Spot Bitcoin ETFs arrived following official SEC approval on Jan.11, 2024. But now that they are here, what next? How should you trade a Bitcoin ETF? Should you get exposure to one of the ETFs by tracking the legacy markets or purchase some BTC instead? Continue reading to see how you can be ready to benefit from this new investment option. We cover trading strategies and the best ways to buy and store your Bitcoin following the spot ETF approval.

KEY TAKEAWAYS

➤ Always evaluate Bitcoin ETFs, their management fees, and the credibility of fund managers before trading.

➤ Choose reputable exchanges and brokerages for secure trading and efficient liquidity management.

➤ Track price action, set alerts, and use portfolio tools to manage investments effectively.

➤ Bitcoin ETFs are subject to capital gains tax; proper reporting is essential for compliance.

How to trade a Bitcoin ETF

If you want to focus on diversifying your portfolio by specifically taking a shine toward the Bitcoin ETFs, here is a step-based approach that you can follow:

In a nutshell:

- Choose a Bitcoin ETF and evaluate the provider’s credibility and fee structure.

- Check the exchange where your chosen ETF trades for liquidity information.

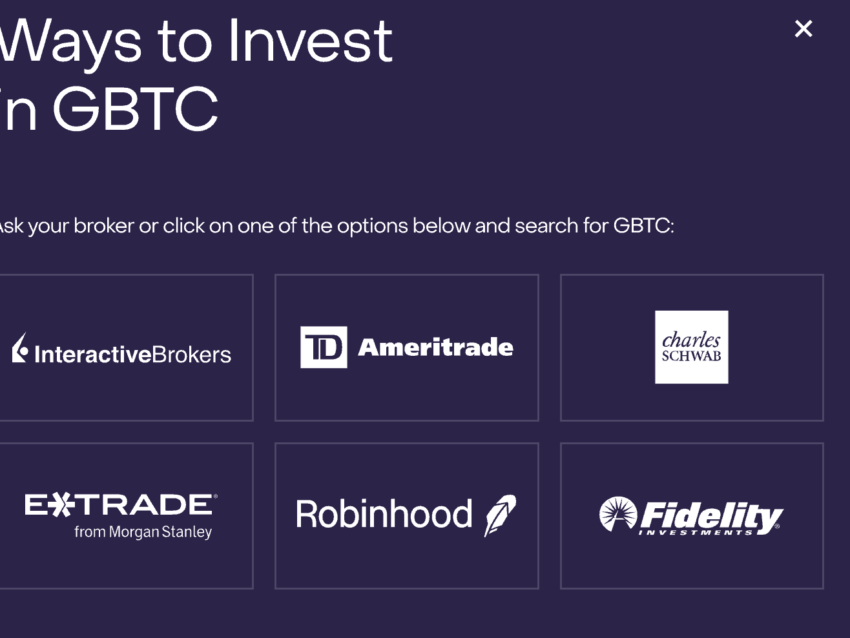

- Register with a brokerage like Interactive Brokers or Fidelity to trade.

- Transfer funds via ACH, wire transfer, or check for account activation.

- Use brokerage tools to research ownership, social sentiment, and price trends.

- Execute buy/sell orders and set alerts based on market prices and conditions.

- Use portfolio tracking tools like TWS or mobile apps for ongoing management.

- Review capital gains tax requirements and use tax forms like 1099-K.

Step 1: Read about the ETFs and choose the right one

To get started, you must first decide about the Bitcoin ETF you want to trade. Notably, trading Bitcoin Strategy ETFs was possible even before the Spot Bitcoin ETFs were approved. Some of the top options include BITS or the Global X Blockchain and Bitcoin Strategy, WGMI or the Valkyrie Bitcoin Miners ETF, and more. These ETFs are listed on top global exchanges — NASDAQ, NYSE, and more.

