If you’ve ever seen a Bitcoin ATM, perhaps at your local gas station, and wondered how to withdraw money from it — look no further. This step-by-step guide demonstrates how to withdraw money from a Bitcoin ATM. Here’s everything you need to know, from fees and legality to maximum withdrawal amounts, advantages, and disadvantages.

- How to withdraw money from anonymous Bitcoin ATM

- What are the types of Bitcoin ATMs?

- How do Bitcoin ATMs work?

- Advantages and disadvantages of using Bitcoin ATMs

- How do I find a Bitcoin ATM near me?

- Comparing Bitcoin ATM transactions with traditional bank ATMs

- How much can you withdraw from Bitcoin ATMs?

- Are Bitcoin ATM withdrawals legal?

- What are the fees for Bitcoin ATMs?

- Are you anonymous at Bitcoin ATMs?

- Remain cautious — as with any BTC transaction

- Frequently asked questions

How to withdraw money from anonymous Bitcoin ATM

In this guide, we use Bitomat Bitcoin ATMs (formerly Shitcoins. club) to demonstrate the process of withdrawing BTC from an ATM. Bitomat has over 260 locations in various countries. So, you are spoiled for choice in terms of availability and convenience. According to Coin ATM Radar, Bitomat ATM also has some of the lowest ATM fees compared to other exchanges.

Bitomat ATMs are also more private than the average Bitcoin ATM and only require minimal KYC (know your customer) for certain transaction limits and in accordance with local laws. This means that there is no KYC requirement in countries where this is allowed.

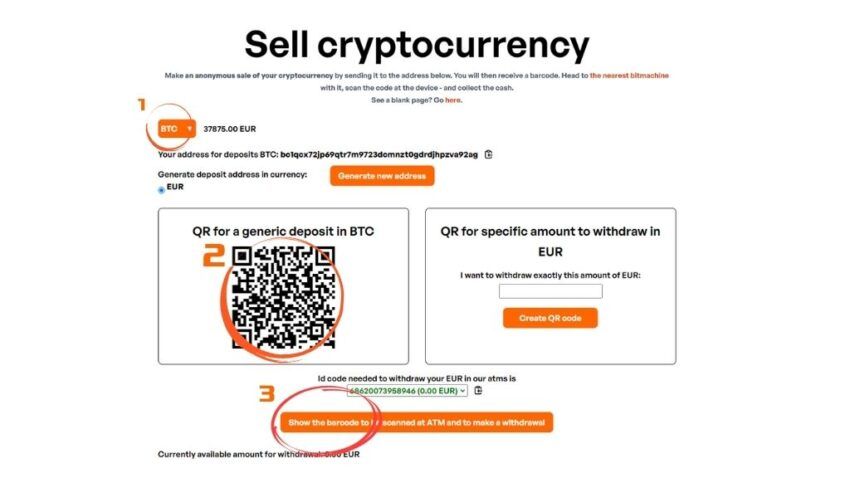

It is also advised that if you are looking to test an ATM, say with a €20 transaction, before using it for a larger amount, you should choose an asset other than Bitcoin or ETH. This is because Bitcoin has high transaction fees and slow confirmation times. Examples of cryptocurrencies with low fees and quick confirmation are USDT on trc20, LTC, DASH, TRX, BTC, and ETH, which are okay to use for large transactions, especially if you sell using the operator’s website at home and then collect the cash at the ATM later. You can do that using the option available on the site.

