The common saying in crypto goes, “Not your keys, not your crypto.” This means that if you don’t control the private keys to your wallet, you don’t truly own the assets. Non-custodial wallets solve this problem by giving users full control over their private keys without relying on a third party. In this guide, we explain what a non-custodial wallet is and the pros and cons of using one.

KEY TAKEAWAYS

➤ Non-custodial wallets give users full control of private keys and complete ownership of assets.

➤ Custodial wallets rely on third parties, which makes them more user-friendly but less private.

➤ Non-custodial wallets can be riskier if users are not careful with their private keys.

➤ Choosing between custodial and non-custodial wallets depends on user experience and security preferences.

What are non-custodial wallets?

Non-custodial wallets give users full control of their private keys and crypto assets without relying on third-party services. Users need to securely manage their keys, as losing them means losing access to their funds permanently.

But before we get into details, let’s quickly brush up on the basics:

How does a cryptocurrency wallet work?

Crypto assets are just data on the blockchain. A crypto wallet is a tool that allows crypto owners to access their blockchain-based assets. Anyone looking to send digital assets across blockchain networks will need to understand and utilize critical wallet elements such as wallet addresses/keys.

Every crypto wallet has two main components:

➤ Public key: This is the address used to receive crypto. To send crypto, you need the recipient’s public key, and others will need yours to send you funds.

➤ Private key: This must be kept secure by the wallet owner. It’s required to authorize any transaction that moves digital assets from the wallet, ensuring only the owner can approve transfers.

Wallet keys can be stored on the Internet or computer via wallet software. They can also be printed out/written on paper or stored in a hardware device. As a result, cryptocurrency wallets can take on different forms.

Custodial wallets explained

Before we discuss the different physical/software forms that a digital wallet can take, it’s important to understand the difference between custodial and non-custodial wallets.

The former is essentially where a crypto investor trusts a third party to manage/protect their wallet keys. This third party takes on the role of “custodian,” tasking it with preserving crypto owners’ property.

Cryptocurrency exchange accounts comprise the majority of custodial wallets. For example, say a new cryptocurrency investor sets up an account with a major crypto exchange like Binance or Coinbase. Imagine they then purchase cryptocurrency but decide to leave it in their exchange account. Their crypto is actually held in a custodial wallet by Binance/Coinbase, who now assume responsibility for managing the wallet keys.

Pros and cons of custodial wallets

| Pros | Cons |

|---|---|

| Third party manages private keys | Risk of losing funds if custodian is compromised |

| Beginner-friendly for key management | Custodians can face insolvency, as seen with Celsius Network |

| High security provided by exchanges | Introduces centralization, which goes against crypto’s ethos |

| Easier recovery of lost passwords | Assets could be seized by authorities or custodian |

| Access to additional services like trading and staking | Assets could be seized by authorities or custodians |

| Minimal user responsibility for security | Custodians may charge fees that reduce profits |

Non-custodial wallets explained

Now that we’ve covered custodial wallets and their main pros and cons, let’s take a closer look. Non-custodial wallets allow the crypto owner to take full control and responsibility for managing their private keys. In this case, no third party is involved in securing or accessing the wallet.

If the owner loses or misplaces their private keys, access to the cryptocurrency in the wallet could be lost permanently, as there is no external support to recover the funds.

Non-custodial wallets come in various forms, including browser-based software wallets, downloadable software wallets for desktop or mobile, hardware wallets, or even paper wallets. Each of these types offers different levels of convenience and security.

Hardware wallets, in particular, are widely regarded as the most secure option. They store private keys offline, which minimizes exposure to online threats like hacking or phishing attacks. This offline, physical method of storage makes them highly popular among those who prioritize security, though they require extra caution and responsibility from the owner to keep the device safe.

| Pros | Cons |

|---|---|

| Complete control over assets | Responsibility of managing private keys |

| No centralized entity can confiscate or freeze assets | Loss of keys results in permanent loss of assets |

| No KYC restrictions, ensuring privacy | More vulnerable to phishing and hacks without proper security |

| Direct interaction with the blockchain | Beginners may find it complex to manage and transfer funds |

| Access to decentralized finance (DeFi) platforms | No customer support to recover access if keys are lost |

Custodial vs. non-custodial wallets

This depends entirely on the user’s needs and preferences. Beginners just looking to buy some crypto and HODL may wish to leave their crypto on the exchange. Larger-scale multi-asset investors who lack specific expertise in crypto technology may choose to purchase crypto via ETFs and ETPs.

