Avalanche (AVAX) price retested the $20 on Monday for the first time since April 2023. Leading cryptocurrency analyst, Hitesh Malviya identifies the GameFi revival within the Avalanche ecosystem as a major growth catalyst that could trigger further AVAX price gains.

Avalanche price attracted investor interest over the past week, racing to a six-month peak of $20. What are the fundamental catalysts behind this price breakout and how much further can the bulls drive the rally?

GameFi Resurgence Triggers Massive Adoption and Fee Burns

AVAX price has gained 75% in the last 10 days, becoming the second-best performing mega-cap altcoin this month, behind Solana (SOL). Looking beyond the broader altcoin market rally, on-chain data has revealed the fundamental drivers behind the ongoing AVAX price rally.

Crypto analyst Hitesh Malviya recently told BeInCrypto that newly launched GameFi subnets are a major driver propelling AVAX adoption.

A subnetwork (subnet) is a separate blockchain protocol built to operate within a native Layer 1 blockchain protocol. Within the Avalanche ecosystem, these subnets supply validators that various blockchains can share.

In an elaborate tweet, Malviya explained that Avalanche gaming subnets like DFK and DEXALOT are already processing more transactions than the Avalanche C Chain.

“Avalanche subnets DEXALOT and DFK are processing more transactions than the Avalanche C Chain,” Malviya said.

In effect, this has increased the number of tokens burned as gas fees in the past month.

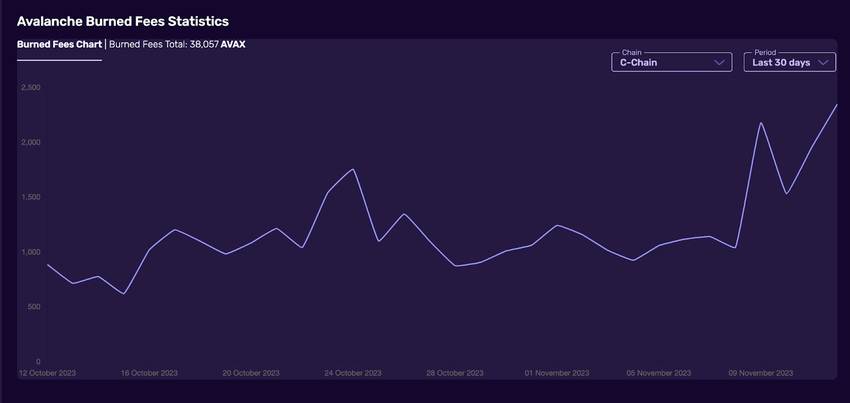

Avalanche burns 100% of its revenue from transaction fees. And the increased network traction from the gaming adoption appears to have accelerated the AVAX burn rate. The chart above illustrates that the Avalanche network has burned 38,057 AVAX in the last 30 days. Essentially, an increased burn rate during a rally is an indication that the price uptrend is currently being driven by organic transactional activity.

Hence, this implies that the ongoing AVAX price breakout is powered by the underlying network activity rather than a case of speculators piggybacking on the broader altcoin market rally.

Notably, according to Malviya, new gaming subnets Shrapnel and Loco Legends are billed to “go live soon.” If they have a similar level of impact as the DEXALOT and DFK subnets, AVAX price rally could hit historic highs in the weeks ahead.

Read more: What Is Avalanche (AVAX)?

Avalanche Holders and Validators Staked 36 Million AVAX Tokens in last 10 days

Avalanche has witnessed a noticeable increase in staking recently, further affirming that the bullish price action is driven by fundamental network activity.

“116 new validators were recently added to the Avalanche Network. With a minimum entry requirement of 2000 AVAX for each validator, this implies that 232,000 AVAX has been staked and effectively temporarily removed from circulation,” said Malviya.

