The Ethereum roadmap shifted from improving on-chain scalability to supporting layer-2 (L2) solutions — evident given the Dencun upgrade. As a result, rollups like Base Chain sit at the forefront as the new face of blockchains. Learn how Base works and everything else you need to know in this guide.

What is Base Chain?

Base is an Ethereum layer-2 brought to users by Coinbase. For those out of the loop, Coinbase is the popular crypto exchange that was created by Fred Ehrsam and Brian Armstrong in 2012 and went public in 2021. Combining the ticker for Coinbase, COIN, and the name of the rollup, Base, cleverly spells out “Coinbase”.

Base is an optimistic rollup on Ethereum and is part of a broader initiative to “bring the next billion users on-chain.”

Starting late 2021, I stepped into a new role and the role was figure out how to bring Coinbase on-chain. You know, if you look at Coinbase’s business historically it’s mostly off-chain, a centralized exchange/brokerage.

Jesse Pollak, Base developer: YouTube

Blockchains have a difficult time processing an abundance of transactions and processing them quickly. There are a few ways to fix this problem.

One of these solutions is rollups. There are two popular types of rollups, zk (zero knowledge) and optimistic rollups, of which Base is the latter. While zk rollups scale by compressing transaction data into a single proof, optimistic rollups only submit proofs for fraudulent activity or incorrect state transitions.

While Base is considered an optimistic rollup, it is important to point out that it has yet to actually implement fraud proofs.

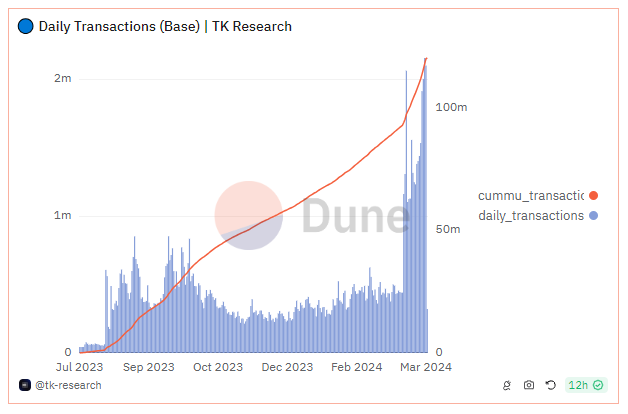

Base Chain metrics

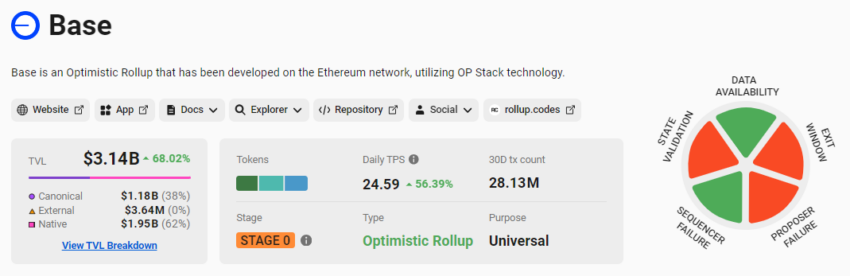

The team behind the Base has plans to decentralize in the future. However, As of April 2, 2024, it is currently in the training wheels stage of development, or “Stage 0,” as L2Beat calls it. This means that there is currently no actual proof system, user’s withdrawals can be censored, and upgrades are executed by a privileged committee of controllers.

This is not completely out of the ordinary for rollups. Many projects take a slow and steady approach to building up blockchains before they are ready for full decentralization. However, it is important to note that virtually all rollups and layer-2 blockchains are centralized.

Base has a total value locked (TVL) of over $3.14 billion, putting it in the third place for rollups, right after Arbitrum and Optimism. On July 30, 2023, Base had a TVL of $2.19 million. This is a 1,433.79% increase as of April 2, 2024, less than a year later.

This value is split between natively minted and bridged tokens — the majority being from natively minted tokens, that is, t created on Base. The majority of the total TVL on Base comes from USDC, both bridged and natively minted.

