In a very short space of time, decentralized finance has revolutionized the crypto industry and brought about the beginnings of a truly reformed financial landscape. The ability to lend and borrow without the intervention of a profit-seeking bank, or credit company, through the use of decentralized finance (DeFi) loans puts the power back into the hands of the people where it should be.

DeFi is only a couple of years old, but it is one of the fastest-growing applications for digital currencies and it has the power to reshape the way we think about money.

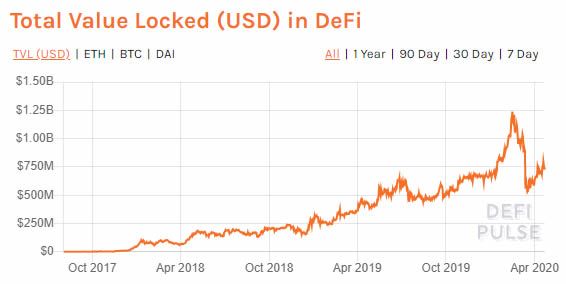

If 2017 and 2018 were the years for Initial Coin Offerings, then 2019 was the year for DeFi. The fledgeling industry grew over 400% from small beginnings to over a billion dollars in total value lockup in just over a year.

The COVID-19 outbreak in early 2020 put the brakes on the embryonic ecosystem as digital asset prices crashed and assets were liquidated, but its future is still very bright.

This article will delve deeper into DeFi and explain how to earn interest or take out a loan and list the current popular platforms and decentralized exchanges.

In this guide:

What is Crypto DeFi?

Decentralized finance can be defined as an ecosystem that enables people to lend or borrow digital assets via secure smart contracts. It is currently dominated by Ethereum, which is the world’s standard smart contract and dapp (decentralized application) platform.

Digital currencies, such as Ether, can be put up as collateral to take out a decentralized loan, which can then be converted into stablecoins or fiat. Those wanting to earn interest can also use their crypto holdings as collateral. Interest rates vary depending on the demand to borrow a particular asset, up until recently double figures were easily achievable.

DeFi is the first step to becoming ‘unbanked’ as there is no intermediary taking commissions, currency exchange spreads, or controlling the finance flow. The only fees payable are network costs such as gas, and anyone anywhere can participate.

The advantages of decentralized loans over the traditional banking system are numerous and include:

DeFi Loan Advantages

- No bank fees, commissions, or charges

- Borderless – anyone anywhere in the world can participate

- Greater earning potential – interest rates much higher than banks

- Anonymous – no intrusive KYC procedures or proof of income

- Transparent, automated arbitration – smart contract governance

- Secure, immutable and permissionless

- Available to those with no/low credit ratings or low income

- Immune to censorship, shutdown or state manipulation

- Open to all – no need for a physical address or bank account

It should be noted though that there are some downsides with decentralized finance and they include:

DeFi Loan Disadvantages

- Technical knowledge – users must be familiar with crypto transfers and wallets

- Over collateralization – some platforms require more crypto collateral than can be borrowed

- Risk tolerance – crypto assets are still highly volatile so risk tolerance is a necessity

- Variable issuance and stability – fees are constantly changing, as are interest rates

Comparison to Traditional Loans

Traditional borrowing is at an all-time high, and loans can be broken down into three major categories;

- Secured loans – backed by collateral such as property

- Unsecured loans – approved usually based on income with no collateral

- Credit lines – specified amounts of credit for specified time periods

Banks and loan providers will require a lot of paperwork before issuing a loan which may include government identification (passport, driving license, ID card), proof of address (utility bills), proof of income (bank statements), proof of employment (letter from work), social security details, and credit score.

There may also be several restrictions including age, geographical location, profession, and minimum income threshold. Interest payable on such loans can range from 5 to 20% and sometimes even higher depending on the circumstances.

According to Federal Reserve Economic Research, the total of consumer loans and credit cards with commercial banks in the US is over $800 billion. Defipulse reports that, at the time of writing, the total value in USD locked in DeFi is just $740 million.

Crypto Borrowing and Lending

There are a number of different DeFi platforms that offer decentralized loans, and more are emerging every week. Leading applications allow users to take out a loan without revealing reams of personal identification documents to third parties.

Specific DeFi platforms are covered later in this article, but first is a step by step guide to taking out a DeFi loan in the world of cryptocurrency lending.

