Trader Joe (not to be confused with Trader Joe’s grocery chain of stores) is a decentralized exchange that embraces the Avalanche network and ecosystem. The platform offers a number of decentralized finance (DeFi) related services, including yield farming, staking, and trading. In this article, we will learn how Trader Joe works and whether this DEX can help you with your crypto needs.

KEY TAKEAWAYS

➤ Trader Joe is a decentralized exchange on the Avalanche network that offers trading, yield farming, staking, lending, NFTs, and more.

➤ The platform utilizes its JOE token for rewards, governance, and accessing features like Rocket Joe for token launches.

➤ Trader Joe provides a beginner-friendly interface with low fees and benefits from Avalanche’s fast and secure ecosystem.

➤ With features like Rocket Joe and an NFT marketplace, Trader Joe aims to expand its ecosystem and attract new users in the DeFi space.

What is Trader Joe?

Trader Joe is an automated market maker (AMM) that focuses on trading on Avalanche. This DEX, however, also has services related to lending and borrowing, liquidity pools, leverage trading, yield farming, NFTs, staking, as well as a launchpad. Overall, Trader Joe is an exhaustive DEX.

The DEX was founded in 2021 by developers whose identity remains anonymous. The primary objective of the platform is to facilitate the trading of AVAX. Many of the Avalanche projects are modeled after other famous projects in the crypto space. For example, Pangolin and Zero Exchange, copy Uniswap’s model.

Trader Joe also has a native token, JOE. Users are rewarded with JOE for contributing to liquidity pools.

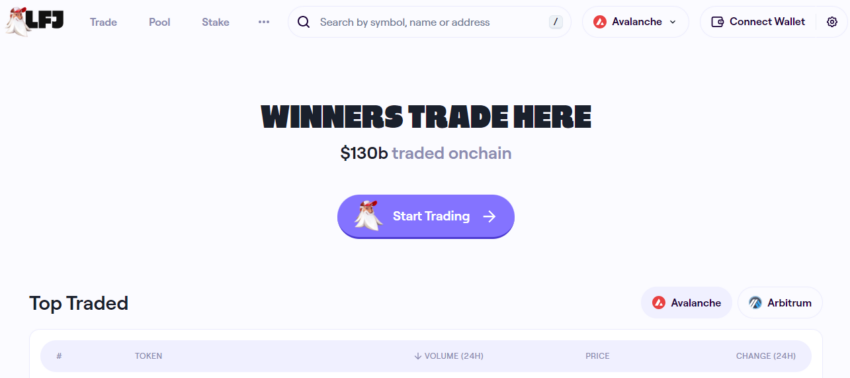

Trader Joe rebranded to Let’s F***ing Joe. The change was mostly cosmetic, opting for a bolder and bigger energy approach. However, the functioning of the actual exchange remains the same.

How does Trader Joe work?

Trader Joe, much like other trading platforms such as dYdX or Sovryn, offers a good deal of services. Let’s see how each of these works.