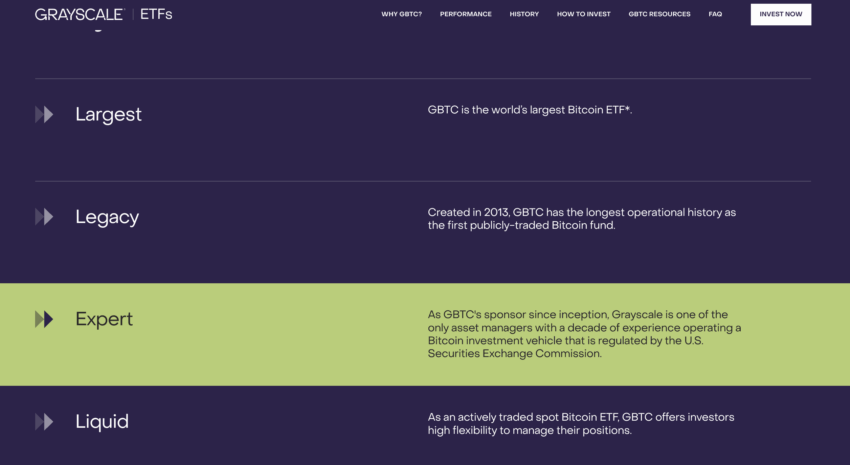

However, if you want to trade Spot Bitcoin ETFs, it is important to check the credibility of the ETF provider along with the year ETF managing fee structure.

Also, review these aspects of the ETF provider before making the trade:

- Bitcoin price tracking accuracy

- Liquidity

- Reputation of the fund manager

- Custodial arrangements

- Underlying assets

- Investment strategies employed by the managers

- Market capitalization and AUM

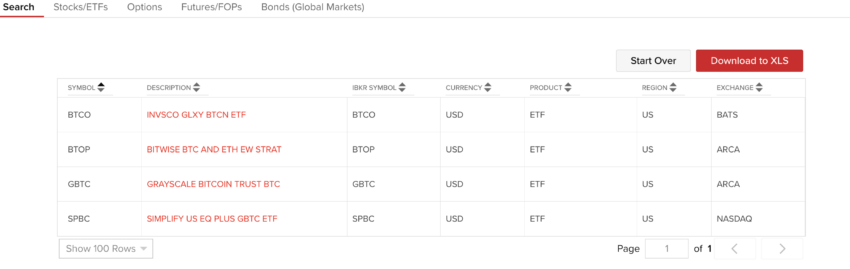

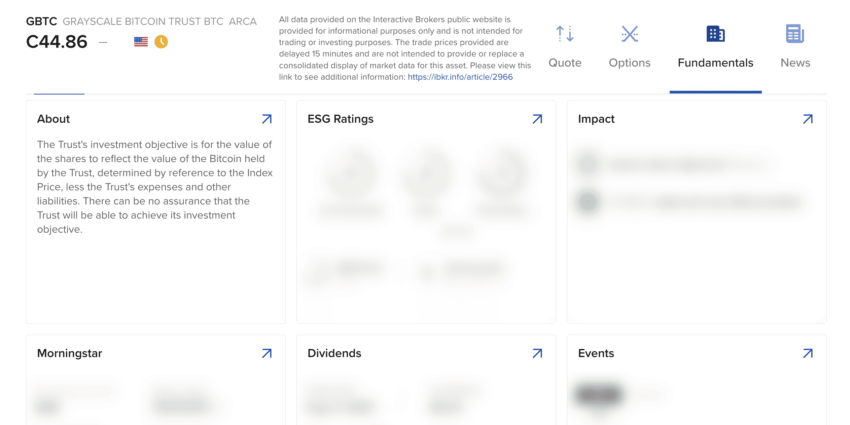

Once the research part is done away with, we can proceed further. For this trading-based explainer, we shall focus on Grayscale Bitcoin Trust (GBTC) and a handful of other ETFs. Notably, GBTC charges the highest management fee at 1.5% on the investments.