- Buy Ethereum on the crypto exchange of your choice

- Transfer the ETH to your personal Ethereum wallet (Metamask is popular)

- Visit a decentralized marketplace (DEX) to get the latest rates

- Connect your ETH wallet to the DEX or DeFi platform

- Convert the ETH into your choice of currency (DAI is popular)

- Use the DAI to earn interest or borrow other currencies

This is the basic premise of decentralized loans, it will vary of course with the platforms of choice and crypto assets used to lend and borrow. The Ethereum is essentially ‘locked up’ with a smart contract as collateral while the dollar-pegged stablecoin DAI can now be used to:

- Earn interest by lending the assets via third-party platforms

- Purchase additional assets as an extended form of margin trading

- Sell DAI into USD to pay for personal expenses

Salt Lending

Another form of DeFi is SALT which stands for Secured Automated Lending Technology. It works on the same principles as DeFi but members need to join the platform in order to contribute, take out decentralized loans or provide crypto as collateral and earn.

Furthermore, users buy a membership to the Salt Lending platform by purchasing its native crypto token, Salt. Members can then borrow funds from an extensive network of lenders that have put up Bitcoin, Ethereum, XRP or other crypto assets as collateral. However, substantial over-collateralization is needed to borrow large loans in fiat and there are associated interest rates to pay, just as traditional loans have.

DeFi Loan Terminology

There is certain terminology that will need to be familiarized with to understand how DeFi works; here are a few of the most common terms.

Stability Fee – applicable to DAI and payable on closure of loan in MKR.

Liquidation Price – price at which the loan will be liquidated, or ‘margin called’.

Liquidation Penalty – mandatory fee that is paid if the loan is force liquidated.

Collateralization Ratio – an indicator to see how leveraged the crypto wallet is.

Minimum Ratio – ratio at which loans will be force liquidated.

Collateralized Debt Protocol/Position – system governed by smart contracts enabling users to mint stablecoins in exchange for crypto assets held in escrow (current standard is MakerDAO and DAI).

Limit Order – a type of order to buy or sell an asset at the best available rate above or below a specified price (may not execute instantly).

Market Order – a type of order to buy or sell an asset at the best rate currently available (usually instant execution).

MakerDAO and DAI in Brief

Maker is currently the industry’s leading decentralized lending platform with over 50% market dominance according to Defipulse.com. The DAO stands for decentralized autonomous organization and Binance Research defines one as:

“An organizational form that coordinates the efforts and resources of members via an a priori binding, formalized, and transparent set of rules that are agreed upon in a multilateral fashion.”

Maker also creates DAI, a dollar-pegged stablecoin backed by crypto collateral and one of the foundations of the DeFi market.

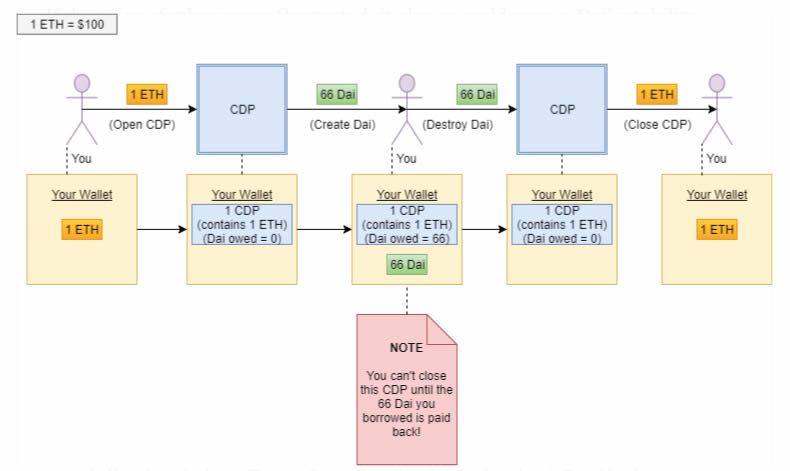

The ecosystem is based on smart contracts that govern the stability of DAI. The core contract is called a collateralized debt position (CDP) which uses Ether deposits to issue DAI which can then be used for DeFi loans.

