Axie Infinity, like every gaming metaverse project, gained some steam during the crypto rally of January 2023. Yet, AXS, the native token of the Axie Infinity ecosystem, showed strength long before this despite the enduring bear market. This Axie Infinity price prediction will unpack the reasons behind the AXS price movements using fundamental, technical, and on-chain analysis for both the short and long-term.

- Axie Infinity: fundamentals and price movement

- Axie Infinity price prediction and tokenomics

- AXS price prediction and the role of key metrics

- Axie Infinity price prediction and technical analysis

- Axie Infinity (AXS) price prediction 2023

- Axie Infinity (AXS) price prediction 2024

- Axie Infinity (AXS) price prediction 2025

- Axie Infinity (AXS) price prediction 2030

- Axie Infinity (AXS) long-term price prediction until 2035

- Is the Axie Infinity price prediction model accurate?

- Frequently asked questions

Want to get AXS price prediction weekly? Join BeInCrypto Trading Community on Telegram: read AXS price prediction and technical analysis on the coin, ask and get answers to all your questions from PRO traders! Join now

Axie Infinity: fundamentals and price movement

Axie Infinity is making immutability and transparency cool again. The pet-based digital play-to-earn game operates in a decentralized ecosystem.

The modus operandi is simple: players collect, raise, trade, and battle NFTs called Axies — which are the primary characters of the ecosystem. SLP, or Smooth Love Potion, is the in-game currency relevant to Axie Infinity’s open gaming universe. While SLP handles breeding and in-game purchases, AXS tokens or Axie Infinity Shards operate as governance, staking, and even purchase tokens.

Did you know? Axie Infinity even impacted the economy of specific countries. These include that of Philippines, where during the pandemic, the individuals turned to the game as a source of income.

Sky Mavis is the firm behind the blockchain gaming ecosystem, with Aleksander Larsen and Trung Nguyen as the co-founders. Here are some of the key insights that make Axie Infinity fundamentally desirable.

Additional insights

Axie Infinity has a significant investor lineup, including Animoca Brands, ConsenSys, and Binance Labs. AXS, or the Axie Infinity Shards, and SLP, or Smooth Love Potion tokens, are tradable and contribute to the transparency and incentivizing traits of the ecosystem.

The ecosystem features a built-in marketplace that mostly deals with in-game ERC-721 tokens and NFTs. Plus, there is an upcoming Land-specific project, Lunacia. This will allow the Axie Infinity ecosystem to shell out tokenized land plots as the base of operations.

“In this environment, grateful to get to keep supporting amazing founders with our new $1.35B raised. Consumer, gaming, and blockchain founders, excited to talk to you.”

Amy Wu, Gaming Partner at Menlo Ventures: X

Overall, play-to-earn gaming setups are growing, and investors are paying increasing attention to blockchain gaming. As such, projects like Axie Infinity, The Sandbox, and Gala Games are all expected to benefit. However, the dual-token architecture of Axie Infinity makes this ecosystem stand out.

Axie Infinity price prediction and tokenomics

Another positive for the Axie Infinity ecosystem comes from the AXS token economics model. The crypto world expects every AXS token to be unlocked by 2026, thanks to the token release algorithm powering the ecosystem.

It is essential to note that AXS and even SLP are ERC-20 tokens, courtesy of the Ethereum-based setup. As for AXS, the tokens support staking and play a major part in handling the governance-based and transaction-specific setups. Also, being ERC-20 makes the Axie Infinity Shards or AXS tokens compatible with most Ethereum-specific crypto wallets.

There is just one alarming element here. As of February 2023, the top 100 AXS holders control 99.19% of the total supply. This number needs to decrease for the price of AXS to become less volatile over time.

Yet, last December 2023, 94.49% of the whales control the overall supply. However, only 3.32% make the trading folks. All of that makes for some optimism at the AXS counter.

