Any successful investor needs to have a strategy. This is also the case in the NFT space, which has grown exponentially since 2021. The most profitable NFT investments result from carefully assessed NFT trading strategies. Whether you’re looking for a short-term plan or trying to devise a roadmap for a new art collection, you’ll want to consider implementing some of these NFT trading strategies.

KEY TAKEAWAYS

➤ Profitable NFT investments depend on understanding market trends, utility, and the potential for long-term growth.

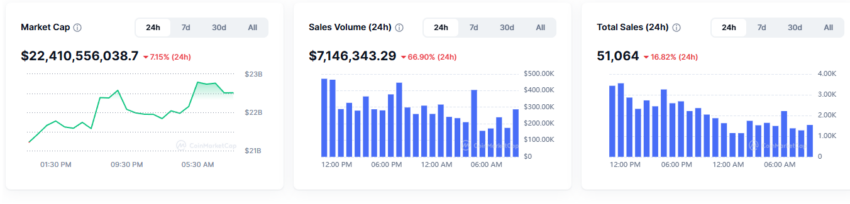

➤ Market cap, trading volume, and team reputation are essential factors when evaluating NFT projects.

➤ Key trading strategies include acquiring floor-priced NFTs, identifying undervalued assets, and analyzing search trends.

➤ Community size and marketing activities significantly impact the value and performance of NFT projects.

Top 7 NFT trading strategies

Investing in NFTs may seem straightforward, but you need to evaluate each asset carefully to make these trades profitable. For instance, when an NFT project starts trending on platforms like Twitter, chances are its price has already skyrocketed. You need to tread carefully in such scenarios as investing in a project after it has already trended can be risky — its price may have already peaked.

Careful considerations like that generally help identify the potential of NFT projects. Here’s what to examine:

1. Buy the floor

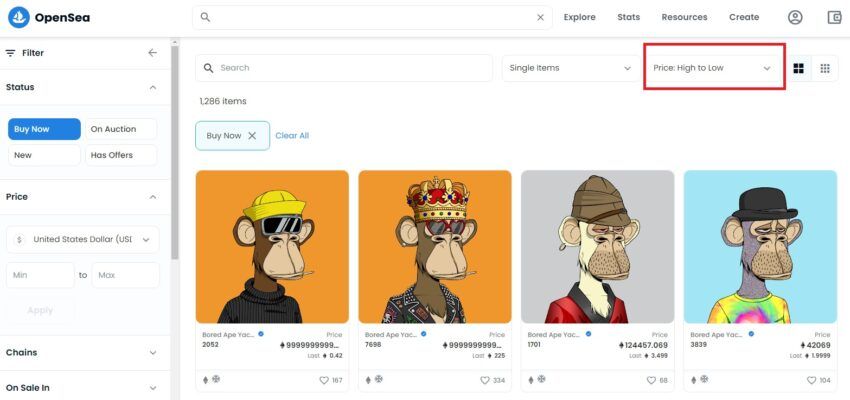

Buying NFTs at the floor price — the lowest price in a collection — offers an entry point for new investors. Sorting NFTs by price helps identify these opportunities. Following a project before its launch increases the chance of acquiring NFTs at their floor price, which may yield profits as the project gains traction.

Remember that it’s always a good NFT trading strategy to buy it at the floor price because if the token becomes popular, you will make a nice profit from selling it.

For further insights, read our guide on how to find affordable NFTs at floor price.

2. Search for Google Trends

Google Trends is a valuable tool for gauging public interest in NFTs. High search volumes for NFT-related keywords indicate growing interest, which could signal a good time to invest.

Declines in search volume, however, suggest reduced market interest. Observing these trends and correlating them with trading volume provides deeper insights into market dynamics. Monitoring trader activity could also help evaluate a project’s health.

3. Buy NFTs collectibles with few sellers

Making a profit from any NFT investment implies that you will successfully sell that NFT for a higher price than the price you pay to buy it. Obviously, it will be more difficult to sell an NFT that doesn’t have a large community supporting the project and is willing to buy it.

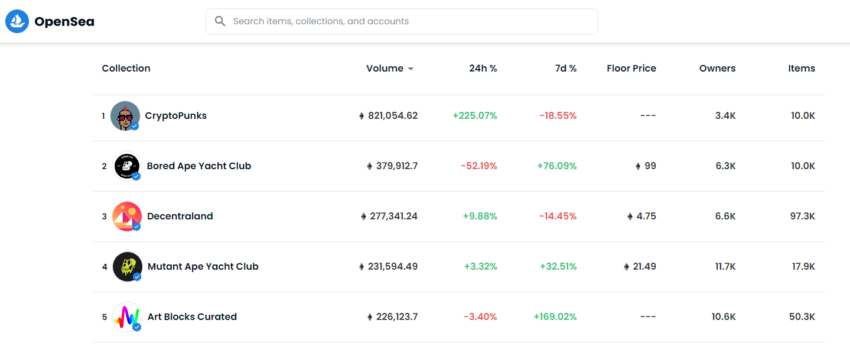

➤ Your NFT trading strategies should always depend on how many sellers there are for that NFT collection. If you want to sell, you need to have a high enough trading volume to make a sale. With more sellers, the difficulty in maintaining competitive prices increases. That’s because there are more people who will lower their prices than you.

