The Avalanche (AVAX) price has increased swiftly since the start of October, reaching $26.96 today.

During the ascent, AVAX moved above a long-term horizontal resistance area. Can it maintain its increase above it?

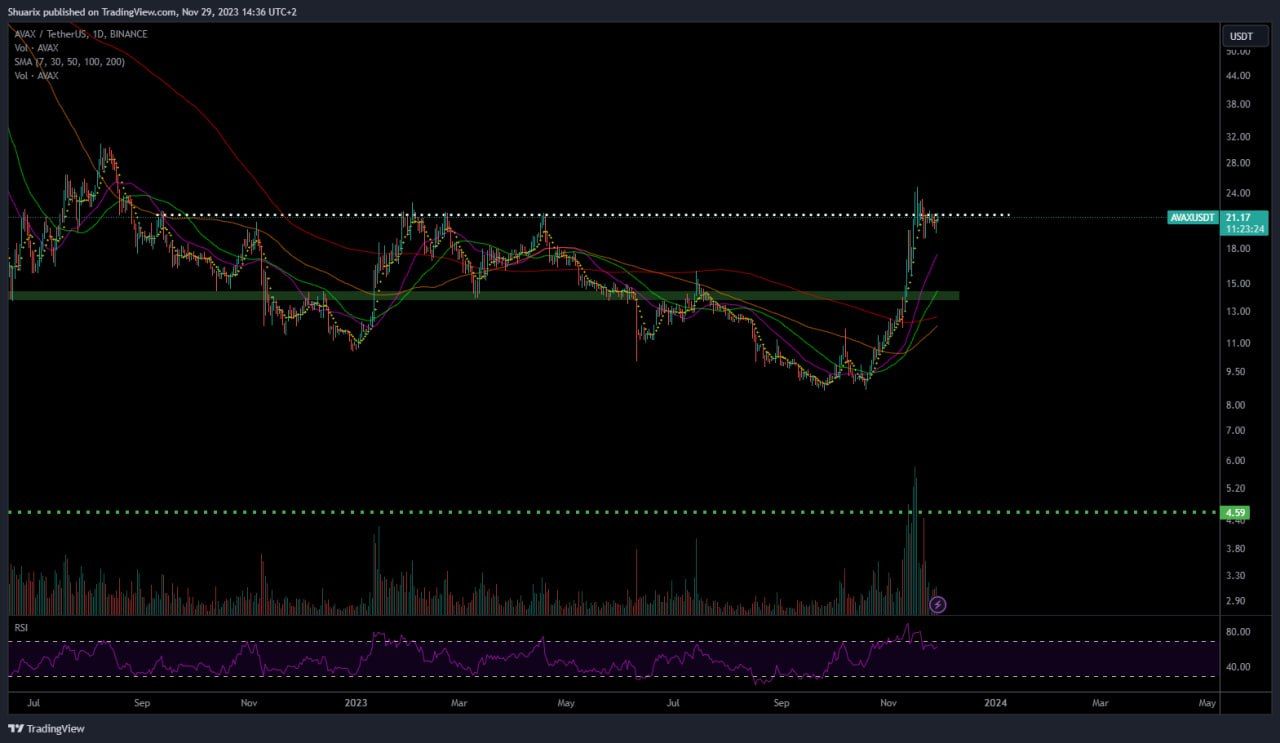

AVAX Clears Long-Term Resistance Trend Line

The technical analysis of the weekly time frame shows that the AVAX price has increased quickly since the start of October. The AVAX price has increased by 200% so far, culminating with a new yearly high of $26.96 today.

The AVAX price broke out from two key descending resistance trend lines during the ascent. The first (solid) trend line had been in place since August 2022, while the second trend line (dashed) had been there since the all-time high.

Market traders use the Relative Strength Index (RSI) as a momentum indicator to identify overbought or oversold conditions and to decide whether to accumulate or sell an asset. Readings above 50 and an upward trend indicate that bulls still have an advantage, whereas readings below 50 suggest the opposite.

The weekly RSI is increasing and is above 50. While the indicator moved into overbought territory (green icon), the previous time it did so led to an all-time high price.

What Do Analysts Say?

Cryptocurrency traders and analysts on X have a bullish view of the future AVAX trend.

Just before the breakout, Shuarix suggested that the AVAX price would clear the $22 level and reach a new yearly high. He stated that:

$AVAX #Avalanche price is likely to break the resistance line if this kind of recent volume is getting back. In the past 42 days it had a 180% increase, like lots of coins that are recovering. Right now, a small correction of a positive impulse, we might see another push.

Degen Hardy also believes that the price action favors the bulls, predicting that the AVAX price will increase toward $26. The most bullish analyst out of the three is Javon Marks, who expects the price will reach its all-time high and reach $120.

Read More: Best Upcoming Airdrops in 2023

AVAX Price Prediction: Is $30 the Next Stop?

Technical analysts employ the Elliott Wave theory to identify recurring long-term price patterns and investor psychology, which helps them determine the direction of a trend.

The most likely count from the daily time frame suggests that the AVAX price is in the fifth and final wave of its upward movement that began in October.

The daily RSI supports this bullish count. The indicator is increasing, is above 50, and broke out from its bearish divergence trend line (green). These are all considered signs of a bullish trend.

If the increase continues, the next most likely target for the movement’s top will be $44. This would give wave five 0.618 times the length of waves one and three combined. A 70% AVAX price increase is required to reach it.

If wave five extends further, AVAX can reach the next target at $58, giving wave five the same length as waves one and three combined.

Despite this bullish AVAX price prediction, a close below the $22 horizontal support area will invalidate the count. A 40% drop to the next support at $16 will likely occur in that case.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.