Better known as perps, perpetual futures contracts are crypto trading instruments tied to the value of an underlying asset. Perps allow traders to speculate on the future prices of the asset. Unlike traditional crypto futures contracts that come with an expiry date, perpetual contracts are signed to perpetuity.

Per seasoned traders, perps mimic the spot crypto market in terms of accessibility and usability. And they provide a higher profit potential than traditional spot trading. But there remain a lot of risks in this high-stakes game. Here’s what you need to know.

BeInCrypto Trading Community in Telegram: get the hottest news on crypto, discuss Web3 with like-minded people. read technical analysis on coins & get answers to all your questions from PRO traders & experts!

- Unpacking perpetual futures contracts

- Traditional vs. perpetual futures contracts: how do they differ?

- Leverage in perpetual futures trading

- How do perpetual futures contracts work?

- Key elements of a perpetual futures contract

- Calculating profit and loss in case of a perpetual futures contract

- Why worry when you can hold futures contracts forever?

- CEX or DEX for playing the perpetual game?

- How to trade a perpetual futures contract

- Are perpetual futures contracts worth the trading effort?

- Frequently asked questions

Unpacking perpetual futures contracts

Perpetual futures contracts are exactly like traditional futures contracts with no expiry dates. Hence, they have the tag “perpetual” as the prefix. But let’s take a quick step back and examine futures contracts more generally.

A futures contract, corresponding to an asset market like crypto or equities, involves a buyer and a seller. The parties sign a legal agreement to either buy or sell a given asset at a given price and that too at a given date.

Imagine a farmer who grows wheat. The farmer wants to sell the wheat when the harvest season arrives, and he/she enters into a selling agreement with the buyer. Let us say that the contract says that the buyer will buy wheat from the farmer at $20 per bushel six months from now.

Regardless of the market price of wheat after six months, per the contract, the farmer gets $20 per bushel. If the market price is lower than this, the farmer gets a good deal; if the market price is higher, the buyer gets the better deal.

Having a predefined contract like this lowers any form of uncertainty and protects the farmer (the seller) from volatile price drops. It even protects the buyers from sharp surges.

In regards to financial markets like crypto, a futures contract is still an agreement between a buyer and seller — meant to offer risk management support or hedge against fluctuations.

Traditional vs. perpetual futures contracts: how do they differ?

Be mindful that each perp comes with an expiry date. For instance, the one between the farmer and the wheat buyer is set at six months from the date of the agreement.

Now imagine this — the farmer and the wheat buyer enter an agreement at $20 per bushel but with no expiry date. The farmer can sell anytime, and the buyer can buy anytime, depending on the terms of the agreement.

Do note that this is an oversimplified example. How long the perpetual futures contract remains open does depend on certain aspects! But we will get to that in time.

Perpetual swaps: what are they?

In crypto, the term perpetual swap is often used interchangeably with perpetual futures. They are synonymous with perpetual futures contracts, allowing you to trade an asset as a derivate. All that without an expiry date or need to own that asset.

Leverage in perpetual futures trading

Perpetual futures contracts lower volatility and give a hint of certainty to buyers and sellers. Yet, they are still considered quite risky trading instruments. And the reason is leverage.

As futures contracts are derivatives, tracking the value of an underlying asset, traders tend to invest a sizable chunk in them, expecting profits. As it is a high-stake game, the platform they are on offers high leverage for them to trade. Here is a quick example:

Imagine you have $1,000 and want to trade in Perpetual Futures on a platform offering 10x leverage. You end up opening a position worth $10,000 (using the 10x leverage). Now imagine you use the leveraged position to open a long position for an asset — planning to sell the asset higher in the future.

And say the asset’s price after two months goes as high as $12,000. The moment you sell, you can make a quick profit of $2,000. Remember that you only invested $1,000 and made $2,000. That’s the power of leverage.

However, leverage is a double-edged sword. Imagine the price of the asset drops by 10% — from $10,000 to $9,000. At this time, selling the contract could erode your entire capital of $1,000. Most trading platforms keep tracking your initial margin and maintenance margin. In case the value drops significantly (such as with a falling knife pattern), the position might be automatically liquidated.

High leverage means traders should employ powerful risk management strategies and keep a close eye on the platform’s maintenance margin to succeed in the perpetual futures contracts space.

How do perpetual futures contracts work?

Perpetual futures contracts involve speculating the future of the underlying asset’s price. Here are the involved metrics and how they work together to create a perpetual contract.

Long position

Going long with a perpetual futures contract means you are buying low and planning to sell the contract when the price of the asset surges. In a way, you expect the underlying asset’s price to increase. In a regular bull market, long futures contracts can outnumber short perpetual contracts.

Short position

A short position refers to selling a contract beforehand, expecting the prices to drop, and you can buy the same at a later date.

Contract size

The contract size represents the number of assets — the underlying ones — locked within the contract. Let us say there is a BTC perpetual futures contract representing one BTC. This means for every instance relating to buying and selling of the contract, you are effectively interacting with and controlling one BTC.