AXS price prediction and the role of key metrics

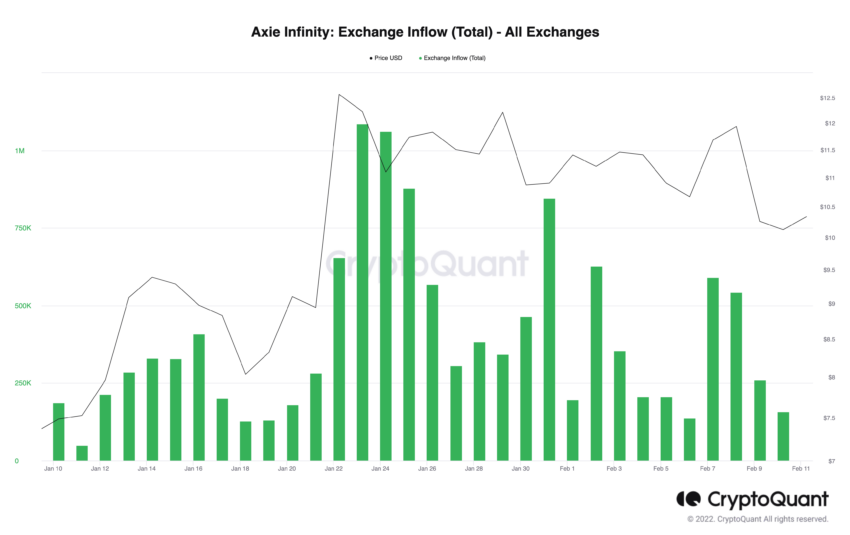

Notice that every time the exchange inflow volume of AXS moved above the 750K mark, there was a correction. And while the price of AXS was down 12.15% week-on-week, there had been a steady decline in exchange inflow volumes as of Feb.14, 2023. It is important to note that a similar decline in early January powered the price surge at the AXS counter.

The exchange inflow trend seems to have pacified in December 2023, triggering an upmove at the price counter.

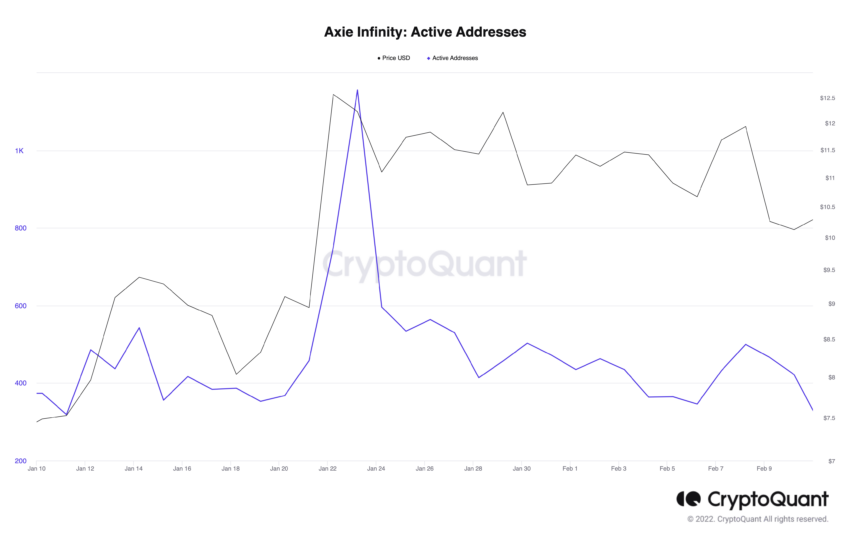

The active address chart also paints an interesting picture. Notice that until January 2023 — when the prices were closer to the recent peak — the active address line was moving close to the price action line. Things changed in February, leading to a decline in the number of active addresses sending and receiving AXS. In comparison, the prices have managed to stay steady. Any rise in the number of active addresses can power the prices up.

In December 2023, the active address count picked up steam, signaling a fresh wave of adoption. This might work well for the price action.