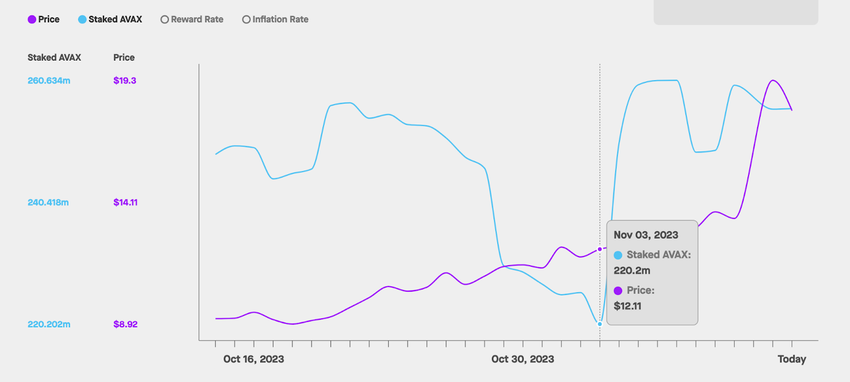

On-chain data tracker, StakingRewards, confirmed Malviya’s claims, showing there were 220.2 million AVAX tokens staked across various smart contracts as of Nov. 3. But that figure has since rapidly increased, hitting 255.91 million AVAX as on Nov. 13.

The graphic below shows that Avalanche holders deposited 36 million AVAX into smart contracts within the last 10 days.

Staking is a process in which cryptocurrency investors deposit their assets into dedicated smart contracts to either secure the network or participate in specialized ecosystem activities. An increase in staking during a rally is often bullish for a number of reasons.

Firstly, staking temporarily removes tokens from circulation. For instance, the 36 million AVAX staked in the last 10 days is worth $720 million when valued at $19. In a strong demand market, such a large reduction in market supply is likely to trigger a price hike. Unsurprisingly, AVAX’s 75% price breakout over the last 10 days, has coincided with the 16% increase in AVAX staking.

With new GameFi projects in the works, Avalanche holders and node validators could be incentivized to keep their tokens staked. If demand remains strong, AVAX price rally could hit historic highs in the coming weeks.

Read more: Top 9 Telegram Channels for Crypto Signals in 2023

AVAX Price Forecast: Could Bulls Reach for $30?

From an on-chain standpoint, the increased staking and rising network activity from GameFi adoption are fundamental drivers behind the ongoing AVAX price rally. With these indicators still on the uptrend, it puts AVAX’s price in good stead for further gains.

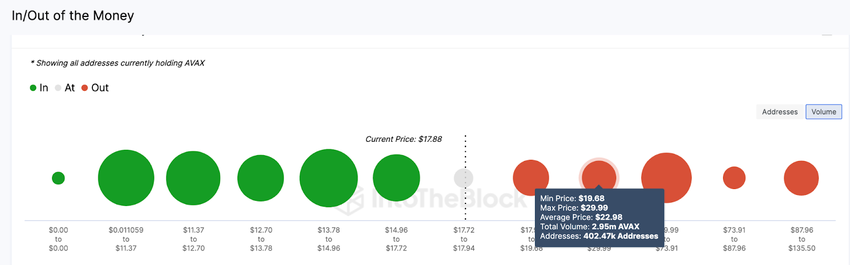

The Global In/Out of the Money (GIOM) data, which groups the current Avalanche investors according to their entry prices, also confirms this bullish AVAX price prediction.

However, the bears must break the initial resistance at $23 to be confident of reclaiming $30. As depicted below, 402,470 holders had bought 2.95 million AVAX at the average price of $22.98. If those investors exit early, they could trigger an AVAX price correction.

But if the bulls can scale that sell-wall, the Avalanche price will likely reclaim $30 as predicted.

Still, the bears could negate the optimistic prediction if AVAX price dips below $12. But, in that case, the 771,030 holders that bought 7.97 million AVAX at the minimum price of $14.96 could offer initial support. If those investors HODL firmly, Avalanche price will likely avoid a larger downswing.

Read More: Best Upcoming Airdrops in 2023