Worldcoin is an increasingly popular AI project from Sam Altman, the OpenAI CEO. OpenAI is the firm behind ChatGPT, the very well-known AI chatbot. Primarily an AI-led novel yet holistic form of identification, Worldcoin aims to make verification “botless,” valuing the unique human element over everything else. In this article, we’ll explore the current and future price potential of WLD as well as its inner workings.

- Worldcoin (WLD) price prediction until the year 2035

- Worldcoin price prediction and technical analysis

- Worldcoin (WLD) price prediction 2024

- Worldcoin (WLD) price prediction 2025

- Worldcoin (WLD) Price Prediction 2026

- Worldcoin (WLD) price prediction 2027

- Worldcoin (WLD) price prediction 2028

- Worldcoin (WLD) price prediction 2029

- Worldcoin (WLD) price prediction 2030

- The hype around the WLD price forecast

- Worldcoin price prediction and fundamental analysis

- Is it worth investing in Worldcoin?

- Frequently asked questions

Worldcoin (WLD) price prediction until the year 2035

Here is a table that extrapolates the WLD price projections until the year 2035:

| Year | Maximum price of WLD | Minimum price of WLD |

| 2024 | $29 | $7.50 |

| 2025 | $45.34 | $11.74 |

| 2026 | $39.33 | $18.30 |

| 2027 | $80.75 | $26.45 |

| 2028 | $122.17 | $40.02 |

| 2029 | $163.58 | $53.59 |

| 2030 | $205 | $67.16 |

| 2031 | $225.71 | $73.95 |

| 2032 | $246.42 | $80.73 |

| 2033 | $267.13 | $87.51 |

| 2034 | $287.84 | $94.30 |

| 2035 | $308.54 | $101.08 |

Do note that the average price of WLD each year should fall anywhere between the maximum and minimum projections. As Worldcoin platforms and Orbs grow in numbers and popularity, the prices might surge. Regulatory concerns can push the price down, closer to the minimum projections.

Worldcoin price prediction and technical analysis

Let us now shift our focus to the technical analysis of WLD, bringing us closer to the price action.

Short-term technical analysis

If you are looking to hold, sell, or even buy WLD in 2025, it is necessary to take a closer look at the short-term price chart.

The daily WLD chart still projects some bearishness as the coin has broken below a not-so-classic Head and Shoulders pattern. For now, it is trading inside an ascending channel pattern, and a breach past $2 can push the prices to $1.5. However, a move above the $3 mark can invalidate the bearish trend.

Long-term WLD price prediction

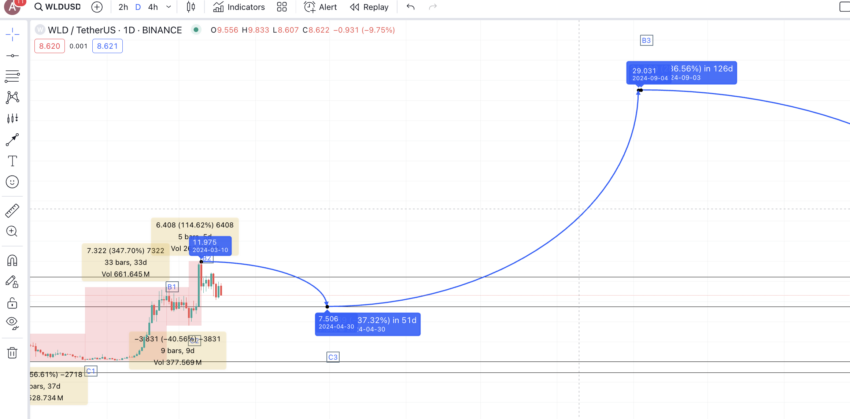

Worldcoin is a relatively new project, and therefore, WLD doesn’t have a lot of historical price data on which we can rely. Therefore, we shall use the daily chart for now.

The daily chart can be divided into three sections: A-C-B, B-C1-B1, and B1-C2-B2. This is because the price actions during each phase remain relatively similar — a high followed by some sideways movement and then another high.

Let us now calculate the price moves and time taken for one point to reach another across all three phases.

| A to C | 50 days and -81.72% |

| C to B | 96 days and 397.18% |

| B to C1 | 37 days and -56.61% |

| C1 to B1 | 33 days and 347.70% |

| B1 to C2 | 9 days and -40.56% |

| C2 to B2 | 5 days and 114.62% |

Even though there are fewer data points, they are points, nevertheless. Therefore, we can quickly calculate the average price drop and the average price hike.

The average figures come out to be 286.50% and -59.63%.

Assuming that the next dip for WLD surfaces at $7.50, per the short-term analysis, we can prepare our year-specific levels.

