The largest cryptocurrency exchange globally in 2025, Binance is a great resource for spot traders but equally reliable and feature-packed for those interested in trading crypto futures. With support for multiple profit amplifying and risk management tools, trading crypto on Binance Futures is seamless — although not without risk. This guide shows you how to trade crypto futures contracts on Binance like a professional.

Methodology

BeInCrypto experts tested several leading platforms to identify the top alternatives to Binance for futures trading. The evaluation was based on a comprehensive set of criteria including security measures, asset diversity, fee structures, unique platform features, and global availability. Here are their top picks, each distinguished by specific strengths:

Kraken

- Global reach: Available in over 190 countries.

- Asset variety: Supports more than 95 cryptocurrencies for futures trading.

- Competitive fees: Maker fees at 0.02% and taker fees at 0.05%.

- Unique feature: Advanced trading capabilities with customizable charts.

Bybit

- Worldwide availability: Accessible in 180+ countries.

- Diverse trading instruments: Provides 390+ cryptocurrencies.

- Low fees: Offers 0.01% for makers and 0.06% for takers.

- Distinctive feature: Mutual insurance available for futures trading.

OKX

- Accessibility: Services 160+ countries.

- Wide range of assets: Offers over 320 cryptocurrencies.

- Fee structure: Charges 0.02% for makers and 0.05% for takers.

- Special feature: Includes a bot marketplace for automated trading solutions.

The methodology for selecting these platforms included assessing each for its feature set that caters to both novice and experienced traders, ensuring they provide a secure and efficient trading environment. For a deep dive into BeInCrypto’s verification methodology, follow this link.

- Unpacking futures trading on a centralized exchange

- Crypto futures vs. crypto options: Understanding the details

- How to trade on futures on Binance

- How to trade crypto on Binance Futures: Step-by-step guide

- Advanced trading strategies: risk management ideas to follow

- Trading Binance Crypto Futures using bots

- An actual trading example (hypothetical BTC price)

- Advanced trading tools for professionals

- Crypto futures trading on Binance: What are the alternatives?

- Kraken

- Bybit

- OKX

- Can beginners trade futures?

- Frequently asked questions

Unpacking futures trading on a centralized exchange

Futures contracts are standard agreements to buy and sell a specific cryptocurrency at a predefined price at a set time in the future. While spot trades are executed immediately and are concerned with ownership, futures trading is all about speculating on the future price of a token.

With futures came controversies:

Crypto futures as a price-defining metric

If studied properly, crypto futures can help track the price movement of the concerned asset.

Here is how:

- When people agree to purchase/ sell an asset at a predefined price in the future, it indicates what the market thinks about the asset.

- Crypto futures introduce the funding rate, where long holders pay a premium to the short position holders in a bullish market in order to keep the future contract rates steady. A positive funding rate associated with futures contracts hints at market bullishness.

Futures contracts aren’t just tools associated with the crypto derivatives market. They can also impact the spot markets. It is important to note that the crypto ETF space also has futures-specific exposure, with ProShares Bitcoin Strategy ETF being one of the more notable funds. The intertwined world of crypto futures and crypto ETFs also highlights the rise of institutional investors in crypto futures, who are slowly gaining crypto market exposure without the need to hold decentralized assets directly.

Note that for retail investors, futures are a highly risky business:

Crypto futures vs. crypto options: Understanding the details

Crypto futures and crypto options are two popular derivatives instruments. Both play significant roles in cryptocurrency trading but serve different strategic purposes for traders on platforms like Binance (where they are listed under the same tab).

Crypto futures

- Definition: Crypto futures are contracts to buy or sell a specific cryptocurrency at a predetermined price at a specified future date. They are obligatory contracts, meaning that once entered, both parties must execute the trade on the settlement date.

- Usage: Commonly used for hedging risks or speculating on future price movements of cryptocurrencies. They allow leverage trading, which can amplify both gains and risks.

- Market impact: Futures can significantly impact market analysis as they influence the underlying asset’s price, particularly near the contract’s expiry date.

Futures are a tricky market, especially for beginners. My take is to walk before you run. Cut your teeth on spot markets before introducing leverage to the equation. When or even if you start adding leverage, keep leverage low.

Remember high leverage equals high risk, and low leverage equals lower risk. During a sideways market, the temptation will be to leverage up and go hard, but perhaps more patience is needed. Wait for the market to come to you. Sometimes, less is more, and you don’t need to be trading every tiny move in the market.

Lark Davis, crypto analyst and the Wealth Mastery founder: BeInCrypto

Crypto options

- Definition: Options give the holder the right, but there is no obligation, to buy (call option) or sell (put option) the underlying crypto asset at a predefined price before the contract expires.

- Usage: Traders use options for risk management or speculative purposes. Bitcoin options trading allows for more strategic flexibility and can be less risky compared to futures because the trader can choose not to exercise the option.

- Cost: Options involve a premium the buyer must pay the seller, which is influenced by factors including the underlying asset’s volatility and the time remaining until expiration.

Key differences

- Obligation: Futures contracts require the parties to fulfill the contract at maturity, whereas options provide the choice to execute the contract.

- Risk profile: Futures generally involve higher risk and potential reward, given the leverage and binding nature of the contracts. Options limit risk to the premium paid but can offer substantial upside potential in a favorable market.

