Curve Finance is a well-known decentralized exchange (DEX). Unlike competitors such as Uniswap, Curve’s protocol does not embrace the instability inherent in most cryptocurrencies. Instead, it focuses its agenda on stablecoin swaps. In this guide to Curve and CRV, we set out everything you need to know about this DeFi protocol in 2026.

KEY TAKEAWAYS

► Curve Finance focuses on minimizing slippage and fees, specializing in stablecoin swaps through its automated market maker (AMM) model.

► The Curve DAO governs protocol changes, with CRV token holders controlling governance and the distribution of rewards for liquidity providers.

► Convex Finance plays a critical role in maintaining Curve’s governance integrity by consolidating governance power.

► Curve’s long-term vision is to act as a bridge for stablecoin liquidity in the DeFi ecosystem for applications and users.

What is Curve?

Curve is a prominent decentralized finance (DeFi) protocol. It was built on the Ethereum blockchain but has since expanded to EVM-compatible chains (e.g., Arbitrum, Base, Optimism, etc.). The platform allows trading through the use of liquidity pools.

Essentially, users deposit crypto assets to pools used for liquidity, and receive rewards in return. These are paid by the fees charged when users swap cryptos.

Curve is similar to protocols like Balancer or Uniswap. It allows cryptocurrency users to earn fees from their assets while letting traders exchange those assets.

Curve differentiates itself with a focus on assets that have direct parity with national currencies. The DEX is a favorite of stablecoin traders as well as liquidity providers who want to minimize slippage and minimize losses.

Slippage is the difference between the expected price for a single trade and what the trade will be executed at. It is a common source of losses on various exchanges. Low slippage means more bang for your buck.

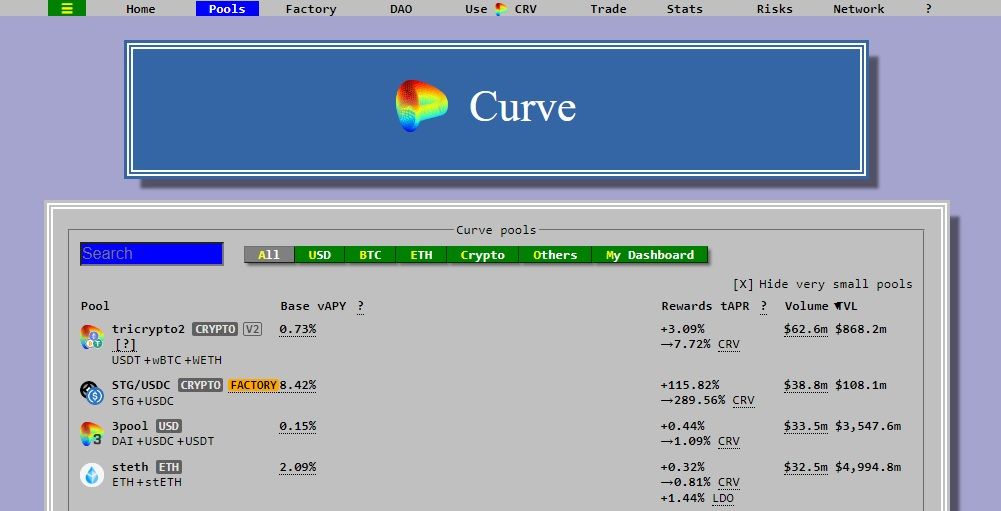

Curve’s available assets

Curve focuses on stablecoins, such as DAI, USDT, USDC, FRAX, PYUSD, and dozens more. These track U.S. dollar prices. It also caters to wrapped tokens such as WETH.

Curve’s aims to minimize fees and price variation in stablecoin trading. Users can also trade ETH, LINK, and a few tokenized BTC assets such as wBTC or renBTC.

Who founded Curve?

Russian physicist Michael Egorov introduced the Curve whitepaper in November 2019. The project was officially launched at the beginning of 2020.

Egorov has been involved with DeFi protocols since 2018. He graduated from the Moscow Institute of Physics and Technology before earning a Ph.D. in Physics at the Swinburne University of Technology. He also co-founded the companies NuCypher and LoanCoin.

The Curve AMM model

Curve is an automated market maker (AMM) protocol. It makes use of market-making formulas alongside liquidity pools.

A liquidity pool is a space that is under the control of a smart contract. Through this, large amounts of crypto-assets are accumulated and injected by liquidity providers (LP). This liquidity is used to facilitate swaps using the assets.

The protocol is characterized by minimum price slippage and a “savings” account for liquidity providers. All of these are managed by smart contracts that function on the Ethereum network.

The protocol provides a means of exchange that acts as a bridge between decentralized stablecoins (DAI, for example) and centralized stablecoins (such as USDT).

As one example, this bridge created between stablecoins is meant to help when the stability fee offered by a stablecoin protocol increases. For example, if DAI becomes expensive or its supply tightens due to a high stability fee, users might want to convert their DAI into another stablecoin like USDT or USDC.

In such cases, users are unable to convert from one coin to another because of the large fees on Ethereum. Curve looks to allow its users to take advantage of the best available options on the market at the time.

Curve’s hybrid formula model

This formula is a similar principle to that used by Uniswap uses. Where Uniswap uses the constant product formula, Curve uses constant product and constant sum formulas.

