While the Tron network remains a distant second to Ethereum in Dapp volume, it hosts traffic reminiscent of the wild west days of cryptocurrency. Gambling, Ponzi Schemes, Incentivized Mining Rugpulls or token dropouts, and, perhaps most-damning of all, a less-than-perfect user interface can all be found on the alleged Ethereum clone. I tested a small amount of TRON to see how much money could truly be made..@Tronfoundation: DeFi Ecosystem Transaction Volume in Q3 2020

— DappRadar (@DappRadar) October 3, 2020

The transaction volume increased by 2,577%.

TRON’s DEX category holds a 41% share of the total volume.

The #dapp helping the category grow is #JustSwap. @justinsuntron @DeFi_JUSThttps://t.co/ryyKTlnpCN pic.twitter.com/uIFiVG96mo

The poor man’s Ethereum?

In a nutshell, the world of Tron DeFi is the squeaky, bad-hair-day version of Ethereum. It works just like Ethereum, only different. For example, Tron boasts it can process over 2,000 transactions per second (TPS), as opposed to Etheruem’s 15 to 30. Under scrutiny, a study found that theoretical 2,000 transactions per second impossible to reach. The apparent true limit of 748 TPS is nothing to sneeze at, but it illustrates the superficial glitz and glam of the Tron network.

JustSwap

The similar, lackluster experience extends to Tron’s Automatic Market Maker “JustSwap.” The transaction fees, which are around 1 TRX ($0.26, at press time), are lower than Ethereum, and most transactions take only a few seconds. However, the market maker fees of 0.3% are equal to those of Uniswap. The functionality is also almost identical to that on Uniswap, with liquidity tokens and slippage fees to boot. To it’s credit, JustSwap reached a peak of $265 million in liquidity in early September, and still hosts the second highest amount of DApp volume after Ethereum. The Q3 2020 Tron Defi volume grew $133 billion.