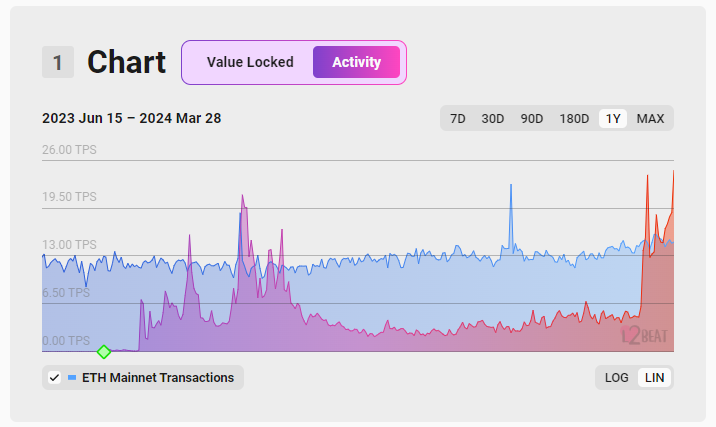

As of April 2024, Base is processing about 24 transactions per second in terms of network activity, at times even surpassing that of Ethereum. Currently, this spike in network activity is largely due to the meme coin craze taking over the crypto sector.

Why is Base popular?

Base has garnered much attention, largely due to its affiliation with Coinbase. However, there are a number of overarching narratives potentially contributing to the success of the Ethereum layer-2. Here are a few to consider.

Rollups and modularity

As stated previously Ethereum has shifted its roadmap from scaling on-chain to off-chain scaling solutions, meaning via rollups and layer-2s. This initiative has kicked off a proverbial arms race to create the next rollup, bridge, or modular blockchain to scale Ethereum and attract users.

As a result, many rollups have been created. This is also largely due to the many benefits of using Ethereum as a settlement layer. Many businesses naturally want EVM compatibility because it makes it easier for developers and users to pivot over.

For example, many of the same decentralized applications (DApps) that exist on Ethereum also exist on popular rollups. Therefore, developers do not have to write a tonne of new code to move an app like Uniswap over to Base. As users are already familiar with Uniswap, it makes it easier to attract new users to rollups that offer Uniswap as well.

Lastly, due to an increasing fascination with modularity, blockchains can now delegate a few tasks to other blockchains to make some services cheaper or more efficient on-chain. This means that customers can benefit from a better user experience, too.

Settling payments

Signet by Signature Bank and Silvergate’s SEN (Silvergate Exchange Network) are examples of private blockchain networks developed by banks to facilitate instant payments, particularly for clients operating within the cryptocurrency space.

These platforms offer a range of benefits over traditional banking systems or public blockchains, especially in terms of speed, availability, and efficiency. They offer 24/7 availability, settle transactions in real-time, are cost-effective, and have significantly more security.

In other words, settling transactions between institutions is costly, time-consuming, and requires a complex web of banking relationships and collateral to settle and resolve each institution’s ledger. Private enterprise chains like Signet and SEN are a huge value-add for institutions and, subsequently, the customers each serves.

In this way, Base can offer the same benefit to Coinbase customers. Using Base Chain in conjunction with USDC for settlements makes sense for a company like Coinbase, which handles a large volume of transactions between large institutions and a multitude of customers in different regions.

Coinbase can offer international payments, lower fees, and faster settlement times using Base than the fractured traditional banking system.

Banks will credit payments to customers and retailers but do not actually settle the payments until days later. This complex banking system requires multiple intermediaries, especially when one party’s bank does not have a relationship with the other. As a result, each intermediary will require a fee along the way.

Base and blockchains generally nullify this process by simply transferring crypto to and from the relevant parties’ accounts. Blockchains bypass the middlemen and extra fees by cutting out the intermediaries and creating a unified ledger.

Low fees

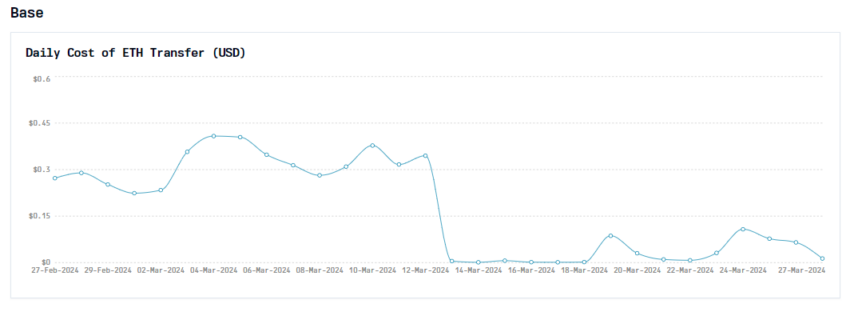

Rollups and layer-2 blockchains generally leverage ultra-low fees and fast transaction times. As opposed to Ethereum, rollup gas fees are usually fractions of a dollar. Base has one of the lower gas fees, averaging about $0.02 for a Uniswap swap.

