This week, crypto market participants have several events in the pipeline that could affect their portfolios. These events span multiple ecosystems, from Aave and Worldcoin to Hyperliquid and Sui.

Forward-looking traders and investors can capitalize on the following headlines to position themselves strategically.

Aave Staking Mechanism

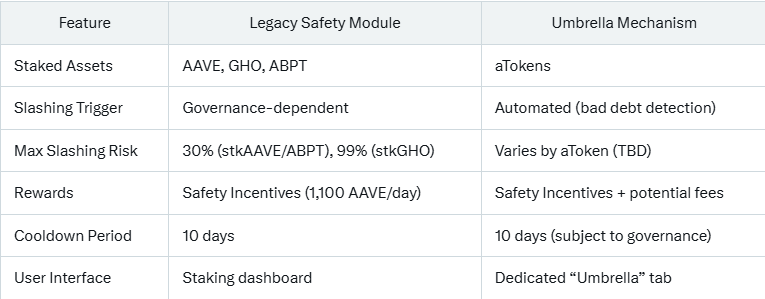

Kicking off the list of the top crypto news this week is Aave’s new staking mechanism, which is expected to launch soon. Aave’s prospective staking mechanism represents a significant development of its Safety Module, which was introduced through the Umbrella upgrade.

It will enhance protocol security, capital efficiency, and user experience. Umbrella shifts to staking aTokens, Aave’s receipt tokens representing supplied assets in liquidity pools. This is unlike the previous Safety Module, which allowed the staking of AAVE, GHO, and AAVE/WETH Balancer Pool Tokens (ABPT).

Accordingly, users can stake assets that are already earning yield from lending, effectively enabling stacked yield generation (earning staking rewards on top of lending interest).

“Aave’s Safety Module is a pool of staked AAVE tokens that can be used to cover deficits in the protocol during black swan events. Stakers earn rewards, but their tokens can be slashed in extreme cases,” one user on X (Twitter) remarked.

The general sentiment, therefore, is that Aave has found product-market fit in staking. This new mechanism and aggressive buybacks could inspire a liquidity vacuum across the sector.

Ionet’s New CEO AMA

Another top crypto news story this week concerns an AMA (Ask Me Anything) session hosted by Ionet, a Solana-based decentralized AI and cloud computing platform.

The event will also welcome Ionet’s new CEO, Tory Green, who could reveal the project’s next steps. Ahmad Shadid, Ionet’s former CEO and co-founder, resigned in June 2024, just before the IO token launch on Binance’s Launchpool.

The leadership transition sparked speculation due to allegations about Shadid’s conduct and the platform’s GPU capacity. This makes the AMA a critical event for clarity.

“Tory explains Ionet’s vision to become a better, cheaper, faster alternative to AWS and Google Cloud by tapping into millions of underutilized computing resources worldwide, and why crypto and AI have a symbiotic relationship together,” DeFi researcher Mr. Shift said recently.

OpenAI Social Platform

There is also anticipation for the OpenAI social platform announcement on April 30, with the expectation that they will use Worldcoin’s WLD token as its currency.

Sentiment on social media suggests the platform will not directly compete with X or Meta. Notwithstanding, it could redefine social media by leveraging AI-generated content and World ID for bot-free interactions.

“OpenAI launching a social app? Makes total sense. AI is about to drown the internet in content. We need real social…,” remarked one user in a post.

However, Worldcoin faces challenges. Among them are privacy concerns over biometric data collection, which led to bans in countries like Spain and Kenya. Additional concerns center around tokenomics issues, with 75% of tokens held by the community and 13.8% by investors, raising centralization fears.

DeFi App Perpetuals and Hyperliquid Integration

Another top crypto news this week is that DeFi App plans to launch its perpetual futures product, integrating with Hyperliquid, a high-performance Layer-1 blockchain optimized for decentralized finance (DeFi).

Hyperliquid’s DEX, known for its on-chain order book, supports over 150 assets with up to 50x leverage. It also offers gas-free trading and sub-second latency, processing 100,000 orders per second.

This integration leverages Hyperliquid’s $2 trillion trading engine, offering a centralized exchange-like experience with DeFi’s transparency and self-custody. DeFi App’s perpetuals product aims to capitalize on Hyperliquid’s deep liquidity and low slippage, competing with platforms like Bybit.

“CEX speed. DeFi custody. Perps on DeFi App launch next week,” wrote DeFi researcher Nick.

BeInCrypto data shows Hyperliquid’s HYPE token was trading for $18.25 as of this writing, up by almost 4% in the last 24 hours.

Kaito Connect Upgrade

Kaito Connect, a core component of Kaito AI’s Web3 information platform on the Base blockchain, has a major upgrade this week in crypto.

“Reminder, Kaito Connect upgrade is in the works! More ways to use KAITO & Yaps, more incentives, and new mechanisms,” the network shared recently.

The upgrade is expected to increase KAITO’s utility, among other things. The token powers the AI-driven InfoFi network, facilitating governance, transactions, and community incentives.

Specifically, the upgrade introduces new mechanisms to balance rewards between Yappers (active social media participants earning Yap points) and long-term KAITO holders. In doing so, it addresses prior criticisms of limited token utility confined to staking and governance.

The revamped Kaito Connect will shift from a voting-based model to an “alignment signals” system. This means integrating Yap points and staked KAITO (sKAITO) to ensure fairer incentives.

Additional features include enhanced Yapper Leaderboard mechanics via the Yapper Launchpad and boosted rewards for Genesis NFT holders.

With KAITO’s price at $0.97 and a $235 million market cap, the upgrade could drive adoption and liquidity, though token dilution risks remain with a maximum supply of 1 billion.

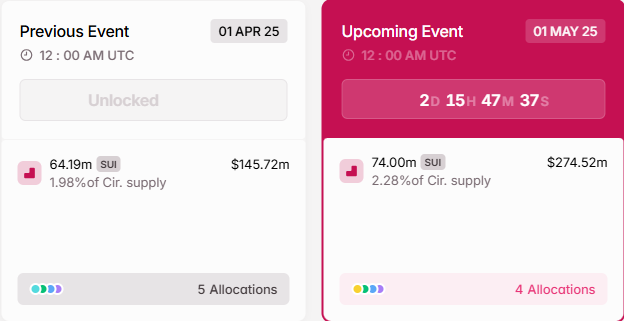

$274 Million SUI Unlock

As BeInCrypto reported, several token unlocks are in the crypto pipeline this week. Among them is the Sui blockchain, which will unlock $274.5 million in SUI tokens.

These 74 million tokens, comprising 2.3% of the circulating supply, will be allocated to early contributors, community reserve, Mysten Labs Treasury, and Series B funding.

BeInCrypto recently reported that large token unlocks tend to cause price dips, which means the Sui price may be due for a pullback. Investors can capitalize on the expected volatility to take long or short positions for SUI.

Infinex Upgrade

Infinex, a decentralized finance (DeFi) platform built by Synthetix, plans a notable upgrade. The update will enhance its cross-chain wallet, which supports over 1,000 tokens across Ethereum, Solana, Arbitrum, Base, Optimism, and BNB Chain.

“Next week’s Infinex release is a big one and it’s for everyone,” Infinex shared on X.

This upgrade aims to make Infinex seamless and deliver a centralized exchange-like experience while maintaining DeFi’s non-custodial security via passkeys and on-chain-recoverable vaults.

With $125 million in total value locked (TVL) and $67.7 million raised via Patron NFT (non-fungible token) sales, investors should watch for improved user experience and potential reward campaigns. However, centralization risks due to its Sydney-based operations remain.