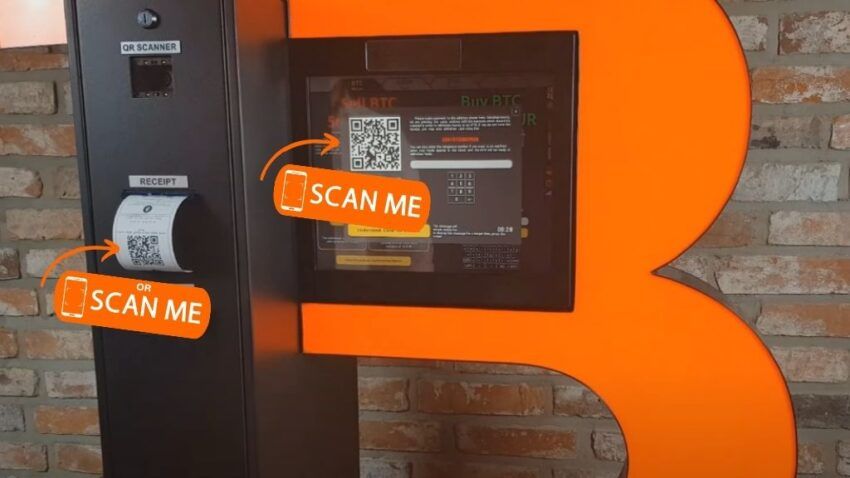

1. Find a Bitcoin ATM and click “Sell Cryptocurrency.”

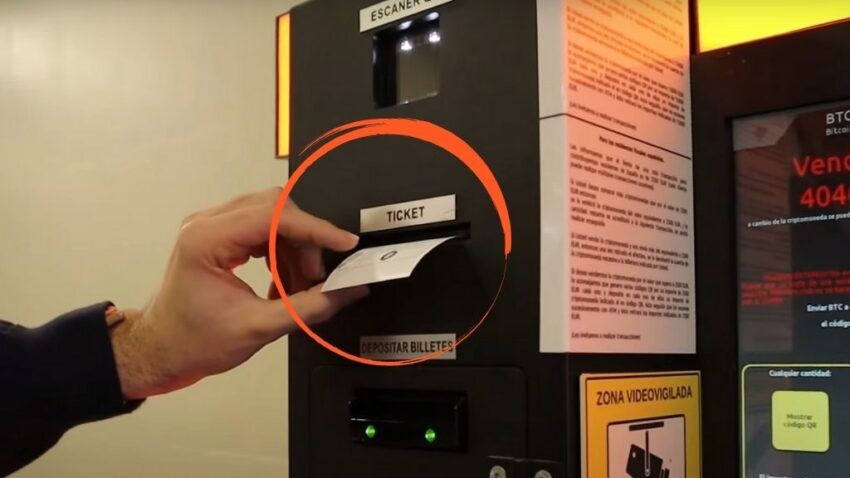

2. Collect printed receipts to scan the QR code with your Bitcoin or crypto wallet.

3. Wait for confirmation. When the transaction is ready on the blockchain, scan the barcode that is on the receipt.

4. Collect your cash and receipt.

5. The receipt is useful in case you need to contact customer support.

6. You can also sell your crypto on the website. In this scenario, follow the instructions on the website and take your ticket to a local Bitomat ATM.

