What is copy trading?

Copy trading is an investment method when traders mimic the trades of other market participants, mostly more seasoned and experienced. Using this strategy, traders do not need to obtain much market research or constantly monitor different charts.

The buys and sells of those traders you copy are automatically reflected in your own portfolio. Thus, once that top investor makes a profit from their strategy, you benefit from it as well. Copy trading is great for beginners.

Copy trading is great for beginners — it’s a way to start trading crypto without starting from scratch. You can see how trading works and learn by doing. Some demo trading platforms allow you to practice copying trades without using real funds.

Benefits and drawbacks of copy trading

Copy trading has become a popular way to enter the crypto market for a reason. However, before engaging in this strategy, it is important to understand all potential drawbacks along with benefits you can get. Let’s break them down.

Benefits

- Low barriers to entry: Crypto copy trading does not require any technical skills or deep analysis of the market. So, literally any can enjoy trading digital assets using this method and gain some experience.

- Time-saving: Another great advantage of crypto copy trading is that it eliminates the need of 24/7 chart monitoring. Instead of spending hours watching what is happening in the crypto market and studying market trends, traders can rely on the expertise of professionals.

- Lesser emotional trading and reduced risk: Different experts often say that traders should avoid being emotional, otherwise it can lead to potential losses. When copy trading, users do not need to be fully involved in the process–they just follow proven strategies.

- Learning opportunities: For beginners, copy trading isn’t just about profits; it’s also an educational tool. By watching how seasoned traders navigate the cryptocurrency market, you can learn valuable insights. Over some time, you can even become one of those top investors.

- Diversification opportunities and passive income: Copy trading platforms usually offer users to follow several traders. You can choose those who use different and unique approaches and portfolios, which increases the chances of profits.

Drawbacks

- Over-reliance on others: Copy trading means dependency. Well, in case you are not willing to learn from strategies the top traders use. Anyway, at the beginning copy traders depend on the chosen trader’s performance, which can impact their returns.

- No guaranteed profits: This point is a continuation of the first one. Even top traders make mistakes–market conditions sometimes change too rapidly, so strategies that worked in the past may not always succeed.

- Lack of full control: Copy trading also means that your investments no longer belong to you completely. When copying other investors, you’re handing over decision-making power. You might not be happy with every move that investors make, but you cannot get back the money.

- Costs and fees: Crypto copy trading is not free. Some platforms charge fees. Thus, if your portfolio is small, you should bear in mind additional costs.

- Market volatility: Always remember that the crypto market is far from stable. Things change all the time, and these changes can cost fortunes.

Copy trading can be a double-edged sword. It is a great way to start if you are thinking about entering the crypto world–copy trading saves time and gives you the opportunity to learn from the best.

However, it is essential to learn about the risks in advance and avoid putting blind trust in others. To use this strategy effectively, traders should balance the convenience of automation with the need for personal understanding.