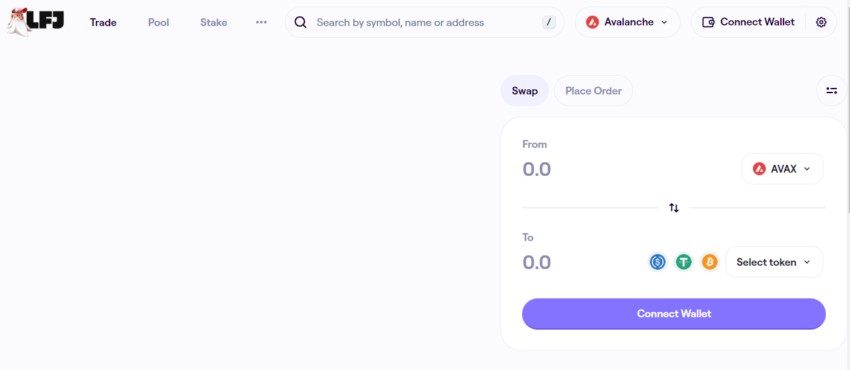

Trading

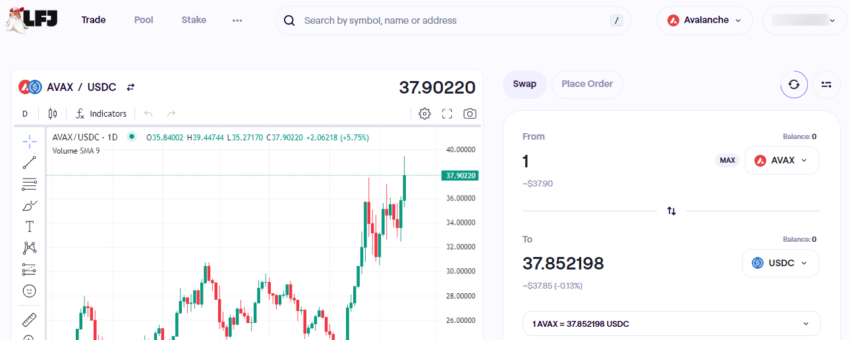

The trading pairs option is the main focus of Trader Joe. The platform features a beginner-friendly user interface. Liquidity for trades is derived from pools supplied by liquidity providers. These providers can farm JOE. This acts as their incentive. All trades carry a 0.3% fee. Of this, 0.25% is distributed to liquidity providers, and 0.05% is distributed to the JOE token farm.

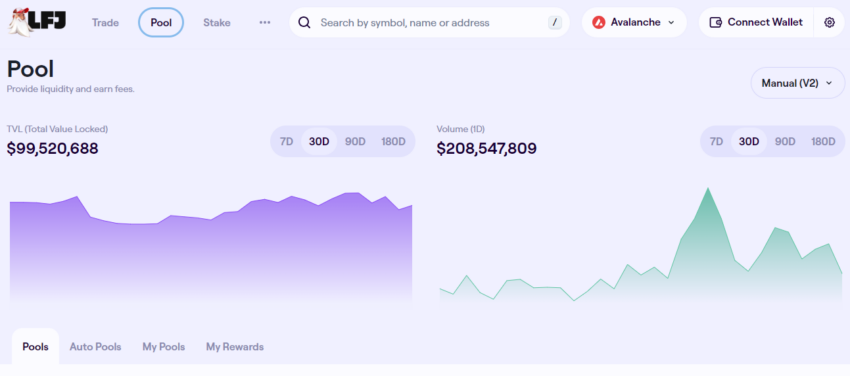

Liquidity pools

As mentioned, liquidity pools receive 0.25% of all trades. The liquidity pools contribute to the seamless trade between two cryptocurrencies. The users’ motivation to contribute to these pools involves the LP tokens. These are rewards for the liquidity providers. It represents their share of the entire pool.

Impermanent Loss is the risk that providers face. This represents the difference between the value of the withdrawal as compared to the value of the deposit. The loss is “impermanent” as long as prices return to their original value.

Collectively, the liquidity pools on the DEX hold about $100 million and the volume is over double of that.

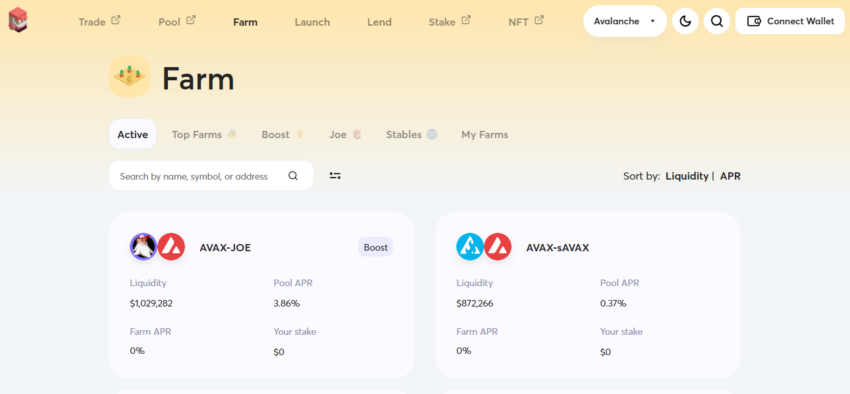

Yield farming

The yield farming process at Trader Joe is relatively standard. This involves depositing liquidity pool tokens to earn rewards in the form of JOE tokens. Users need to visit Trader Joe’s farming page and choose the pool to which they are contributing.