How to buy from an anonymous Bitcoin ATM

1. Find a Bitomat ATM and insert cash into it.

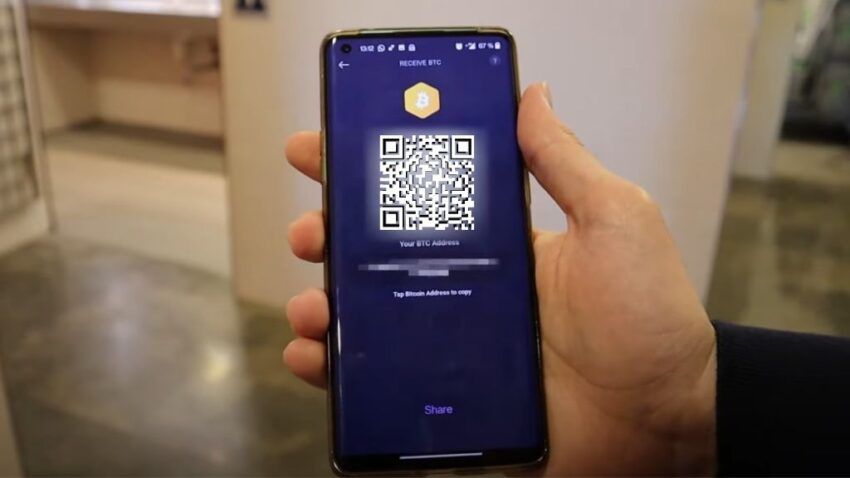

2. Open your crypto or Bitcoin wallet app.

3. Scan the QR of your wallet address on the ATM.

4. Wait for confirmation on the blockchain and collect your ticket.

Keep your ticket in case you need to contact customer service.

What are the types of Bitcoin ATMs?

As of 2025, there are predominately two types of Bitcoin ATMs. One-way and two-way ATMs. These are also referred to as uni-directional and bi-directional ATMs.

As the name implies, one-way or uni-directional ATMs support either buying or selling Bitcoin, but not both. Two-way or bi-directional ATMs support both buying and selling.

Although the user interface and transaction method of each type of Bitcoin ATM vary slightly, they all generally need customers to follow a set of steps for authentication (e.g., ID scanning or SMS verification) and order execution. In the case of Bitomat.com, there is no account or SMS, but there’s an ID scan required, usually between 1000 and 15000 EUR, depending on local law.

Depending on the manufacturer, the operator, and the machine’s location, there might be vast variations in the functionalities available, the supported cryptocurrencies, and the transaction restrictions.

How do Bitcoin ATMs work?

Bitcoin ATMs work similarly to your standard ATMs. With a traditional ATM, the kiosk connects you to your bank account. The user inserts a debit card that contains their account information on a magnetic strip. Once you make a withdrawal, the ATM dispenses cash and communicates the transaction to your bank to update your account status.

However, with Bitcoin ATMs, the kiosk is simply an intermediary between you and an exchange instead of a bank, and your Bitcoin wallet replaces the debit or credit card. When you buy or sell cryptocurrency at these types of ATMs, you are buying and selling with an exchange.

During this process, you can use your crypto wallet instead of a bank account. If you don’t have a wallet, some ATMs will generate a paper wallet for you. They may also allow you to scan QR codes to make the transaction process much smoother.

Advantages and disadvantages of using Bitcoin ATMs

There are many considerations you must take into account before using a Bitcoin ATM. For instance, cryptocurrency ATMs typically have a stigma for high transaction fees. According to Coin ATM Radar, the average transaction fee across a survey of 39,000 ATMs falls within the range of 8% to 15% or higher.

This is opposed to traditional ATMs, which typically charge a flat fee. However, as the market grows, we will likely see lower fees for Bitcoin emerge. Bitcoin ATMs like Bitomat charge an average fee of 3-4%. There are also discount events in which the fees drop to 0%. Then, the price is the same as on the exchanges or even better.

Another example that Bitcoin native users may particularly care about is privacy. As previously alluded to, due to regulations in certain countries, you may have to KYC when transacting at an ATM. On the other hand, many crypto ATMs today offer a tiered KYC policy. This means that identification is only required at certain transaction amounts. All in all, choose an ATM based on your personal needs.

| Pros | Cons |

|---|---|

| Provides an entry point into crypto for the unbanked | May require some level of KYC |

| Transactions are completed almost instantaneously | High fees compared to exchanges |

| Convenient for cash-based transactions | Limits on large transaction amounts |

| Generally simple to navigate | Limited availability |

| Convenient if you do not want to use exchanges directly | Transactions on ETH must be started at home and finished at ATMs later due to the long confirmation time |

How do I find a Bitcoin ATM near me?

The availability of crypto and Bitcoin ATMs is steadily increasing year-on-year, with more available in 2024 than there were in previous years. Sites like Coin ATM Radar make this process extremely simple. This site lets you choose ATMs by location, cryptocurrency, and services. Another method is to use GoogleMaps or Bitomat.com to browse its 270 locations of Bitcoin ATMs.

