Optimism (OP) price has hit a 25% decline as the bearish trend enters the third consecutive week. A deeper analysis of the underlying on-chain data suggests more tough times ahead for OP holders.

Optimsims (OP) is one of the largest scaling solutions for Ethereum, with over $900 million in market capitalization at its peak. On April 14, things took a bearish turn when Hundred Finance DeFi lending protocols built on the Optimism network got hacked for $7 million.

Large institutional investors holding the native OP coins appear to have grown pessimistic, exiting their bullish positions as they turn to alternative DeFi yield-bearing protocols.

Optimism Investors Grow Wary Of a Contagion Effect

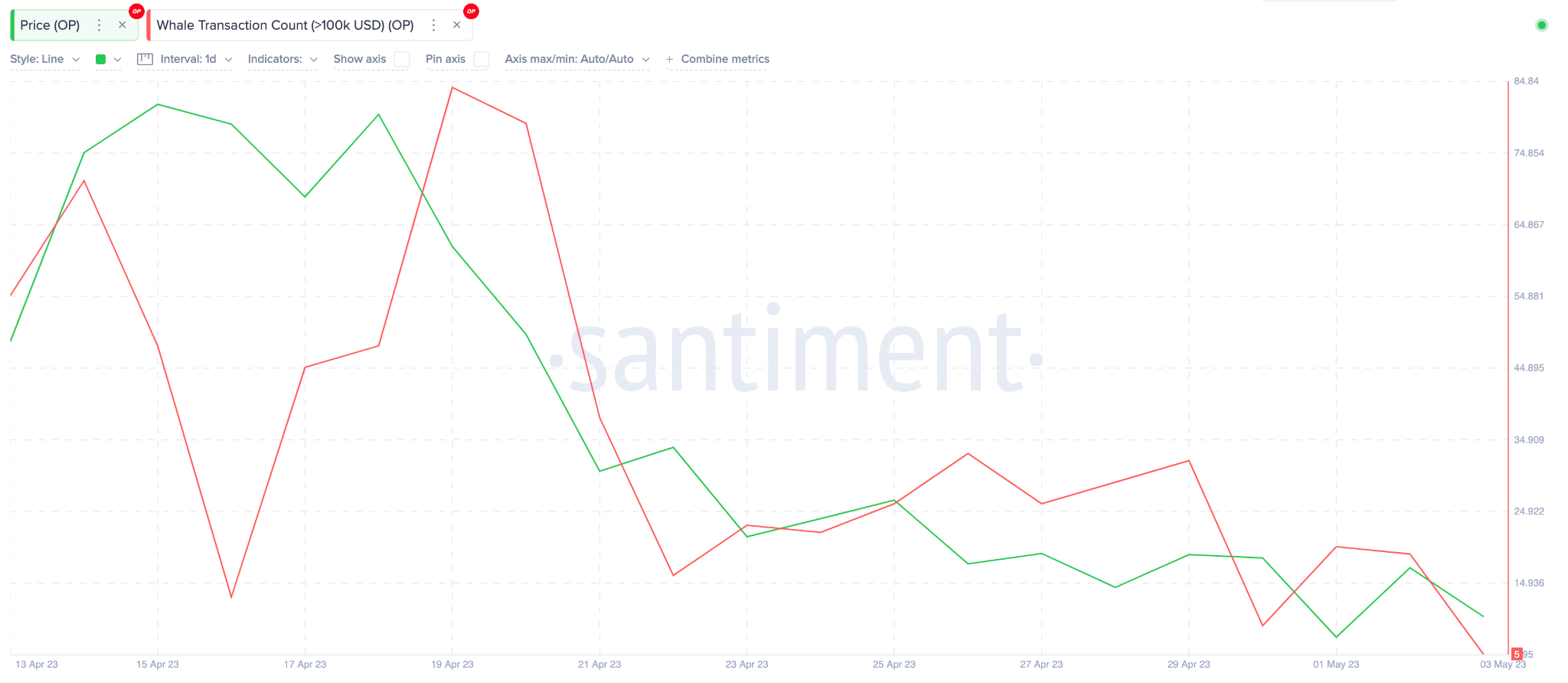

Since the Hundred Finance hack on April 14, large transaction volumes on the host Optimism network have been downturned. Specifically, the number of transactions exceeding $100,000 has reduced by 73%, from 48 to 19 daily transactions on April 15 and May 2.

This indicates that Institutional investors are growing wary of a potential contagion effect spreading across the Optimism network.

Unless this sharp decline in whale trading activity is abated, OP holders can further price downswing in the coming days.

