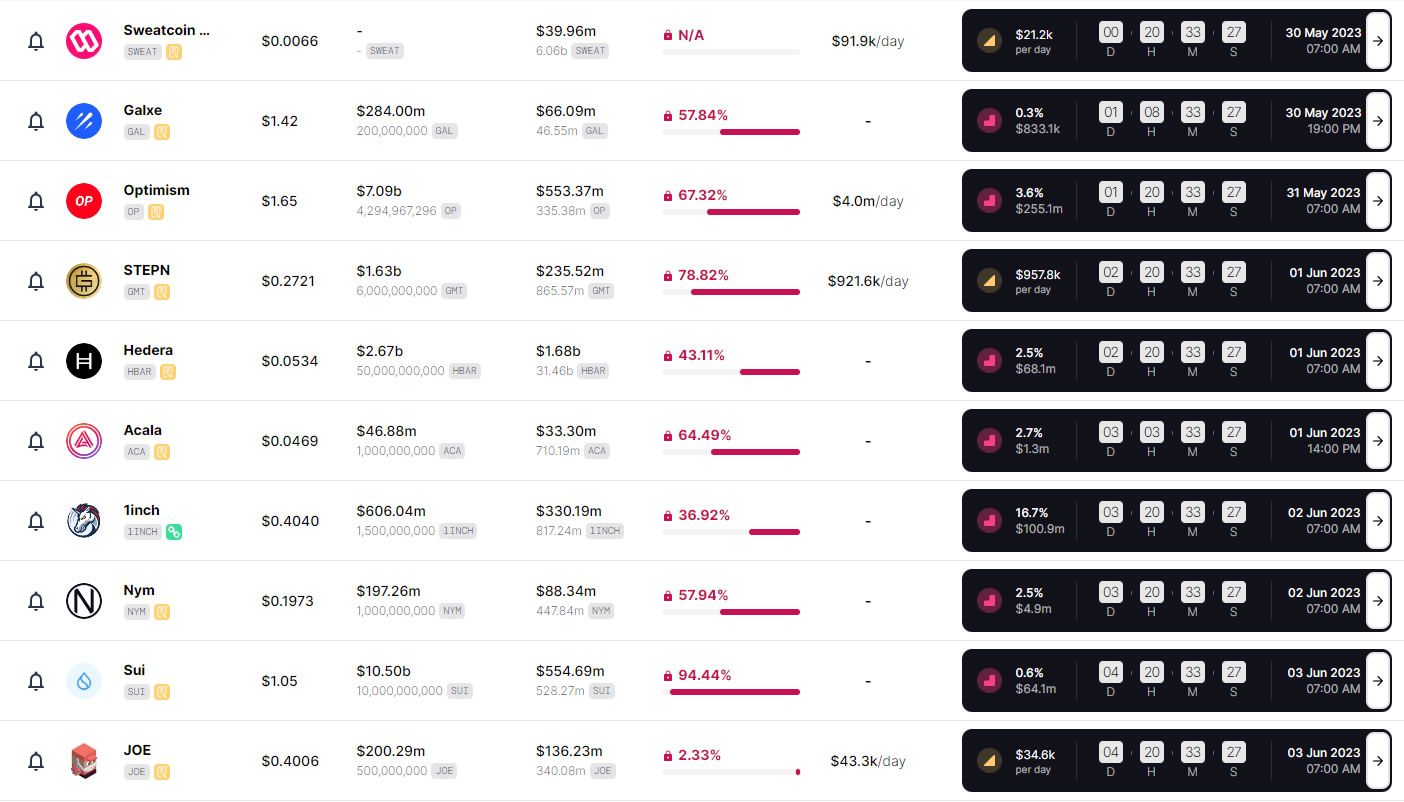

Several prominent crypto projects will be unlocking tokens this week. The move could have an impact on token prices as markets are currently in the green.

Layer 2 network Optimism is among the ten crypto projects that will be unlocking tokens this week.

On May 31, 3.6% of the supply of OP tokens will be unlocked. This equates to 154.6 million tokens worth around $255 million. According to Token Unlocks, it is the first major unlock for the core contributors and investor groups.

Optimism’s schedule will release 4.7 billion coins linearly until August 2026. Currently, 67% of the total supply remains locked.

Token Unlocks Abound

Token unlocks usually dilute the supply putting downward pressure on prices. OP is trading up 1.6% on the day at $1.65 but is down 49% from its February all-time high of $3.22.

On May 30, there will be releases for Sweatcoin (SWEAT) and Galxe (GAL). Sweatcoin unlocks around 3.2 million tokens per day, while Galxe will release 586,666 tokens.

June 1 sees unlocks for STEPN, Hedera, and Acala, and June 2 will release tokens for 1inch and Nym.

On June 3, 61 million SUI tokens worth around $63.7 million will be released. Furthermore, Sui tokenomics are heavily venture capital weighted with large chunks of tokens allocated for insiders, investors, and the Foundation.

SUI prices are up 3.4% on the day at $1.04 at the time of writing. However, the token has been trending lower since its launch and is 52% lower than its peak price of $2.16 earlier this month.

Trader Joe (JOE) is also releasing tokens on a linear daily basis, but just 2% of the supply remains locked.

Crypto Market Buoyed on Debt Ceiling Deal

Crypto markets have gained 2.8% on the day, rising to a three-week high of $1.21 trillion. Momentum has been driven by the U.S. government’s agreement on a deal to suspend the debt ceiling.

Over the weekend, President Joe Biden and congressional Republican Kevin McCarthy finally came to a deal to lift the debt limit until January 2025.

This effectively means that there is now no limit on how much more debt the government can incur. Furthermore, the move has increased risk appetite, and markets have moved.

Bitcoin gained 3.3% on the day to reach $28,075 at the time of writing. It is the asset’s highest price since May 8. Ethereum topped $1,900 following a 2.9% increase over the past 24 hours.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.