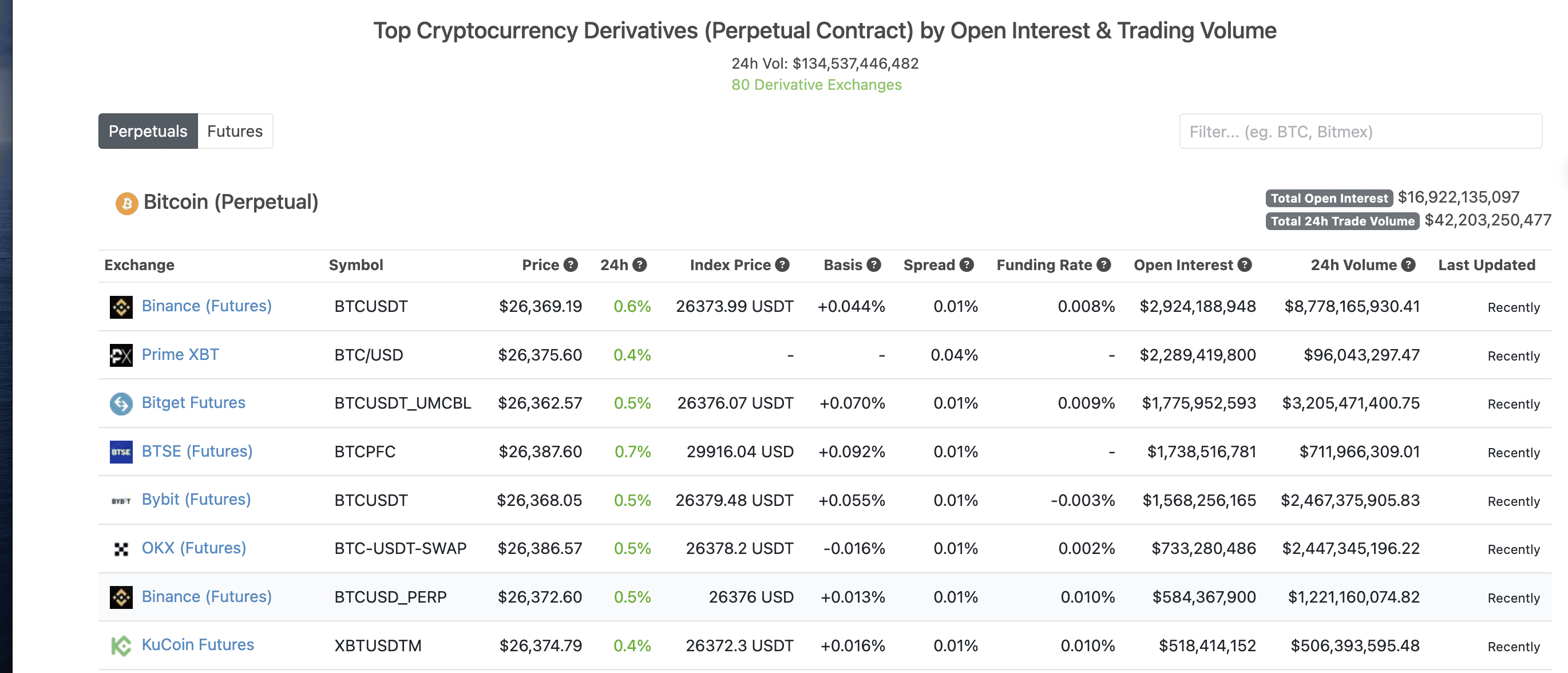

Funding rate

This is a unique metric that actually keeps the contract price closer to the spot price of the underlying asset. In simple terms, it is the rate exchange between long and short positions to keep the prices steady effectively.

Let us understand the concept of funding rate with the farmer-wheat example. Let us say other farmers are also betting on the wheat prices to increase, hence going long.

These farmers will then have to pay a portion of their positions to the short holders — the farmers who plan on going short with the wheat contracts — selling now and buying later at a lower price.

Funding rates are platform-specific and help you identify the trends associated with the perpetual futures market. In a bullish space, where long positions outweigh shorts, the funding rate is positive and long positions pay short positions. And in bearish spaces, funding rates are negative — short holders paying long holders.

The type of position (long or short), contract size, and funding rate discussions form the core of a standard perpetual futures contract.