When you are identifying sellers for an NFT, consider how they act. If the prices listed are spaced from one another, it means that the sellers have enough patience to wait for the right buyer for them. They will probably not react if you offer a lower price.

However, if there are many prices that are close together, it is a sign that the sellers are impatient and want to undercut. Selling NFTs is about a battle for buyers’ money. You will be more successful selling NFTs with patient sellers.

The market trends and how sellers behave will significantly impact how they act. Note that this NFT trading strategy trend can change over time. It is best used when you are comparing similar NFTs collections.

4. Value strategy

Investing in high-value NFTs, often rare items within collections, can be profitable. Platforms like rarity.tools makes it easier to make informed decisions by offering tools to find and evaluate valuable NFTs.

However, note that this might not be the best trading strategy if you’re just starting out and you have a limited budget.

5. Buy the ceiling

For those with substantial funds, buying ceiling NFTs (those at the highest prices within a collection) is an option. These assets often appreciate if demand for the project increases.

However, this high-risk strategy may not suit all investors, as finding buyers for expensive NFTs can be challenging. Losses can be significant if the project loses popularity.

6. Look for underpriced NFTs

The dream of any newbie NFT investor is to find an underpriced NFT on a marketplace. This strategy doesn’t rely on a rising market trend and can work even when there is little demand for a certain NFT collection.

To use this NFT trading strategy to make a profit, you will have to find NFTs that are being sold now for a lower price than they were bought for.

For instance, you might find five copies of the same NFT listed for $300. At the same time, the rest of the collection is listed for over $600. While this looks like a great deal, you might want to take a look at the cheaper NFTs in this collection.

Don’t exclude the possibility that those NFTs were bought for only $50 each. That makes their current listing of $300 more expensive than it should be. The takeaway is to not judge the value of one NFT based on their current listing price.

➤ Market prices are important to consider, but this is not the only thing you should take into account. If the market overall for a project has improved, you can presume that the NFT value is now higher.

7. Consider the market for an NFT project

This is probably the most important aspect of NFT investments and one important pillar for your NFT trading strategies. You should always ask yourself if there is a market for that NFT project you want to invest in.

➤ If the community is small and the plans for a marketing campaign are nonexistent, then you shouldn’t put too many eggs in that basket. Probably, the safest bet would be to avoid it altogether.

NFT marketplaces are flooded with new projects each day. But successful NFT investors are those who can filter through all those projects and find the ones that have a purpose. Try to find NFT projects that have a utility and, most importantly, a supportive community. Aim to discover communities that are large enough to have future buyers for your NFTs.

Why invest in NFTs?

➤ Non-fungible tokens (NFTs) are one of the most lucrative investment markets in 2024. We have seen many NFTs and NFT collectibles skyrocketing in price over the years, with online influencers bragging about their income from NFT trading.

NFTs as a profit opportunity

Many internet gurus and crypto influencers have publicly claimed to have made huge profits by buying and selling NFTs. Of course, each NFT is unique, and reaping the rewards later means that you’ve invested in the right NFT project from the start.

NFT investors who utilise a solid trading strategy may be able to make reasonable profits over the long and short term; or, they could lose money. Regardless of your strategy, you are not invincible. It’s important not to underestimate the volatility of the markets and the risks associated with that volatility.

NFTs promote original creators

NFT marketplaces allow content creators to tokenize digital items and eliminate the threat of copyright infringement. An NFT investment will always guarantee both the owner and the art creator that the respective work is protected.

While there have been a few complaints from artists that their work has been tokenized without their consent, however, experts believe this will soon be resolved. New features are continually being developed to improve NFT marketplaces.

For instance, the most popular NFT marketplaces check if the provided digital image already exists as NFT over the internet. At the same time, NFT creators have to sign an agreement specifying that they have full rights over the provided artwork.

However, you want to make sure of the legitimacy of your chosen content creators. Verify them online, before you promote their work through an NFT investment.

Which NFT trading strategies is best for you?

There is no golden NFT trading strategy to guarantee massive returns, but each investor has to examine and adopt a trading strategy suitable to the available funds.

At the same time, it’s important to set realistic expectations and don’t get disappointed when an NFT project doesn’t sell for the expected price. These projects rely heavily on market trends and marketing campaigns. Regardless of the chosen NFT trading strategies, you should always factor in the current state of the market.

Disclaimer: This article is for informational purposes only and should not be considered investment advice. NFTs are a high risk asset.

Frequently asked questions

Can you make money from NFTs?

Are NFTs a good investment?

What are the best NFT platforms?

What can I do with an NFT?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.