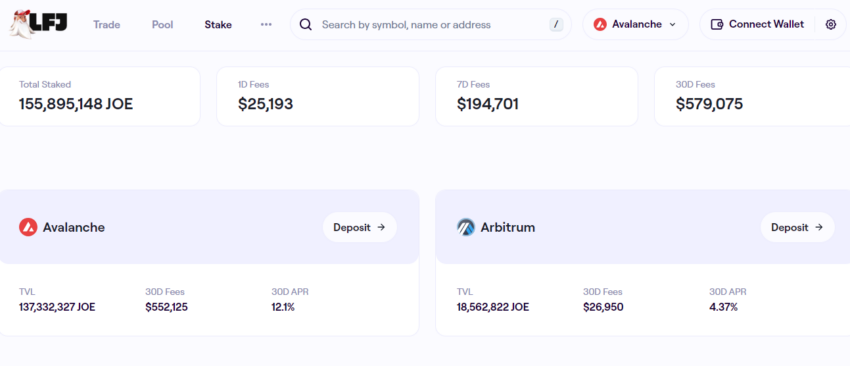

Staking

Let’s F***ing Joe Stake: lfg.gg

Staking on the platform involves using your JOE to earn sJOE, the main reward for staking on the exchange. As we mentioned, 0.05% of each trade goes into the sJOE pool. This, ideally, means that by holding JOE, each user can earn a higher quantity of sJOE.

Finally, when a user redeems their sJOE for profit, they receive a USD stablecoin (typically USDC), and they will have a greater quantity than when they started.

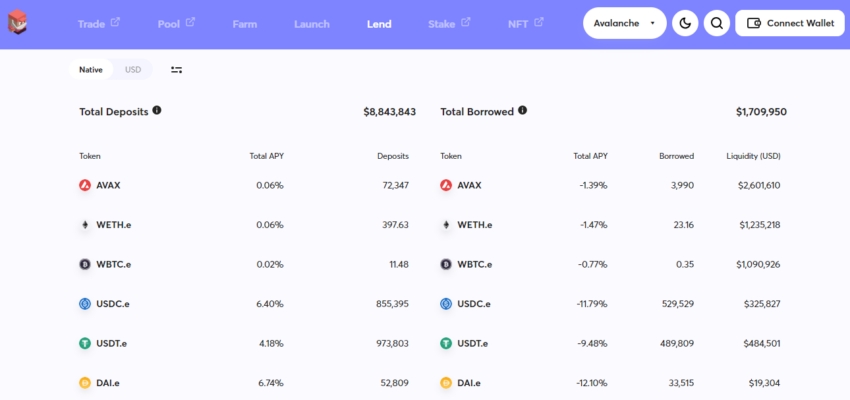

DeFi lending protocol

Let’s F***ing Joe Lend: lfg.gg

The lending feature is based on the Compound protocol. Tokens can be withdrawn at any stage, provided that the outstanding debt has been paid in full. The collateral value determines the borrowing limit, and users can improve this by adding more funds.

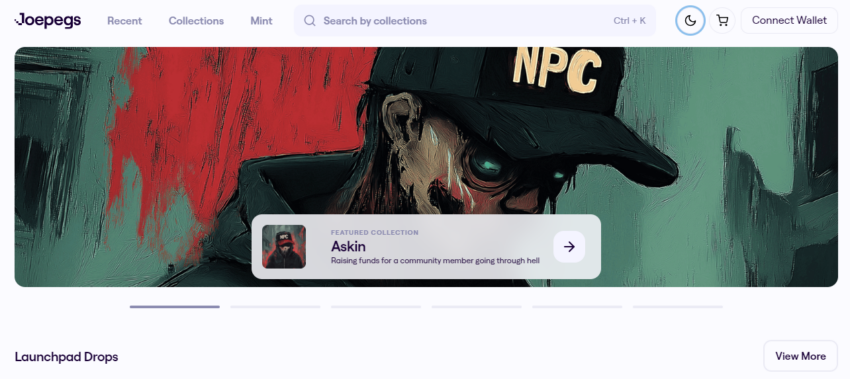

Trader Joe NFTs

The Joepegs Marketplace exists to support the Trader Joe NFTs. It is currently one of the largest NFT marketplaces in the Avalanche ecosystem. Joepegs includes several interesting features related to auction settings, whitelisting, and presentation.

There is also an artist-focused support page that offers information in real-time, as well as extensive NFT filters.