Once Ether is in the CDP smart contract, DAI creation can be carried out. The amount of DAI created is relative to how much Ether has been put into the CDP. The collateralization ratio is fixed but it can change over time. The following diagram simplifies the process for borrowing DAI [source].

Finally, if the price of Ethereum drops significantly, Maker tackles this by liquidating CDPs and auctioning off the ETH inside before the value of it is less than the amount of DAI it is backing. This happened on a large scale in March 2020 when the COVID-19 outbreak caused crypto markets to crash.

What is a DEX?

A DEX is a decentralized exchange and the foundation of most DeFi transactions. Unlike popular cryptocurrency exchanges, such as Binance or Coinbase, which are completely centralized and controlled by a CEO and company, a DEX is an autonomous platform with no central authority. They are the future of crypto trading and truly decentralized finance.

Centralized exchanges (CEX) operate on a profit basis and need to charge fees, spreads, and commissions to make money for their bosses, staff, and shareholders. Conversely, a DEX will run autonomously on network fees alone.

The number of decentralized exchanges is growing all of the time and there are too many to list here. Some of the most popular ones in the industry at the time of writing are:

- 0x – permissionless protocol that allows developers to build their own DEXs for trading tokens.

- Kyber Network – on-chain protocol that aggregates liquidity from a wide range of reserves.

- IDEX – decentralized Ethereum asset exchange focused only on ERC-20 tokens.

- Decred – protocol using atomic swaps supporting UTXO-based assets.

- Oasis – interfaces directly with Ethereum wallets for transfer to and from various DeFi assets and tokens.

- Shapeshift – a popular app offering private peer-to-peer crypto exchanges.

- Uniswap – automated Ethereum token exchange platform.

Dex.ag is a good resource for comparing token conversion rates on multiple decentralized exchanges for specific DeFi purposes. However, many people use decentralized exchanges for general trading..

