Crypto news: It hasn’t been a good week for the US Securities and Exchange Commission (SEC), who were challenged in how they interpret US securities laws. The agency also affirmed that it could not contact PulseChain founder Richard Heart to serve notice of its July enforcement.

This week, BeInCrypto’s technical analyst Valdrin Tahiri noted six bullish candlesticks for Bitcoin (BTC) in October. Advice from investors and traders points to notable crypto growth in the coming months, and we start with one of the most polarizing of them all: Jim Cramer, the host of CNBC’s Mad Money.

Cramer Goes Mad for Bitcoin

On Sunday, Cramer flipped bullish on Bitcoin after previously saying all the money that could be made in Bitcoin had been made. The move confounded investors, some of whom suggested adopting an anti-Cramer strategy.

But crypto experts cautioned that there was no reason to sell Bitcoin yet. BeInCrypto’s Ali Martinez predicted critical resistances at $38,440 and $47,360, while others see Bitcoin rising above $41,000. BTC has broken the first resistance level and is currently trading at $38,440.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

Raoul Pal Says Crypto Will Beat Tech

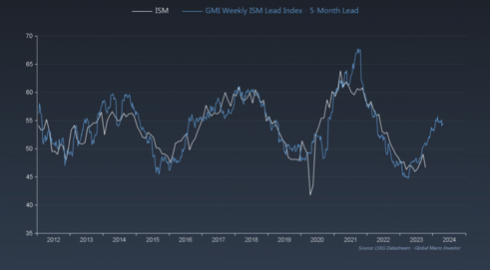

Prominent investor Raoul Pal agreed somewhat, believing crypto will beat tech stocks in 2024. He said this in a Twitter thread he posted on Monday.

“Using our GMI Financial Conditions Index, we can peer 11 months into the future, suggesting a strong year in 2024. This is where the growth assets of NDX and Crypto live. This is why they bottomed before everything else…”

Researcher and analyst Vetle Lund said open interest for long Bitcoin positions is at an all-time high. The high premium between Bitcoin and futures contracts is a bullish indicator for Bitcoin.

Bitcoin’s Bullish Candlesticks

Speaking of bullish predictions, BeInCrypto’s technical analyst Valdrin Tahiri noted how swiftly Bitcoin had risen in October. It reached an annual high of $38,437 that month.

On the way to this high, Bitcoin created six consecutive bullish candlesticks. The last time this happened was when the previous bull cycle was starting, around October 2020.

However, Bitcoin can still drop 6% to its next support level of $35,000, Tahiri noted, according to Elliot Wave Theory. The method uses long-term price patterns and investor psychology to determine a trend’s direction.

Hoskinson Critiques SEC Crypto Test

There have rarely been dull moments during SEC chairman Gary Gensler’s war on crypto. This week, however, the agency became the implied object of Cardano co-founder Charles Hoskinson’s wrath.

Hoskinson slammed the inconsistent application of US securities laws. ADA is not anymore a security than Bitcoin, given the right context, Hoskinson said.

Crypto lawyer John Deaton agreed, saying an asset’s use is more important when testing whether it might be a security. According to the Howey Test, Bitcoin’s initial sale by Satoshi Nakamoto was likely an unregistered securities offering.

As a result, it’s not enough to consider the asset only when deciding whether it is a security. The circumstances that define a sale must be factored into the judgment, rather than the opinions of so-called Bitcoin maximalists.

Read more: What Is Bitcoin? A Guide to the Original Cryptocurrency

SEC Fails to Find Pulse of Richard Heart

The SEC encountered more problems after being unable to confirm whether PulseChain founder Richard Heart received its July lawsuit. The agency accused Heart of raising $1 billion through an unregistered securities offering.

Heart reportedly lives in Finland, making reaching him difficult for the SEC. He allegedly offered investors up to a 38% annual return for locking up tokens for an extended period.

Read more: What Is a Rug Pull? A Guide to the Web3 Scam

Terra Firma or Not Just Yet?

Over 18 months after it collapsed, the Terra Classic blockchain showed signs of life. On Nov. 22, the blockchain recorded almost double the daily average transaction count in October. The number of tokens staked also increased to 15% of the supply two days later. Terra Luna (LUNC) also recorded a 60% price increase in the month.

Read more: What Is Terra (LUNA)?

But time will tell whether these numbers are a false positive or the start of a trend. Sustained growth in network use will be needed to make Terra Classic a serious contender in the crowded blockchain space.

Crypto – Socially Speaking

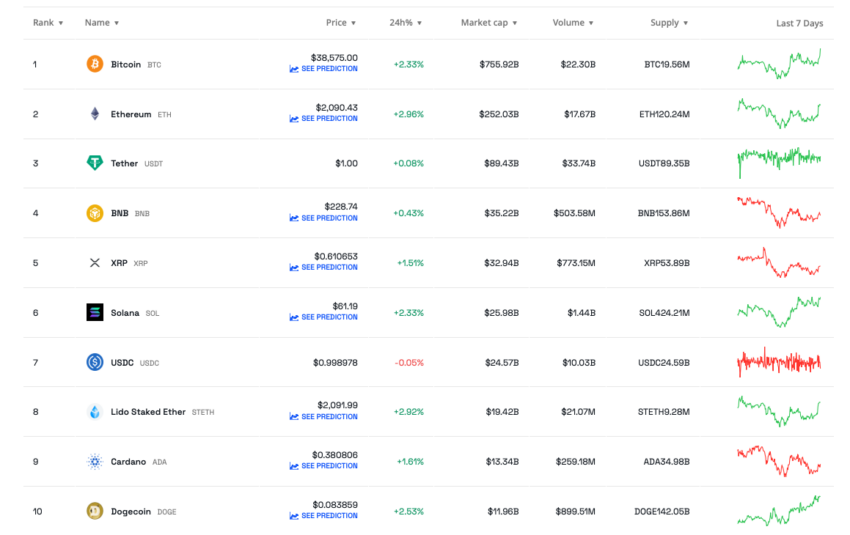

Top 10 Cryptos’ Performances This Week

Do you have something to say about the biggest crypto news this week, or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.