Axie Infinity (AXS) price is down 15% from last week’s peak, dropping to $5.73 on Wednesday, November 22. On-chain analysis examines how AXS top holders’ recent trading activity could impact price action.

Last week, Axie Infinity’s price rebounded remarkably to a 20-month peak as the GameFi sector emerged as one of the biggest gainers in the month-long crypto market rally. Will AXS top holders swoop in again to avoid a historic bearish price reversal or race for profitable exits?

Axie Infinity Top Holders Have Been Selling Since the Start of November

When Axie Infinity’s price tumbled toward $4 in mid-September, the largest investors within the ecosystem swooped to avert a reversal to historic lows. But following an impressive 68% recovery between September 15 and November 17, that picture now seems to have turned on its head.

According to on-chain data pulled from Santiment, the top 100 investors in the Axie Infinity ecosystem have been booking profits stealthily since the start of November. They started to book profits just as AXS price crossed the vital $5.50 resistance zone.

On November 1, the top 100 largest addresses held a total of 552.31 million AXS in their cumulative balances. Since then, as shown in the chart below, they have gradually sold off 1.05 million tokens, cutting their balances down to 551.26 million AXS at press time on November 22.

The supply held by top addresses metric tracks the real-time changes in the balances held by the largest investors within a cryptocurrency ecosystem. Generally, a decline in top holders’ balances during a price rally is a bearish signal. Chiefly, this indicates the biggest investors are not convinced of significant positive changes in the project’s fundamentals.

A closer look at the chart shows that the top holders had swooped in to avert historic losses by around September 15. As AXS price slid toward $4, they rapidly acquired 720,000 AXS (~ $2.9 million), setting the initial recovery in motion.

But, as AXS rallied in November, rather than double-down on their positions, the Axie Infinity top 100 addresses began to sell.

Considering the level of positive impact their buying pressure had on AXS price in September, a similar outcome could set in, in reverse, if they continue selling.