However, since the Dencun upgrade fees on Base and many other rollups have dropped to fractions of a cent. This is a huge improvement to user experience, as one of the greatest arguments in the web3 vs. TradFi debate has always been that blockchain transactions were more expensive.

Meme coin craze on Base

As the bear market thaws, meme coins have become one of the best-performing asset classes in crypto as of early April 2024. Many chains have benefitted from this increased speculation, some of the most popular being Solana and Base.

Overall, daily transactions increased in March for Base. This increase in activity actually had an inverse relationship with Base fees, thanks to the Dencun upgrade. In other words, fees dropped while the number of transactions increased, largely due to Base meme coins.

Low fees are especially popular with meme coin traders, as they lead to reduced slippage, fewer failed transactions, and more predictable fees.

Base explainer: How does Base Chain work?

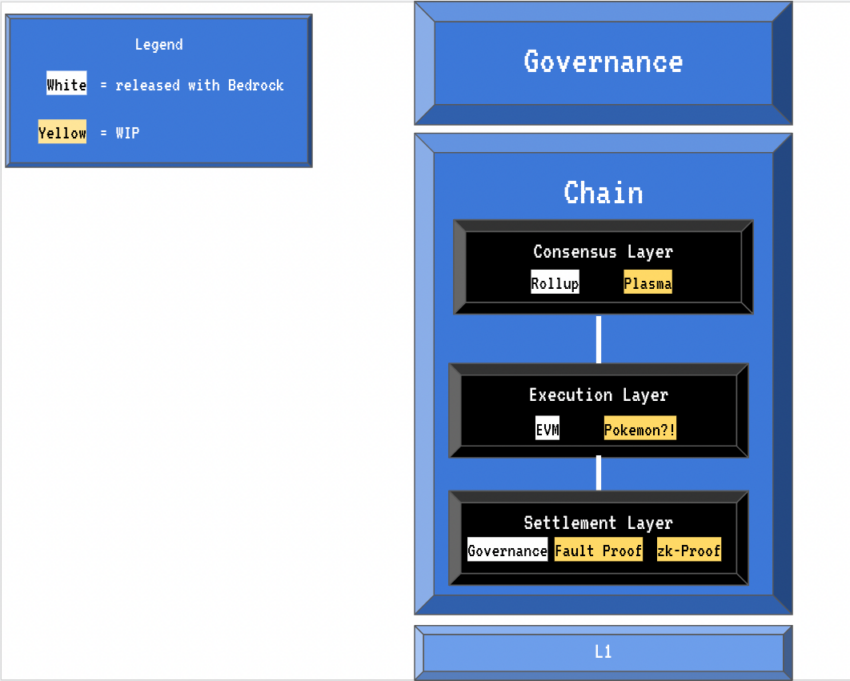

To reiterate, Base Chain is an optimistic rollup. The first highly anticipated optimistic rollups on Ethereum were Arbitrum and Optimism. Base uses the Optimism SDK or OP stack, specifically the Bedrock release. The Optimism SDK is a series of modules across the consensus, execution, and settlement layers that work together to form a blockchain.

A module is a portion of code that can be added as a whole or reused. Modules are a method of breaking down larger software programs into smaller, independent sections that are then combined to form the executable program.

For the Bedrock release, this means that developers can modify or swap out specific modules. The result is that they can specify features like governance, settlement, execution, or data availability.

Base fees

Base Chain groups off-chain transactions into batches before transferring them to Ethereum. This allows the Base rollup to distribute the costs of posting to Ethereum across a wider group of users. As a result, users benefit from reduced fees instead of posting to Ethereum directly.

This process spreads the cost of the transaction across many users, making rollups cheaper. Rollups also reduce the base layer’s computational load, leading to faster settlement.

Users that interact with rollups incur a unified transaction fee, which essentially comprises three distinct components, each corresponding to a specific layer:

- Rollup fees: These are charged for the management and operation of the rollup itself.

- Settlement fees: Fees associated with proof verification and the commitment of state roots to the settlement layer.

- Data availability fees: Costs for submitting compressed transaction data to the Data Availability (DA) layer.

Additionally, Base generates blocks every two seconds, irrespective of their status. This means that the blocks can be empty or full. Base is also engineered to allow users to send arbitrary messages across smart contracts on the L2 (Base) and L1 (Ethereum) layers. This is useful for the transfer of tokens, including but not limited to ERC20 tokens.