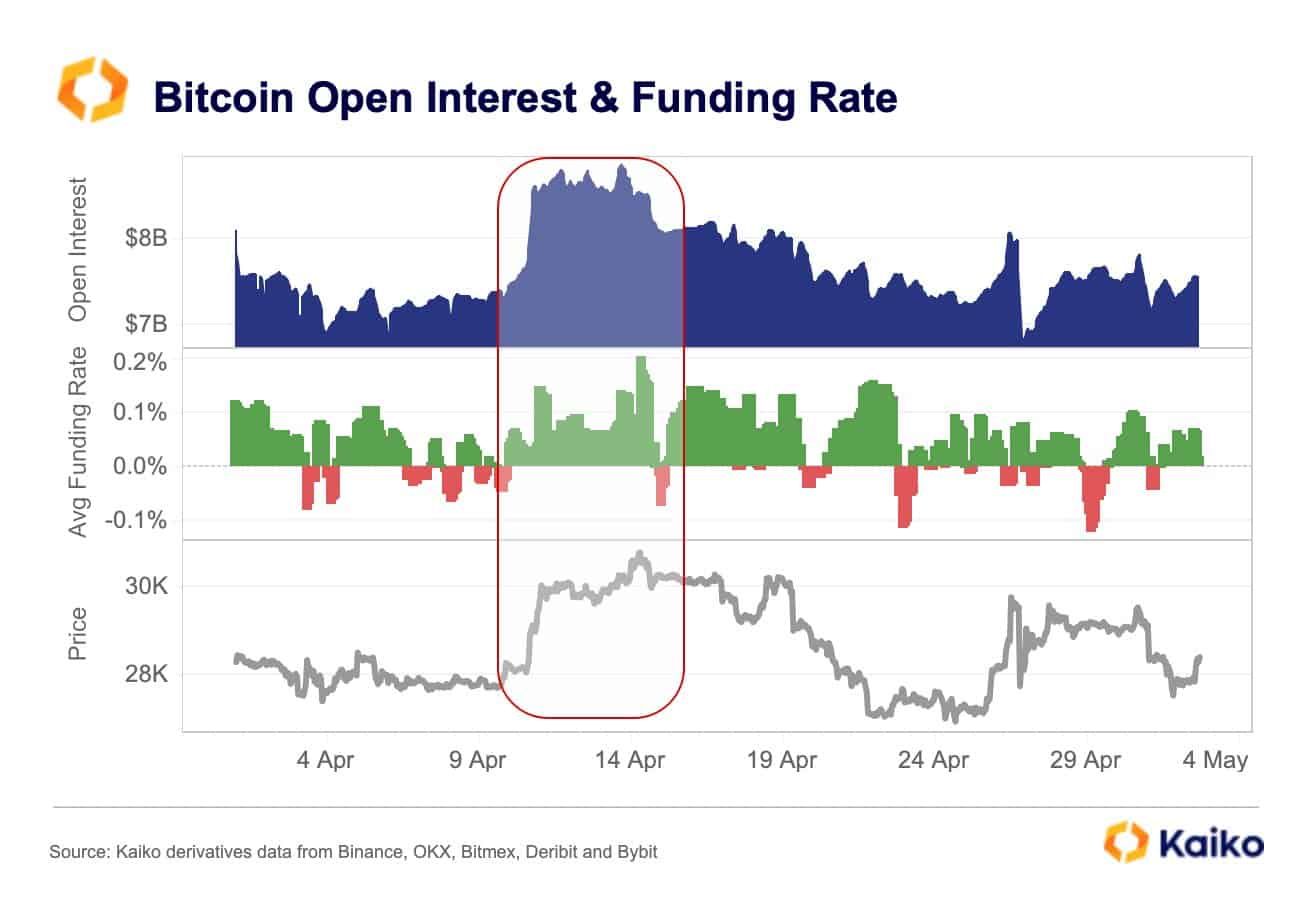

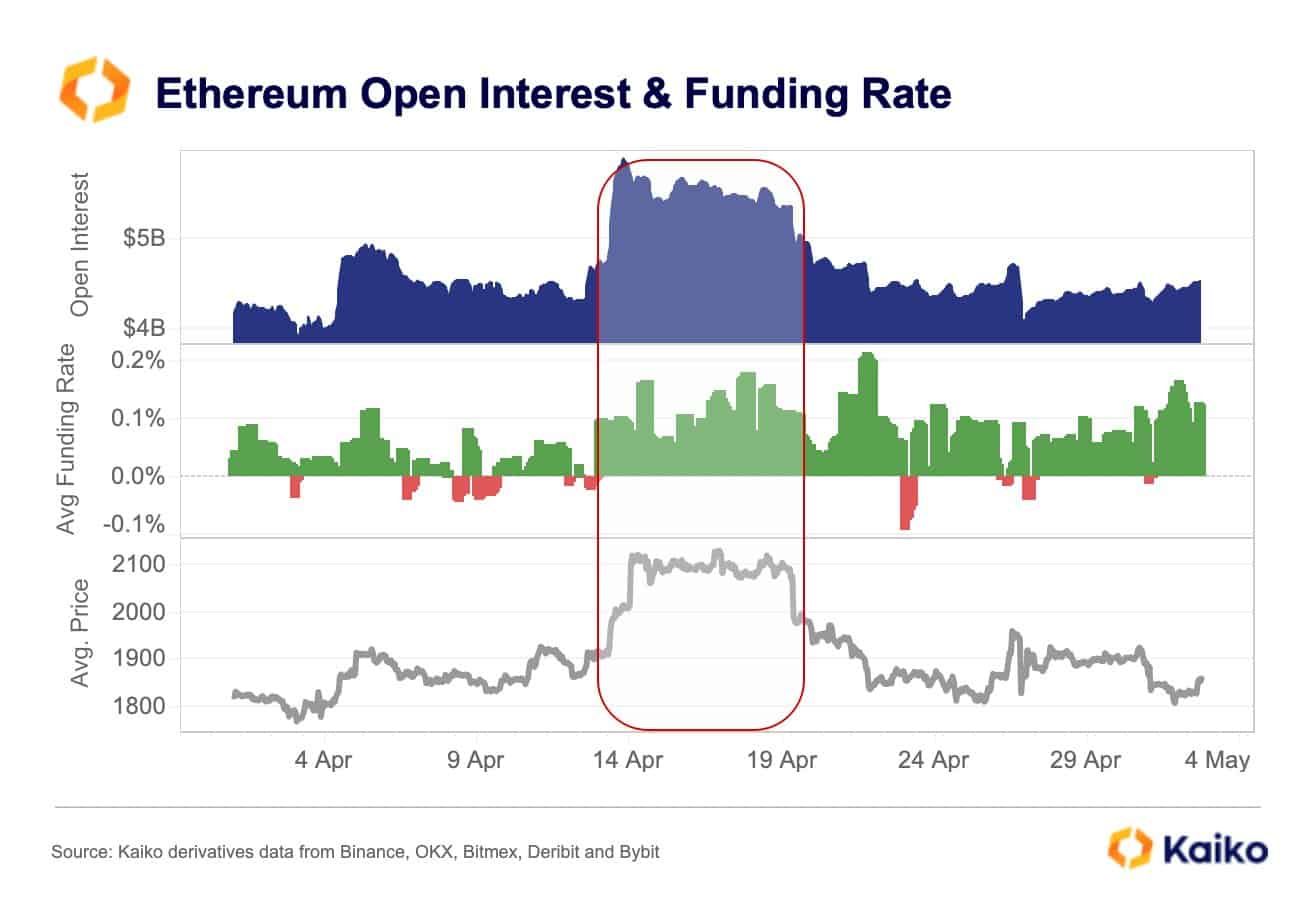

Note that funding rate changes (negative to positive) and open interest (perp liquidity growth) can indicate an upcoming price surge.

Key elements of a perpetual futures contract

While long and short positions, contract size, and funding rate are the building blocks of any perpetual futures contract, there are a few elements to consider to understand the concept in its entirety. These include:

Index price: It is the market price of the asset that underlines the futures product. In the case of a bitcoin perp, the index price is the market price of BTC. It is the weighted average price with values spread across exchanges.

Mark price: This is the fair price of an open futures position, calculated by taking the index price (asset price) and the funding rate. The mark price is taken into consideration to determine unrealized user profits or losses and the liquidation threshold.

Spot price: This is the immediate or, rather, the instant asset price that you can sell it for.

Future price: As the name suggests, the future price is the expected price at which you can sell the futures contract. This price is speculative and can be higher or lower compared to the index price.

Open positions: These are unsettled futures contracts that are still active and have sufficient maintenance margin seeing them through.

Trading positions: These include all of your open positions and the positions exited from.

Open interest: One of the more essential elements of the perpetual futures discussion, open interest refers to the total number of outstanding perpetual futures contracts for the given asset.

These contracts haven’t been settled and indicate the extent of liquidity on offer relevant to the market. Imagine this as the total number of concert tickets sold, but as the concert hasn’t started, it is difficult to determine the number of tickets that have been used.

Calculating profit and loss in case of a perpetual futures contract

Let us now look at a hypothetical example of how a perpetual futures contract works and how you can calculate the profit (loss) on the same:

Scenario 1: Long position

Assume that you have purchased one BTC perp at $30,000. Assuming that we are in a bullish phase, the funding rate would be positive, meaning that you would be paying it to the short holders to keep the price of BTC close to the contract price. Let us assume that the funding rate is 0.01%, and you keep the position open for a week.

The funding rate payout happens after every 8 hours — thrice in a 24-hour period. Therefore, in seven days, there would be:

3 x 7 = 21 funding rate payments — each at 0.01% of the contract size. As mentioned previously, the contract size, in this case, is $30,000. Hence the total funding fees that you need to pay to the short holders would be: 30,000 x 0.01% x 21 = $63

Now say after a week, the price of BTC reaches $35,000, and you end up selling the contract — closing the position in the process. That way, you would make a profit of $5,000. From that profit, you need to subtract the funding fees. Hence, the total profit comes out to be $4,937.

Do note that this profit value doesn’t take the exchange-specific fee into account, and that must be calculated separately.

Scenario 2: Short position

Assume you plan to sell an ethereum perpetual futures contract at $2,000 and buy the same back (short holding) when the prices drop. Let us say the price drops to $1,500 in 24 hours, and as the market is bullish, the funding rate is still positive — long holders paying fees to short holders. Therefore, you would receive the funding fees, say at 0.01%.

And as the settlement happens in 24 hours, there would be three funding payouts, as each payout happens in eight hours. Therefore, the total profit you make would be:

- $2,000 – $1,500 = $500

- 2000 x 0.01% x 3 = $0.6

Total = $500 + $0.6 = $500.6 (excluding any trading fees attracted by the platform)

Why worry when you can hold futures contracts forever?

If we can hold a contract indefinitely, why do we even worry about the losses? If the price drops, in case of a long position, can’t we always keep holding till things get better? The answer is yes. But there are a few factors to consider that might not allow you to do this:

- Market volatility: The price fluctuations, to the downside, might be too much. And that would require you to keep infusing additional maintenance margin to keep the position open. In case the initial margin doesn’t feel enough, the platform might liquidate your position.

- Opportunity costs: Even though you might consider beefing up the maintenance margin portion to keep the position open, the infused money could be used elsewhere to profit from a more rewarding trait.

- Funding payments: Assume you are a long holder in a market with a positive funding rate. In that case, you need to pay funding fees to the short sellers, albeit a very small portion. Keeping the position open indefinitely might pile up the funding fees.

These are the reasons why despite the perpetual tag, people have ready risk management strategies in place in order to close positions in case the tables turn.

CEX or DEX for playing the perpetual game?