- Strategic use: Futures are often preferred by those looking to hedge or take full advantage of leveraged positions. Options are favored for their flexibility and the ability to manage risks more precisely.

How to trade on futures on Binance

If you are interested in Binance crypto futures, it is important to understand how they work before you begin trading. On Binance, you can trade quarterly futures (delivery) or perpetual futures. Trading on the world’s largest crypto exchange has its own set of benefits, especially when it comes to choices. Here is how each futures trading type works fundamentally:

Quarterly futures

Binance offers futures contracts that expire quarterly — in March, June, September, and December. These are fixed-expiration contracts and do not come with the baggage of funding fees. The contracts settle on the expiration date and are ideal for traders who prefer hedging and speculating with a clearer timeline.

Perpetual futures

Perpetual futures contracts have no expiration date. This way, traders can hold onto positions indefinitely on the condition that the margin is managed correctly. Plus, perpetual futures traders must also keep track of the periodic funding rates. These contracts are flexible and help navigate the market changes better.

USD-M futures

Quarterly and perpetual futures settled in stablecoins like Tether are termed USD-margined futures. The stability quotient is pegged to the USD. In 2025, Binance offers USDT and even USDC-settled futures contracts.

Coin-M futures

These futures contracts are settled in the crypto that the contracts actually represent. For instance, a Bitcoin-specific futures contract is settled in Bitcoin.

How to trade crypto on Binance Futures: Step-by-step guide

Now that we’ve covered some of the key information, let’s dive into the practical steps. Here’s how to trade crypto on the Binance Futures platform.

Setting up an account

Before you can start trading crypto futures on Binance, you must take the following steps.

- Create and verify a trading account on Binance. This process requires KYC verification.

- Fund your account.

- If you are venturing into the futures space for the first time, you must select the terms and conditions, participate in a quiz, and then agree to enable futures trading.

- Keep a close eye on the fee structure. This is often set at 0 for the maker (limit order) and 0.017% for the taker (market order).

Keep track of orders where you can get better deals by utilizing the exchange’s native BNB crypto.

Setting up a trade

Here’s what the entire Binance Futures crypto trading process looks like:

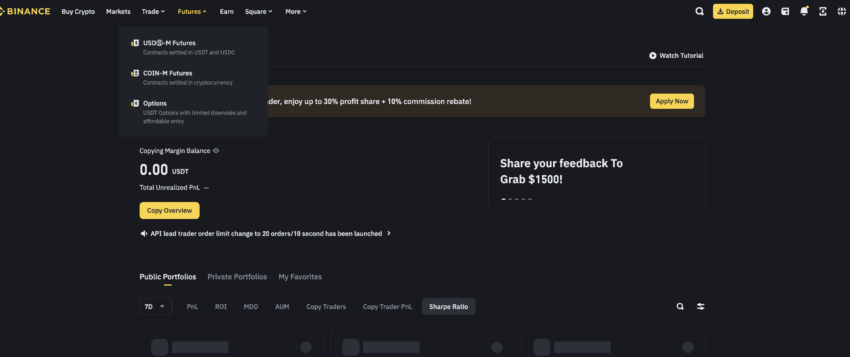

- Start by heading over to the “Futures” tab right at the top of the dashboard.

