Shiba Inu (SHIB) price momentum waned this week after the bulls failed to break down the $0.000009 resistance. On-chain analysis beams the searchlight on critical data points that could decide SHIB price action in the days ahead.

Shiba Inu’s price entered a consolidation phase this week as the bullish momentum weakened. Will the 2nd largest memecoin by market capitalization break down and rebound from this point?

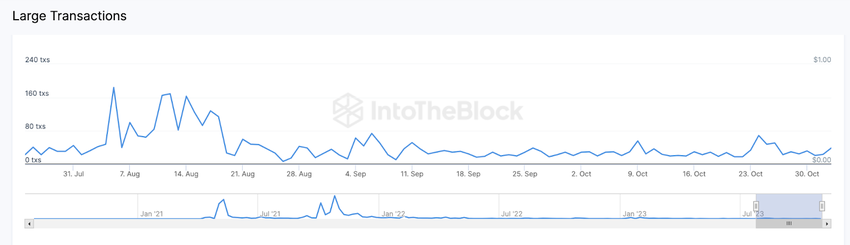

Crypto Whales Holding SHIB Have Tuned Down Their Trading Activity

SHIB price registered double-digit gains as the Bitcoin (BTC) market rally spread toward the memecoin markets in the last week of October. However, on-chain data readings show that whales have dialed down their trading activity since Shiba Inu rejected $0.000008 on October 24.

According to IntoTheBlock, Shiba Inu whales conducted a two-month high of 69 Large Transactions on October 24. But as of November 2, that number has gradually dropped to 39 whale transactions, representing a 44% decline.

The daily transactions metric provides a daily aggregate of the number of trades that exceed $100,000 in value. Typically, a steep decline in whale transactions, as observed above, is often taken as a bearish signal.

It indicates a growing disinterest among large institutional investors. Crucially, this could influence strategic retail traders to take on a negative disposition as well. If this thesis holds, the SHIB token could experience low market demand in the days ahead.

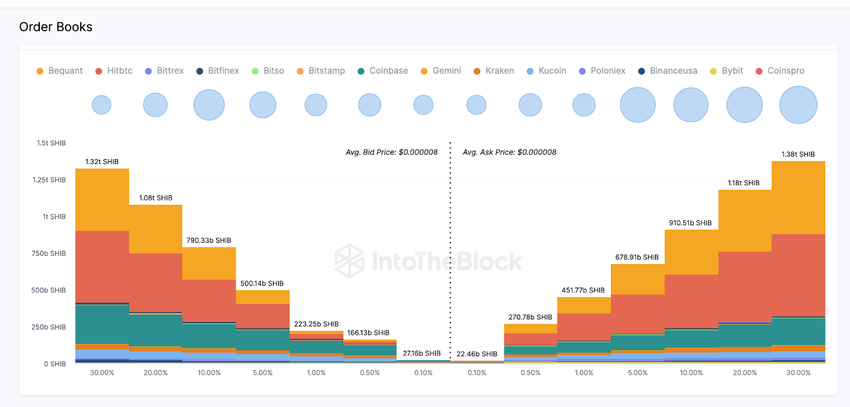

SHIB Sell Orders Have Surpassed Current Market Demand

The Aggregate Order Books is another vital on-chain chart currently pointing towards a weakening demand across SHIB spot markets. As depicted below, SHIB traders have placed active sell orders for 6.5 trillion tokens. And worryingly, this is considerably higher than the 6 trillion SHIB buy order currently listed across 10 crypto exchanges.

The Aggregate Order Books of Exchanges show a snapshot of the total active market orders for an asset. Logically, when demand is lower, many sellers may have to compete by lowering their prices.

Hence, the decline in whales’ trading activity and the weakening market demand could combine to trigger a downward SHIB price movement in the days ahead.

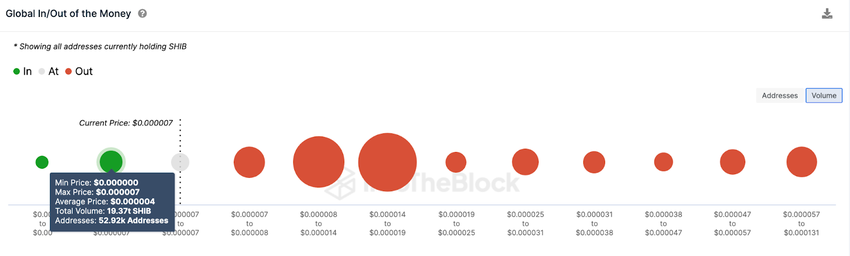

SHIB Price Prediction: Potential Downswing toward $0.000005?

Based on the current on-chain stats, Shiba Inu will likely experience a further price downswing toward $0.000006 in the coming days.

The Global In/Out of the Money (GIOM) chart, which depicts the entry price distribution of current SHIB holders, also supports this bearish narrative. It depicts that Shiba Inu losing vital support at $0.00007 could catalyze larger losses.

As illustrated below, 52,9200 addresses purchased 19.37 trillion SHIB at a maximum price of $0.000007. Considering this is the largest support cluster below the current prices, they will likely make frantic efforts to HODL.

But if the whale demand keeps dropping, Shiba Inu’s price could dip further toward $0.000005

Alternatively, the bulls could negate that bearish prediction if Shiba Inu’s price can reclaim $0.00001. But that currently seems far fetch, as 153,700 addresses are holding 68.5 trillion SHIB bought at the average price of $0.000008. If they book profits early, SHIB’s price will likely retrace.

But if that resistance level caves, Shiba Inu’s price could rally toward the $0.00001 range.

Read More: 6 Best Copy Trading Platforms in 2023