From deceitful ICOs to fake wallets, the cryptocurrency space is full of scams. Some prey on those uneducated in the ways of digital assets, while others disguise themselves as legitimate ventures, only to run off with the funds. That said, there’s a lesser-known scam prevalent in a variety of ways to rip one out of their money: masternode scams.

Masternode scams are harder to spot mainly because they’re not a blatant attack. They’re disguised as admissible proof-of-stake projects that promise a valid return on your crypto investment.

Put simply, proof-of-stake projects incentivize users to invest enough money into a project that they become a masternode. As a masternode, that user will earn a return on their investment. They’ll also have more say in the project’s network. It feels good to have power, no? That’s the pitch these projects provide.

However, while there are a few successful masternode projects, like DASH, many are simply a waste of time and money. Keep in mind that to become a masternode, one must invest a significant amount of their own funds into a token that may or may not hold its value. If you place a ton of money into a project, hoping to become a masternode, only for it to tank in price months later, you’ve lost out. This is worse if the other masternodes decide to cash out, dropping the price even further.

The point stands that most masternodes simply aren’t worth the investment. It’s not that they aren’t legitimate networks, more that they don’t stand for anything useful. These networks exist simply for their creators to earn quick and cash out, dropping early and later investors in the process.

If you’re looking to make money investing in cryptocurrency, there are better ways than a masternode. In this list, we’ll go over just that.

Cryptocurrency Trading as an Alternative to Masternode Scams

Arguably, the most efficient way to earn on your investment is to trade your cryptocurrency. This can be done on an exchange like Binance, Coinbase, Kraken, or many others. All one has to do here is create an account, input some credit card or banking information, and begin trading. Of course, it’s a little more complicated than that.

For one, there are multiple forms of cryptocurrency trading. There’s limit trading, margin trading, day trading, automated trading, trading based on different theories like the Elliott Wave Theory, and this isn’t even getting into futures or options trading.

Then, there’s also which application or exchange to trade on—centralized or decentralized. Peer-to-peer or exchange-based. It’s all different, and each caters to a different type of trader.

Cryptocurrency Analysis

If you feel like a decent trader, you might want to learn trading analysis. This breaks down into either fundamental analysis or technical analysis. The former is when the potential investor takes an in-depth look at the company behind the project, as well as the long-term prospects of the asset. For example, one might examine the team developing an asset, take a look at the whitepaper, ensure the group is transparent about their past work and if that ties into what they’re doing now, and more.

Technical analysis focuses more on price charts and trading volume. Essentially, the trader would keep an eye on the various charts available regarding the asset’s price history, its highs and its lows, its recent and long-term movements, any trends the asset price may follow, resistance and support levels, and so much more. This takes a lot of time and requires a trader to have vast financial knowledge. Many advanced traders have dedicated followings that pay to gain insight and make proper trades themselves.

Cryptocurrency Mining as an Alternative to Masternode Scams

Cryptocurrency mining is the act of utilizing one’s computer power to solve complex algorithms that validate transactions within a blockchain network. Essentially, in a proof-of-work network like Bitcoin, for example, cryptocurrency transactions bunch into a block. Once that block is full, those transactions need to be validated and accounted for. This is not only to store it on the public ledger but also to ensure there’s no double-spending happening here.

Those complex algorithms are math equations that solve to find the unique, 64-digit hexadecimal code that represents that block. Think of it as a serial code for each one. Once found, in the case of Bitcoin, at least, that block is then solidified and sent into the blockchain. From there, the finder is rewarded in Bitcoin, and more is released into the network.

However, while potentially hundreds of miners are searching for that hexadecimal number, there’s no point in rewarding the others for their efforts once the code is found. Only that first person sees a reward, and the rest are out of luck. This makes mining initially appear inaccessible, as those with the most power are the ones who will see rewards.

Mining Pools

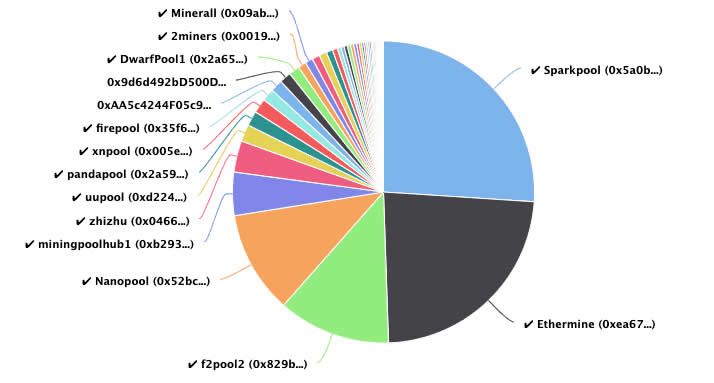

This is where mining pools come into play.