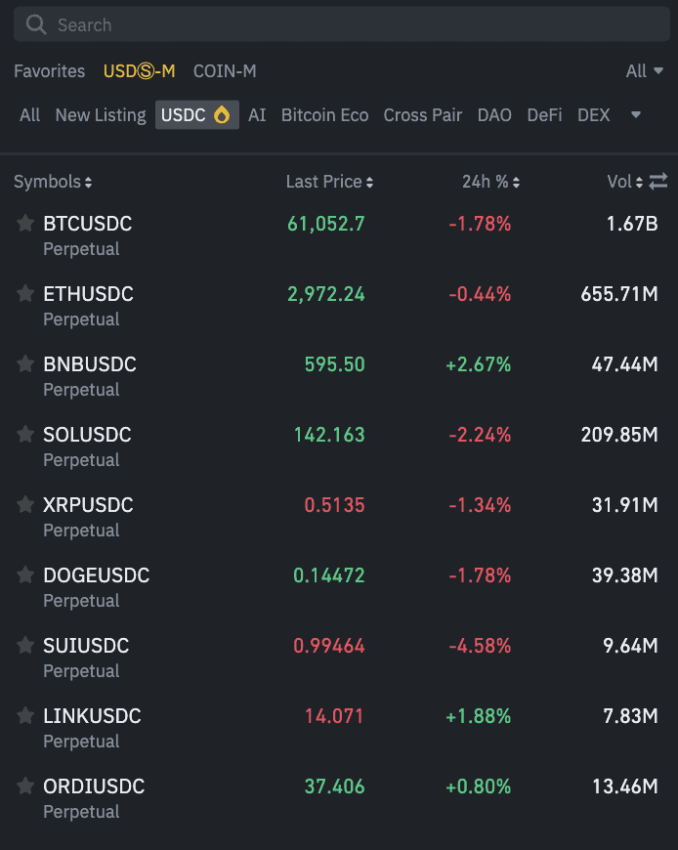

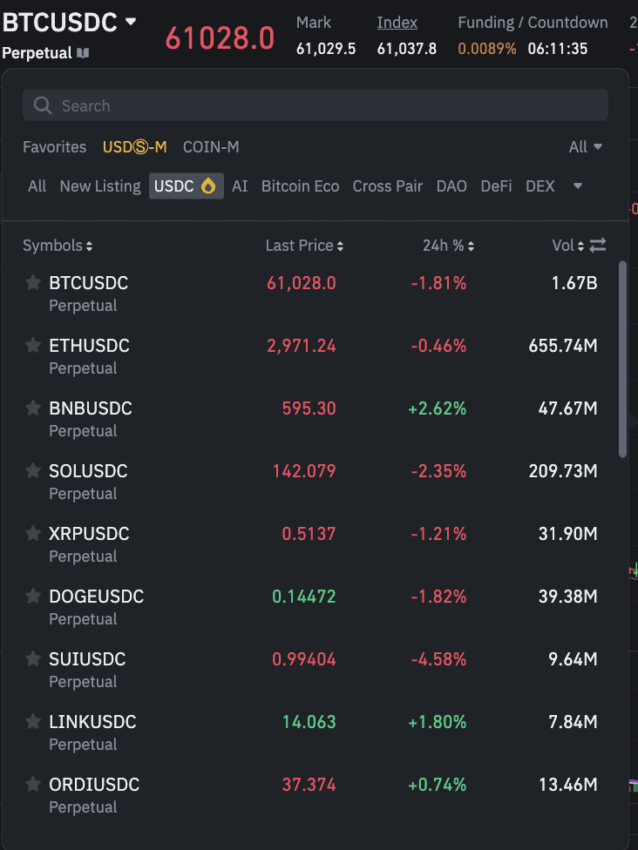

- You can quickly choose between the USD-M and Coin-M futures contracts first.

- Scroll and pick from the list of assets. In most cases, you will find perpetual futures.

- For any given pair, you can check the funding rate, mark price, 24-hour volume, and other insights before proceeding.

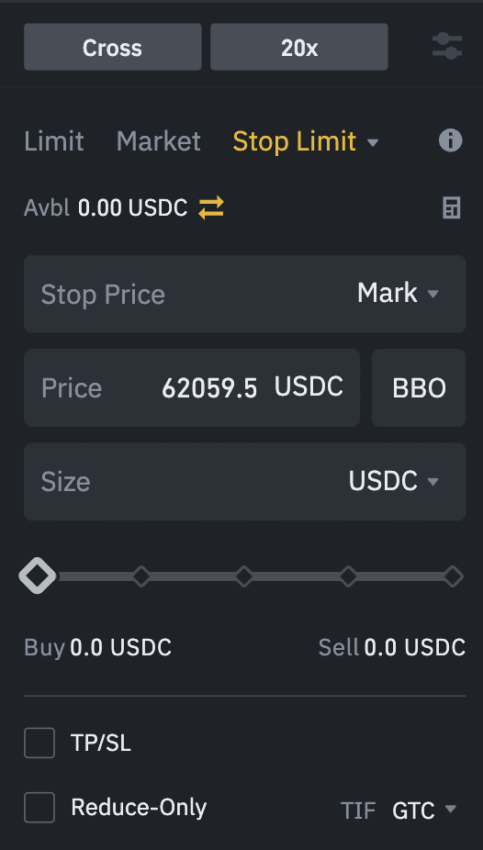

- On the Binance Futures platform, you can add the order value and select the type of bet you want to move with — long and short — depending on market conditions. If you place a long order, you are betting that the market will remain bullish in the future.

Once all the order elements are handled, you must review them and confirm the trade to place an order.

Did you know? Open interest plays a crucial role in futures trading. Open interest refers to the outstanding futures contracts that have not been settled. For traders, tracking open interest is important because it indicates the liquidity and depth of a particular market. High open interest suggests that many players are involved, which generally leads to better price discovery and more stable markets.

Note: You can trade Binance Futures for all the top crypto assets, even via the mobile application. You should, however, choose Binance Pro and not Binance Lite for margin trading in the crypto derivatives market.

Advanced trading strategies: risk management ideas to follow

The Binance crypto exchange allows you to play around with order types, especially when implementing adequate risk management tools. Here are the types that can help you stay on the safer side of the trade:

Stop loss and take profit orders

- Stop loss orders: This tool allows you to set a specific price at which your position will automatically close to minimize potential losses.

- Take profit orders: Similar to stop loss, you can set a price at which your position will automatically close to secure profits.

Trailing stop loss orders

This feature adjusts the stop price at a fixed percent below the market price as the market price rises. If the market price dips, the stop loss price doesn’t change. The market order is submitted when the stop price is hit.