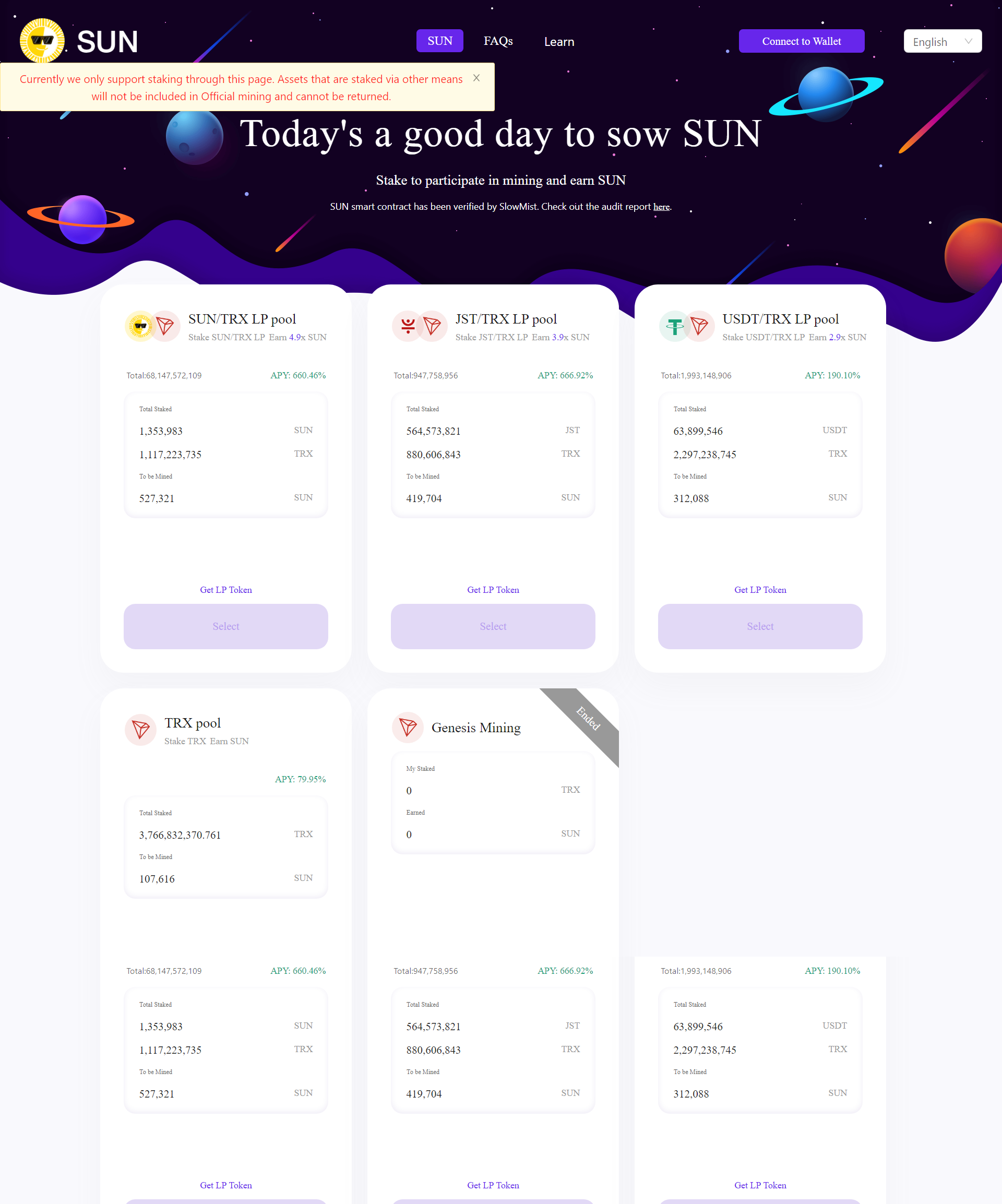

Incentivized mining and the Sun Token

On Aug. 31, 2020, Tron CEO Justin Sun announced the launch of his meme coin, the SUN token. The aim of the token, Sun said, was to give back to the Tron community and have fun in the wake of the meme coin bubble. In essence, SUN would be subject to genesis mining, and huge yield farming opportunities would finally come to the Tron network.In fact, Sun genesis mining offered incredible rewards on liquidity token staking, though it was short lived. Nonetheless, subsequent rounds of yield farming with ever-dropping yields followed on Sun.io, the Sun token staking site.TRX could pull a YFI here. No Premin, No ICO, No angel investor ? We love this kinda 5hit sir! Thank you.

