The Avalanche (AVAX) price has been on a downtrend since October 7, when Stars Arena suffered a hack.

The decrease also validated the long-term $10.50 horizontal area as resistance.

Avalanche Fails to Clear Horizontal Resistance

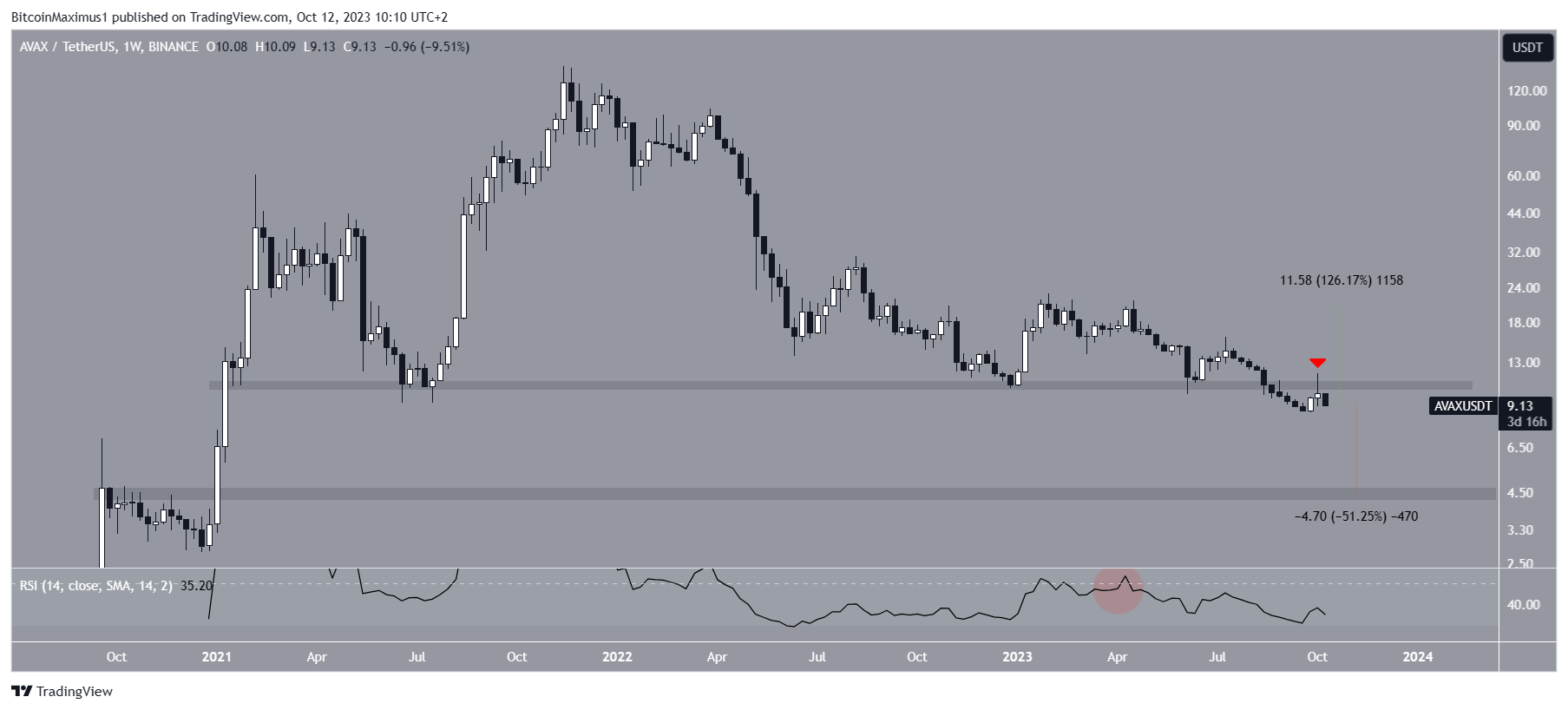

The technical analysis from the weekly timeframe shows that the AVAX price could not sustain its increase last week. While it initially reached a high of $11.88, it failed to close above the $10.50 horizontal resistance area.

Rather, it created a long upper wick (red icon) and fell below it.

The $10.50 area is crucial since the altcoin has traded above it since 2021. After falling below it in August, AVAX made its unsuccessful attempt at reclaiming it last week.

The area is now confirmed as resistance.

The previous increase in Avalanche‘s price picked up momentum soon after introducing Stars Arena, a SocialFi platform built on the Avalanche blockchain.

Stars Arena is a derivative of Friend.tech, another Social Finance (SoFi) platform that has been grappling with phishing problems lately.

However, Stars Arena was hacked on October 7, which could have catalyzed the ongoing AVAX price downtrend. It has since recovered 90% of its funds after reaching an agreement with the attacker.

This cost the team 27,610 AVAX, worth $252,000 at the current price. A new smart contract has now been put into effect.

AVAX Price Prediction: Will Bearish RSI Lead to More Downside?

The weekly RSI supports the continuation of the decrease.

Market traders use the RSI as a momentum indicator to identify overbought or oversold conditions and to decide whether to accumulate or sell an asset.

Readings above 50 and an upward trend indicate that bulls still have an advantage, whereas readings below 50 suggest the opposite. The indicator is below (red circle) and moving downwards, both considered signs of a bearish trend.

Read More: 9 Best Crypto Demo Accounts For Trading

If the decrease continues, the closest support will be at $4.40, 50% below the current price.

Despite these bearish readings, well-known traders @VikingXBT and @TheShamdoo believe that the relaunch of the Stars Arena is enough of a catalyst to initiate new longs for AVAX in anticipation of reclaiming the $10.50 resistance.

Even though the AVAX price prediction is bearish, reclaiming the $10.50 area can lead to a 125% increase towards the next resistance at $20.50.

For BeInCrypto’s latest crypto market analysis, click here.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.