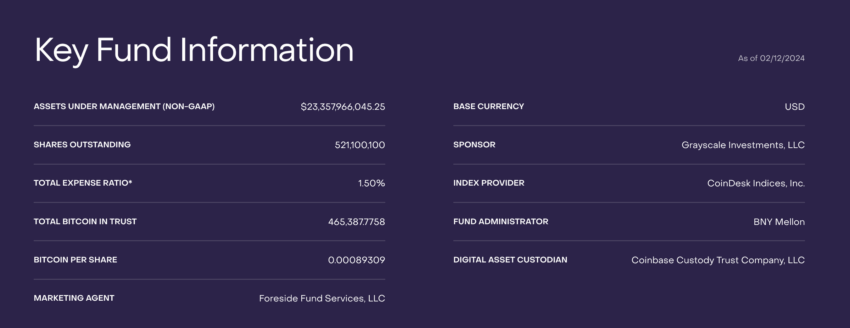

You might also want to check the fund info, either by visiting the website of the find provider or whenever you open an account on a brokerage firm. The focus should be on tracking who the Fund Administrator is, the base currency, the amount of BTC per share, and more. This gives clarity and a sense of transparency.

Step 2: Choose the exchange

Even though this step is optional, it is always advisable to check the exchange your choice of spot ETF is trading on. Even though the trades will happen via the brokerage firm, the nature of exchange often influences the liquidity and trading accessibility.

Here is the list of ETFs and the exchanges they are currently trading on:

- Franklin Templeton Digital Holdings Trust (EZBC): 0.19% fee, trading on NYSE Arca.

- Bitwise Bitcoin ETF (BITB): 0.20% fee, trading on NYSE Arca.

- Ark 21Shares Bitcoin ETF (ARKB): 0.21% fee, trading on Cboe BZX.

- iShares Bitcoin Trust (IBIT): 0.25% fee, trading on NASDAQ.

- VanEck Bitcoin Trust (HODL): 0.25% fee, trading on Cboe BZX.

- Fidelity Wise Origin Bitcoin Fund (FBTC): 0.25% fee, trading on Cboe BZX.

- WisdomTree Bitcoin Fund (BTCW): 0.25% fee, trading on Cboe BZX.

- Invesco Galaxy Bitcoin ETF (BTCO): 0.25% fee, trading on Cboe BZX.

- Valkyrie Bitcoin Fund (BRRR): 0.25% fee, trading on NASDAQ.

- Grayscale Bitcoin Trust (GBTC): 1.50% fee, trading on OTC Markets and can be viewed on the NYSE Arca.

Step 3: Open a brokerage account

To trade a Bitcoin ETF, you need to open a brokerage account. As of February 2024, the top choices include Robinhood, Interactive Brokers, Fidelity, and more.

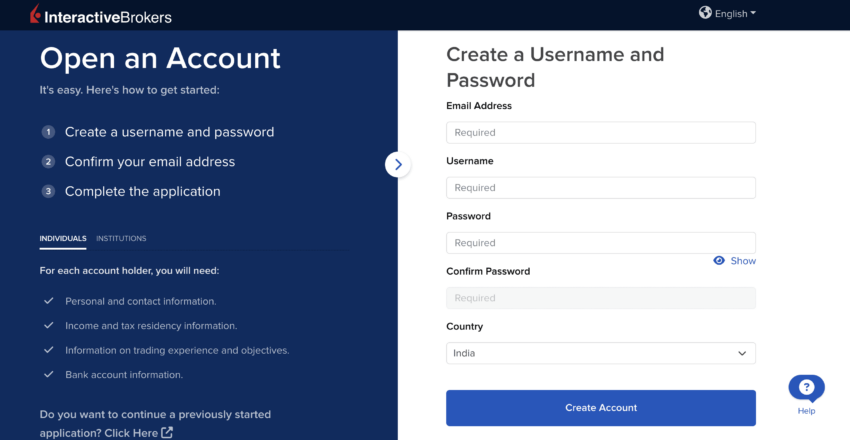

Let us start by exploring Interactive Brokers.

Once you are on the home page of the brokerage firm of your choice, you can simply hit the “Open an account” tab to get started.

As Bitcoin Spot ETFs are legacy instruments, opening a brokerage account to trade these ETFs requires personal info, tax and residency information, bank account information, and other details. You can only start trading once the brokerage account is verified.