Popular DeFi Platforms

Popular DeFi Platforms

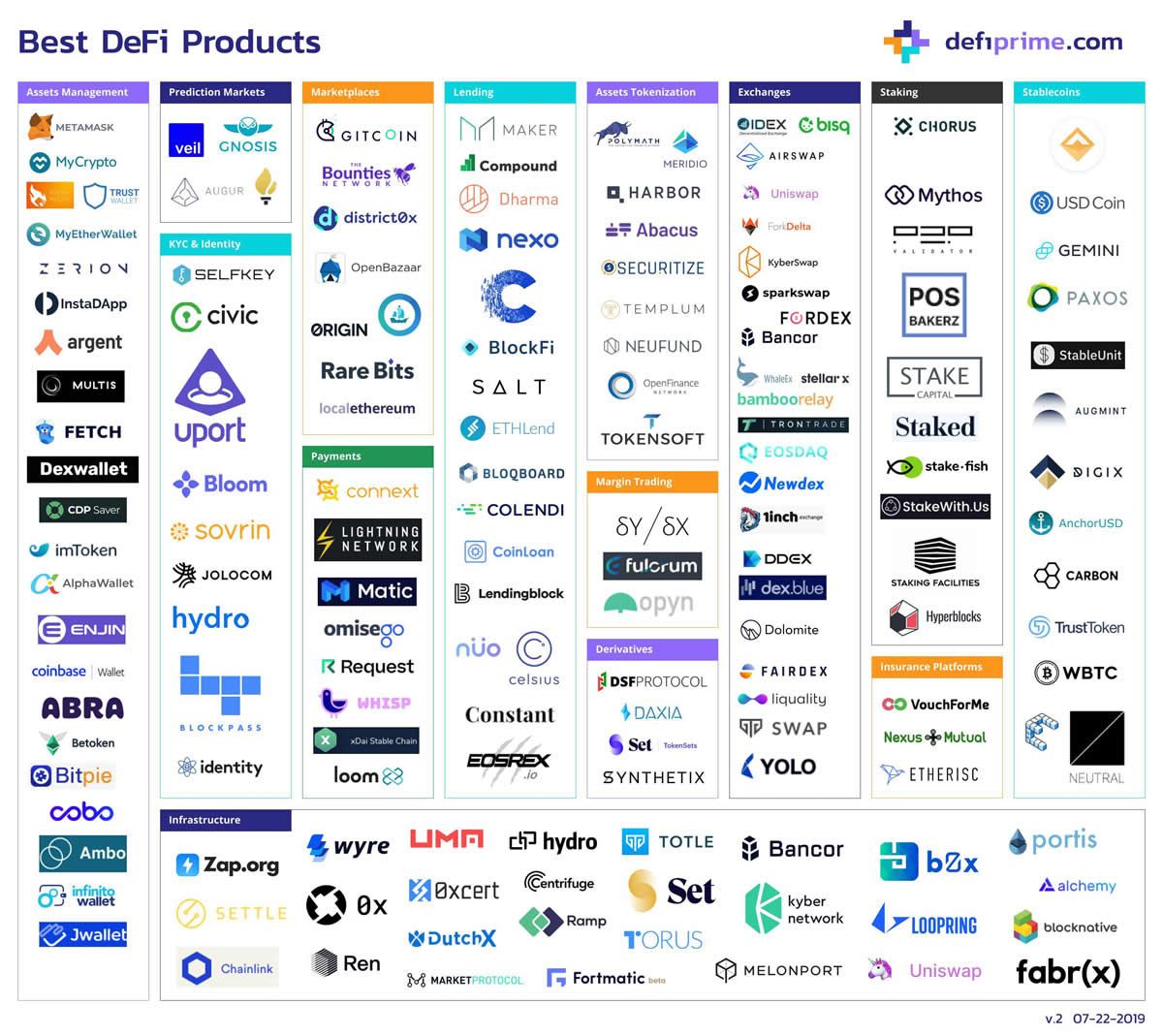

Just as the number of decentralized exchanges is ever-increasing, so is the number of decentralized finance platforms. A smart contract-based lending and borrowing platform is more geared up for DeFi, while users can only use a DEX for token trading and swapping..

Currently, some of the most popular ones include:

- Maker – decentralized credit platform supporting DAI stablecoin

- Compound – open-source Ethereum-based protocol allowing users to lend or borrow assets against collateral

- BlockFi – crypto earning platform for investors using Gemini exchange

- Aave – non-custodial protocol for users to earn interest on deposits and borrow assets

- Atomic Loans – lending platform accepting trustless Bitcoin collateral

- dYdX – a trading platform on Ethereum geared toward experienced traders

- bZx – decentralized protocol enabling crypto lending and borrowing for margin trading

- Fulcrum – a platform for tokenized margin lending and trading

- Salt – lending and borrowing platform allowing members to leverage their crypto assets to secure loans

- Synthetix – Ethereum-based platform for the creation of on-chain synthetic assets that track the value of real-world assets

There are too many DeFi platforms to list here and the number is still growing as the industry matures.

DeFi Resources

There are a number of analytics and metrics providers that closely follow the industry. These resources can offer a quick glance into the state of the ecosystem, the best platforms, and the most favorable interest rates for crypto lending and borrowing.

- Defipulse – DeFi market tracker and analytics provider

- Defiprime – DeFi projects, blogs, and analytical services

- Defirate – summary of the latest interest rates offered by different platforms

- Loanscan – DeFi loan metrics and interest rates

- 0xtracker – trade explorer for the 0x protocol and ERC-20 tokens

There are also a number of free and paid newsletters from DeFi professionals such as:

- Bankless – crypto finance guide written by Ryan Sean Adams

- The Defiant – DeFi news and updates penned by Camila Russo

- DeFi Tutorials – Guides to the latest platforms and making the most out of DeFi

Decentralized finance is still in its infancy; barely a couple of years old but it has come a long way in that short time.

The crypto scene, in general, has also moved on from ICOs, pump and dump schemes, and celebrity shitcoin shills and is starting to mature. Improved regulatory clarification, a more diverse range of products, more fiat onramps, an increase in institutional investment and greater adoption and acceptance have occurred in the past couple of years.

DeFi can only benefit from all of these developments as it evolves into a complete financial landscape that is free from central authorities and central bank monetary manipulation. The future is wide open for decentralized loans and the next decade will see a surge in adoption as the market matures and products are launched to lower the technical entry barriers that currently hold it back.

< Previous In Series | Decentralized | Next In Series >

Frequently Asked Questions

What is a DeFi loan?

What is a flash loan?

What is arbitrage flash loan?

What is DeFi?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Popular DeFi Platforms

Popular DeFi Platforms