Lastly, the price volatility chart shows prices have dipped close to the volatility peak. And there have been smaller price peaks closer to the volatility troughs. Considering this historical dataset, you can expect AXS to consolidate in the short term as the metric is moving towards a high.

The on-chain and price-specific metrics are throwing mixed reactions. For more, we will need to look at the technical analysis.

Axie Infinity price prediction and technical analysis

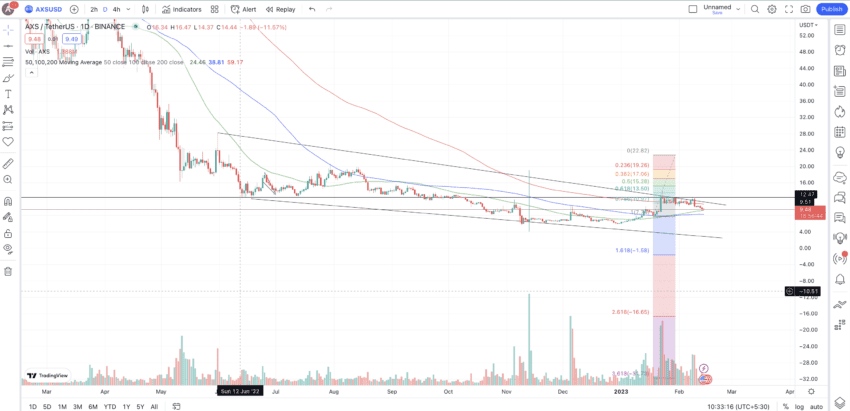

Our technical analysis from Dec. 5, 2022, placed the long-term resistance at $9.50 — the price AXS is trading at the time of writing. But for now, let us take another look at the short-term chart.

Our early analysis

It is worth seeing how we identified $13.50 as a crucial resistance level for AXS. And sadly, AXS couldn’t breach the same in 2023, as of December 27, 2023. Here is how we went about the same:

A falling wedge pattern was in play, with the current price of AXS closer to the descending resistance trendline. Notice that AXS tried to break out of the descending trendline earlier, but the volume pillars didn’t support it. Currently, $9.51 remains a crucial resistance, followed by $10.97 and $13.50.

The only heartening news is the occurrence of a golden crossover — with the 50-day moving average line (green) crossing above the 100-day moving average line (blue). If the green line crosses above the red line even (200-day moving average), we can see the prices increase. Still, the broader crypto market should permit such an up-move.

Our late 2023 analysis

You can clearly see AXS breaking out of the cup and handle pattern. However, to keep the momentum going, AXS needs to trade with high volume. Well, the RSI is in the overbought region, which might push the prices down in the short term.

Now, look at the weekly chart to locate any lasting or broader trends.

Pattern identification

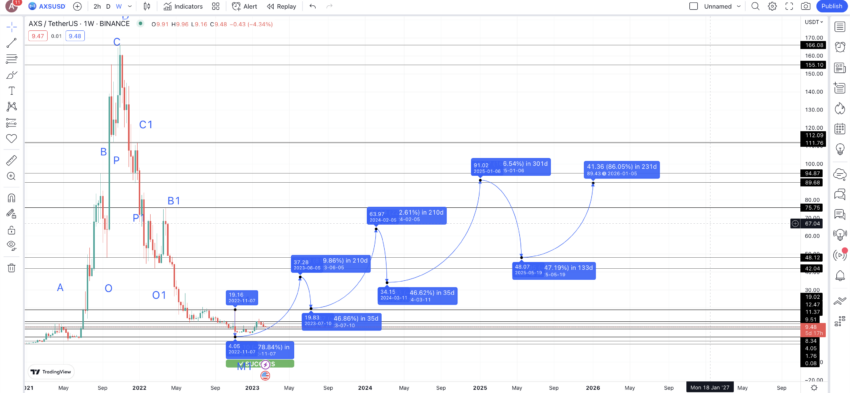

If you look at the weekly AXS-USDT chart, you will notice that the price has been on a downward trend since the peak of $165.37, formed on Nov. 6, 2021.

