The newly launched Worldcoin token WLD has already tanked as investors dig deeper into its tokenomics model. The project has also attracted a torrent of criticism over privacy issues, among other things.

Worldcoin has been live for less than 24 hours and has already created a maelstrom of negativity in the crypto community. Furthermore, its native token WLD has dumped 40% due to the project’s questionable tokenomics.

Worldcoin Tokenomics Under Spotlight

The much-hyped Worldcoin project went live on July 24. It uses iris scanning hardware and technology to verify identities and rewards participants with its native token.

As reported by BeInCrypto shortly after the launch, it has been heavily criticized over privacy concerns and an “Orwellian” approach to verifying identities.

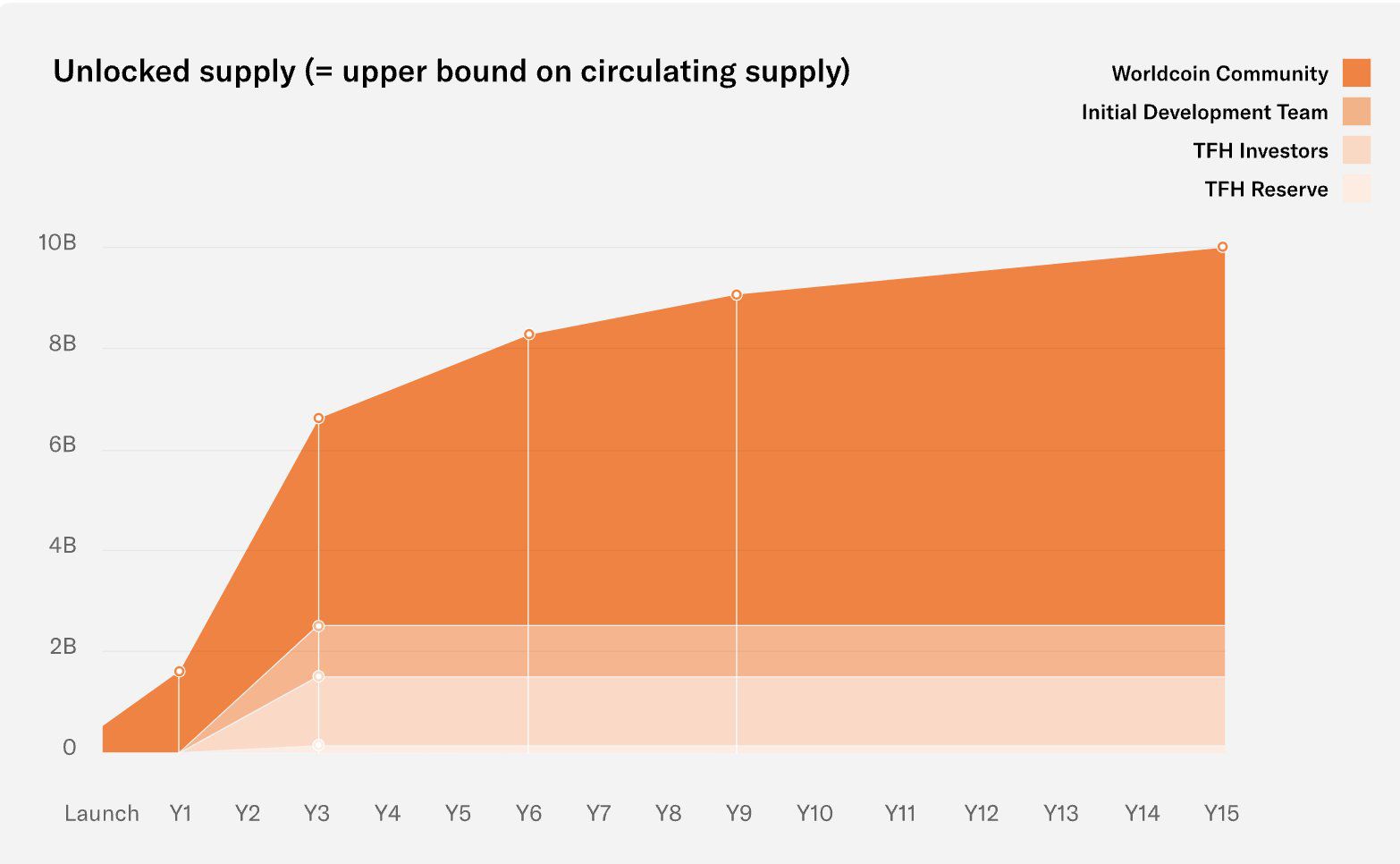

The project is now under fire for its tokenomics model, which sees the majority of its 10 billion WLD tokens unlocked over the next 15 years.

According to Token Unlocks, three-quarters of the supply will be for the community. This is much better than certain DeFi protocols, which allocate most of their tokens to VC investors and insiders. However, its definition of “community” includes governance and is very vague.

Additionally, almost 10% of the supply is allocated to early investors such as a16z, which led the ICO.

Furthermore, major projects that have regular token unlocks have seen a lot of selling pressure on their tokens.

Moreover, senior analyst Dylan LeClair noted similarities between its token distribution model and that of other platforms:

“Worldcoin taking a page out of SBF Solana eco playbook, launching and pumping a microcap shitcoin with 1% of total supply in circulation. $22.8 billion fully diluted market cap. lmao.”

Stay vigilant of your privacy and learn how to transact discreetly using cryptocurrencies:How do Privacy Coins Work?

The sarcasm continued, “This ponzi is still on the ground floor,” he said before adding, “Ignore the VCs ready to dump on you (again). This time is actually different.”

Opinions and WLD Price Dump

The founder of the security agency SlowMist said that if Worldcoin succeeds, it will be an ‘evil product.’ It is possible for hackers to paint a portrait through the hash information, he added.

Dr. Jeff Ross, founder and CEO of Vailshire Capital Management, ran a poll asking whether Worldcoin “would be the biggest crypto rug-pull yet?” Almost 63% of the 962 people who voted at the time of press agreed.

Less than 24 hours after launch, you can already see the initial pump and dump for Worldcoin tokens.

WLD surged to a peak of $3.30 a couple of hours after it went live. However, the token has dumped 41.3% since then in a crash to $1.97 at the time of writing, according to CoinGecko.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.