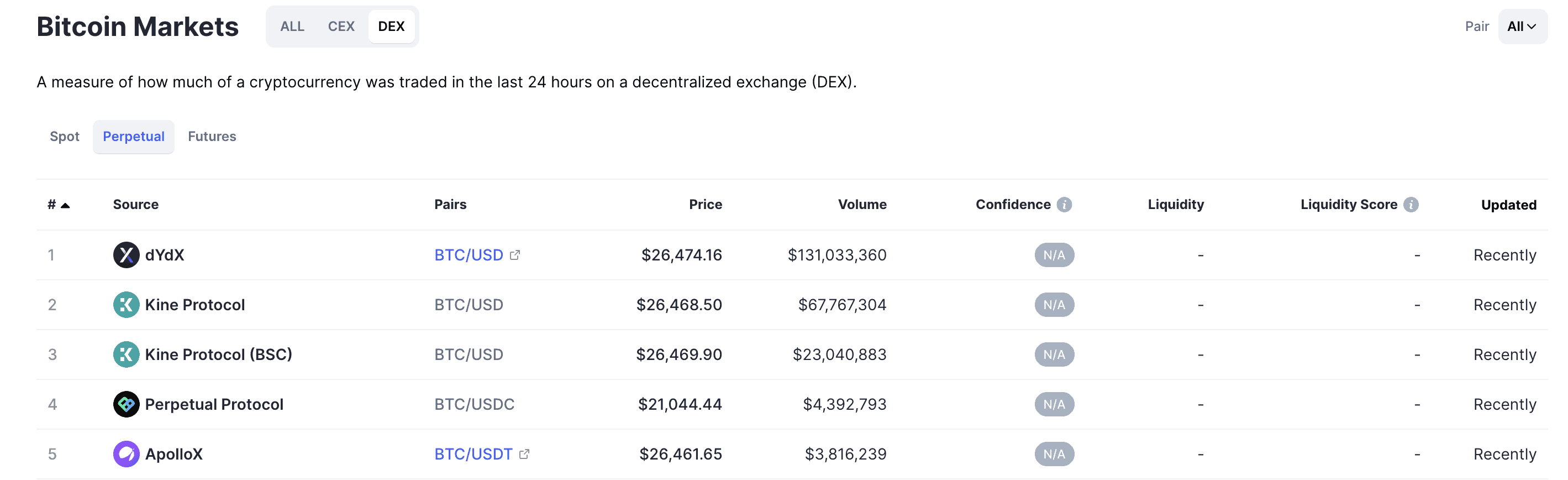

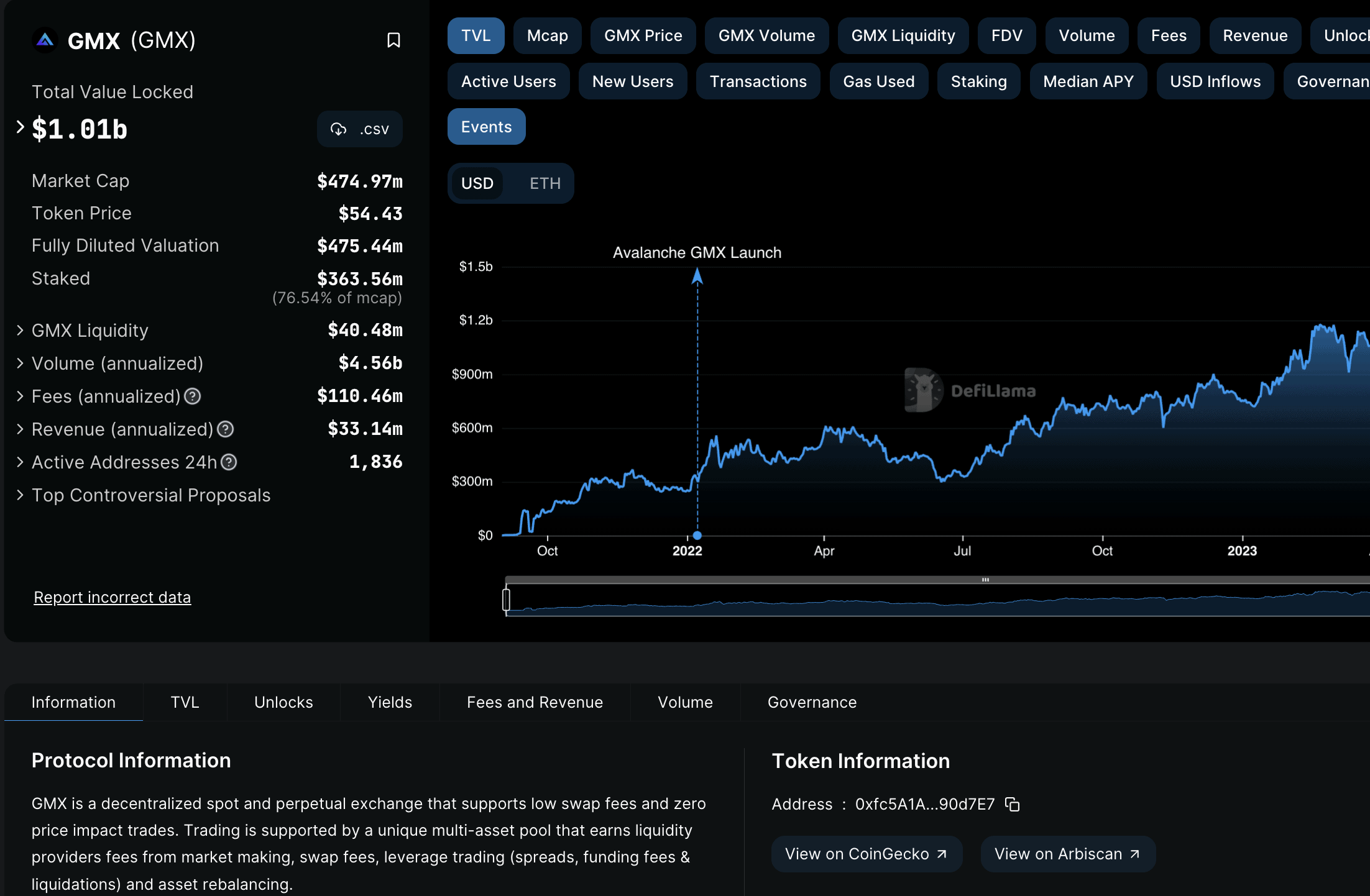

Needless to say, Perpetual Futures certainly qualify as a reward crypto trading instrument. And while several centralized exchanges offer credible and high-volume perpetual trading pairs, DEXs are also upping their perpetual game, seeing volumes to the tune of $230 billion from January 2023 to early May 2023.