More sophisticated cryptocurrency investors may wish to use a combination. They may maintain some crypto in a custodian exchange wallet for fast trading, and some might also want to keep some crypto in software-based custodial wallets for moving funds in and out of various DeFi platforms.

Here’s custodian vs. non-custodian wallets in a nutshell:

| Custodial wallets | Non-custodial wallets |

|---|---|

| Private keys held by a third party | This may involve service fees |

| Easy to use for beginners | Requires greater responsibility and knowledge |

| Assets can be frozen or seized | Assets cannot be frozen by external entities |

| Password recovery available | No recovery if private keys are lost |

| Complies with KYC and AML rules | No KYC, offering more privacy |

| May involve service fees | No fees for managing your own keys |

How to create a non-custodial wallet

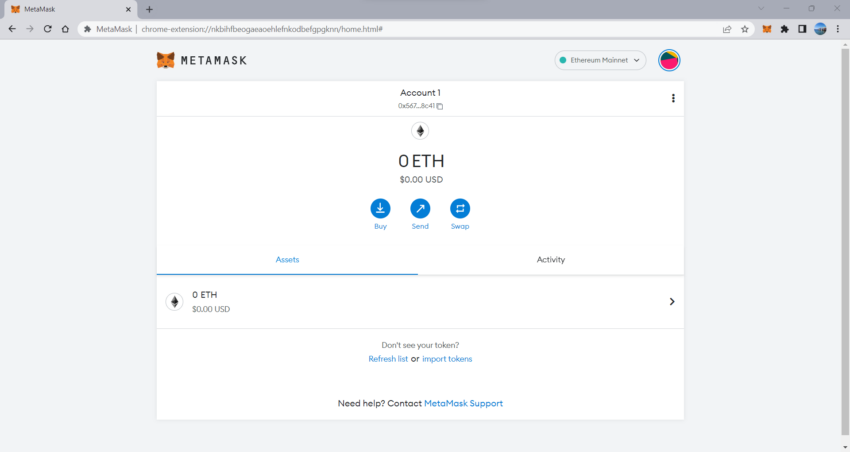

The process is straightforward, with minor variations here and there depending on the wallet you choose. We are using MetaMask (browser extension) for this demonstration as it is one of the most widely used non-custodial wallets in the market in 2025. Here’s how you do it:

1. First, you will need to download the MetaMask chrome extension from the application’s website.

2. Once you have done that, it will appear as a Chrome extension in the upper right. Click on the extension to begin setting up the wallet.

Note that those who already have a MetaMask wallet on another device will be able to access it via their Secret Recovery Phrase, which is essentially their private key. Otherwise, click on “Create a Wallet.”

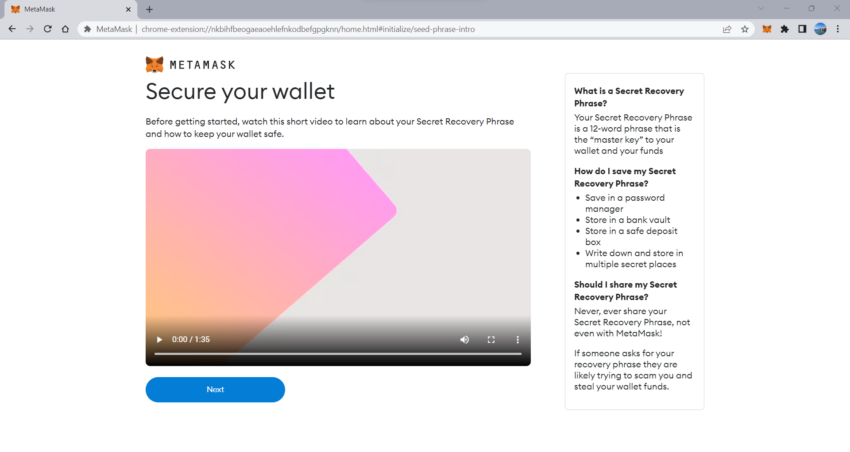

3. MetaMask will prompt you to create a new password. Make sure it is strong. Once you have done that, you will see a page where MetaMask explains how the Secret Recovery Phrase works and why it is important to keep it private.

Essentially, the phrase allows you to access the wallet from other devices. If compromised, a thief could steal all of the crypto you are holding in the MetaMask wallet.

It is important to record the Secret Recovery Phrase securely. If it is lost, you may lose access to the funds in the wallet, and MetaMask will not be able to help you.