And the reason is quite clear. The RSI dropped, and there was no way the prices could sustain the drop in momentum. However, the recent trend, in addition to the positive short-term analysis, hints at a possible price improvement.

Notice that the price action is on a shaper downward slope, whereas the RSI seems to be flatlining instead of dropping, similar to the price action. Another RSI peak, above the last peak obviously, can push the prices higher and kickstart a new pattern.

The usual pattern comprises three higher highs, a peak, and three distinguishable lower lows. We can expect a new high to form above the last high, which might help start a fresh foldback pattern for AXS.

Here are all the points marked for your reference:

Price changes

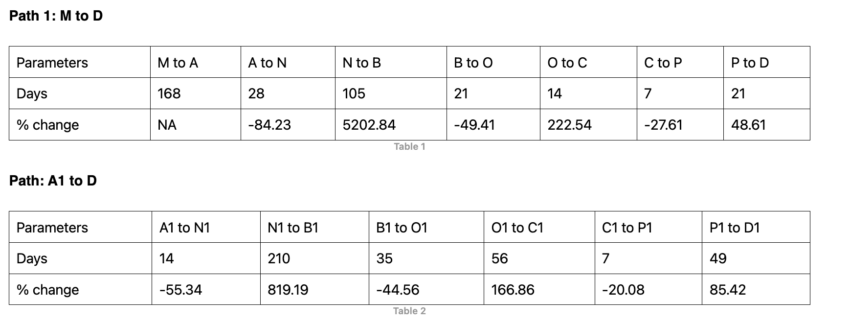

Our job is to locate the last low of this pattern or M1. Once we have that level, we can use the high-to-low and the low-to-high price change percentages to plot the subsequent price paths for AXS tokens.

But for that, we need to locate the price percentage changes and the distance between each point, corresponding to two paths, M to D and A1 to D.

Note that we wouldn’t take the M to A % change for calculating the average. This is because the value is exorbitantly high and not aligned with the current market conditions.

Calculations

Based on the data from the provided tables, we can deduce the following statistics:

The average increase from low to high is 1090.91%, calculated as the average of all non-negative column values. Conversely, the average decrease from high to low is -46.87%, determined from the average of all negative column values.

It’s important to note that the time required for these changes can vary, falling between the maximum and minimum distances observed between each point. Specifically, the time range for low-to-high movements is between 210 and 14 days, as indicated in Tables 2 and 1. This range is between 35 and seven days for high-to-low movements, also sourced from Table 2 and Table 1.

Additionally, the average percentage change is not a fixed value. The actual peaks and troughs may assume any percentage level from the tables, influenced by the broader conditions in the crypto market.

Axie Infinity (AXS) price prediction 2023

Even though AXS didn’t surge per our expectations, the price prediction pattern for 2023 makes sense, considering 2024 to be a more than optimistic year for gaming.

We can now use the data from the previous section to locate the price of Axie Infinity in 2023. However, before we proceed, we need to locate the M1 from the A1 or the last point on the chart. As the current market consolidates, a dip of -46.87%, using the high-to-low average, isn’t out of the question.

Notice that the week AXS reached a peak of $19 or A1, it dropped to its lowest possible value of $4.05, translating into a drop of almost 79%. Notice that the drop percentage aligns with our maximum drop percentage value of 84.23% from Table 1.

Now that we have M1 at our disposal, we can use the low-to-high percentage values to plot the next point or even A3.

Notice that AXS already moved up by almost 250% from the low of $4.05. Therefore, we can expect the high to go as far as 819.19% (second highest price percentage peak) in 210 days (the max distance). This puts the Axie Infinity price forecast for 2023 at $37.28.

The low in 2023 can be at a drop of -46.87%, owing to the stronger market conditions. Hence, the lowest price of Axie Infinity tokens going into 2023 can surface at $19.81 — a level coinciding with A1 or one of the previous lower highs.