Whales Have Entered A Sell-off Frenzy

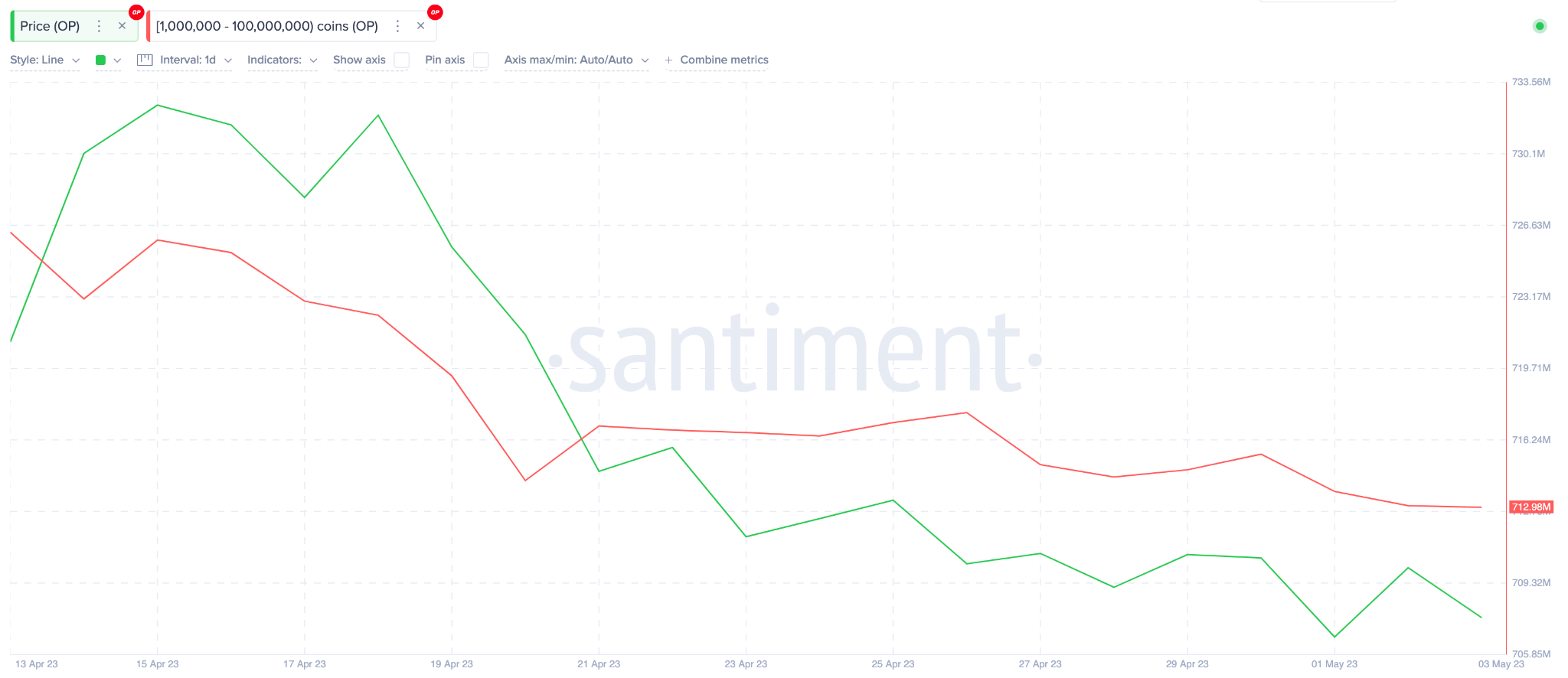

Furthermore, on-chain data shows that Optimism whales have been gradually reducing their OP holdings. This adds credence to the bearish price outlook.

The chart below shows how crypto whales holding 1 million to 100 million OP started to sell once the hack event hit the news. Since the news broke on April 15, the whales have now sold off 12 million coins as of May 3.

At the current market value of $2.10, the 12 million coins they sold are worth $25 million. For proper context, this is nearly 4% of Optimism’s current market capitalization.

When whales begin to offload large amounts of coins within a short period, it could send the price of the underlying coin into a downward spiral.

Unless the Optimism network can reignite the interest and confidence of whale investors, the bearish trend could linger.

OP Price Prediction: Possible Decline to $1.65

IntoTheBlock’s Global In/Out of the Money (GIOM) price data shows that OP will decline toward $1.65. But the bears will have to battle the initial support line around $2. Around that price level, 7,000 investors that bought 8 million coins will attempt to prevent the drop.

But if the market remains bearish as expected, then the Optimism price could slump toward $1.65, where there is more significant support from 51 investors holding 797 million OP coins.

Yet, the bulls could invalidate the bearish stance if OP price can break above $2.26. But fierce resistance from 58,000 addresses holding 38 million coins could pose a challenge.

Though unlikely, if the bulls manage to scale the sell-wall at $2.26, Optimism holders can be optimistic of an early recovery toward the $2.65 zone.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.