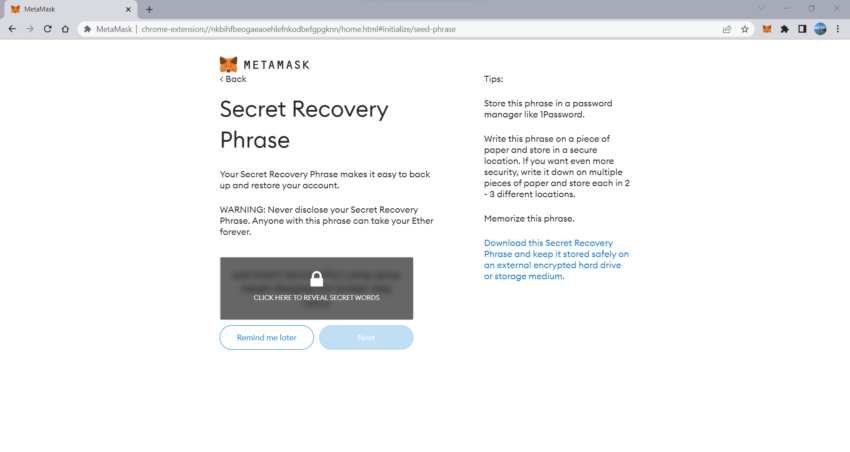

4. On the next page, MetaMask will reveal this Secret Recovery Phrase. Write it down. MetaMask then asks for you to repeat the Secret Recovery Phrase on the next page.

5. Once you’ve done this, the wallet is ready. You’re now ready to buy, send, and swap cryptocurrencies on various blockchains.

Top 5 web-based non-custodial wallets

You have several non-custodial wallets at your disposal. Here, we list five of the most popular non-custodial wallets.

1. MetaMask

Since its launch in 2016, MetaMask has grown to become one of the most popular non-custodial wallets. It supports multiple blockchains compatible with the Ethereum Virtual Machine (EVM) and offers direct integration with decentralized applications and NFT marketplaces like OpenSea.

2. MyEtherWallet

MyEtherWallet, or MEW, is another wallet that has been around for a long time, having first launched in 2016. Like MetaMask, MEW focuses predominantly on the Ethereum network.

The wallet can interact with a range of Ethereum/EVM-based DApps and also supports NFTs. Unlike MetaMask, however, it does support Bitcoin swaps but offers little compatibility with other non-Ethereum/EVM altcoin networks.

Critics generally regard the wallet as very user-friendly. However, MEW users have frequently been targeted in phishing attacks.

3. Coinbase Wallet

Coinbase launched its own non-custodial wallet in 2018, and it has become a popular choice among crypto investors owing to its familiar, simple user experience. It is more compatible with a wider range of blockchain networks than the above-mentioned wallets.

Coinbase’s wallet is completely separate from its exchange. That means, unlike when setting up an exchange account, there are no KYC requirements.

The wallet can be connected to a Coinbase exchange account to facilitate the easy transfer of crypto, but this is optional.

Unlike MetaMask and MyEtherWallet, the code behind Coinbase’s Wallet is not open source. Whilst this might not be an issue for many crypto investors, decentralization purists tend to distrust code that isn’t open to public scrutiny.

4. Trust Wallet

Another popular option is Trust Wallet, which is backed by Binance. It supports various blockchains, offers staking features, and provides additional security layers, such as optional biometric scanning.

Trust Wallet’s code is open source, and its ease of use makes it a solid choice for both beginners and experienced users.

5. Crypto.com DeFi Wallet

The DeFi Wallet from Crypto.com offers users seamless integration with a wide range of DeFi platforms, allowing them to generate yield on their assets.

It supports NFTs, and users can swap tokens directly within the wallet, making it a versatile choice for those engaged in decentralized finance.

Convenience versus control

The choice between custodial and non-custodial wallets often boils down to a trade-off between convenience and control. Hardware wallets, also known as cold storage, offer the highest level of security by keeping private keys offline. However, for less tech-savvy users, custodial services may be a better fit since they handle the security of private keys on the user’s behalf.

Ultimately, the decision is personal, and investors must weigh their desire for control against the added responsibilities of managing their own keys.

Frequently asked questions

What is a non-custodial wallet?

What is the difference between a custodial and non-custodial wallet?

Is Coinbase a non-custodial wallet?

Is Trust Wallet a non-custodial wallet?

Is MetaMask a non-custodial wallet?

Are non-custodial wallets safer?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.