Furthermore, Base employs a sophisticated smart contract bridge. This is designed to facilitate both the deposit of digital assets from Ethereum into Base and the subsequent withdrawals from Base back to Ethereum.

Base Chain vs. other blockchains

There are a few chains that you can compare Base to. We will compare Base to Ethereum to lay out the tradeoffs and improvements users receive or give up when using Base vs. Ethereum.

Base vs. Ethereum

The most obvious difference between Ethereum and Base is that while Ethereum is a layer-1 blockchain, Base is an L2 on Ethereum. Ethereum is a monolithic network that handles consensus, settlement, execution, and data availability, all on a single blockchain.

Crypto-economic security bootstraps and secures these features. As a result, it is a lot more expensive to use Ethereum. Base, on the other hand, delegates most of these features. Ethereum handles Base’s settlement and data availability tasks, allowing it to reduce fees for Base users.

As a direct result of this optimization, Base Chain’s fees are significantly cheaper than Ethereum’s. However, Base and Ethereum have a few things in common — predominantly the EVM. The Ethereum Virtual Machine (EVM) executes programs or smart contracts on Ethereum.

As it is EVM compatible, Base can execute the same smart contracts and, therefore, can house the same DApps that exist on Ethereum.

In terms of speed, Ethereum typically processes about 11-13 transactions per second (tps) and has a block time of about 12 seconds. Base can process twice as many transactions and generates blocks six times faster than Ethereum.

Is Base the best Ethereum layer-2?

There are a few requirements that you should consider when deciding what is the best Ethereum L2. These include:

- Security

- Fees

- User/developer experience

- Liquidity

Security covers a broad range of features. At the moment, Base can censor users’ transactions. Additionally, Base has yet to implement actual fraud proofs and uses a privileged set of operators to update the chain.

This means that the chain is, for all intents and purposes, centralized — and operators can make illegitimate state transitions without a verifiable way to challenge them. To reiterate, many of these qualities are true for most L2s.

In terms of developer experience, the Base Chain is equivalent to Ethereum. This means it is EVM compatible and thus uses the Solidity programming language. Many developers have complained about problems with Solidity, such as arithmetic underflow, reentrancy, and other problems. As a result, Base naturally inherits these issues.

Moreover, there are also problems associated with the EVM, the execution engine of Ethereum. For example, the EVM is not aware of many of the assets that exist on-chain, such as tokens and NFTs.

We have discussed user experience in detail above, so we will move on to liquidity. Ethereum is the most liquid smart contract platform in crypto. That is why many rollups choose to have EVM compatibility despite the problems associated with the EVM and Solidity programming language.

The base has the third highest TVL out of all rollups, native USDC, and bridges assets to and from Ethereum relatively easily. In summary, while Base isn’t objectively the best Ethereum layer-2, partly benefiting from but partly limited by its EVM compatibility, it is one of the more popular rollups on the market.

Base: The culmination of enterprise and web3

Base Chain is a natural culmination of the ethos of blockchains. While decentralization always sat at the forefront, enterprise and corporate adoption was always intended to arrive on-chain. Base is the realization of that vision. While it isn’t as decentralized as Ethereum or Bitcoin, it doesn’t necessarily have to be — although this remains a concern for some purists.

Frequently asked questions

Base is an Ethereum layer-2 scaling solution funded by Coinbase. It utilizes optimistic rollup technology to increase transaction throughput, reduce costs, and maintain security. Base aims to offer a scalable, developer-friendly environment, and bring users on-chain.

Base differentiates itself by its close association with Coinbase, one of the largest cryptocurrency exchanges. It utilizes the OP Stack or Optimisim software development kit. This allows Base to batch transactions and distribute the fees across multiple users of Base.

Transactions on Base are significantly cheaper than Ethereum. This is because Ethereum node have high operational costs, while Base offloads some of its costs to Ethereum rather than keeping them on Base. Base also spreads the fixed costs of Ethereum gas fees across many transactions, significantly reducing the cost per transaction.

Yes, Base supports the transfer of tokens, including ERC20 tokens, between Ethereum and Base through a smart contract bridge. This bridge allows users to deposit assets from Ethereum to Base and withdraw them back to Ethereum. This allows seamless asset transfer with ease.

Base inherits some security features of Ethereum as it is an optimistic rollup. It relies on Ethereum for its data availability and finality guarantees. However, like any layer-2 solution, there are additional considerations regarding the specific implementation of the rollup and the bridge for asset transfers.

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.