— Corn Longer (@Im_a_Scalper) August 31, 2020

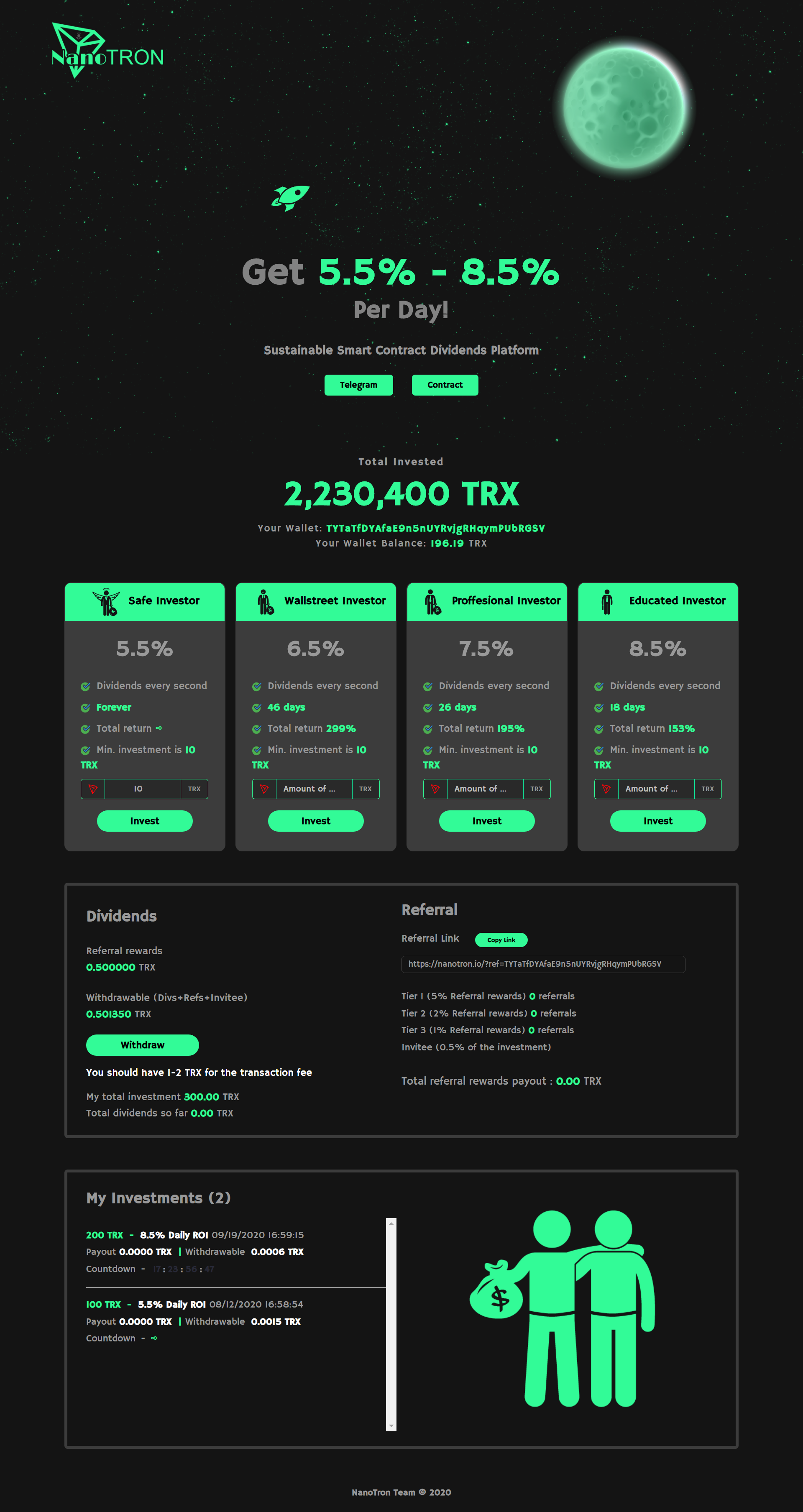

Decentralized Ponzis

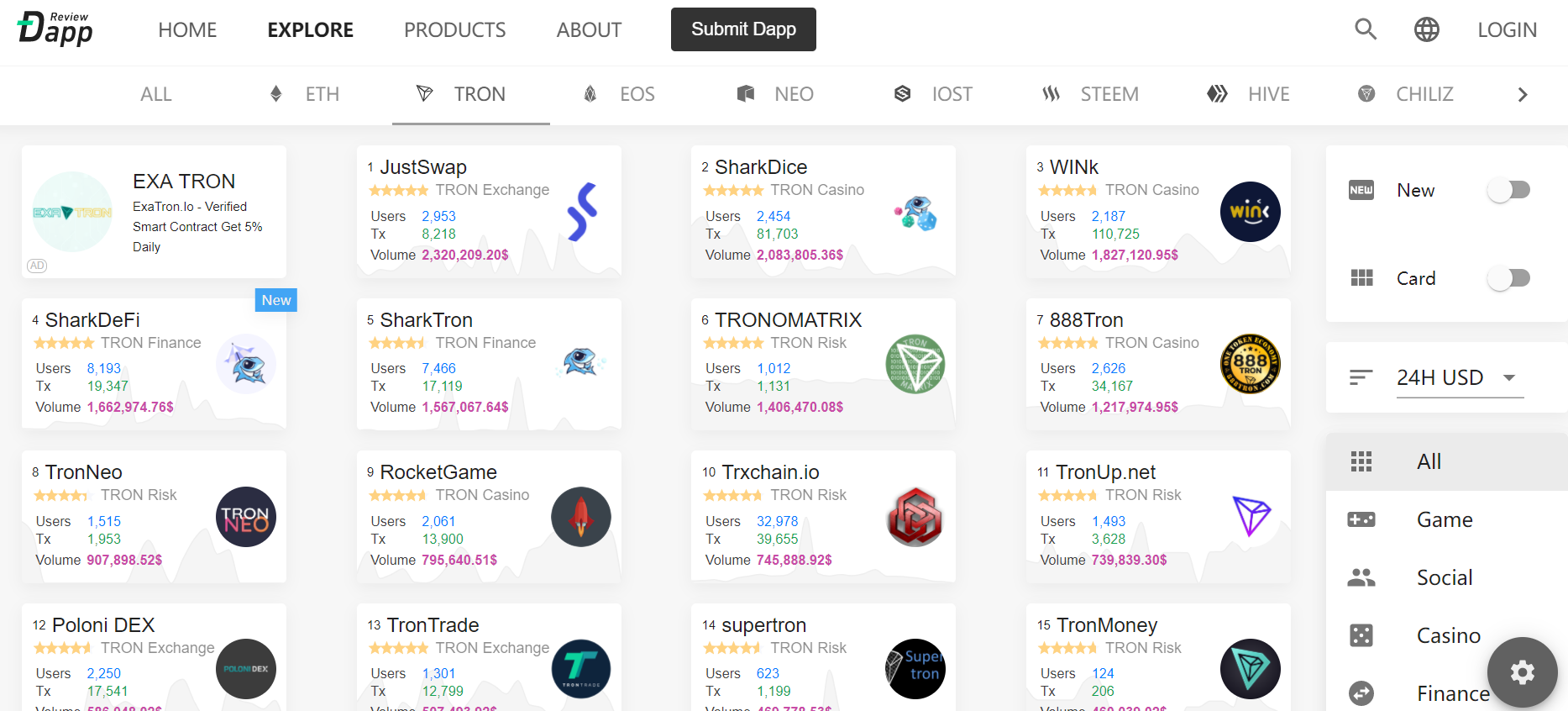

In search of he best of that Tron had to offer in terms of DeFi, I ended up at Dapp.review. The site lists and ranks different decentralized applications by intended use, protocol, as well as various metrics. The site offered an impressive number of Dapps for Tron. Each of the dozens of Tron Dapps had pages including positive reviews and links to Telegram groups. These Telegram groups had hundreds, sometimes