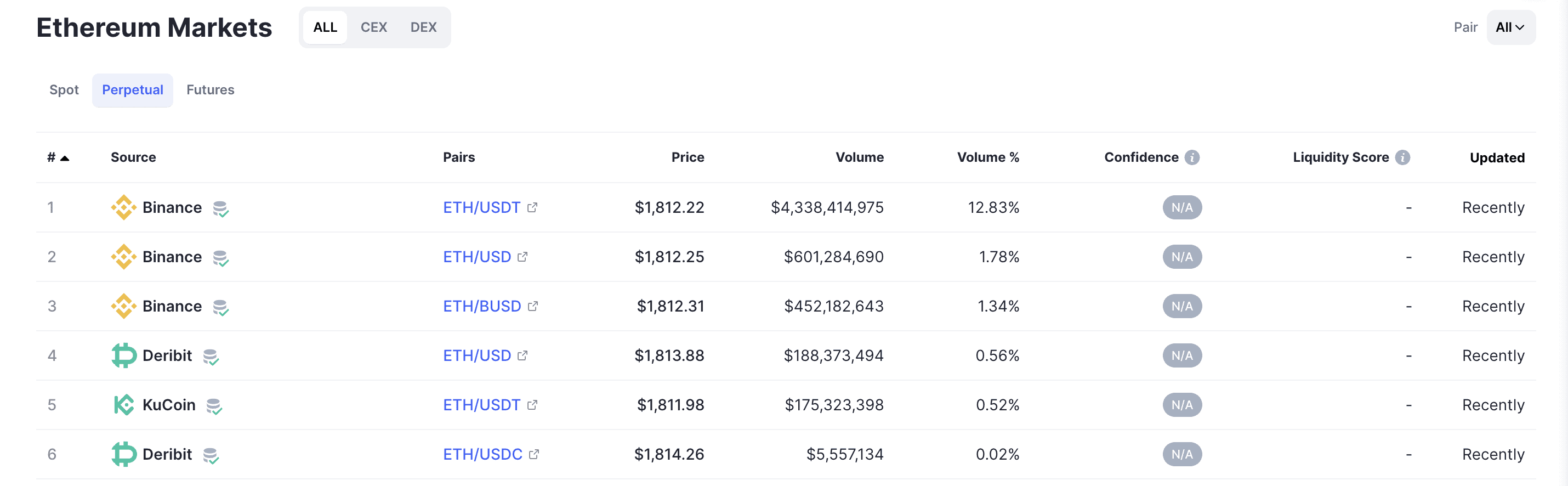

And even though CEXs still lead the perpetual futures market, DEXs like dYdX, GMX, Metavault Trade, and more also see some well-deserved perpetual action.

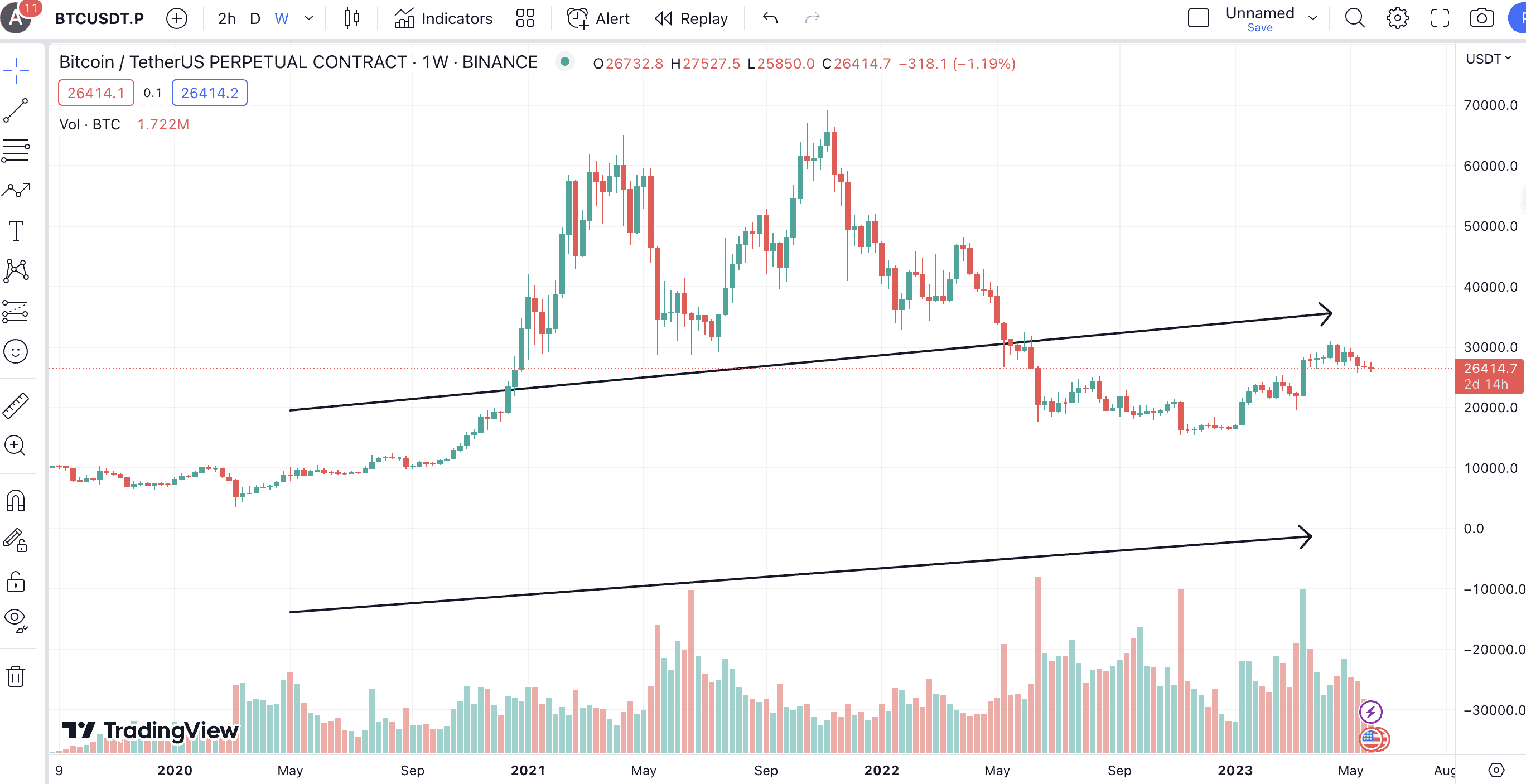

Yet, Binance continues to lead the market in terms of Perp share.

Conor Ryder, research analyst at Kaiko: Twitter

How to trade a perpetual futures contract

Now that we have looked into the theory associated with perpetual futures contracts let us understand the trading pointers that you might find while enlisting on a platform like OKX or Binance to kickstart your futures trading career:

Leverage and margin: why they matter

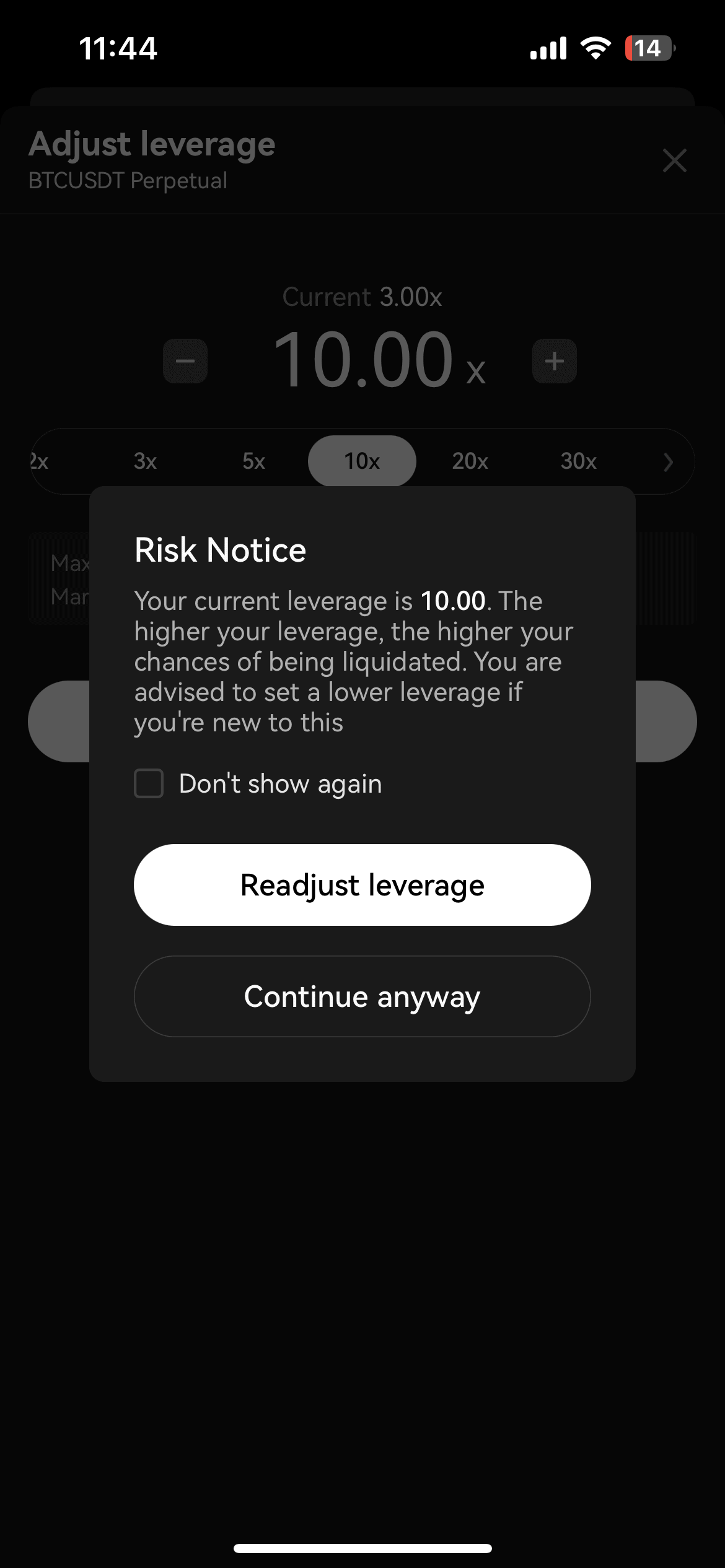

Before you start trading perpetual futures, you should know that trading platforms offer high leverage on these financial products. While this might help you maximize profits, letting you control a large number of assets for a smaller sum of money, leverage trading also increases the potential for loss.

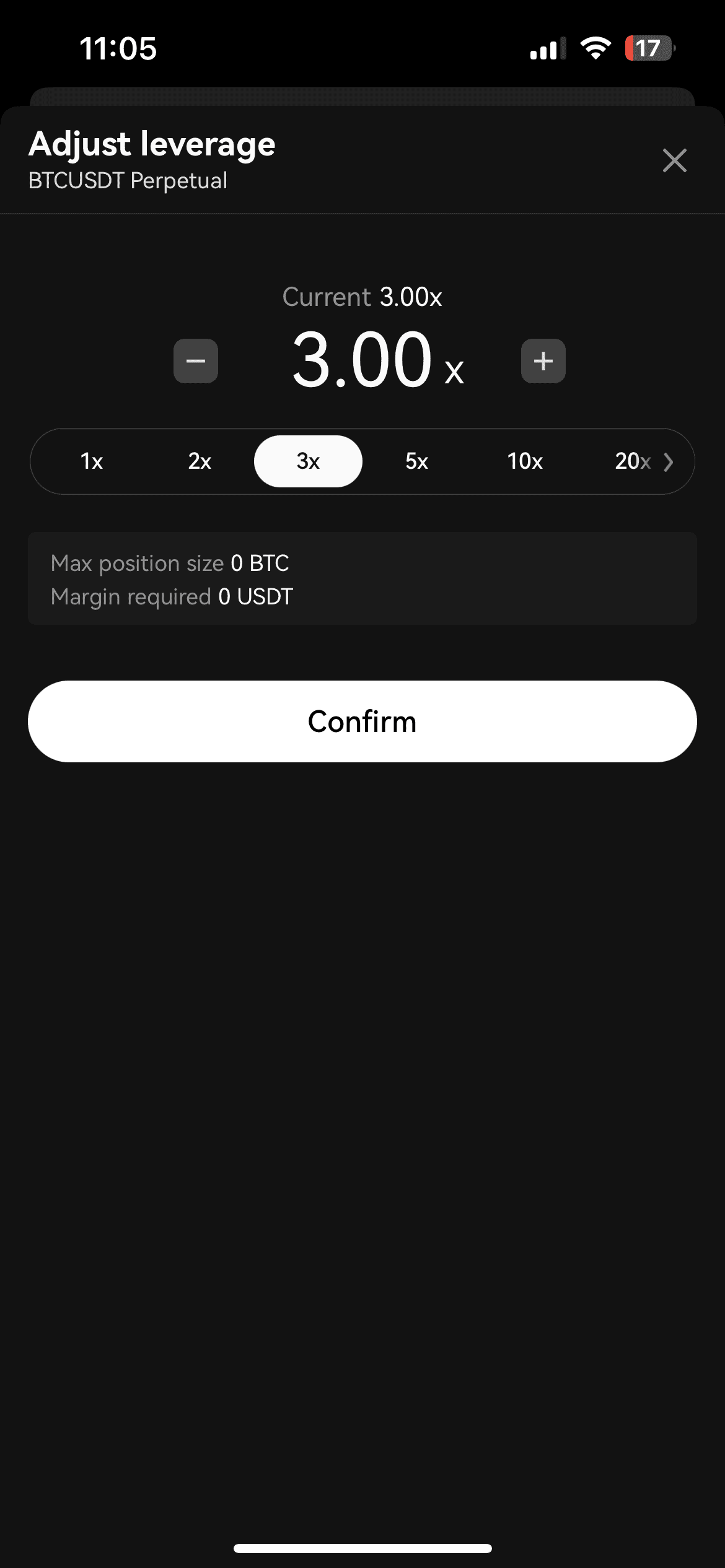

Therefore, whenever you plan on trading perpetual futures, it is necessary to check and decide how much leverage you want to play with.

