Yield farms on the Ethereum network provide DeFi solutions and passive income opportunities for users across various experience levels. This overview will focus on the top yield farms of Ethereum in 2026, addressing essential questions and key terminology to enhance your understanding of the DeFi sector. Here’s what you need to know.

KEY TAKEAWAYS

➤ Yield farming allows users to lock up their crypto, providing liquidity to a DeFi platform in exchange for token rewards.

➤ Some of the top yield farms on the Ethereum network include Aave, Uniswap, and Sushiswap.

➤Users interested in yield farming must be aware of the risks, which include but are not limited to impermanent loss, volatile prices, fluctuating rates, scams, and smart contract flaws.

Top 5 yield farms on Ethereum

Here’s a quick list of some of the top yield farms on Ethereum in 2026.

1. Aave

Aave is a non-custodial liquidity protocol that specializes in the lending and borrowing of assets. On Aave, users can deposit their assets as collateral and “borrow” against them or “lend” them via deposits to Aave and generate yields.

Aave allows users to borrow and lend close to 20 leading cryptocurrencies. Borrowers on Aave can alternate between fixed and variable interest rates. Aave is heavily used by yield farmers, with a Total Value Locked (TVL) of $13.77B as of Jan 10, 2025.

While the price of AAVE, the platform’s native governance token, has not yet surpassed it’s 2021 all-time-high of $661.69, the token has made a solid recovery from 2022 and 2023 lows, sitting at $298.20 in mid-January 2025.

2. Uniswap

Uniswap is the leading decentralized exchange (DEX) on the Ethereum network. Uniswap is primarily used for trading and swapping various assets using an automated market marker (AMM). The platform maintains full decentralization using algorithmic equations to balance liquidity and stabilize trading.

Investors can supply their assets to the vast liquidity pool and earn rewards and yields. Due to the large volume and assets secured on Uniswap, the yields generated are ample.

“Uniswap is by far the most libertarian thing developed after BTC. It doesn’t fight nation states, it has a unicorn logo and its pink. You wouldn’t associate it with money laundering, yet it is perfectly capable of doing that. It’s the symbol of the DeFi revolution.”

@tanselkaya: X

3. SushiSwap

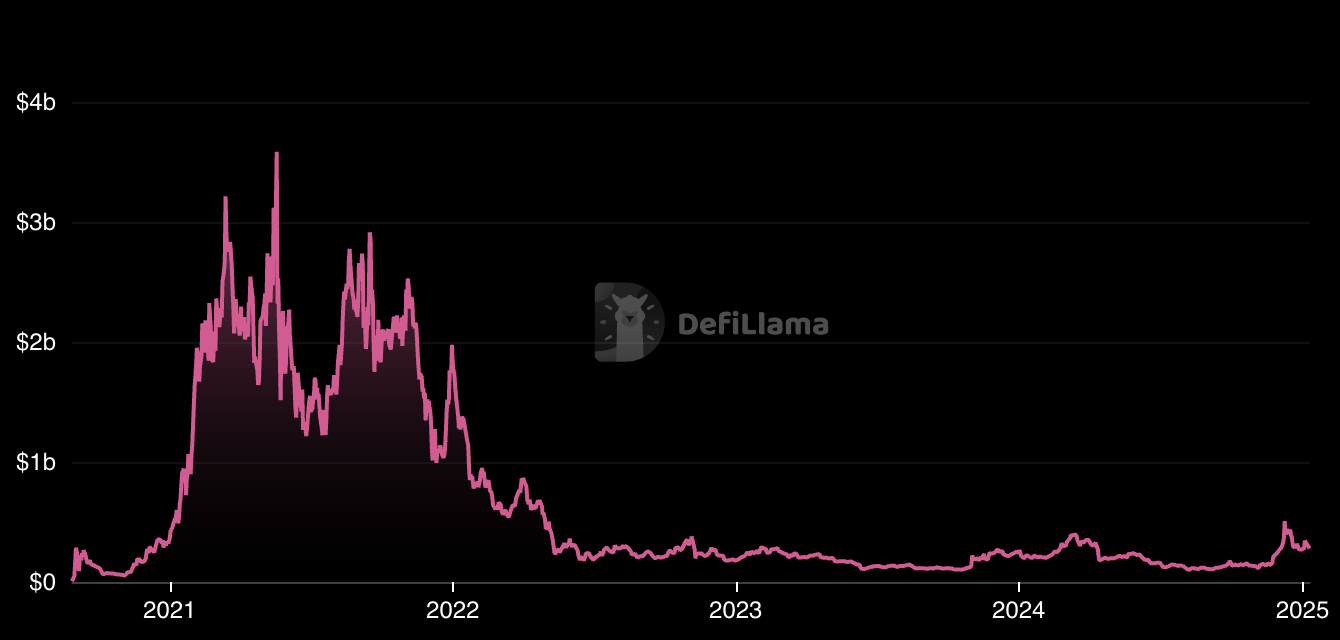

SushiSwap is known primarily for its DEX but has expanded its range of DApps to lending, staking, and yield farming solutions. Originally a fork of Uniswap, the platform offers trading and liquidity pool options on over 1000 pairs. Note that while the DEX’s TVL reached almost $4 billion during 2021’s “DeFi Summer,” it sits just over $188 million as of Jan 10, 2025.