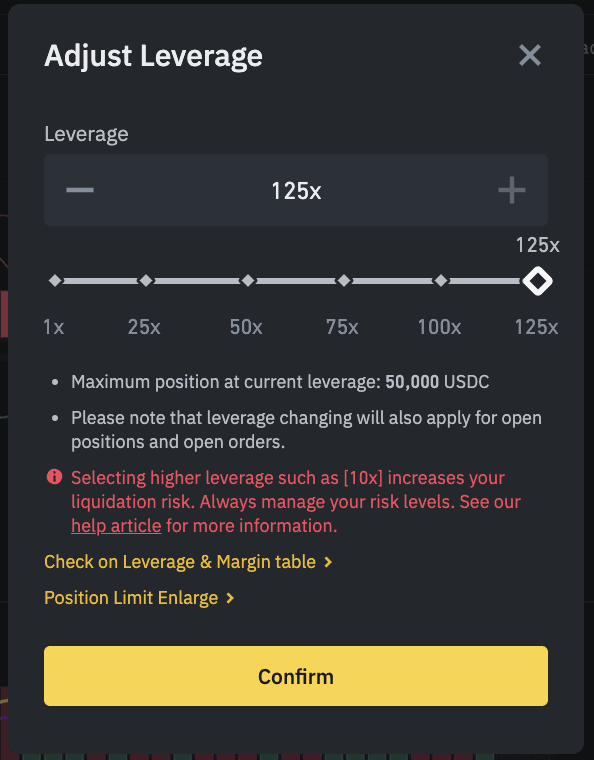

Leverage and how to adjust the same

Futures trading allows you to trade with leverage, meaning you can open positions larger than your existing capital. Binance offers leverage from 1x to 125x. It’s crucial to understand that higher leverage increases both potential returns and potential risks.

Risk and reward calculation

You can play around with the dashboard settings to choose the perfect risk-reward ratio for your trades. Here is how you can set these on Binance specifically:

Identify entry and exit points:

- Entry point: Determine the price at which you plan to enter the trade.

- Exit point (profit target): Determine the price at which you intend to take profit.

Determine stop-loss level:

- Stop loss: Decide the price level at which you will exit the trade to minimize losses if the market moves against your position.

Calculate risk and reward:

- Risk: The difference between the entry point and the stop loss level. This represents what you are risking on the trade.

- Reward: The difference between the profit target and the entry point. This represents the potential profit of the trade.

Compute the risk/reward ratio:

- Ratio: Divide the potential reward by the potential risk. For example, if you stand to gain $300 from a trade and are risking $100, your risk/reward ratio is 3:1.

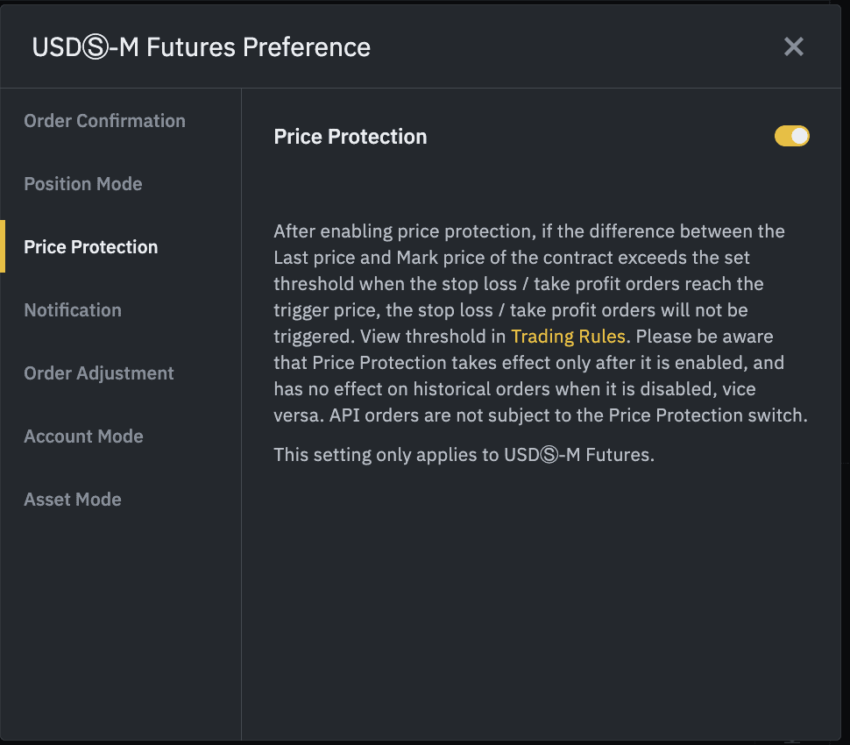

Besides the mentioned advanced risk management strategies, you can also set futures-specific trading preferences. These include selecting and customizing the following elements:

- Asset mode

- Price protection

- Order adjustment support

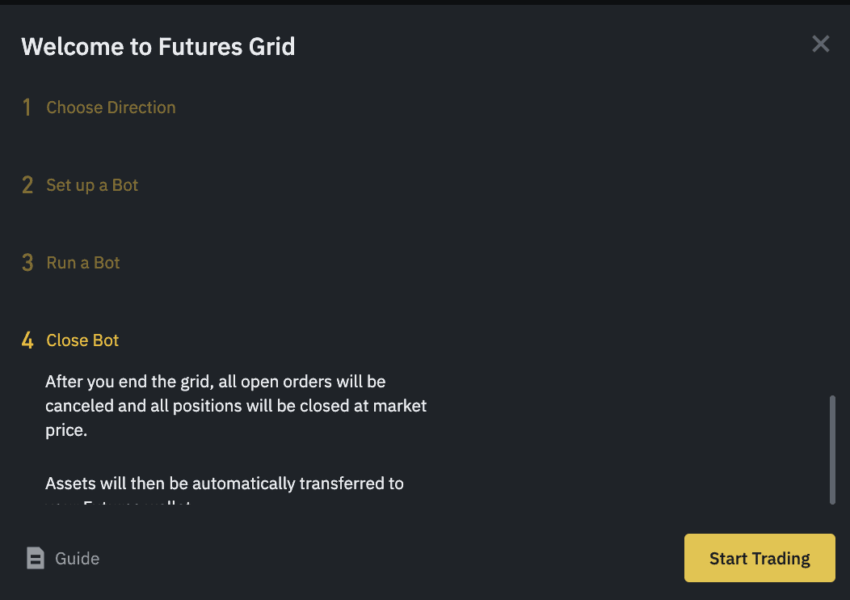

Trading Binance Crypto Futures using bots

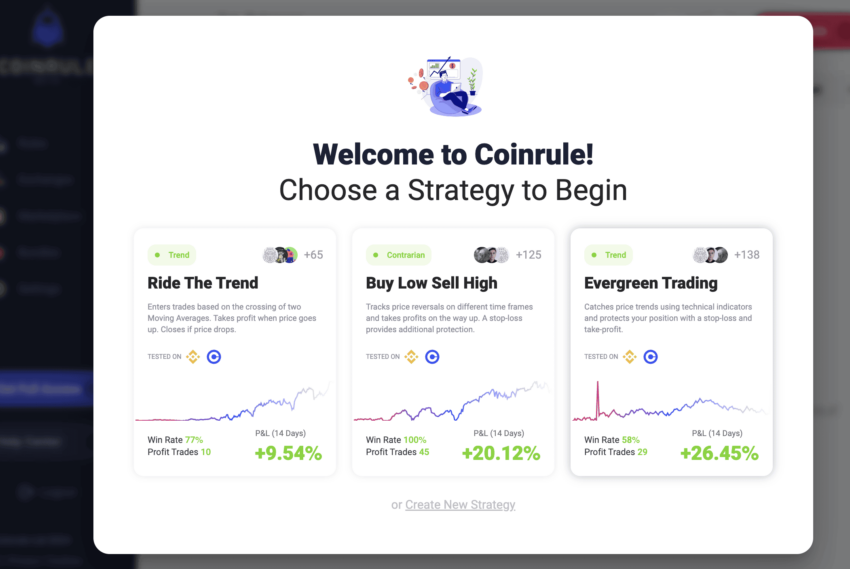

Trading crypto futures on Binance needn’t be hard. You can even use trading bots specific to platforms like CryptoHopper, 3Commas, and Coinrule. And while each one is good enough, Coinrule and 3Commas are the easiest ones to use and test, courtesy of the following features:

- Access to backtesting and simulation

- Advanced API security (will discuss APIs while mentioning the process)

- Access to multiple exchanges, including Binance

- Tons of learning resources

Even experts believe in the potential of AI bots:

But wait, why would you want to use bots even?

- Automation: Bots can execute trades 24/7 without human intervention.

- Speed: Bots can react to market conditions instantly.

- Strategy Implementation: Bots allow for complex strategies that can be backtested and optimized.

- Emotion-free Trading: Automated trading eliminates emotional decisions, maintaining discipline.

- Pre-built strategies: Bots make market making, arbitrage trading, mean reversion, and more easy

- AI Support: This trading bot platform offers access to an AI assistant in case you need help.

Plus, you can connect Coinrule to Binance and start slow, using the demo account first.

How to use Coinrule? or any other trading bot platform

Here is a quick guide to help you make sense of using Coinrule for trading Binance Crypto Futures: (The API process is rather uniform for most trading bot ecosystems)

- Create an Account on Coinrule:

- Visit the Coinrule website and sign up for an account.

- Choose a plan that suits your needs. Note that some features might be limited to higher-tier plans.

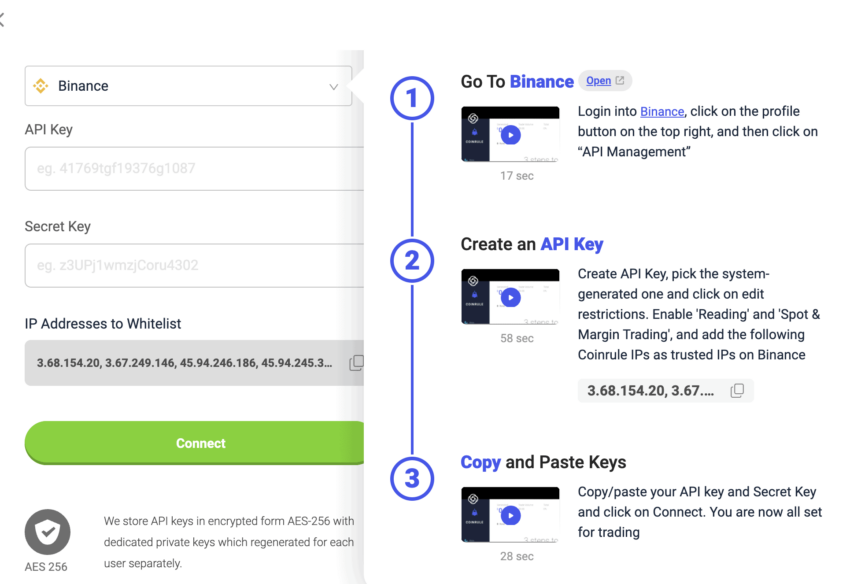

- Connect Binance Account to Coinrule:

- Log in to your Binance account.