Comparing Bitcoin ATM transactions with traditional bank ATMs

- Purpose: Bitcoin ATMs are used for buying and selling Bitcoin with cash, while traditional bank ATMs are used for withdrawing money, checking balances, and other banking transactions.

- Transaction Process: Bitcoin ATMs require a Bitcoin wallet address and may require ID verification, whereas traditional bank ATMs require a bank card and PIN.

- Fees: Bitcoin ATMs typically have higher fees (7% to 12% per transaction), while traditional bank ATMs have lower fees (around $2 to $5 per transaction, sometimes free within the same bank’s network).

- Accessibility: Bitcoin ATMs are found in limited locations, mostly in major cities or specific retail locations, while traditional bank ATMs are widely available at banks, malls, and various public places.

- Transaction speed: Bitcoin ATM transactions can take minutes to an hour, depending on network congestion. Traditional bank ATM transactions are usually instantaneous.

- Currency types: Bitcoin ATMs deal with Bitcoin and sometimes other cryptocurrencies, whereas traditional bank ATMs deal with fiat currencies.

- Regulations: Bitcoin ATMs are subject to varying cryptocurrency regulations by region, while standardized banking regulations govern traditional bank ATMs.

How much can you withdraw from Bitcoin ATMs?

The amount of cash you can receive from a Bitcoin ATM varies. Most importantly, the local laws for anti-money laundering (AML) and KYC predominately affect these limits.

However, ATM companies also reserve the right to limit withdrawals further. For example, Bitomat sets a limit of €1,000 in Spain before you must go through the KYC process. This is not entirely a negative. As users could potentially be victims of some form of extortion, given the nature of ATM interactions, customers can benefit from these set limits.

Here are detailed limits of anonymity for Bitcoin ATMs in each country. Since Bitomat.com is the most pro-privacy operator, these somewhat set the general limits for each country:

- Turkey: KYC limit of 185,000 TRY

- Ukraine: Single transaction limit of 30,000 UAH

- Poland: KYC limit of 15 transactions, max 1000 EUR each

- Bosnia: KYC limit of 990 BAM

- Peru: KYC limit of 29,990 PEN

- Bulgaria: KYC limit of 9,750 BGN

- Romania: KYC limit of 10,000 RON

- Slovakia: KYC limit of 10,000 EUR, transaction limit of 5,000 EUR

- Spain: KYC limit of 1,000 EUR per day

- Slovenia: Always KYC, Transaction limit of 4,990 EUR

- Cyprus: ATMs will be online soon (KYC: 1000 EUR)

- Chile: KYC limit of 990 USD

- Italy, South Africa, Greece, Brazil, Macedonia: Always KYC

- Croatia: Sell and get +1.5%

Are Bitcoin ATM withdrawals legal?

Yes, it is legal to withdraw Bitcoin from ATMs in virtually all parts of the world where cryptocurrencies are authorized. However, countries like Bolivia and Algeria have banned the use of cryptocurrency altogether, implying that Bitcoin ATMs are also prohibited there. In regions where it’s permitted, operators must adhere to local financial regulations such as registering with appropriate financial authorities and complying with Anti-Money Laundering (AML) and Know Your Customer (KYC) laws.

What are the fees for Bitcoin ATMs?

Unlike traditional ATMs, Bitcoin ATMs typically charge based on a percentage of the transaction size. Coin ATM Radar data shares that these fees average around 15%.

What is the max Bitcoin ATM withdrawal amount?

The maximum withdrawal amount from a Bitcoin ATM is based on several factors, including the local fiat currency, the type of cryptocurrency involved, and the ATM’s adherence to anti-money laundering (AML) and know-your-customer (KYC) regulations.

Fiat currency and the specific cryptocurrency’s liquidity play a crucial role; more liquid cryptocurrencies and stronger fiat currencies often allow for higher withdrawal limits. AML and KYC requirements further dictate these limits, with more stringent identity verification processes enabling larger transactions.