Curve uses the constant sum formula in stablecoin pools or pools where assets are expected to maintain a near 1:1 peg (e.g., wBTC and renBTC, or WETH and stETH). For example, if a pool offers DAI/USDT swaps, and parity exists between its tokens (1000 DAI and 1000 USDT), then the exchange ratio is 1:1, and each asset will trade for about $1.

However, if that ratio changes (e.g., 800 DAI or 1200 USDT), the constant sum formula still allows each asset to trade for about $1. While Curve primarily relies on the constant sum formula for stablecoin pools, it also uses a hybrid bonding curve.

As trades become larger and deviate more from the initial balance in the pool, Curve gradually shifts toward the constant product formula. This maintains liquidity and price stability for larger trades or when the price deviates.

Curve DAO explained

Curve’s DAO (decentralized autonomous organization) is used to manage protocol changes.

Curve rewards the participation of users with crypto rewards and access to other DeFi protocols. Governance tokens give token holders voting rights and control most DAOs. The CRV token controls Curve’s DAO.

The DAO is responsible for the functioning of the entire Curve ecosystem. This means that any administrative actions, regardless of importance, can only be implemented once a successful DAO vote is in place.

Anybody can propose an update for the Curve protocol, and they must have at least one CRV vote-locked. These changes can pertain to fees and how they are used. Other aspects covered by the vote include the creation of new liquidity pools or adjusting yield farming rewards. By locking up CRV tokens, holders can vote to accept or reject a proposal.

Earning rewards with Curve

When you deposit assets into a liquidity pool, you receive tokens as an incentive. For example, you can earn the CRV token by providing DAI to Curve liquidity pools. This is in addition to interest and fees.

Curve CRV crypto tokens are the native currency of the Curve ecosystem. You can purchase CRV directly from a crypto exchange, or earn the Curve CRV crypto token by yield farming.

Yield farming the token increases incentive for a regular crypto user to become a Curve liquidity provider. You not only receive a financial asset, but also own a stake in a strong DeFi protocol.

Convex Finance

Convex Finance simplifies the process of earning rewards through Curve’s liquidity pools, while also consolidating governance power within the ecosystem.

Liquidity providers receive CRV tokens as rewards in Curve. They can stake, lock, or use CRV to vote in Curve’s governance. In Curve’s native system, CRV token holders can lock their CRV for up to four years in exchange for veCRV.

Users can deposit their Curve LP (liquidity provider) tokens or CRV tokens directly into Convex. By doing this, users earn boosted CRV rewards and CVX (Convex’s native token) without having to personally lock their CRV tokens for years.

Example

Imagine a scenario where a new DEX is offering boosted rewards to attract users and liquidity providers (LP). In essence, LPs will deposit their crypto into a liquidity pool and receive a boosted return or yield. However, the DEX offers boosted rewards for Curve tokens (CRV and veCRV) as well.

Now, users are taking their Curve tokens to the new DEX to earn higher rewards than they would have earned on Curve. Since Curve token holders can participate in governance, this means that the new DEX can participate in governance on Curve. This would allow the DEX to create new liquidity pools and change the amount of rewards that LPs can earn in liquidity pools.

Why is this bad? The DEX would theoretically act in its own best interest. It could create a token with no value or utility, create a pool for it on Curve, offer a boosted reward for that pool (paid in CRV), and potentially steal or siphon the CRV from Curve for little to no cost.

Convex fixes this by incentivizing users to deposit Curve tokens on its own platform. This means that Convex users can receive boosted rewards from CVX instead, aligning the incentives of Convex and Curve, reinforcing protocol-owned liquidity, and consolidating governance power.

The Curve (CRV) token and its role

The CRV token is at the heart of the Curve platform. It has several uses, as we shall see below.

How the CRV crypto token fits into Curve

CRV is the native token of Curve and operates on the Ethereum blockchain network. The DEX uses CRV throughout most processes across the platform. Curve uses an AMM model to allow its users to trade stablecoins. The coin can be purchased or can be earned as a reward or bonus when you add liquidity to the platform’s liquidity pools.

The Curve platform released its native token in 2020, shortly after the protocol was launched. The token facilitates all the activities on the platform.

The distribution of the Curve CRV token

Initially, the token was offered as a reward to early adopters (5%). Users who had locked coins on the platform received approximately 60% of the CRV tokens. The Curve team and investors received 30% of the entire quantity. The rest was reserved for project employees and as a reserve for community projects.

Initially, about 2 million CRV tokens were released each day. This means that 750 million coins were issued annually. These tokens can be used to vote for proposals that will affect the rules that govern the Curve ecosystem.

The utility of the Curve CRV crypto token

CRV is meant to incentivize and encourage liquidity. CRV is a governance token. It features value accrual and time-weighted voting mechanisms.

Curve platform liquidity providers receive the $CRV token as a reward for providing liquidity on select pools. This allows the protocol to incentivize certain token pairs. Vote locking boost is a key incentive for holding CRV. Through this, the liquidity providers can increase their daily CRV rewards.

To learn about CRV’s potential price performance, check out BeInCrypto’s Curve price prediction.

What does Curve’s future hold?

Curve aims to be a bridge for liquidity in the DeFi ecosystem. With more crypto adopters joining the ecosystem every day, it is safe to say that a desire for stability within decentralized financial systems is going to grow. Curve offers rewards directly, as well as the opportunity of shaping the mechanism’s progress. Considering all of these elements it is safe to assume that Curve has some staying power.

Disclaimer: This article is for informational purposes only and should not be considered investment advice.