- Navigate to the API Management section.

- Label a new API key appropriately (e.g., “Coinrule”).

- Enable trading permissions (including futures) and copy the API key and secret.

- In Coinrule, go to the “Exchanges” section and connect your Binance account by pasting the API key and secret.

- Create a Trading Rule:

- Go to the “Create Rule” section in Coinrule.

- Choose the type of rule you want to create (e.g., if/then rule, strategy-based rule).

- Define the conditions for the rule (e.g., if Bitcoin price crosses above the 50-day moving average, buy a futures contract).

- Set the actions (e.g., buy/sell, stop-loss/take-profit levels).

- Define the execution parameters (e.g., frequency, time period).

- Backtest Your Strategy:

- Use the backtesting feature to test your strategy against historical data.

- Analyze the performance metrics to ensure your strategy is robust.

- Deploy the Rule:

- Once satisfied with the backtest results, deploy the rule.

- Monitor the bot’s performance in real time and make adjustments if necessary.

- Monitor and Optimize:

- Regularly review the bot’s performance.

- Make necessary tweaks to the strategy based on market conditions and performance data.

Here are some of the examples of how your trades will be executed:

- Rule Trigger:

- Condition: Bitcoin price crosses above the 50-day moving average.

- Action: Buy a Bitcoin perpetual futures contract with 10x leverage.

- Stop-loss and Take-profit:

- Stop-loss: 5% below the entry price.

- Take-profit: 10% above the entry price.

- Execution Frequency:

- Check the condition every 5 minutes.

This is the level of automation you can achieve using trading bots.

“One of the downsides of using bots is that you’ll be paying more trading fees because you’re trading more actively.”

James, Creator at Money DG: YouTube

An actual trading example (hypothetical BTC price)

So, how do all these elements of the Binance Futures trading platform work? Here is an example:

Initial setup and account preparation:

- Trader’s equity: $10,000.

- Risk tolerance: 2% of equity per trade, which is $200.

- Desired leverage: 10x on one of the leading crypto exchanges, Binance.

Market conditions:

- BTC current price: $60,000 per BTC (hypothetical)

- Anticipated direction: Bullish, expecting the price to rise.

Understanding and monitoring funding rates

- Funding rates: If the funding rate is 0.01% every eight hours, monitor this as it affects the cost of holding the position. The trader will need to pay or receive this depending on the net position regarding whether longs pay shorts or vice versa.

Monitoring open interest

- Check open interest as part of the BTC futures market analysis. Rising open interest with rising prices could indicate strong market support for the price increase.

Trade management and execution

- Monitor the trade: Continuously check the trade against market conditions, funding rates, and open interest. Adjust stop-loss or take-profit orders as needed to react to market movements or news.

Closing the position

- Position closing: The position will automatically close if the price hits the stop-loss or take-profit levels. Manual closure might be necessary based on futures trading strategies or to avoid negative impacts from upcoming funding rate changes.

Advanced trading tools for professionals

If you have previously traded crypto futures, here are some of the more advanced elements found on Binance to help you take your trading performance to the next level:

Best bid offer (BBO)

- BBO automatically aligns your order with the best bid or ask price on the Binance crypto exchange, enhancing order execution speed.

- Example: If you’re looking to buy 0.133 BTC in a bullish market scenario where BTC is priced at $60,000, setting a BBO buy order would automatically find and execute at the lowest available ask price in real-time, ensuring you get the best possible entry price without manually hunting for it.

Queue Options

- Queue orders allow you to place your order at the best or a specified best price on the same market side.

- Example: For selling 0.133 BTC, using a Queue 1 option would place your sell order at the highest current bid price, optimizing your exit strategy by positioning the order where it is most likely to be filled quickly at a favorable price.

Counterparty options

- Counterparty options place your order at the best or a specified best available opposite market price, facilitating quicker executions as taker orders.

- Example: If you decide to close your position of 0.133 BTC and the current bid price is significantly lower, using Counterparty 1 could immediately lock in a sell at the highest available bid price, reducing the spread cost typically encountered in fast-moving markets.

Reduce only orders

- This tool ensures that an order will only reduce your position, not accidentally increase it, which is crucial for risk management in futures trading.

- Example: If you have set a take-profit on your 0.133 BTC position at $61,500, but the market is fluctuating rapidly, a reduce-only order guarantees this take-profit order doesn’t inadvertently become a new buy order if triggered multiple times.