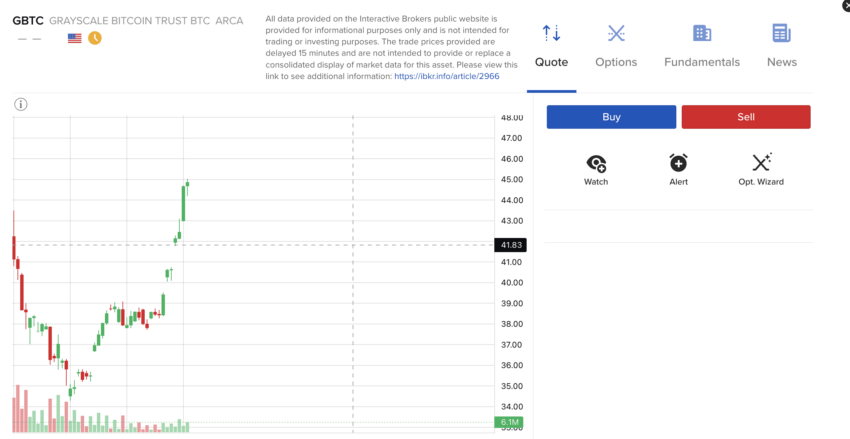

You can even conduct a manual search to look for the Bitcoin ETF to trade.

Step 4: Fund the trading account

Once you have opened a brokerage account, you need to fund the same via ACH transfers, wire transfers, or checks to get started. Do note that the account verification process might take anything between a few hours to a week.

Step 5: Research and track the ETFs closely

The brokerage platform, Interactive Brokers, in our case, also offers a host of ETF-based research options to the users. From tracking ownership and competitors to social sentiments, dividends, and more, opening a brokerage account comes with a host of research-specific benefits.

Step 6: Place a trade

Brokerage firms have standard options to place a trade. Like any other legacy asset, you can place Buy and Sell trades at market prices or set price alerts.

It is advisable to track the price action of Bitcoin and the concerned ETF using platforms like TradingView to zero in on specific price levels to purchase or sell Bitcoin ETFs.

Before you proceed with a trade, always check if the brokerage firm has its own commissions in place. For Interactive Brokers, there is an active Commission Rebate Program in place, which might change or evolve depending on the Broker’s business model.

Step 7: Monitor investments

Once you have started buying and selling Bitcoin ETFs, you might want to focus on monitoring investments. Most brokers offer direct, integrated portfolio monitoring options, with Interactive Brokers offering a Portfolio Analyst or the TWS or Trader Workstation to get you up to speed with portfolio tracking.

You can even install the mobile app(s) related to the broker to keep comparing prices of ETFs, conduct additional searches, and do more with your investment-specific proclivities.

Other ways to monitor Bitcoin ETF trades and investments could be connected to the brokerage account to apps like Delta Investment. Do note that apps like Delta also support tracking of actual BTC, and we have discussed this at length later in this guide.

Step 8: Consider tax implications

As a person looking to trade Bitcoin ETFs or even invest in them it is necessary to keep track of the tax implications. Do note that Bitcoin ETFs are treated as traditional stocks and ETFs and, therefore, are eligible to be taxed per the long-term capital gains bracket for longer investing durations. However, for short-term trades, they would be taxed per the short-term gains slab. This bracket can be anywhere between 10% to 37%, depending on the income bracket.

Long-term gains are taxed anywhere between 0% to 20%, depending on the income slabs. You might want to use the Form 1099-K to fill in the tax obligations. Notably, brokerage firms like Interactive Brokers can easily provide the tax reports that you need to furnish for tax-loss harvesting, which is applicable to Bitcoin ETFs.

Indirect trading and investing ideas

For months prior to the SEC’s ETF approval, interested parties and investors were chomping at the bit, awaiting the potentially game-changing news. Most expected BTC to pump following ETF approval.

Yet once ETFs were approved, the price of BTC was corrected and began to fall.

So what to do now? How should you trade these Bitcoin ETFs on a market level? We’ve compiled a few strategies to help you prepare for what comes next.

1. Buy and store bitcoin

People expected the spot approval to send BTC prices to the sky. However, the reverse of that happened initially, and BTC was corrected by close to 8%, as per BeInCrypto price data.

