Fetch AI (FET) price currently sits at $0.21, down 20% from its monthly high of $0.27 recorded on September 3. On-chain data examines how the increased whale demand coinciding with NVIDIA stock price bounce this week could impact FET prices.

FET is the native token of Fetch.ai. Fetch.ai is an artificial intelligence (AI) cryptocurrency protocol offering permissionless, decentralized machine learning services. Crypto whales were spotted stacking FET this week as Morgan Stanley tagged NVIDIA (NASDAQ: NVDA) as a “buying opportunity.”

Crypto Whales Spotted Loading Up 18M Tokens This Week

FET’s price performance in September has been underwhelming. But this week, a cluster of whale investors holding 1 million to 10 million FET balances were spotted buying aggressively.

As depicted below, the whales held only 302.24 million FET in their wallets as of September 19. But by September 26, that figure had increased to 320.84 million FET.

Notably, the 18.6 million FET token buying spree has coincided with a noticeable price bounce in NVIDIA stock prices.

Currently valued at $0.21, the 18.6 million tokens recently acquired by the FET whales are worth approximately $4 million. Historical trends show that the buying activity of this whale cluster has often moved FET prices significantly.

Hence, if they keep up the buying frenzy, it could spark a bullish price reversal in the coming weeks.

The Bullish Sentiment is Spreading to the Retail Spot Markets.

The recent uptick in whale demand seems to have boosted confidence among retail investors. In confirmation of this stance, there has been a noticeable influx of FET purchase orders across crypto exchanges.

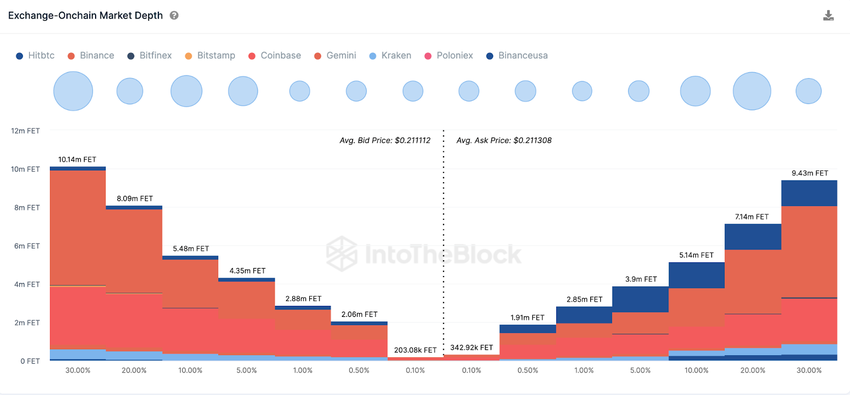

As shown below, the bulls have placed active orders to buy 33 million FET. This is 3 million tokens higher than the 30 million FET currently up for sale.

The Exchange On-chain Market Depth chart shows the volume of active FET token orders placed across recognized crypto exchanges.

As seen above, the market demand for FET has outstripped supply by more than 3 million tokens. This suggests that the whales’ buying pressure may have buoyed confidence among retail market participants.

In conclusion, if NVIDIA stock breaks its month-long downtrend, it could boost investor confidence in Fetch.ai, and the broader Crypto AI sector.

Read More: 6 Best Copy Trading Platforms in 2023

FET Price Prediction: Potential Upswing Toward $0.30

From an on-chain standpoint, the Fetch.ai price could reclaim $0.30 if the whales extend their current buying spree to October.

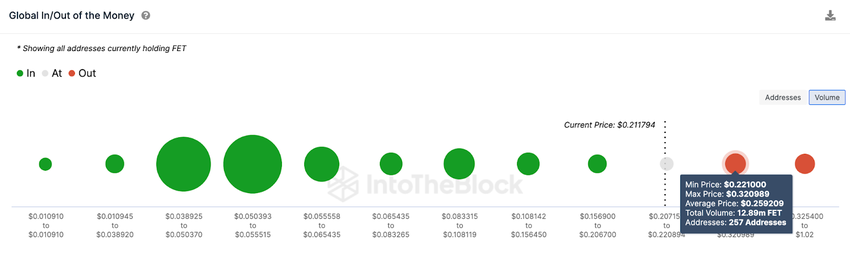

The Global In/Out of Money Around Price (GIOM) data, which depicts the entry price distribution of current Fetch.ai holders, also validates this bullish prediction.

It shows that if Fetch.ai scales the initial resistance at $0.26, the bulls could ride the wave toward $0.30. As shown below, the 257 addresses bought 12.9 million FET tokens at an average price of $0.26. If they book profits early, those sell-walls could pose a major obstacle.

But if the whales keep up the buying pressure, the FET price could surpass $0.30.

Conversely, the bears could invalidate the positive prediction if the Fetch.ai price drops below $0.15. However, as shown above, 3,500 addresses had bought 19.7 million FET tokens at the maximum price of $0.16.

But considering the bullish traders remain dominant in the FET spot markets, they will likely prevent the bearish downswing.

But if the FET price fails to hold that vital support level, it could open the door to a reversal toward $0.10 next.