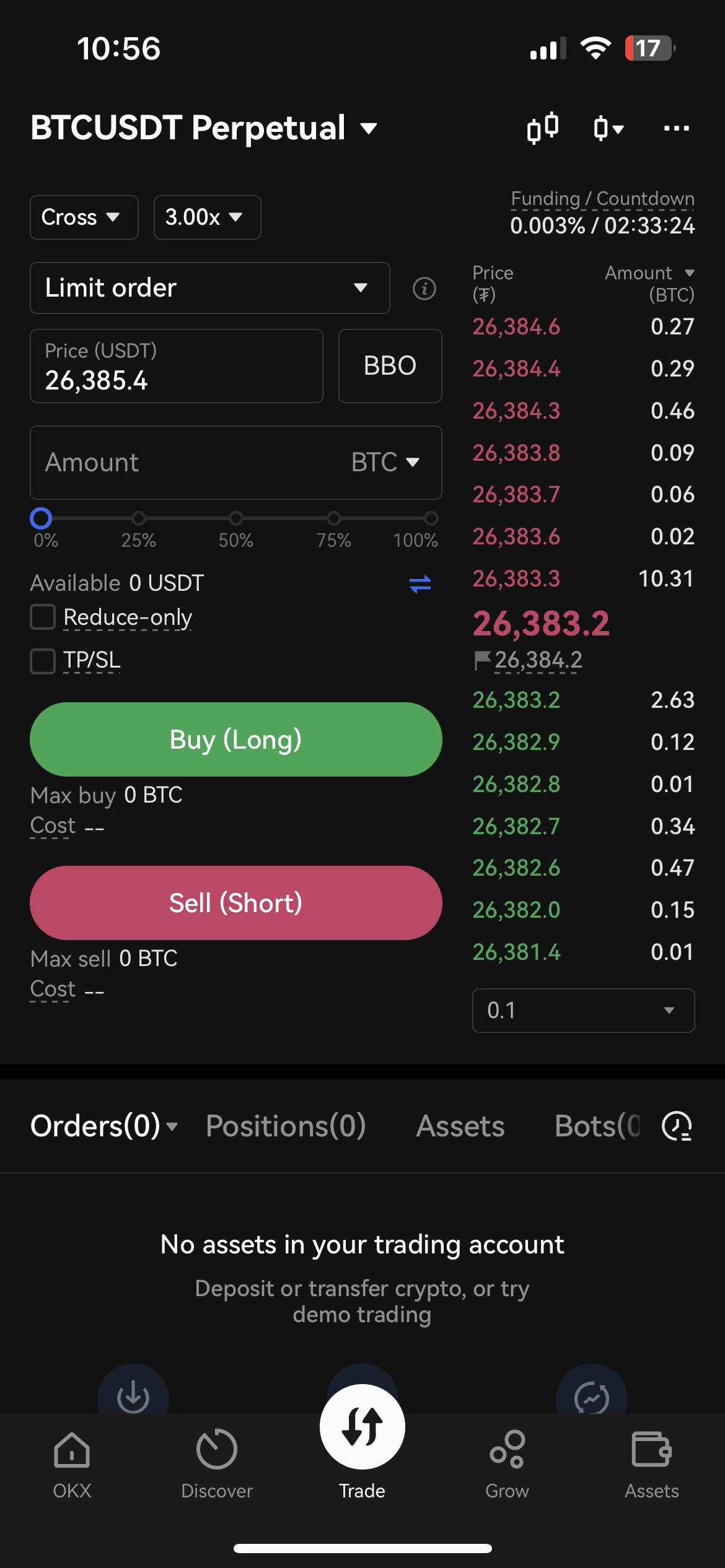

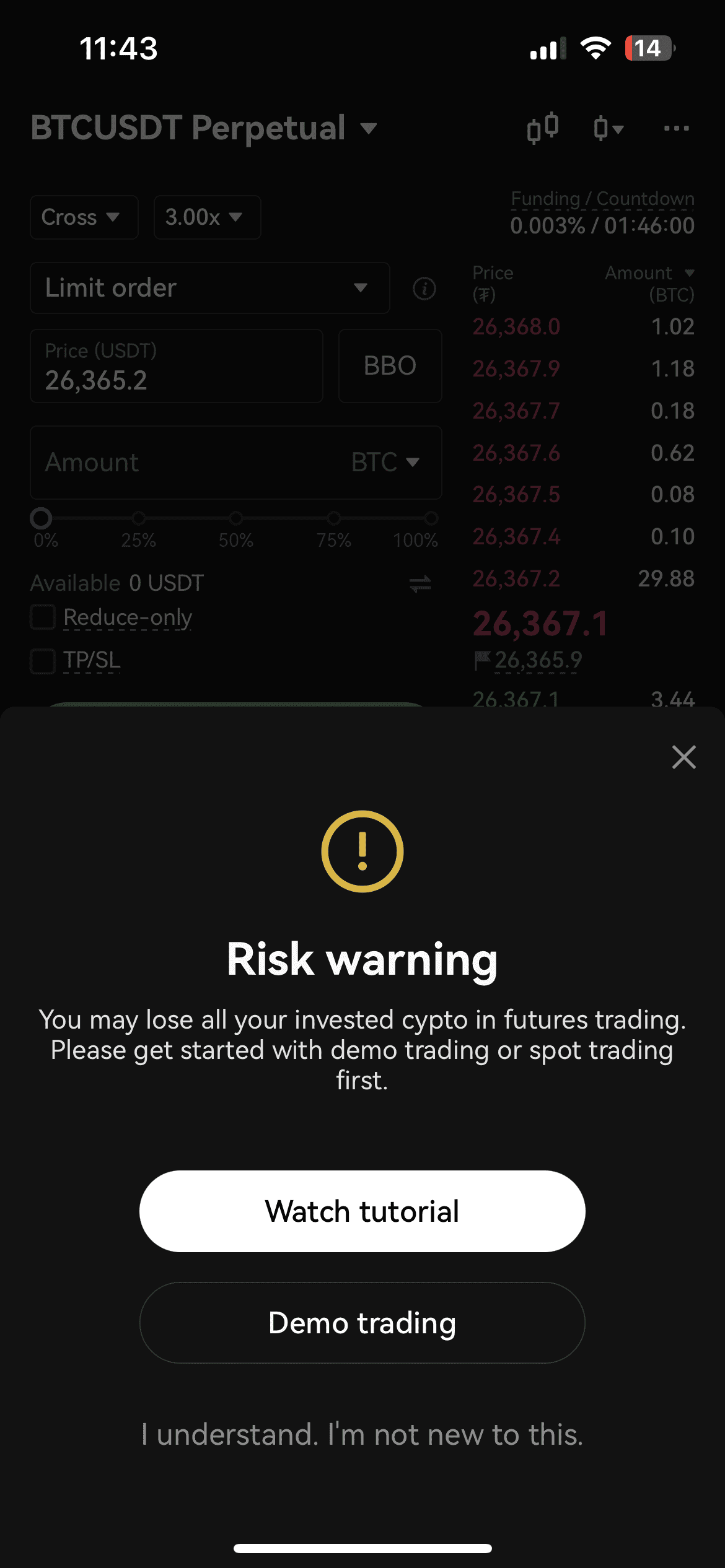

Here is what the BTC-USDT Perpetual dashboard at OKX looks like:

It is the amount of leverage that determines the initial and maintenance margin associated with a perp. While the platform determines the amount of leverage it will give, the margin is more like a “good faith” deposit of collateral from the user to justify the leverage. Simply put, the margin is the fund limit you must have even to open a leveraged trading position.

For instance, if you have $100 in your trading account, you might open a perp position valued at $1,000, considering that the platform is offering 10x leverage.