What makes Trader Joe unique?

Trader Joe resembles other decentralized exchange services available in the DeFi space in many ways. It includes features related to trading, liquidity pools, yield farming, staking and lending, and governance. Still, the anonymous developers of the platform have integrated a few unique features.

One of the unique features developed on the platform is Rocket Joe. This is a launch platform for DeFi protocols. It allows crypto developers to launch their own token and bootstrap their protocol-owned liquidity.

Trader Joe is competing with a number of similar services launched in the DeFi space. It looks to incentivize users through significant benefits.

The platform is beginner-friendly. It is secured and decentralized. Finally, the platform benefits from a solid community supported by a skilled and responsive technical support team.

How to trade on Trader Joe?

Trader Joe works similarly to other AMM-based cryptocurrency exchanges, such as Uniswap or Quickswap. Users simply need to:

- Navigate toward the “Trade” page.

- Choose the tokens that they will use in their swap.

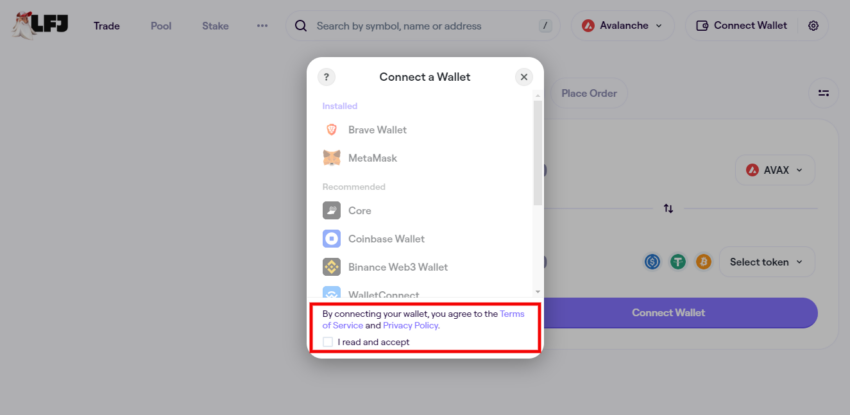

- They will also need to connect their crypto wallet (such as MetaMask).

Once they confirm the transaction, they’ll receive the assets through the swap at the contract address. Here is a more detailed guide of this process.

1. Navigate to the official website and select the “Start Trading” button.

2. Accept the terms and conditions and connect your wallet.

3. Select the tokens and the amount you wish to trade. After this part, press the blue button to complete your order.

Before proceeding with the trade, users see the minimum amount that they’ll receive, the price impact this has on the liquidity pools, and the liquidity provider fee. Make sure there is enough liquidity, or you will encounter high slippage.

What is the Trader Joe (JOE) token?

Shortly after its release in 2021, Trader Joe introduced its native token, JOE. JOE runs on the Avalanche blockchain. It has a supply of 500 million tokens.

Half of the JOE tokens are meant to go towards liquidity providers, and the rest is split between the treasury (20%), the dev team (20%), as well as future investors in the project. (10%).

Contributors to Trader Joe (stakers, farmers, liquidity providers) receive the token. The governance process, through JOEVOTE, also utilizes the token.

What is rJOE?

The rJOE token is used to enter Rocket Joe Launches. It is part of the protocol’s vision to support new tokens developed on the Avalanche network. Crypto users can accrue rJOE when they deposit JOE into staking pools. The token is not available on other platforms and has no value per se. Its use is exclusive to the Rocket Joe project.

What’s the future of Trader Joe?

Trader Joe is capitalizing on the public’s growing desire for a decentralized financial system. The AMM-based protocol includes a high number of financial services. Its embrace of the Avalanche ecosystem and the rewards it offers may, indeed, earn it even more users as time goes on. Still, time will tell how well Trader Joe fares within the DeFi space.

If you want to learn more about Trader Joe and the Avalanche ecosystem, check out the BeInCrypto Telegram Group. The group members will be happy to get you up to speed on Avalanche, AVAX, and the opportunities in the ecosystem.

Frequently asked questions

How do I use Trader Joe on Avax?

How do I get Joe crypto?

Tell me how I can farm Joe Avax?

What is rJoe token?

How do you buy crypto from Trader Joe?

What is Trader Joe crypto?

Where can I stake JOE token?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.