Typically, withdrawals are a few hundred dollars per day without extensive KYC verification, whereas verified users could potentially withdraw thousands of dollars worth of cryptocurrency in fiat currency.

These limits are set by the ATM operators and can vary significantly based on the machine’s location and the operator’s policies. For example, Bitomat’s are:

- Customer verification ranges from €0 or €1,000 to €15,000 per day

- Deposit in EUR, GBP, USD + native currency of a given country

- Buy/sell transactions for BTC, ETH, USDT (ETH and TRC20 networks), USDC, LTC, TRX and DASH

- Some ATMs allow you to choose whether you want to withdraw in EUR or USD

- 260 locations on three continents, most in Spain, Poland, and Italy, and many in Eastern Europe

Are you anonymous at Bitcoin ATMs?

The anonymity of Bitcoin ATMs depends on a few factors. Many jurisdictions may require KYC, surveillance, or providers to retain personal data for a specified amount of time.

Therefore, in many cases, Bitcoin ATMs are not anonymous. However, some employ a tiered KYC policy. So, users only need to give personal information for larger transaction sizes. In other words, you can buy Bitcoin anonymously at low transaction sizes.

The video material from monitoring is recorded for everyone but stored only for those who exceed KYC limits. If one does not exceed the limit, the material is automatically removed in accordance with Article 5, paragraph 1 of the GDPR.

What happens when you sell Bitcoin at ATMs?

When you sell Bitcoin at an ATM, the order goes to an exchange where it is fulfilled. An ATM kiosk is simply an intermediary for exchanges where buy and sell orders are filled. This saves users massive amounts of time and work from having to use an exchange directly. In the case of some ATM operators, such as Bitomat, the funds do not go through any exchange.

Remain cautious — as with any BTC transaction

It is important to understand how to withdraw from Bitcoin ATMs before you use them. This will save you a lot of time and frustration in the future. It is also better to get familiar with them now, as they will likely become a larger part of our everyday lives in the event of mass crypto adoption. As with any interaction with decentralized ecosystems, safety is paramount. Ensure you follow these step-by-step instructions carefully.

Frequently asked questions

You cannot transfer Bitcoin directly to your bank account. However, you can trade Bitcoin for cash at ATMs or on exchanges. In this scenario, simply deposit the cash into your bank account with instructions from your bank.

In some cases Bitcoin ATMs do require identification. Some ATM operators have a tiered KYC policy. This means that you do not have to KYC under a certain amount.

Many Bitcoin ATMs allow you to scan a QR code for your wallet to exchange your BTC for cash. If you want to purchase Bitcoin, you can insert cash or other payment methods. Some also allow you to receive a paper wallet with your BTC and private keys printed on it.

Bitcoin ATMs are an intermediary for exchanges. When you want to buy or sell crypto at an ATM, the kiosk sends the transaction to an exchange to be fulfilled. The Bitcoin ATM will facilitate this by providing the software to securely exchange the payment and resolve the ledger.

It is best to only use small amounts of value to use a crypto ATM for the first time. If you must use Bitcoin then it is better to use larger Bitcoin transactions at Bitcoin ATMs. This is because of transaction fees and confirmation times.

You can convert Bitcoin to cash at a Bitcoin ATM. Bitcoin ATMs allow you to buy or sell your crypto. They are particularly useful for people who transact in cash.

In many cases, it is safe to pay in Bitcoin. Bitcoin transactions settle faster than your average fiat transaction and benefit from the security of the Bitcoin Network. This is because Bitcoin allows you to transact on a peer-to-peer basis.

It is extremely difficult to receive Bitcoin for free. Therefore, you should be wary of scams that offer free Bitcoin. However, it is not uncommon to receive free Bitcoin in exchange for completing tasks on GPT (get paid to) sites.

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.