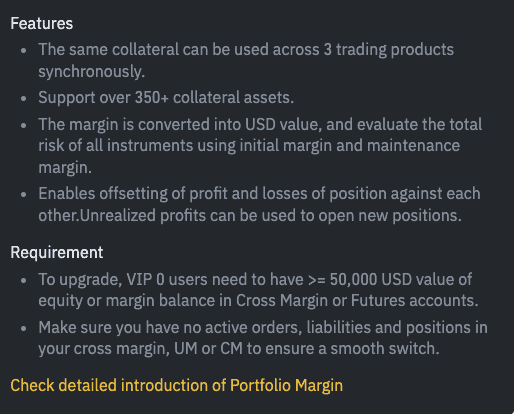

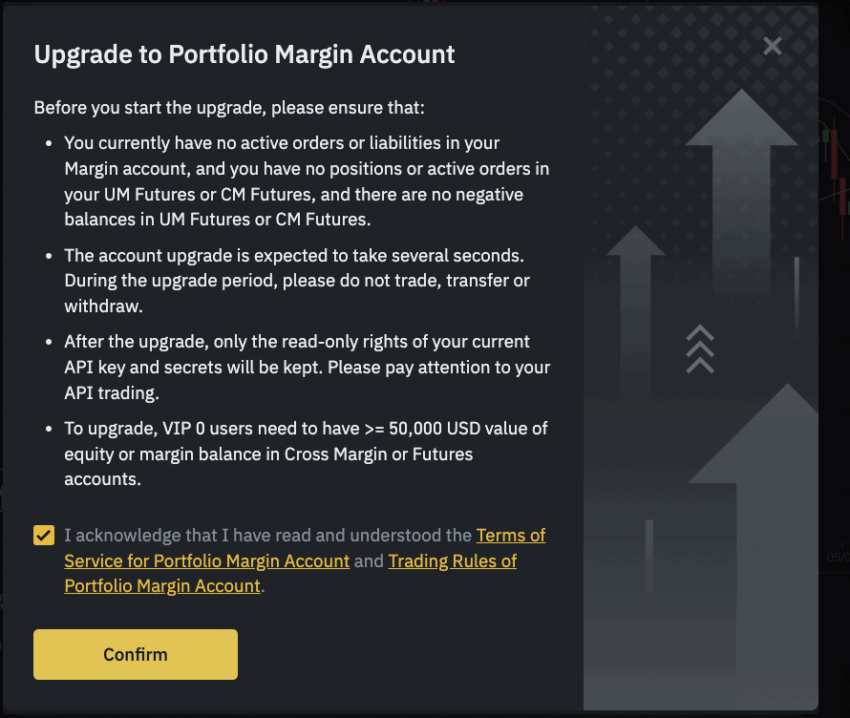

Cross collateral

- Use assets from your spot wallet as collateral for futures trading, which increases your leverage trading options without requiring additional capital.

- Example: Instead of liquidating part of your spot BTC holdings to meet margin requirements for a new futures position, you could use the value of your BTC directly as collateral, maintaining your exposure to BTC while also pursuing additional futures trading opportunities.

Cross funding tab

- This feature allows for the management of funding across different collateral types, optimizing the use of capital in diversified trading strategies.

- Example: As a trader holding multiple types of cryptocurrencies, you can manage and adjust the collateral across different assets (e.g., using ETH to fund BTC positions) based on their performance and your trading needs. This is particularly beneficial for institutional investors in crypto futures who need to manage large and diverse portfolios efficiently.

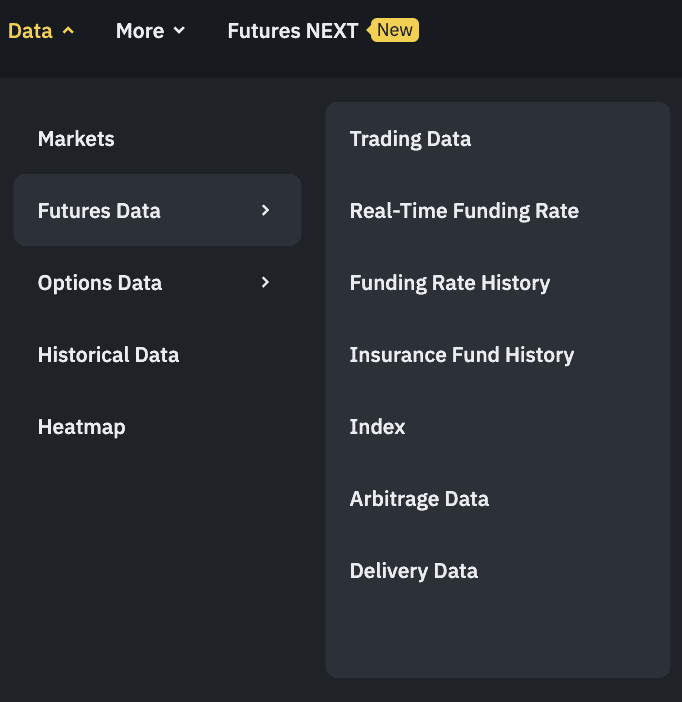

Futures data

- Funding rate: A crucial element in Binance futures that helps align the perpetual contract prices with the spot market prices. Traders either pay or receive this rate, which is recalculated every eight hours.

- Premium index: Adjusts the funding rate based on the difference between the futures contract price and the mark price.

- Historical funding rates: Accessible on Binance, offering insights into past rates that can guide futures trading strategies.

- Usage: Understanding these metrics is essential for traders involved in cryptocurrency derivatives trading, providing a strategic edge in predicting future price movements and managing trades.