Higher leverage needs a low margin, whereas low leverage needs more margin. Say the platform you are using is offering a 3x leverage instead of 10x, and you still want to open a perp position of $1,000. Then, you would need to have $333 in your trading account (higher margin) instead of $100.

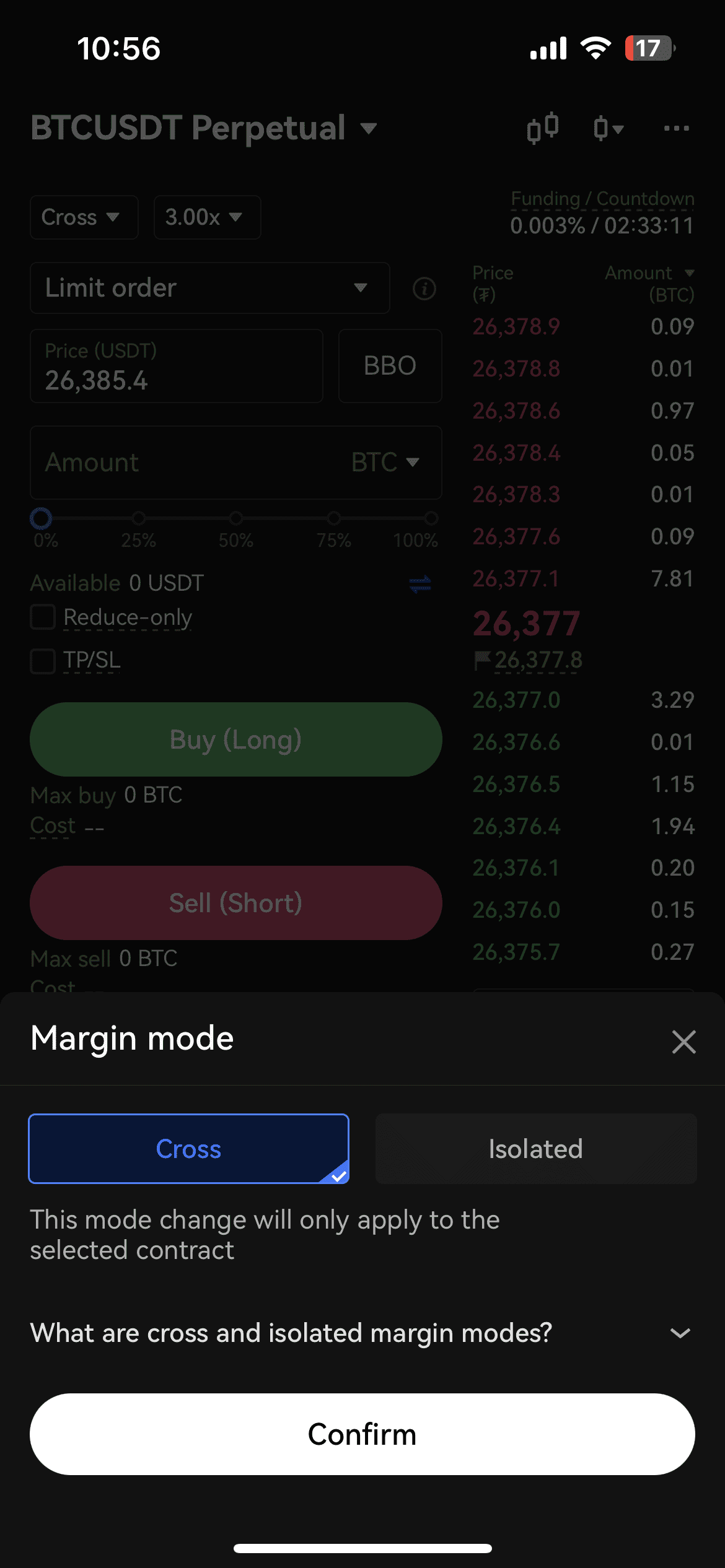

Did you know? Specific trading platforms allow you to choose between Cross and Isolated margins. Cross margin identifies using all your portfolio funds as collateral for a perp whereas Isolated margin refers to the use of a specific type of fund as collateral or margin.

The liquidation risk

While leverage is a profit-enhancing trading tool, it does come with its share of pitfalls. Here is an example.

Assume you have $300 in your account, and you want to open a perpetual futures position at a 100x leverage. You plan on going long, assuming BTC prices will rise. Also, the funding rate is positive due to the bullish sentiment, which means you, the long holder, will need to pay out funding fees.

Now let us understand the margin needs for this situation. To enter a position worth $30,000 (1 BTC hypothetically), the initial margin requirement would be $300.

Now let us say that the platform has a 0.5% maintenance margin requirement: for a $30,000 position, that would be $30,000 x 0.5% = $150. Therefore, to keep using the open position of $30,000 BTC perp, you would need an initial and maintenance margin requirement of $300 and $150, respectively.

Profits and liquidation: two sides of the “perpetual futures” coin

Now, let us say that the price of BTC increases by $500, pushing the value of your position to $35,000. However, a lot of this position is leverage, and your actual equity position includes your initial margin of $300 and the recent gain of $500 — $800 in total. Therefore, with leverage, it was possible for you to gain close to 200% on your initial capital.

However, if the price of BTC reduces by $100, your BTC perp position would become $29,900. The drop of $100 is first adjusted against your maintenance margin and initial margin. As you have $150 as maintenance, $100 getting erased will see you getting a margin trading call — the need to put in more as collateral.

And if the price of BTC continues to drop, you would need to feed more maintenance margin for the position to remain open. Without that, your open position would be liquidated.

You also need to understand that funding payments will also keep eroding your capital, albeit very slowly. You should also factor this in while picking leverage.

Price monitoring

While it is crucial to focus on the technical elements of a perpetual futures contract before proceeding, you should keep a close eye on the price of the asset in the futures and spot market. Higher spot market prices show that most futures traders are betting on the prices to go down in the future and vice versa. The difference in the spot and future prices also determines the nature of the funding rate and the flow of funding fees.

Also, standard trading insights like technical analysis, understanding of candlestick patterns, working around moving averages, and more can come in handy while tracking future prices and related expectations. This can help you take better futures-specific trading calls.

External factors

Like the spot market, the price of crypto futures can also depend on various external factors. These include the supply-demand curve, macroeconomic factors, regulatory insights, and chances of rate hikes. It is important to keep your eyes open to gauge these market-moving factors to stay ahead of the game.

Trading costs

And finally, if you plan on trying out futures trading, you should keep a close eye on the trading fees and other overheads charged by the concerned platform. A tip here is to keep an eye on fee rebates offered to large futures positions that can add liquidity to the concerned market.

Are perpetual futures contracts worth the trading effort?

Perpetual futures contracts aren’t as complex as you might think. They offer exposure to a lot of cryptos, with leverage, for the least possible capital, allowing traders to maximize profits.

Yet despite the price certainty being higher than the traditional spot market, perps aren’t without their share of risks. Higher leverage can quickly extinguish your entire capital if the market moves opposite to your expectations. Therefore, if you are new to this game, it is better to start slowly, keeping a tab on the investments and also the leverage selection.