A mining pool is literally that: a pool in which tons of users will combine their power to solve for these unique hashes. This way, you’ll have much more of a chance at getting rewarded, though that reward will be much smaller, as it’s divided up between all of the pool participants.

It’s also worth noting that even participating in a pool has some pre-requisites. For one, you must have a wallet to store these assets in. Then, you must download some mining software like CGminer, before subscribing to one of these mining pools, have a powerful computer regarding your GPU. That’s not to mention fans for cooling, of course.

There are also specific GPUs one can purchase called ASICs that are streamlined for the mining process entirely. These are generally more expensive, but if you’re making a significant mining investment, they should be worth it.

It’s important to consider the fact that you might not make it big right away while mining. Expect a couple of hundreds of dollars a month at first, and note that you’ll have to pay increased power bills as well. Consider if mining is worth those extra monthly fees.

Decentralized Finance (DeFi) as an Alternative to Masternode Scams

Decentralized Finance is more of an emerging field than the previous two, but a fast-growing one at that. Thanks to Ethereum and other blockchain networks, we now have what are called dApps or decentralized applications. Think of these as traditional applications, only blockchain-based!

Content creators, gamers, bankers, gamblers, and more all utilize decentralized finance to make money in some way. Let’s take one of the crypto space’s most famous examples: CryptoKitties.

CryptoKitties is the dApp that pushed Ethereum gaming about as close to the mainstream as it has been. Similar to Neopets or Tamogachi, CryptoKitties is a website that allows you to breed unique kitties represented by tokens, also known as non-fungible tokens or NFTs. Non-fungible means non-interchangeable, essentially meaning that no kitty is precisely the same as another.

This means that each has its own value and can be sold for ETH. Some kitties might be worth less than others, but they can be bred into more worthy ones that can sell for tens of thousands at times. If that’s not a way to profit from crypto, I don’t know what is.

Other gaming projects are similar, involving an initial investment that can grow and eventually be sold to make more money. Gods Unchained is a card-battling app with the same concept. Each card is also an NFT, and players can earn some by participating in the network or purchase some with their own funds. The incentive is to beat other players, so it’s possible to sell some rare cards for a hefty profit.

Then there are banking dApps, which reward users for storing Ethereum or other assets within their wallets, similar to interest at a more traditional fiat bank. These applications also incentivize users by matching investments, awarding referrals, and more.

Social media dApps are another way to earn. Something like Steemit or D.tube, for example, reward content creators for creating value within the platform. Steemit is similar to Reddit, in that thoughtful or entertaining posts can be upvoted or tipped by users. Those funds then go to the author. The more insightful the content, the more they’re likely to receive donations. D.tube is like a blockchain-based YouTube, which provides a similar option only for video content instead.

Finally, we have gambling dApps. These are precisely what they sound like: gambling games like Blackjack and Slots, but utilizing cryptocurrency instead of fiat. Gambling dApps are some of the most popular ones out there, due to their accessibility and low effort required, but potentially high rewards – much like real gambling!

Working in the Cryptocurrency Space as an Alternative to Masternode Scams

Of course, if you’re looking for a more hands-on approach to cryptocurrency, you can always get a job in the space based on your existing skills. Are you a writer with a good understanding of crypto? Become a journalist or blogger within the space. Websites like our own hire content creators, editors, and writers of all sorts – all it takes is some drive and the desire to share that knowledge.

You can also learn to develop with Solidity or other blockchain-based languages, building decentralized applications like the ones mentioned above or even helping to develop new blockchains for different startups. Blockchain development is one of the fastest-growing skills around the world, and this exclusive knowledge is sure to net you a big paycheck.

If you have the means to hold significant amounts of cryptocurrency, you can participate in lending, earning interest on those you lend to. Users may borrow to have extra funds for their daily lives, while others might borrow to start trading.

That said, this is a riskier prospect for sure. For one, platforms are lacking on the insurance side of things. If whoever you’re lending to doesn’t have the funds to pay back, there’s not a lot you can do to get that money. Some platforms do have collateral or similar mechanisms, but it’s crucial to vet any website before committing to it.

Conclusion

Regardless, there is a variety of ways for users to make money in cryptocurrency that are much more reliable than masternodes. Some are certainly quicker, like day-to-day trading, but that can also be quite risky. A more reliable skill like blockchain development is the way to go for patient enthusiasts. All are better than masternode scams.

To learn more about avoiding scams, join us in our Telegram Trading Community.