Worldcoin (WLD) price prediction 2024

Outlook: Very bullish

While we were bullish about WLD reaching $29 in 2024, we were also aware that the final price of WLD in 2024 could settle anywhere between the low of $7.50 and high of $29. The final 2024 high went up to $11.69, aligning with our predictions.

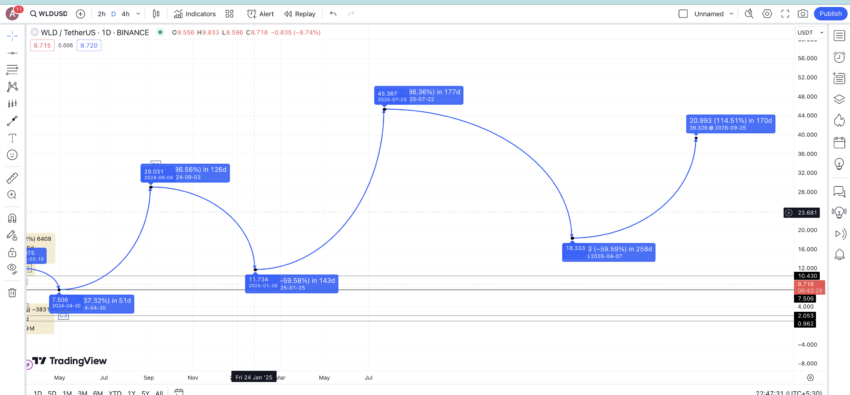

Worldcoin (WLD) price prediction 2025

Outlook: Very bullish

Assuming the 2024 high forms at B3, the next low can be at a correction of 59.63%. You can refer to the earlier calculations to understand how we reached this level. This puts the expected 2025 low at $11.74. From this level, we can expect an average hike of 286.50%, putting the Worldcoin price prediction high for 2025 at $45.34.

However, considering the lackluster performance of WLD in 2024, a high of $11.74 might also make sense.

Projected ROI from the current level: 1960%

Worldcoin (WLD) Price Prediction 2026

Outlook: Bullish

Based on the previous calculations, we can also predict a 2026 low for WLD at $18.30, reflecting a 59.63% correction from the previous high.

However, it is unrealistic to expect WLD to maintain a near 300% growth consistently. Instead, assuming a more conservative rise of 114.62% (the lowest rise from our table), we can predict the 2026 high for Worldcoin at $39.33.

Projected ROI from the current level: 1687%

Worldcoin (WLD) price prediction 2027

Outlook: Very Bullish

Assuming the 2026 high forms at $39.33, the subsequent correction (59.63%) would bring the 2027 low to $26.45. From this level, we can expect a price increase of 205.34%, leading to a projected high of $80.75 by the end of 2027.

Projected ROI from the current level: 3570%

Worldcoin (WLD) price prediction 2028

Outlook: Very Bullish

Using the same pattern, the 2027 high of $80.75 would correct by 59.63%, bringing the 2028 low to $40.02. From this level, assuming a 205.34% rise, the predicted high for 2028 would be $122.17.

Projected ROI from the current level: 5453%

Worldcoin (WLD) price prediction 2029

Outlook: Bullish

Following the established trend, the 2028 high of $122.17 would correct by 59.63%, resulting in a 2029 low of $53.59. From this point, anticipating a rise of 205.34%, the high for 2029 is projected to be $163.58.

Projected ROI from the current level: 7335%

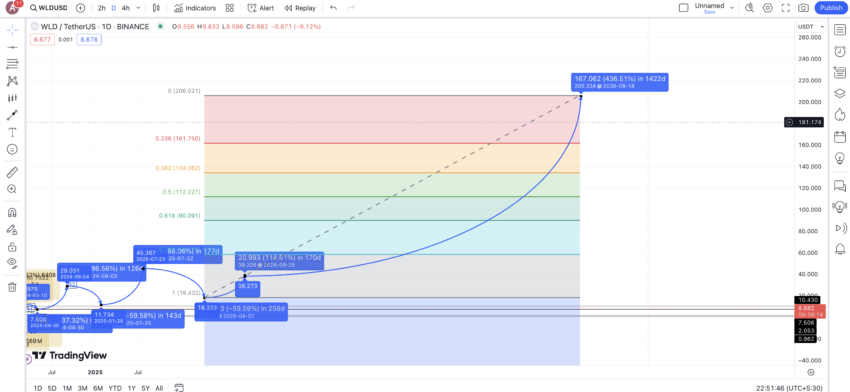

Worldcoin (WLD) price prediction 2030

Outlook: Bullish

Based on the previous calculations, we can also chalk out to a 2026 low for WLD. This can be expected to surface at $18.30, per the 59.63% calculation.

However, in 2026, we cannot expect WLD, or any other project for that matter, to keep growing consistently, hitting close to 300% from the lows. At this point, we can assume a price rise of 114.62%, per the lowest value from the previously discussed table.