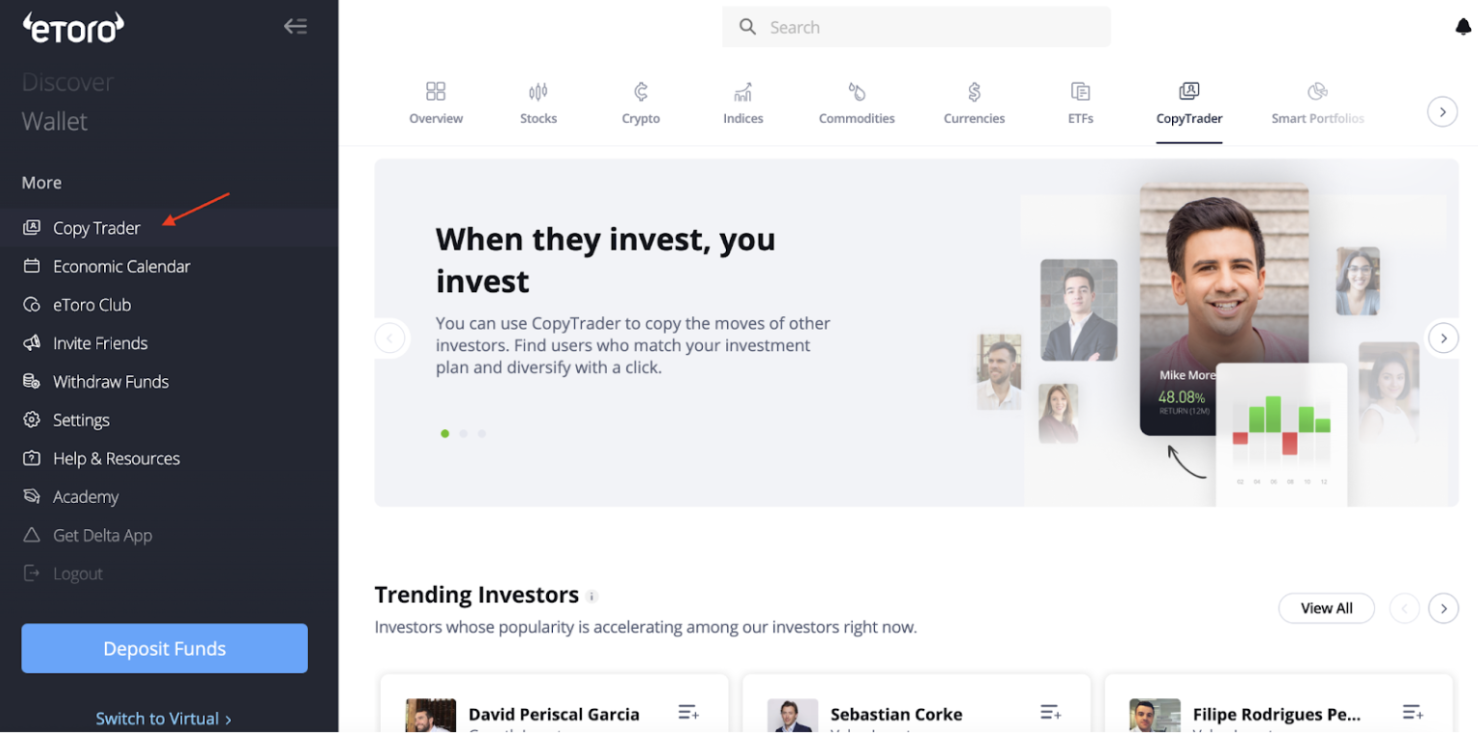

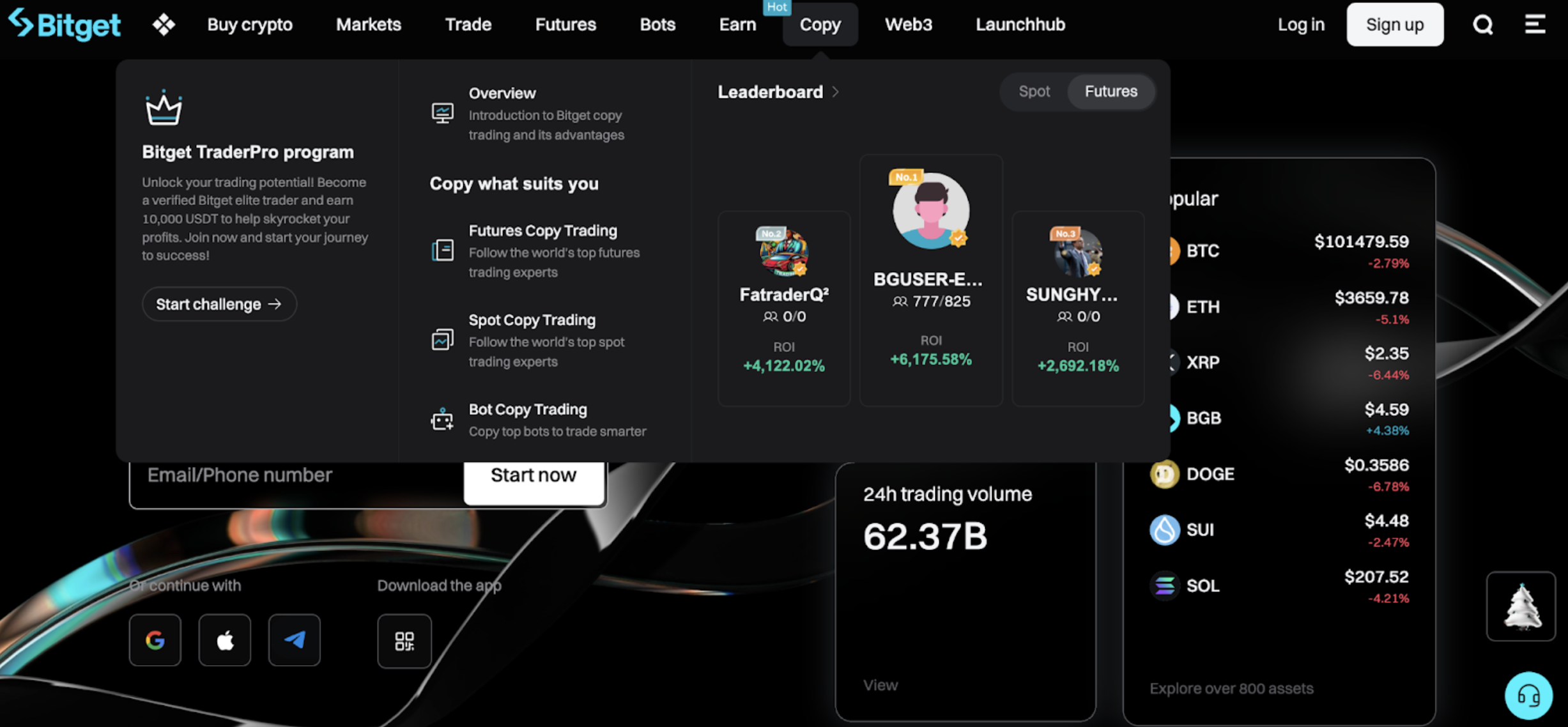

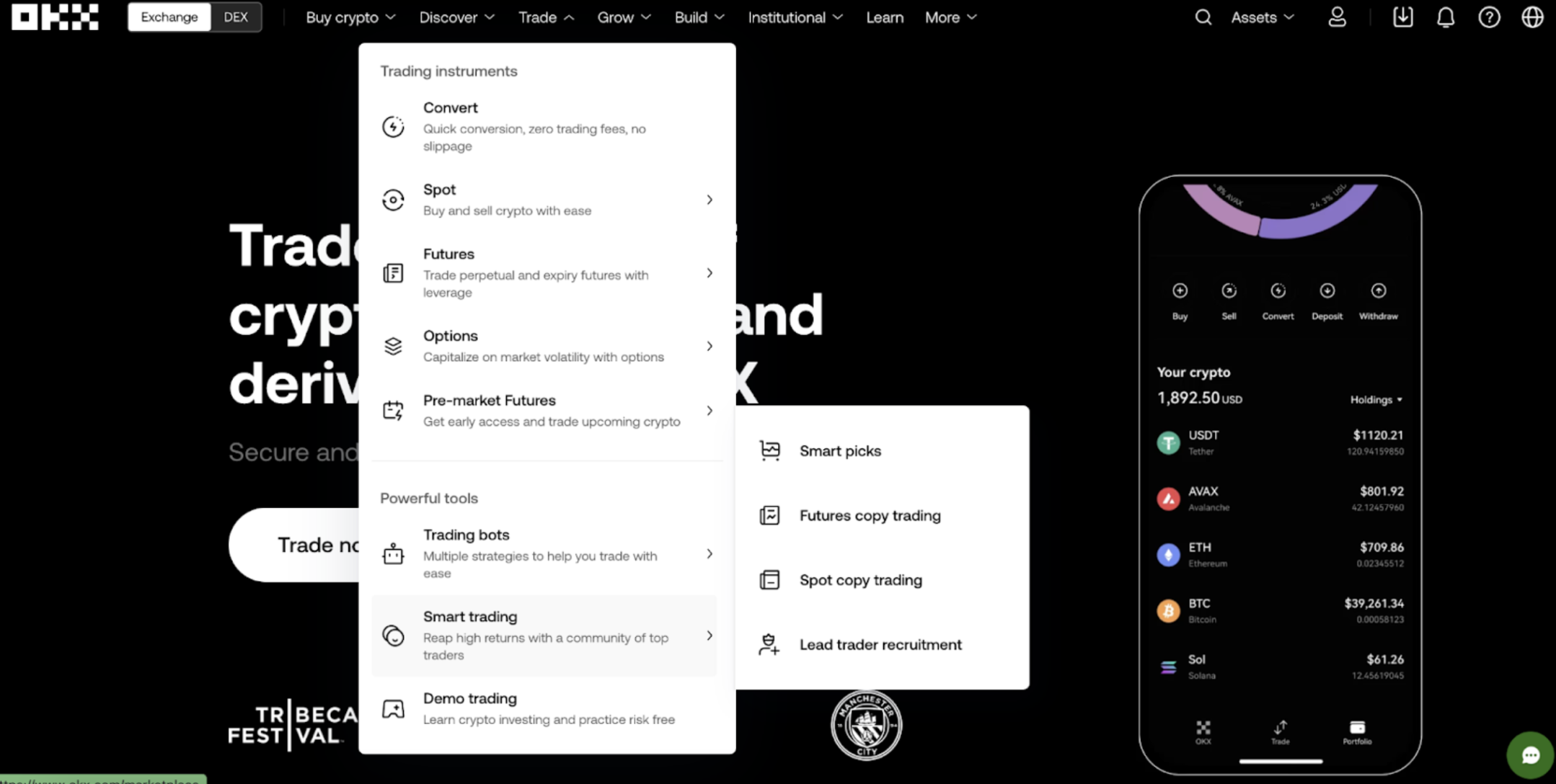

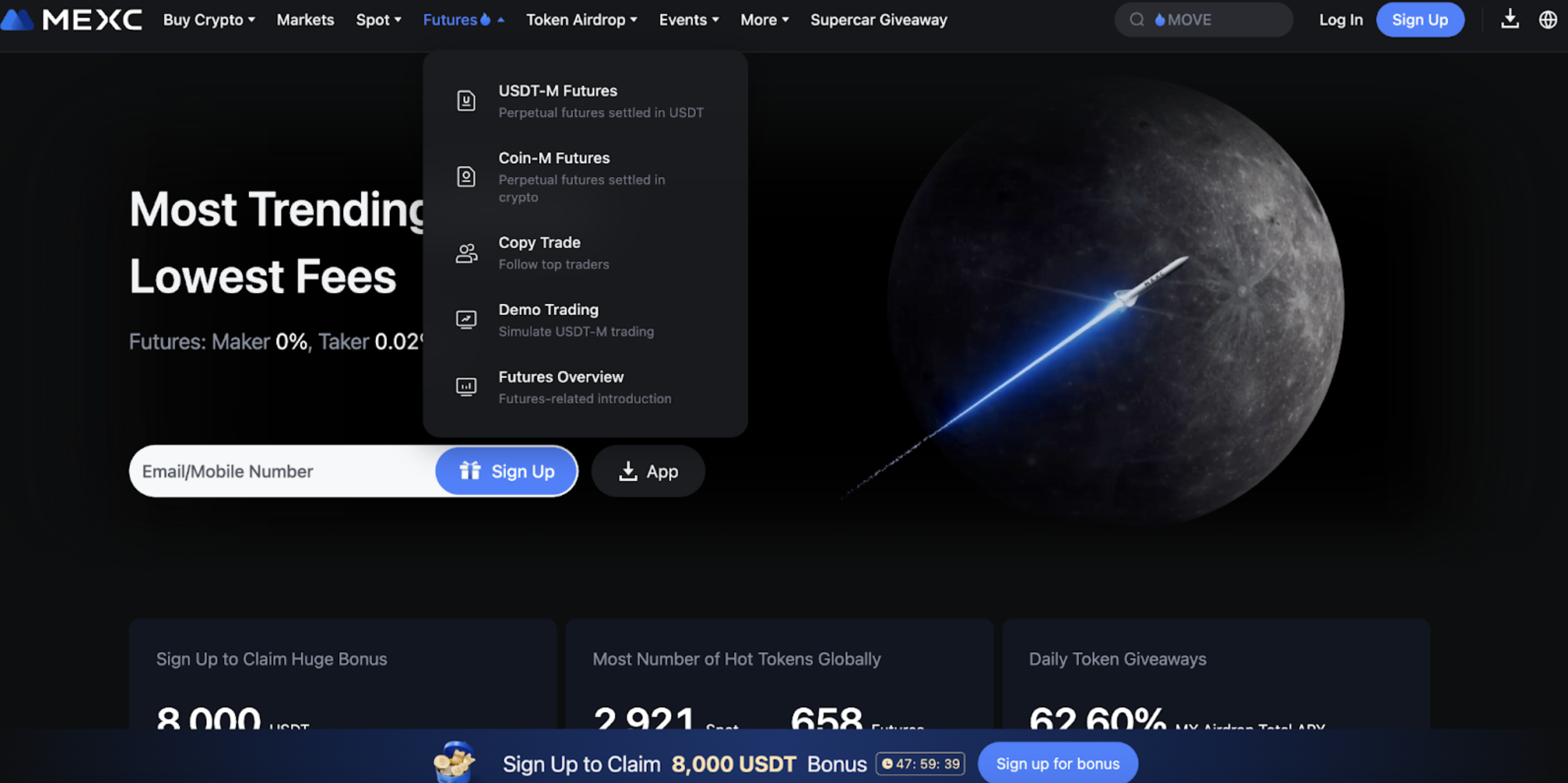

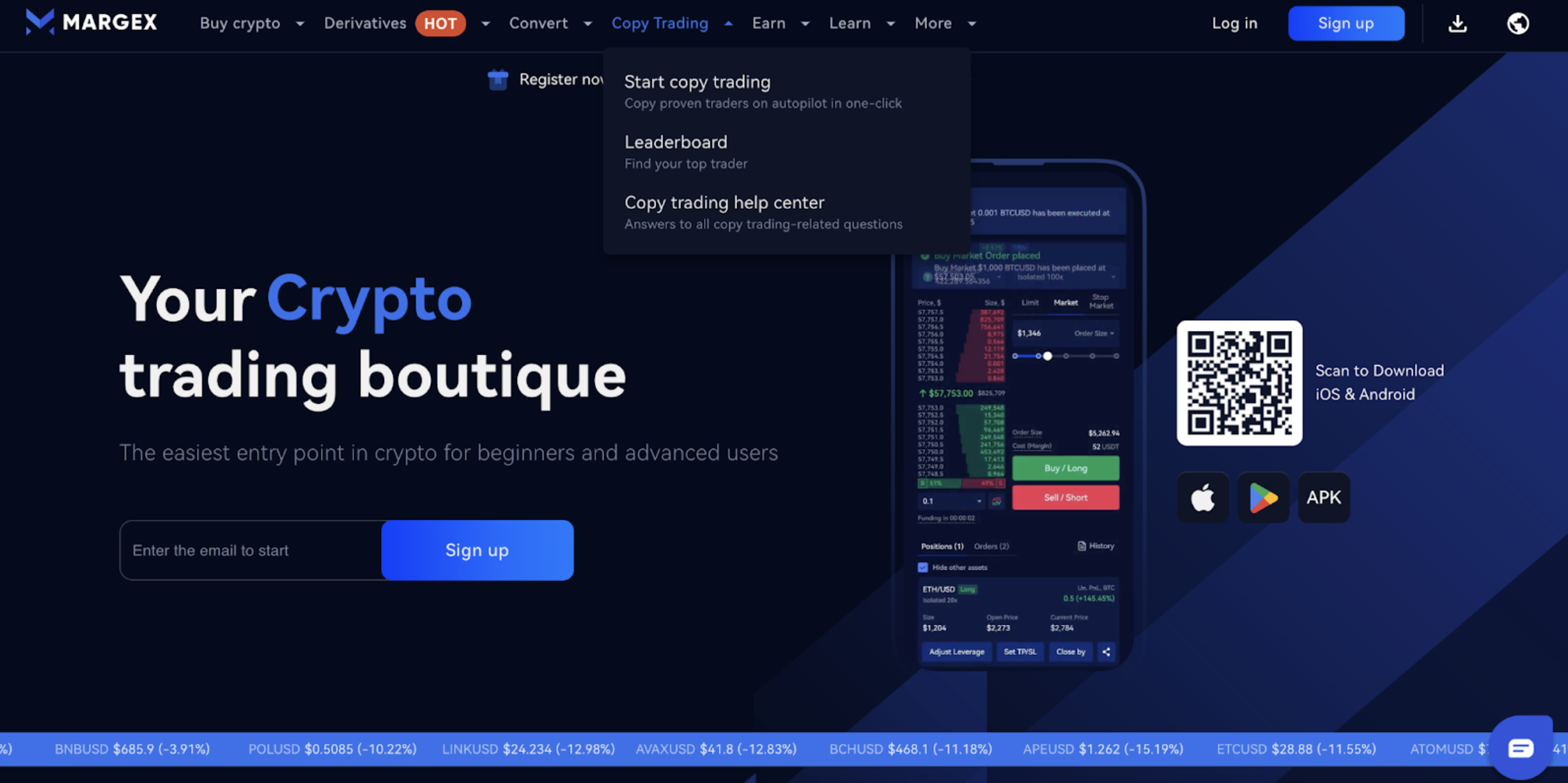

Choosing the right copy trading platform

After understanding the benefits and drawbacks of crypto copy trading, the next step is to find the right platform. Let’s see the factors you should consider when doing that:

- User interface: This is the first and one of the most important points, especially for newcomers to the market.

- Reputation and security background: Then you should check if the chosen platform deserves trust. Study its history, find reviews from ordinary users or industry leaders. Also pay attention to security measures. Ideally, a platform should employ two-factor authentication (2FA) and encryption to protect your funds and data.

- Amount of fees: Another important thing to consider when choosing a platform for copy trading is to pay attention to fees they charge. This point can significantly impact your experience. So, always compare the various fees charged by different platforms, including trading fees, subscription fees and withdrawal fees.

- Regulation and compliance: Make sure that the platform you picked is not under regulatory oversight in your region. Otherwise, you might get into trouble.

- Filter settings: Some platforms allow users to adjust settings, such as trade size, stop-loss levels or which trades to copy. Customization can give you more control over your portfolio, even when relying on another trader’s strategy.

- Community and support: Check if the platform’s community and customer support are active. You can learn even more while chatting with other traders on forums.

We’ve covered only some aspects of choosing the right platform for copy trading. Remember that it’s always about aligning those features with your personal trading goals and risk appetite.

Tips for successful copy trading

Copy trading can be an excellent way to earn while learning, but success isn’t guaranteed. To maximize your potential and minimize risks, you need a thoughtful approach. Here are practical tips to help you succeed in crypto copy trading.

