Cheaper to Hire Fedex Than Use ETH

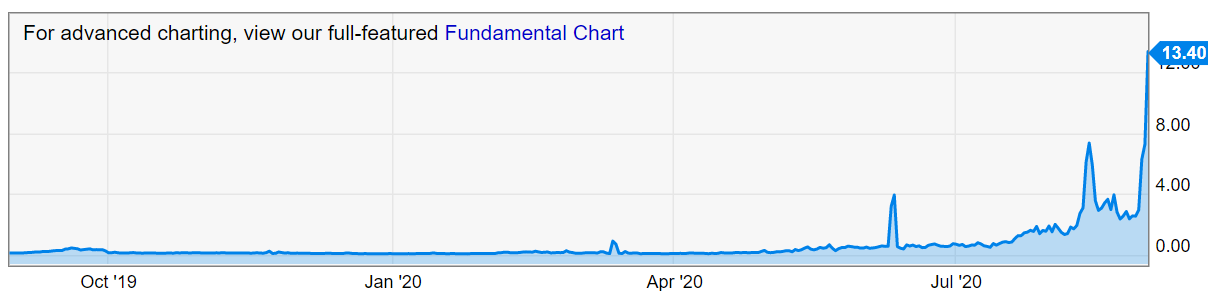

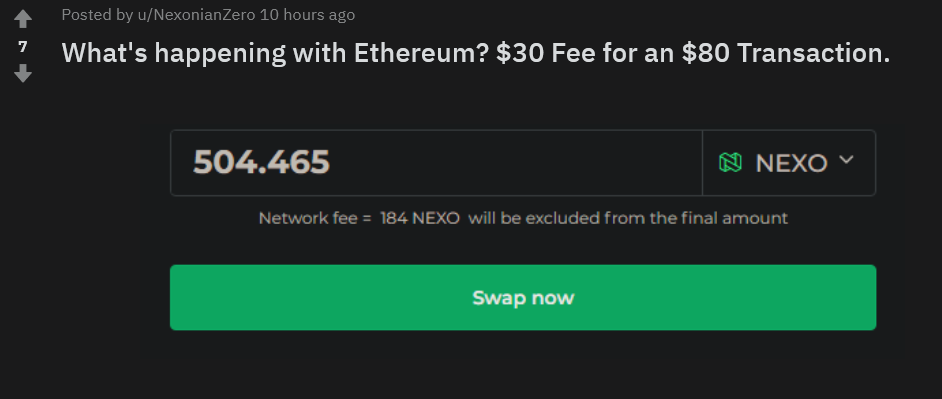

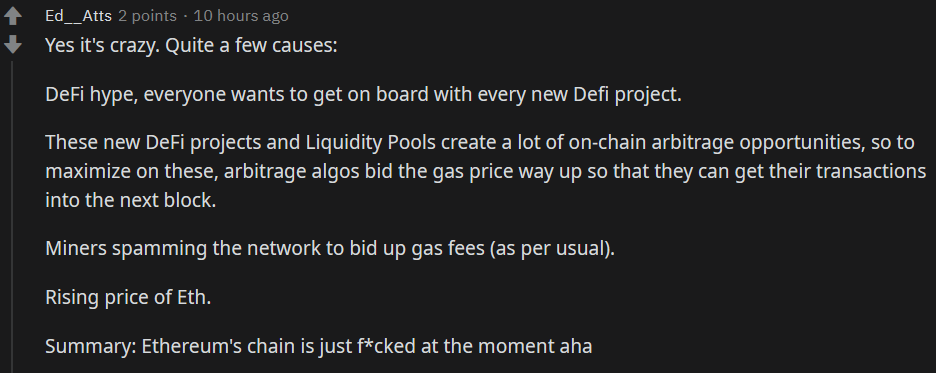

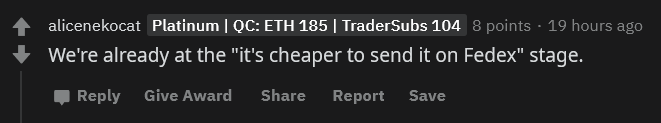

Saving on gas left some users waiting 12 hours or more for their transactions to go through. In the fast-paced world of Uniswap and speculation, that’s a long time. Some Reddit users have pointed out that high ETH fees contradict the purpose of fast, trustless transactions. With wait times like these, some have argued, it would be faster and cheaper to send a check with overnight shipping. One reddit user posted a ghastly screenshot on the r/Nexo subreddit. This image shows a transaction of 504 Nexo (NEXO) tokens (about $80 at the time) with a fee of 184 Nexo tokens (about $30) at the time. Reddit user Ed_Atts offered an explanation. With the high price of ETH and liquidity pool arbitrage opportunities,Ethereum’s chain is just f*cked at the moment.

Vitalik Weighs In

Finally, Ethereum’s founder Vitalik Buterin offered an opinion. For weeks, gas fees have been a point of contention for users. On September 1, Vitalik defended ETH, pointing out that other solutions exist.One solution was Loopring, an ETH-based decentralized exchange. Loopring has microscopic fees compared to Uniswap. However, users need to send ETH to their Loopring wallet to begin with. The number of coins traded on Loopring is also minuscule compared to other DEXs.To those replying with "gas fees are too high", my answer to that is "well then more people should be accepting payments directly through zksync/loopring/OMG". Seriously, scaling to 2500+ TPS for simple-payments applications is here, we just need to… use it. https://t.co/J2KMJyLKv6

— vitalik.eth (@VitalikButerin) September 1, 2020

Another idea Buterin had was the OMG network. When Ethereum broke a previous all-time high record on August 22, Tether (USDT) announced that it would be available on the OMG network. Tether accounts for the second most Ethereum chain transactions, after Ether itself. The OMG network can process thousands more transactions at a fraction of the cost, and it does so layered over the existing Ethereum network.It may not be in the tens of millions (yet), but to us, $500k daily volume on https://t.co/7kOIOTYGAC is a big win. It's also a win for Ethereum: zkRollup DEXs are here, and people use it.

— Loopring💙 (@loopringorg) June 21, 2020

And when more people use it, it will not be congested, but actually more efficient 🏃♂️ pic.twitter.com/pioCtVtJ94

Outgrown Its Shoes

Unfortunately, the existing solutions have not caught on yet. Some of this may be the DeFi craze caused by Uniswap, an exchange which only functions on the Ethereum blockchain. The demand for the capabilities of DeFi, yield farming, and DEXs has simply outgrown Ethereum in its current state.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.