This puts the 2026 high for Worldcoin at $39.33.

Now that we have the 2026 low and 2026 high, we can extrapolate the same to locate the possible levels in 2030. Using the Fib retracement tool, we can expect the 2030 high for WLD to surface at $205.

Projected ROI from the current level: 9218%

The hype around the WLD price forecast

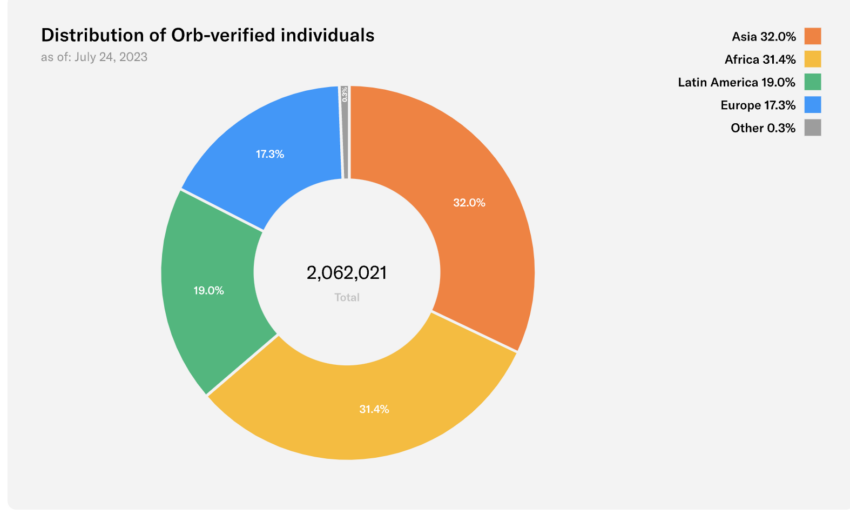

Worldcoin tokens were initially distributed as airdrops. Individuals engaging with the projects during the development phase and others verifying identities using Orb-based retina scanning were eligible for those airdrops.

Initially, the listing price of Worldcoin was supposed to be $0.30, which immediately rose to $2.79 on Bybit, even before the Binance listing. On Binance, 60 minutes after it was listed, WLD reached $2.97, led by high trading activity and investor interest.

On March 10, 2024, buoyed by the crypto market rally, the price of WLD briefly crossed the $11 mark, an increase of almost 270% in under nine months. But then, geopolitical concerns led to a sharp price correction.

Note that challenges continue to exist for Worldcoin:

BeInCrypto spoke to Lark Davis, Founder of Wealth Mastery, while formulating the WLD price prediction. When asked about Worldcoin’s future, especially amid the challenges, Davis said:

“There are a lot of things that I don’t really like about Worldcoin. The whole thing feels very Orwellian.

That being said I would not be quick to fade a coin backed and launched by Sam Altman, the guy behind open AI. Regulatory challenges are just that challenges. This is a super well funded company behind this very popular cryptocurrency. My guess is that in time they will overcome these challenges and make a real mark in the crypto space for better or worse.”

Lark Davis, Founder of Wealth Mastery: BeInCrypto

Despite concerns among many in the crypto community around the ethics of the project, the project has demonstrably gained steam since its launch.

Worldcoin price prediction and fundamental analysis

Before we dive deeper into the technical analysis, it is time to look at the fundamental aspects of Worldcoin as a project. For starters, Worldcoin has a fixed token supply of 10 billion. Also, the project clearly defines the yearly issuance, setting it at 1.5%.

Did you know? The default inflation rate for Worldcoin is 0%. However, keeping token unlocks and other aspects in mind, the inflation quotient will only come in after 15 years and cannot go higher than 1.5%, as it is set in code.

Another fundamental stance that Worldcoin takes is how diversified the Worldcoin Orbs are geographically:

Also, here is transparent the token unlocking schedule is, prepared with market-wide sell-off resistance in mind:

Fundamentally, from innovation to handling tokenomics correctly, Worldcoin has most bases covered.

Is it worth investing in Worldcoin?

Like any other AI-driven project, Worldcoin is expected to grow price-wise in this existing bull market. However, the focus should always be on a project’s long-term potential, which, in the case of WLD, happens to be the vision of the largest financial and identity network. Plus, with physical orbs around and more being rolled out across multiple cities and countries, this optimistic Worldcoin price prediction model does look realizable.

Frequently asked questions

What is Worldcoin?

Is WLD available on OKX?

Will Worldcoin’s value increase?

Is Worldcoin free?

How do I cash out Worldcoin?

How to I sell Worldcoin to Binance?

How does Worldcoin ensure the privacy and security of users’ biometric data?

What are the potential use cases for Worldcoin and how might they impact its value?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.