Yet, as of Oct. 28, 2024, BTC is closing in on the $69K mark, which makes it an optimistic bet. Therefore, if you had purchased BTC right near the spot ETF launch, at the corrected prices, you would now be sitting on a sizable profit.

If not, you can still purchase BTC, especially with the halving around and with the ETFs starting to see massive inflows.

➤ The first practical step you must take is to purchase Bitcoin. Doing this means you can buy BTC before the possibly impending supply shortage and benefit from the increased demand. As the demand increases, the price increases, and you can sell into the market, potentially for a decent profit.

“The relationship between the price of an ETF share and its underlying asset value is policed by institutional investors who make money by arbitraging the ETF’s share price and underlying fund asset values.”

– Wang, Joseph (2021). Central Banking 101. Amazon Digital Services LLC

Pre-approval drama and price action

However, if you purchased BTC before the Bitcoin ETF approval, expecting the eventual price rise, the SEC drama might have helped.

A day before the actual approval, the SEC’s Twitter (X) handle was hacked with a confirmation. As soon as the hack news broke, BTC’s price corrected — along with several altcoins.

A day later, the SEC released a PDF mentioning the actual approval, which also was taken down. And while even that pushed the prices higher, the effects weren’t as pronounced, courtesy of the pre-approval drama.

Amid all the drama, BTC, which climbed as high as $48,572, is trading at $42,578 as of Jan. 15, 2024, down almost 5%, week-on-week.

A focus on ETH, post-Bitcoin ETF approval

A discussion focusing on ETH might seem counter-intuitive in the wake of BTC ETF approval. However, with VanECK, ARK, Grayscale, and other reputable names already pushing for spot ETH ETFs, buying Ether could be a good investment strategy in 2024.

And while BTC initially corrected following the news of ETF approval, ETH flew up by over 13%, as per BeInCrypto data.

Where to buy and trade BTC after the ETF approval

Naturally, if you are in the market for bitcoin, you will need somewhere to purchase it. Here are our top choice exchanges to buy BTC and prepare for Bitcoin ETF.

Firstly, if reliability and security concerns give you sleepless nights, you may want to try out a credible and regulated exchange like Coinbase.

1. Coinbase

If you have a host of cryptocurrencies lying idle in your wallet(s), OKX, with support for diverse trading pairs (and low fees!), might be the answer.

If safety and security are of utmost importance to you, consider checking out Kraken. (Although, the $3 million bug exploit in June 2024 somewhat dented Kraken’s erstwhile relatively secure image.)

3. Kraken

If you don’t want to spend extra money on your first purchase, Paybis might be an option worth considering.

4. Paybis

Where to store BTC post-ETF approval

Acquiring Bitcoin leads to the need for secure storage. Below, you’ll find a selection of crypto wallets suited to safeguarding your BTC.

Advanced wallets can be confusing. But what if there was a versatile option that promises zero complexity and exclusive rewards? As a crypto newbie, COCA is a BTC wallet that outshines the competition.

If crypto wallet security is your top priority, choosing Zengo to store your BTC could be smart. The wallet is a non-custodial offering with no seed phrase vulnerability; instead, it utilizes facial recognition software to ensure that only the wallet owner can access their digital asset portfolio.

What if there was one BTC wallet that could help you make fiat conversions, earn interest on the stored BTC, and even borrow funds — all while you remain the HODLer? If all that seems exciting, check YouHodler’s offering.

3. YouHodler

Offline BTC is safe BTC. If you are one of those old-school BTC HODLers prepping for the ETF approval or any other long-haul, GridPlus, boasting top-of-the-line hardware, steals the show.

4. GridPlus

2. Develop a strategic investment plan for ETFs

After you have bought BTC, you must develop an investment or trading strategy. Note that steps one and two can be switched around, depending on your timeliness. If you’re uncertain about your investment decisions, consider seeking advice from a Registered Investment Advisor (RIA) specializing in cryptocurrencies or ETFs.

Also, with the prices expected to correct (as of mid-January 2024) — considering the formation of a top — a strategic investment plan is more than important. And if you plan on holding the ETFs instead of simply going for BTC, here are the names you should know.

