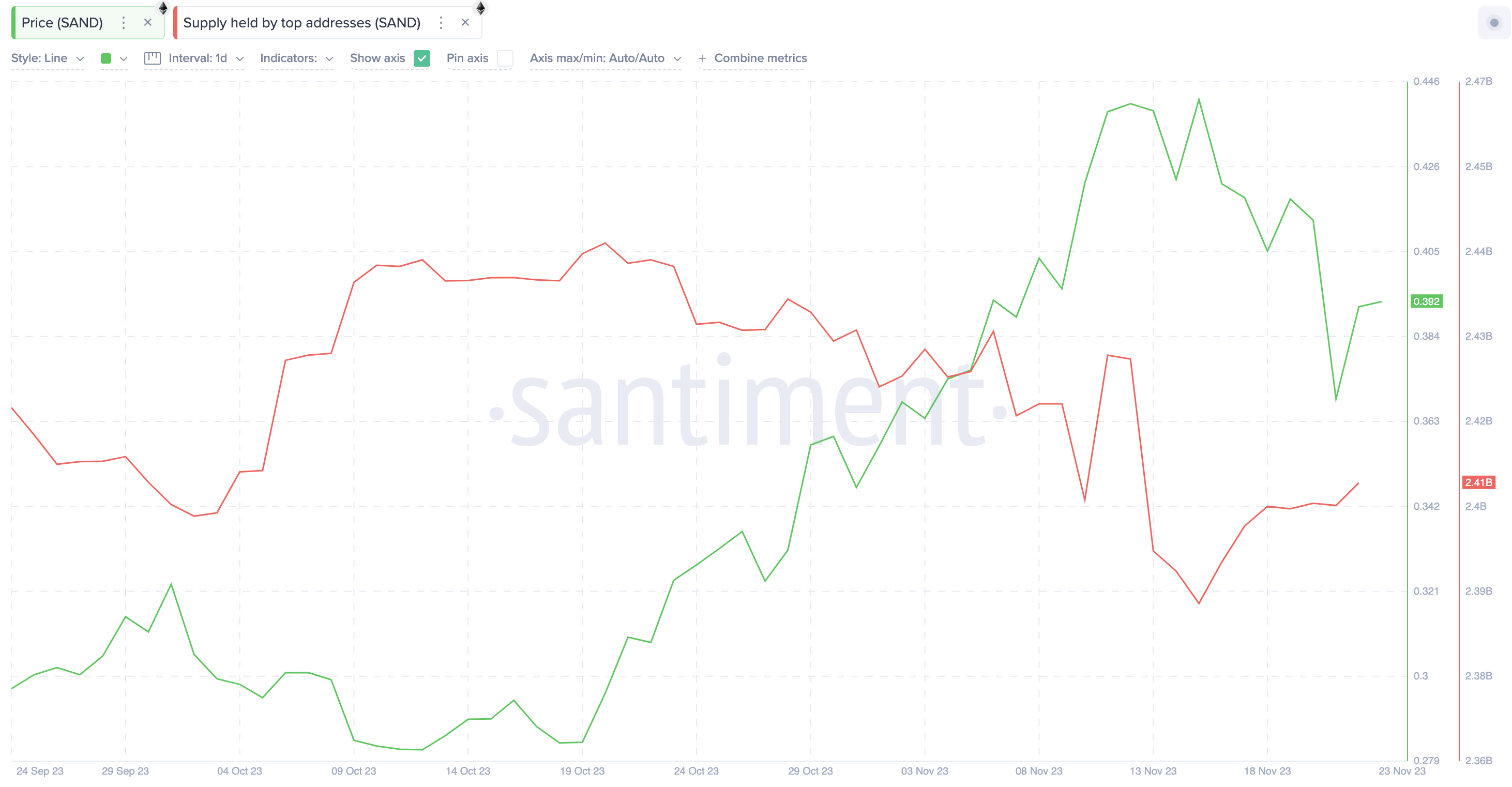

According to on-chain data pulled from Santiment, the top 20 investors in the Sandbox’s metaverse ecosystem accelerated the buying trend around November 15, just as the price began to decline.

Between November 15 and November 20, they increased their holdings from 2.39 billion to 2.40 billion SAND. And since the crypto markets tumbled on November 21, they have added another 10 million SAND to their balances.