Here is a quick take on reading funding rates:

Adam Cochran, Partner at Cinneamhain Ventures (CEHZ): X

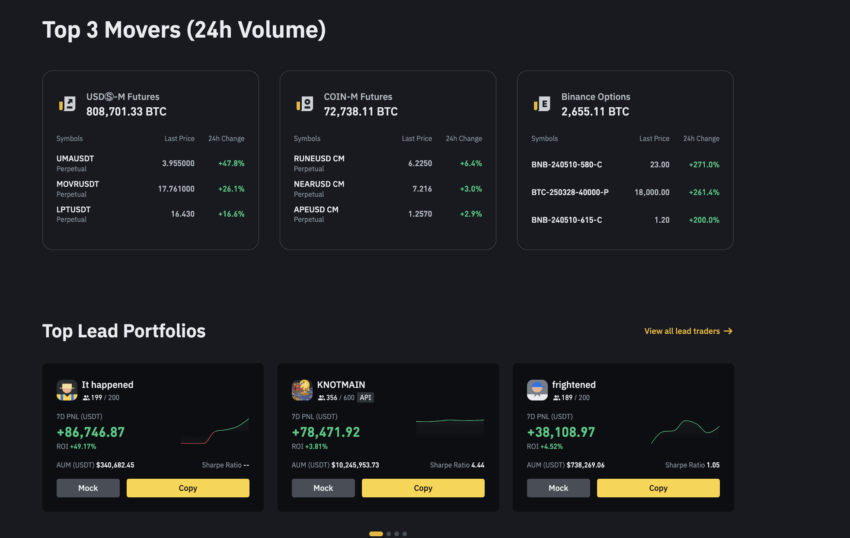

Copy trading support

- Functionality: Allows traders to copy the positions of experienced traders directly on the Binance platform, making it ideal for those new to futures trading for beginners.

- Benefits: Enables less experienced traders to benefit from the strategies of veteran traders, enhancing learning and potential profitability in the crypto derivatives market.

- Considerations: Essential for risk management in futures trading, as traders must choose whom to follow carefully based on past performance and trading style compatibility.

Trading bots

- Integration: Binance supports the use of automated trading bots which can execute trades based on predefined conditions.

- Advantages: Bots support continuous trading without the need for constant manual supervision, making them the ideal tools for leveraging opportunities in a 24/7 market like crypto futures trading.

- Strategy implementation: Bots can be programmed for various futures trading strategies, including technical analysis setups, trend following, and arbitrage opportunities, which are crucial for both institutional and retail investors.

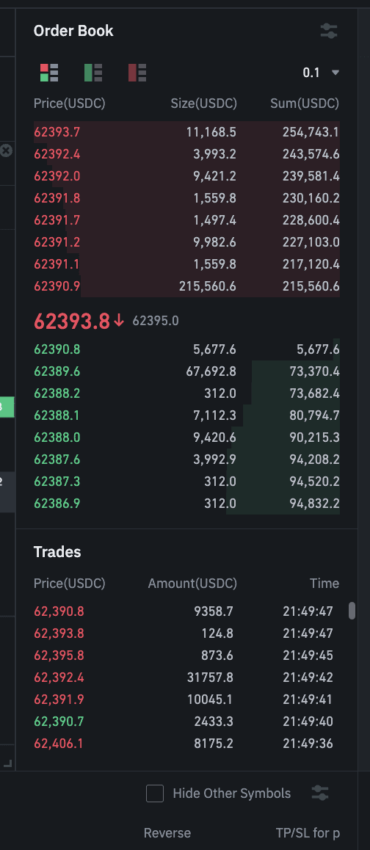

These strategies and sections work regardless of the USD-M and Coin-M futures trading form you choose. Note that to get the most out of BBO and queue orders, you need to understand how an order book works with crypto futures trading platforms.

As mentioned earlier, the crypto derivatives market on Binance extends beyond Bitcoin. You can trade all the top coins, with varying leverage, choice of settlement — delivery or perpetual, and the choice of an asset to settle in — USDT, USDC, or the contract-specific coin.

Crypto futures trading on Binance: What are the alternatives?

Binance offers one of the best trading experiences for crypto futures. Yet, if you are concerned about trading regulations, geographical restrictions, and other elements, here are a few Binance alternatives to consider:

Kraken

- Long-standing reputation with a focus on security.

- A high number of supported cryptocurrencies for futures trading.

- Offers leveraged tokens with no liquidation risks.

- Maximum leverage is capped at 50x, which may be lower than some competitors.

- The KYC process can be extensive.

Bybit

- Low trading fees with additional discounts for higher volume traders.

- Offers a high degree of leverage for those looking to maximize potential returns.

- Advanced trading tools and a user-friendly interface enhance trading experiences.

- Not available in the U.S. and some other countries due to regulatory restrictions.

- No fiat deposit options; only cryptocurrency deposits are supported.

OKX

- Extensive range of supported cryptocurrencies and fiat currencies.

- Advanced features like copy trading and bot marketplace enhance trading capabilities.

- 24/7 customer support and a robust security framework.

- Does not serve U.S. customers and has limited fiat withdrawal options in many countries.

- The platform's complex features may be overwhelming for new users.

Can beginners trade futures?

Futures trading for beginners can be tricky. However, if you’re still keen to get started, trading crypto using Binance Futures is an excellent option, as the dashboard itself is self-explanatory and beginner-friendly. Regardless of your expertise and skill level, it is important to stay aware of the regulations and risk management techniques in order to keep your account and funds safe. However, if you are risk averse and just starting your crypto journey, it is advisable to focus on more traditional investment vehicles, such as crypto ETFs, rather than diving straight into the riskier world of futures.

Frequently asked questions

Is Binance futures good for beginners?

How to make $100 a day on Binance?

How do you trade in futures crypto?

How to take profit in Binance futures?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.