Projected ROI from the current level: 292%

Axie Infinity (AXS) price prediction 2024

Outlook: Bullish

From the 2023 low, AXS can go as high as 222.54% (third highest peak) in 2024. This is due to the law of averages, as an 800+ percent move in 2023 might be difficult to replicate even in 2024. This puts the Axie Infinity (AXS) price prediction for 2024 at $63.97.

The low in 2024 could drop by -46.87%, per the high-to-low average. This puts the lowest price of Axie Infinity in 2024 at $34.15. However, as AXS didn’t surge a lot in 2023, you can expect the low to form near the $12.56 mark — which was the high of 2023.

Projected ROI from the current level: 576%

Axie Infinity (AXS) price prediction 2025

Outlook: Bullish

After moving up to $63.97, we can expect some correction at the AXS counter. Keeping this assumption in mind, the next high could surface at the peak of 166.86% (the fourth highest move from the tables above). This level might surface in 2025, putting the Axie Infinity price prediction high at $91.02.

Projected ROI from the current level: 856%

Axie Infinity (AXS) price prediction 2030

Outlook: Very bullish

With the price movement of AXS tokens surfacing close to $91.02 by 2025, we can expect the next low to take support at $48.12, which translates to a drop of -46.87%. Notice that 46.87% is the average high-to-low percentage we came across during initial calculations. The price of Axie Infinity taking support at this drop level further validates the accuracy of our Axie Infinity price prediction model.

The next high, keeping the yearly moves in mind, can surface at a high of 85.42% from the last low. This is the second lowest growth percentage, inferred from the tables above. This puts the Axie Infinity price forecast level for 2026 at $89.43.

This level might be lower than the 2025 high. So, by 2026, the price of AXS might experience some weakening due to constant selling. However, the growth in the play-to-earn gaming space by then would mean that post-2026 AXS might again surge, provided it sees higher trading volume.

Therefore, we can connect the 2026 high and 2025 low using the Fib levels. This extrapolation puts the price of Axie Infinity at $401.90 by the end of 2030. To reach this level, AXS tokens should see an increase in 24-hour trading volume and a price breach above the existing high of $165.37 by early 2029.

Projected ROI from the current level: 4126%

Axie Infinity (AXS) long-term price prediction until 2035

Outlook: Bullish

You can easily convert your AXS to USD here

Now we have charted the price movement (s) of AXS tokens till 2030, we can consider how AXS tokens might move through to 2035. If the possibility piques your interest, here is the table to follow:

| Year | | Maximum price of AXS | | Minimum price of AXS |

| 2023 | $12.56 | $4.13 |

| 2024 | $63.97 | $12.56 to $34.15 |

| 2025 | $91.01 | $48.12 |

| 2026 | $89.43 | $69.75 |

| 2027 | $134.14 | $104.63 |

| 2028 | $181.09 | $141.25 |

| 2029 | $271.64 | $211.87 |

| 2030 | $401.90 | $249.18 |

| 2031 | $542.56 | $423.19 |

| 2032 | $759.59 | $592.48 |

| 2033 | $987.46 | $612.22 |

| 2034 | $1333.08 | $1039.80 |

| 2035 | $1666.35 | $1299.75 |

Is the Axie Infinity price prediction model accurate?

This Axie Infinity price prediction model is reliable for the following reasons. Firstly, the discussion captures the on-chain and fundamental metrics of Axie Infinity. Secondly, the technical analysis and long-term AXS price predictions are data-centric and consider moving averages and RSI indicators. Overall, this Axie Infinity price prediction piece is well-informed and as practical as possible in a volatile and dynamic crypto market.

Frequently asked questions

What will Axie Infinity be worth in 2025?

Is AXIE a good investment?

Does AXIE still have a future?

How high can Axie Infinity go?

What will AXS be worth in 2030?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.