Retail Traders Have Queued Up Orders to Sell Off 2 Million Tokens

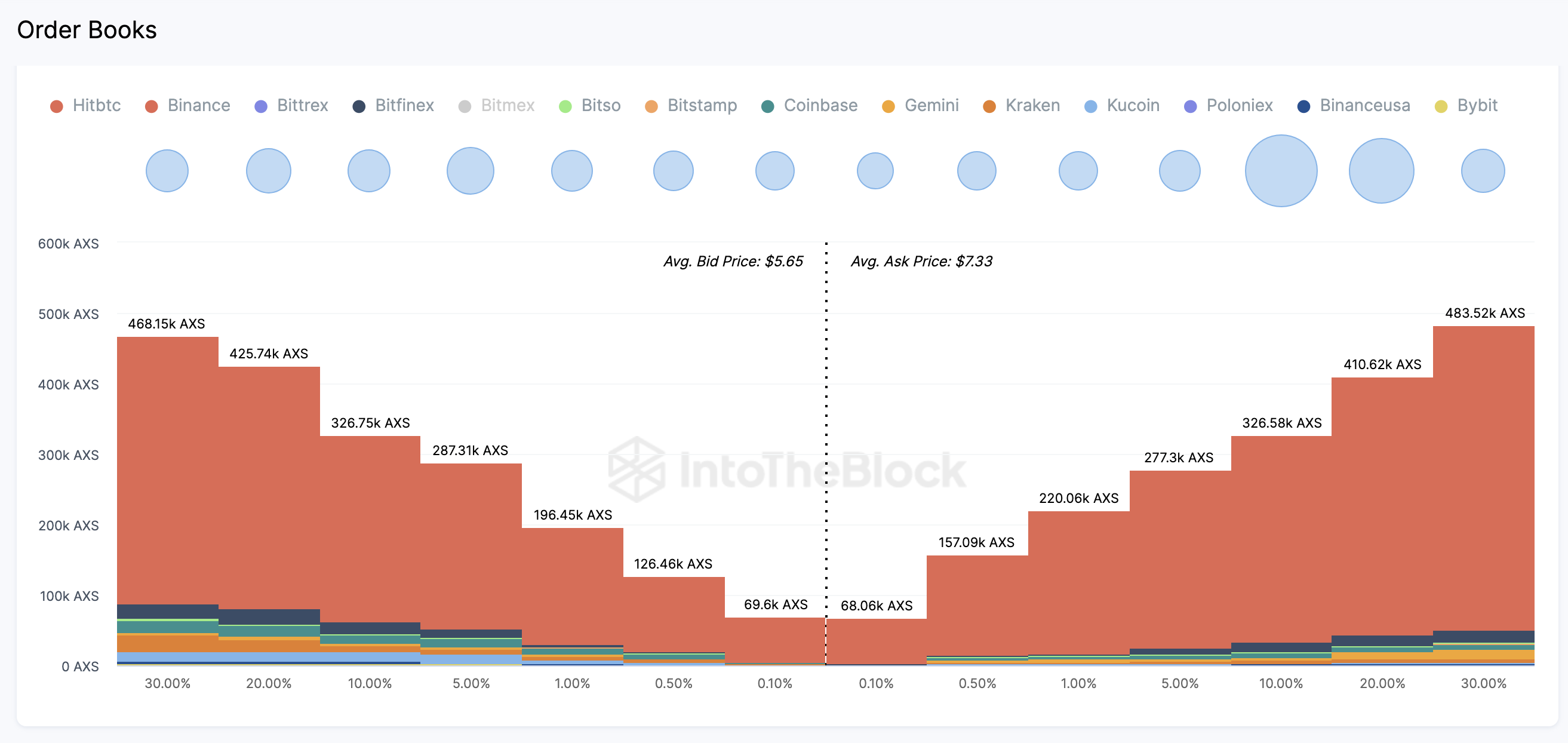

As the top 100 largest investors accelerate their selling frenzy, on-chain data shows that bearish sentiment is now spreading toward the retail market as well. According to the latest data pulled from the Aggregate Order Books of 10 crypto exchanges, bearish traders have started mounting large volumes of sell orders.

As seen below, investors in the leading Play-2-Earn project have queued up active orders to sell off 1.94 million AXS tokens around the current price. Notably, the 1.94 million AXS sell-orders far outweigh the total active buy-orders currently standing at 1.83 million AXS.

The aggregate exchange order books chart tracks the current price distribution of active buy/sell orders listed for a particular digital asset. When the number of buy orders falls short of sell orders, as observed above, it indicates that the bears are in the driving seat.

In summary, the top 100 investors reducing their holdings and the 110,000 AXS demand shortfall indicate that the trading sentiment within the Axie Infinity ecosystem is now dominantly bearish. If these current on-chain movements and market dynamics persist, AXS traders can anticipate more downside in the days ahead.

AXS Price Prediction: Possible Reversal to $4?

At press time, AXS price is currently hovering around the $5.73 area, down 7% in the last 24 hours. And from an on-chain perspective, AXS seems in a prime position for more downside.

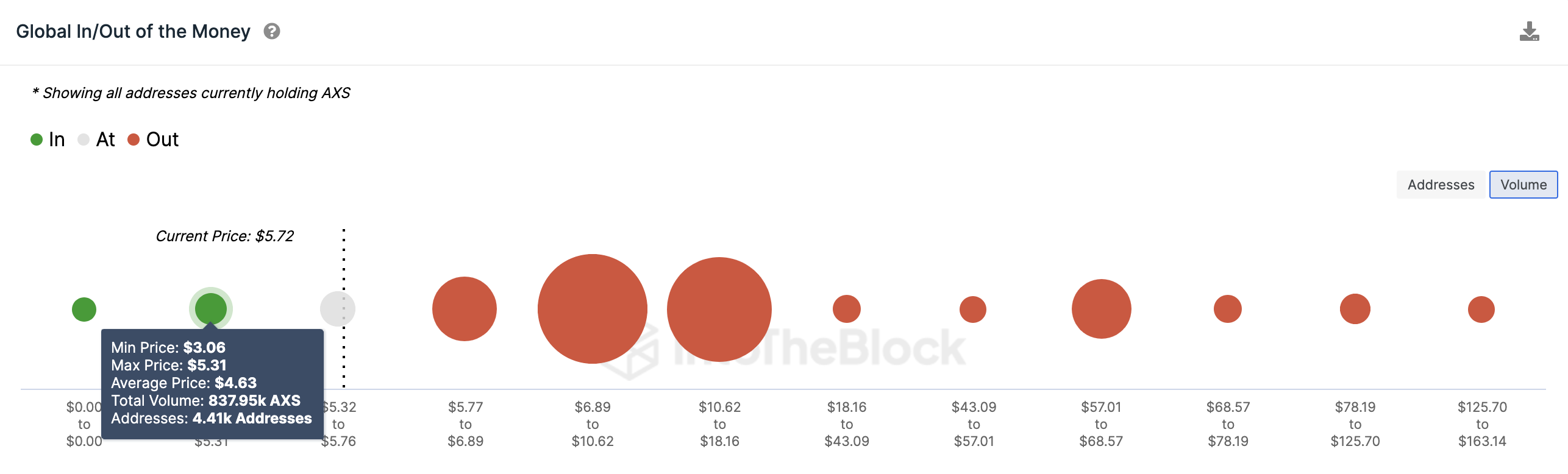

The Global In/Out of the Money (GIOM) data, which groups Axie Infinity holders by their entry prices, also confirms this outlook. It, however, shows that the bulls could mount a formidable support buy-wall at the $5.30 area.

As depicted below, 4,410 addresses had bought 837,950 AXS tokens at the average price of $5.32. This is the largest support cluster below the current AXS price. If they frantically defend that support area, AXS could avoid a major price downswing.

But if the top holders keep up the month-long selling trend, the AXS bears could force a $4 retest.

On the downside, the bulls could restart the GameFi comeback if AXS price can break out above $7. But in that scenario, the sell-wall around $6 could pose a challenge. At that zone, 8,120 current addresses had bought 25.8 million AXS at the average price of $6.30. If they HODL firmly, the AXS price could gain bullish momentum to reclaim $7.

However, failure to hold that support level could see Axie Infinity’s price retrace toward $4.

Read More: 9 Best Crypto Demo Accounts For Trading

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.