Valued at the current SAND price of $0.36, the whale has invested approximately $4 million in the last 48 hours. Effectively powering the early rebound.

The supply held by top addresses metric tracks the trading activity and sentiment among the largest investors within a cryptocurrency ecosystem. Generally, an increase in top holders’ balances during a price downtrend is a bullish signal. Chiefly, the liquidity provided by the Sandbox whales’ $4 million inflows has enabled panic sellers to execute their exit trades without causing a significant price dip.

More importantly, it indicates the biggest investors remain confident that the price dip was not driven by a significant deterioration in the project’s fundamentals. If strategic retail investors pick up on this positive outlook, SAND price could enter a bullish trajectory in the days ahead.

Read More: Best Upcoming Airdrops in 2023

SAND Price Prediction: Breaking $0.50 Could Amplify the Rally

From an on-chain standpoint, the rising whale demand and increased capital inflows in the Sandbox derivatives markets are key factors driving the ongoing SAND price recovery. With these indicators still on the uptrend, it puts The Sandbox price in good stead for a prolonged rally.

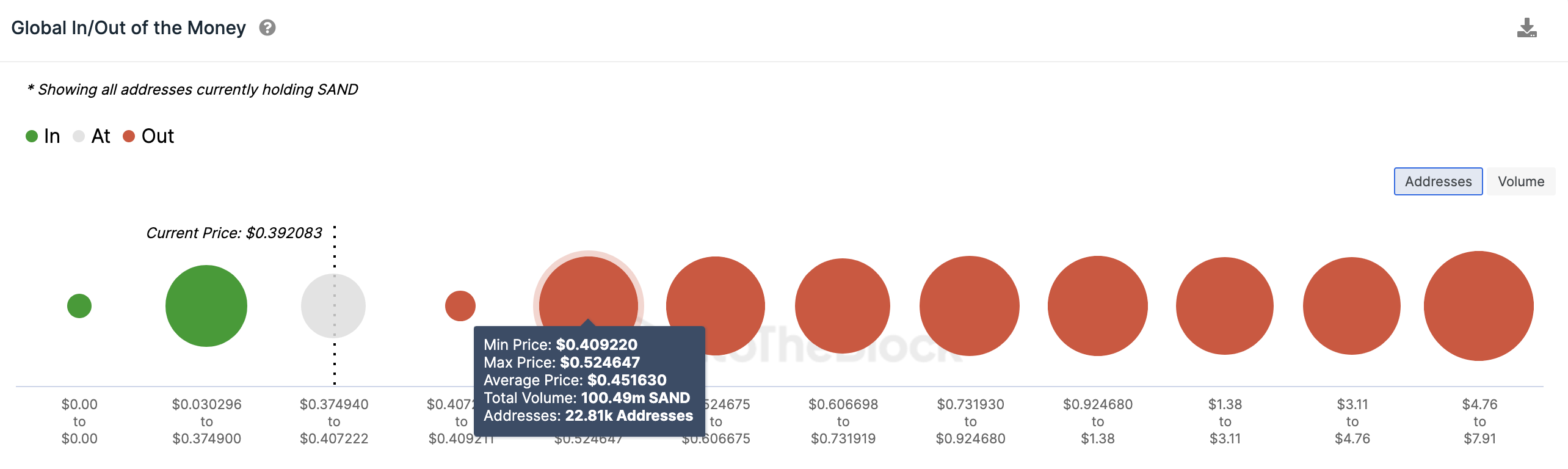

The Global In/Out of the Money (GIOM) data, which groups the current Sandbox investors according to their entry prices. This also confirms this bullish price forecast.

It, however, shows that the bulls must scale initial resistance at $0.45 to be confident of a potential parabolic breakout.

As shown below, 22,810 addresses bought 100.5 million SAND at an average price of $0.45. If those investors exit early, they could inadvertently cause a SAND price correction.

But if the bulls can scale that sell-wall, The Sandbox’s native token price will likely reclaim $0.50 as predicted and possibly head toward $1.

Conversely, the bears could negate that positive prediction if the SAND price tumbles below $0.35. But, in that case, the 13,330 addresses that bought 953.2 million SAND at the maximum price of $0.37. These investors could offer initial support. And if those investors cover their positions as observed this week, the SAND price will likely avoid a major downswing

Read More: Best Crypto Sign-Up Bonuses in 2023

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.