thousands of subscribers, all spamming their affiliate links. For the purposes of this experiment, I chose NanoTron. According to Dapp.review, Nanotron had over 100 five-star reviews and a 24 hour volume in the tens of thousands.

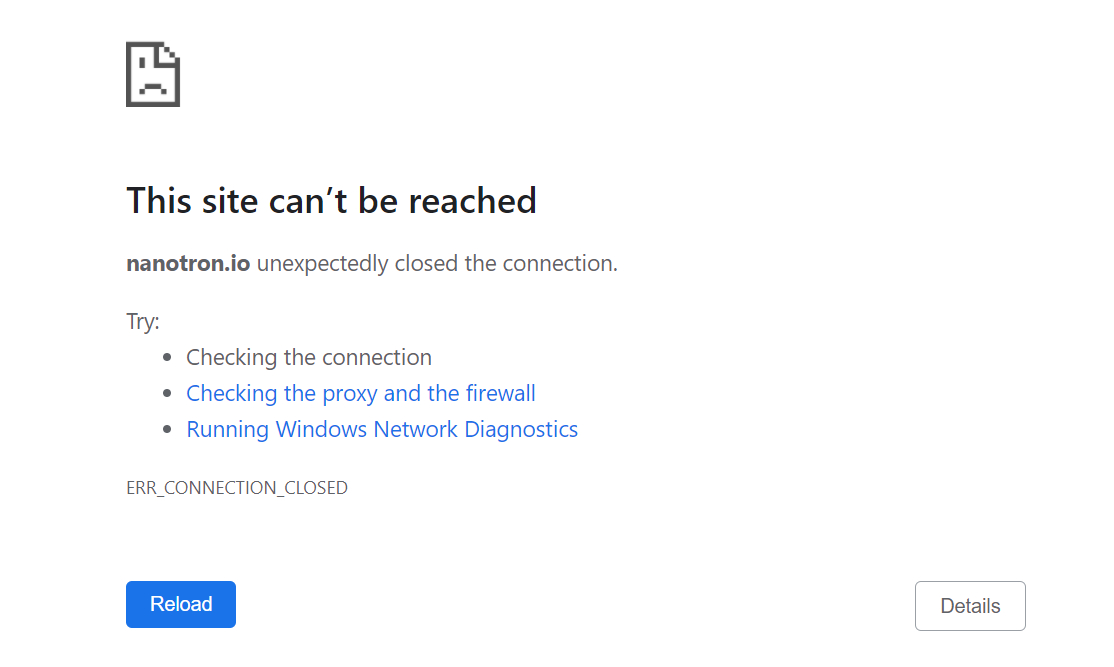

It was gone. The whole site. Goodbye $7.50

And when I scrolled down on the Dapp.review list of Tron projects, I noticed that many Dapps suddenly had no funds in the protocol, no volume, and broken links. Those tiles representing dozens of apps on Tron turned out to be gravestones.