Through the SushiBar, users can stake their SUSHI tokens in return for xSUSHI, which can be used to interact with other Ethereum-based protocols. The DEX also supports BentoBox, a lending and borrowing platform that provides competitive yields on popular assets and stablecoin pairings.

4. Curve

Curve Finance is another popular DEX and AMM solution, specifically designed for users to swap stablecoins with low fees and minimal slippage.

In a similar vein to Uniswap, Curve requires more advanced knowledge to maximize returns for yield farming. However, it offers the most competitive yield returns on stablecoins and leading assets such as BTC and ETH.

The platform offers multiple liquidity pools, which constantly change based on market demand. Curve incentivizes participation in its liquidity pools through integrations with external DeFi protocols and the available liquidity on their respective platforms.

Rewards on Curve are delivered through the platform’s native token, CRV, alongside fees and interest from trades made on the platform.

5. Yearn.finance

Our final mention in this list of top yield farms is yearn.finance, a DeFi aggregator that uses automation to maximize profits for investors from yield farming.

Yearn.finance uses various products and tools that act as an aggregator for DeFi protocols such as Curve, Compound, and Aave, bringing those who stake cryptocurrency the highest possible yield.

Yearn’s target market is investors who lack experience in the space and those who wish to maximize their returns. The platform offers two key solutions: Earn, which identifies the highest interest rates users can earn lending an asset, and Vaults, a collection of investment strategies designed to generate the highest returns from other DeFi projects.

Through Vaults, DeFi users have easy access to a range of high-earning pools that offer rewards and yields in the pool’s denominated asset.

As of Jan. 10, 2025, there’s over $212 million in TVL secured on the platform.

Some notable further mentions include Bancor, a DEX and AMM that provides high yields and returns on leading assets, and Maker, a protocol that uses deposited collateral to mint DAI, a highly popular and widely-used stablecoin.

What is yield farming?

Yield farming is a way to generate rewards and earn yields on your cryptocurrency assets by securing them on a DeFi platform. Users deposit assets in liquidity pools or stake them in smart contracts on most platforms. This provides platform liquidity, generating rewards and yield in the platform’s native token.

Popular yield farms often use the automated market makers (AMM) model. This allows for automatic, permissionless asset trading using liquidity pools, bypassing the traditional buyer-seller market.

Yield farming terminology

If you’re just starting out with yield farming, there are a number of basic related terms you should be aware of. Here’s a quick run through of some of the basic associated terminology.

- Total Value Locked (TVL): The TVL on a DeFi platform is the number of collective assets that are locked in on the platform via smart contracts. It’s also a reliable indicator of the overall health of the yield farm. The higher the TVL, the better the platform.

- Smart contracts: These are programs that operate on the Ethereum network that can execute automatically when certain conditions are met. Smart contracts enable DeFi developers to build more advanced products and solutions.

- Decentralized apps (DApps): A product that is built with and functions using decentralized technology.

- Decentralized exchanges (DEX): Online exchanges that enable users to trade cryptocurrencies directly without having to trust any intermediaries (Example: Uniswap).

- Stablecoin: A cryptocurrency pegged to the price of an outside asset (most commonly the U.S. dollar) to reduce fluctuations in price.

- Liquidity pool: A smart contract that contains the collective TVL and funds secured on a platform. Those who contribute to liquidity pools are often referred to as LPs.

How much can I earn using a yield farm?

The rewards you can earn vary. Most popular platforms offer anywhere between 10-50% yield on major assets such as Ethereum and other leading altcoins.

Other platforms offer higher yield rewards when using a platform’s native token or more speculative assets. With the top yield farms on Ethereum, rewards can fluctuate based on price action and liquidity, so it’s worth ensuring the yield percentages offered are stable.

Yield farming rewards are calculated annually, meaning they’re displayed as the returns that you could expect over a year. The most commonly used metrics are Annual Percentage Rate (APR) and Annual Percentage Yield (APY). APY takes into account the compounding of your assets whilst APR doesn’t.

Stay safe when yield farming on Ethereum

As the DeFi space matures, new yield farming options will naturally arise as investors look to put their assets to good use and maximize their returns. However, it’s important to note while yield farming can be profitable, it is also a risky investment strategy.

In particular, cryptocurrency prices are highly volatile. This can impact the value of any rewards as well as the assets you’ve deposited. So, if the token you are generating rewards with drops in value, you could lose all of your profit. Other risks include impermanent loss and bugs in smart contracts. Always conduct thorough research and never invest more than you can afford to lose.

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Always DYOR.