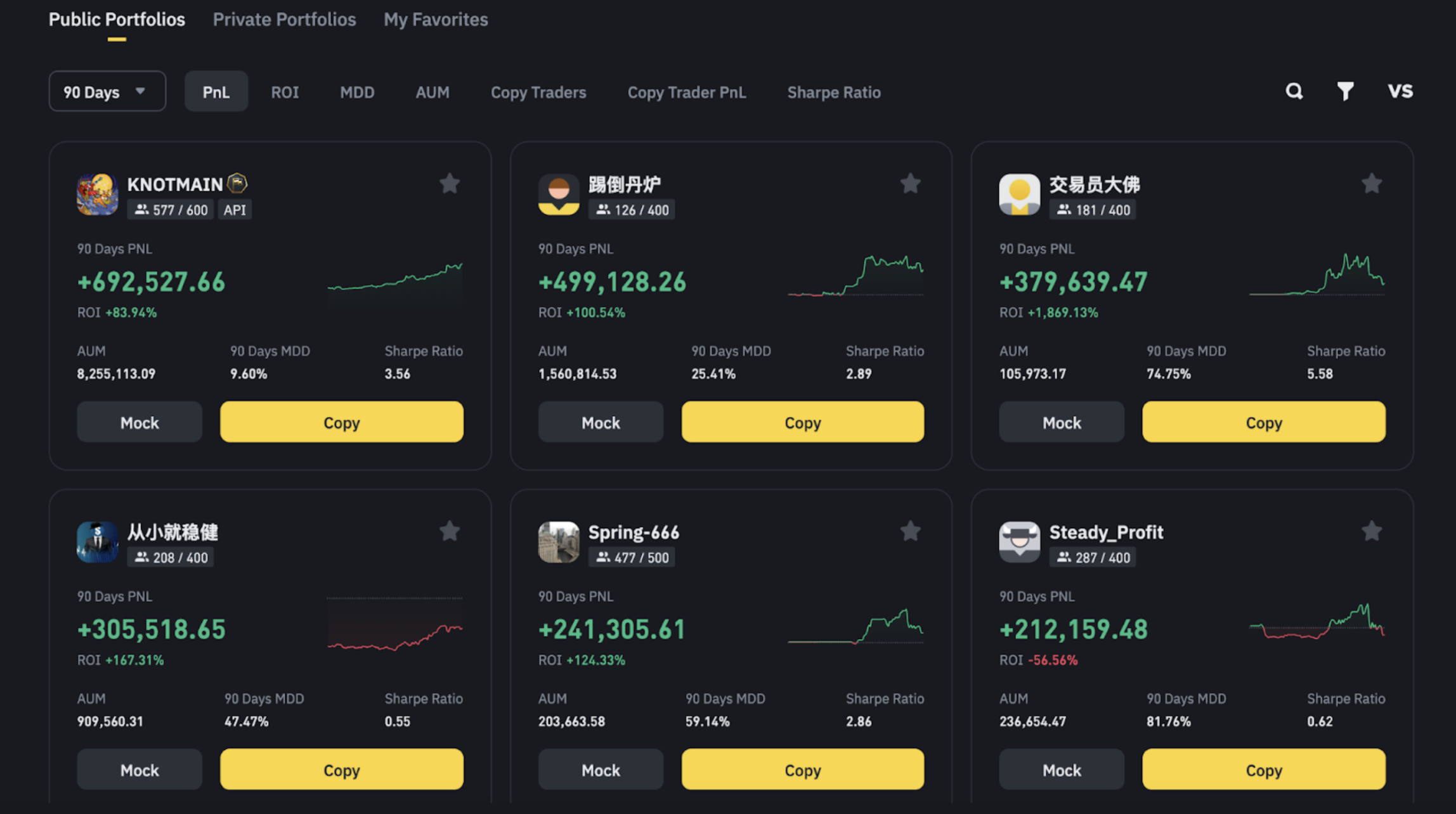

Tip 1: Pick skilled and consistent traders

Do not blindly click on the first trader’s profile and start copying them. Before doing so, thoroughly research their trading history, performance metrics, market knowledge, transparency, reviews and ratings. Follow only those with a proven track record of consistent profits.

Tip 2: Always remember about diversification

Diversification is a key to succeed in copy trading–it works just like with any investment strategy. Follow multiple traders with different strategies. This way, you will increase your chances to actually get profits.

Tip 3: Track your portfolio

Copy trading means passive income, because everything here is automated. However, you should still monitor your portfolio regularly and stay up-to-date with most of what is happening in the crypto market. Only then will you be able to notice if the strategy of that trader you chose starts declining.

Tips 4: Use rick management tools

As we’ve already mentioned, platforms usually offer their users tools like stop-loss settings or maximum investment caps for each trade. Leverage these features to safeguard your portfolio and do not forget about evaluating your risk tolerance first.

Conclusion

Crypto copy trading is definitely one of the most convenient ways to participate in the market. It offers a low barrier to entry and does not require any special skills or technical knowledge. The most important points include selecting a platform that suits your needs, carefully researching traders and appropriately weighing all pros and cons of such strategy.

Frequently asked questions

Crypto copy trading is a way of trading cryptocurrency by automatically copying experienced traders on specialized platforms.

Crypto copy trading can be safe, but it depends on the platform and the trader you follow. Research and due diligence are crucial to minimize risks.

Yes, crypto copy trading can be a good starting point for beginners as it allows them to learn from top traders without the need for extensive knowledge.

In crypto copy trading, you follow a successful trader’s trades. Their actions are automatically replicated in your account, allowing you to benefit from their expertise.

When engaging in crypto copy trading, users start following successful traders, copying their strategies. The whole process is automated, and those traders’ actions are automatically replicated in copiers’ accounts.

Profits are unfortunately not guaranteed in crypto copy trading, but it all depends on the performance of the trader you follow and market conditions. Copy trading can definitely be a way to potentially earn returns.

To choose a reliable copy trading platform, you need to consider such factors as security measures, repudiation, fees, transparency and the success rates of the traders listed.