It was gone. The whole site. Goodbye $7.50

And when I scrolled down on the Dapp.review list of Tron projects, I noticed that many Dapps suddenly had no funds in the protocol, no volume, and broken links. Those tiles representing dozens of apps on Tron turned out to be gravestones.

The House of the Rising SUN

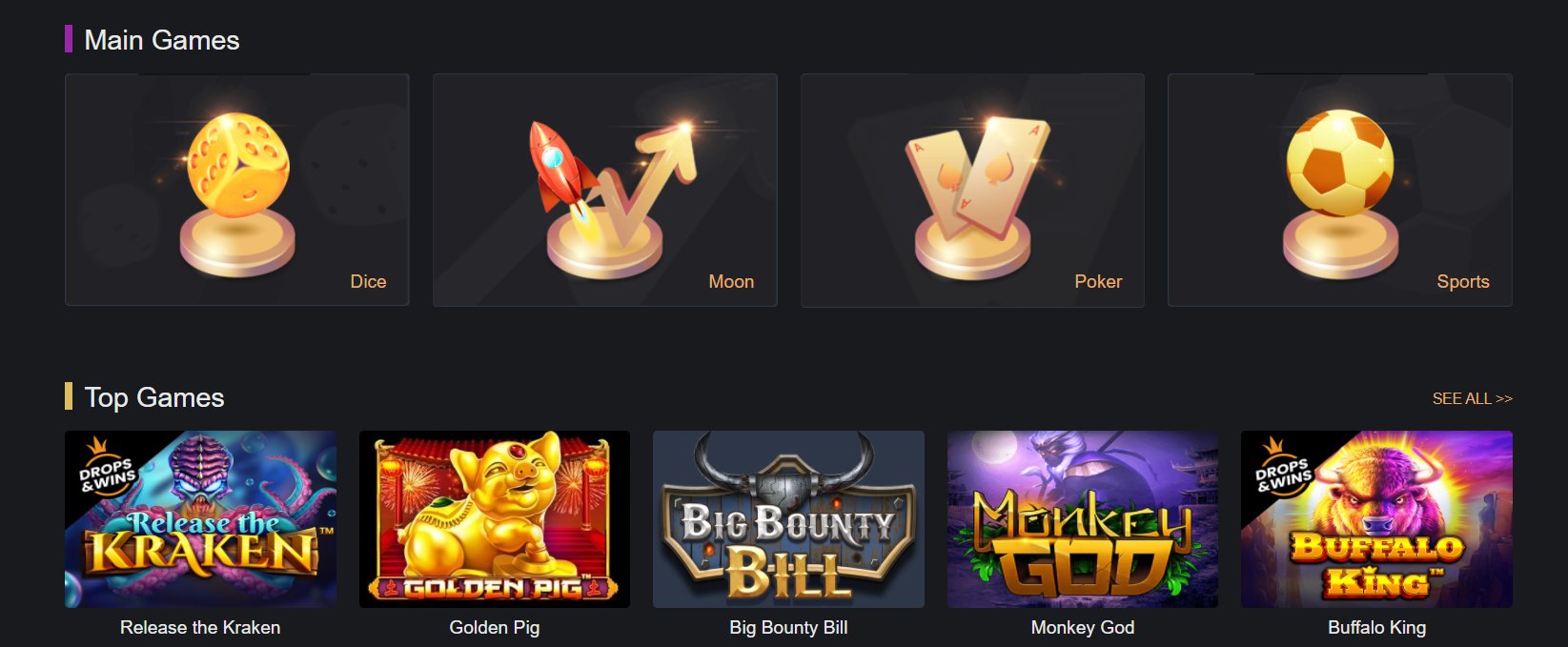

Still, one corner of Tron’s DeFi is able to shine, if in an unsavory way. Tron-based decentralized gambling is alive and well. Both DappRadar and Dapp.Review offer several gambling sites run on Tron. One particularly successful site is WINK. The site boasts a pretty nice user interface and experience. They offer poker, dice, casino games, non-casino games, and sports betting. Wink, also known as Tronbet, also checks users’ IP addresses, and will block access based on location. (Nothing a good VPN can’t fix).

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.