Additionally, considering your investments’ tax implications is essential when trading the Bitcoin ETF. Tax-advantaged accounts, such as Individual Retirement Accounts (IRAs) or 401(k)s, can significantly optimize your investment strategy.

By using these accounts, you may benefit from tax advantages, including tax-deferred growth or tax-free withdrawals, depending on the account type.

Be aware of the tax implications of your investments, such as capital gains tax. Consult a tax advisor to optimize your tax strategy and reduce crypto tax.

Lastly, managing crypto trading emotions is a big part of investing. Some people opt for RIA’s to mitigate the potential to trade on a whim. Nevertheless, it is still important for you to find a perfect balance between your emotions and investments.

3. Assess your investment/trading goals and risk tolerance

An often overlooked aspect of investing is creating realistic investment goals and determining risk tolerance. If you are unsure how to structure your portfolio so that it aligns with your investment goals and risk tolerance, there are a few time-tested strategies that you can use.

➤ Perhaps the most famous is the “60-40 portfolio,” a traditional asset allocation strategy. In a 60-40 portfolio, an investor allocates 60% of their portfolio to crypto, stocks, or equities and 40% to bonds or fixed-income securities.

If you want to take a shot at trading Bitcoin ETFs, you can allocate 10 to 20% of the fixed-income portfolio to Bitcoin ETFs.

The reasoning behind this strategy is that the assets that fall under 60% are considered riskier but likely to have a significant price performance. The assets that fall under 40% are considered safer and pay you to own them.

In the event of a market downturn, you shouldn’t have to take a haircut (a significant loss) by selling any assets. You can still make money from dividends or interest, mitigating risk.

It’s worth noting that this strategy has variations, such as the “70-30 portfolio” or “80-20 portfolio.” However, in general, the idea is to allocate a portion of your portfolio to assets that could benefit from a thriving market and assets that pay you in intervals so that you aren’t necessarily worried about a market downturn.

Another aspect of spot BTC approval is to keep focusing on other Bitcoin ETFs like the futures ETF, miner ETF, strategy ETF, and more. While holding BTC is advisable, you can even follow these ETFs and take exposure depending on your risk appetite.

4. Start DCA-ing Bitcoin

Earlier, we suggested buying and storing BTC immediately as the first step toward trading the Bitcoin ETF, indirectly. Individuals who are not able to buy BTC instantly should consider implementing a dollar-cost averaging strategy instead.

Rather than timing market entries precisely, this strategy spreads out investment so that risk is distributed more evenly. You can invest a fixed amount of money regularly, regardless of price fluctuations.

Also, as some analysts are predicting more correction at Bitcoin’s counter, Dollar Cost Averaging could be the best way forward if more correction comes in.

This approach can be a prudent way for investors to manage risk and avoid the pitfalls of trying to time the market. Many people anticipate a large influx of institutional investors hopping on the Bitcoin ETF train, potentially leading to a high demand for BTC.

However, high demand for bitcoin could lead to increased prices and a drop in supply, making it difficult to acquire for retail investors. Therefore, if BTC is experiencing a correction, it might just be a good time to gain exposure.

5. Get your portfolio tracking underway

It’s common to want to monitor your BTC portfolio frequently, but this can pose a security risk to your wallet. Therefore, it’s advisable to utilize a portfolio tracker for safe and effective crypto portfolio management.

A cryptocurrency portfolio tracker is a crucial resource for exploring the of digital assets. Do note that not just for BTC, portfolio tracking using third-party tools is also a reliable way to track Bitcoin ETF trades, made using brokerage firms like the Interactive Brokers.

The first tracker is more than an alpha. From personalized analytics to real-time insights, this should be your go-to tracker if you wish to prepare a diversified portfolio.

The following tracker lets you sync wallets, discusses market trends, and delivers one smooth interface. All of your coin stats are listed under one convenient roof.

Coinstats

6. Monitor market trends and news events

Now that the Bitcoin ETF is approved consider the potential impact on the market. Prices may surge due to increased accessibility for institutional and retail investors. As part of the trading strategy associated with legacy Bitcoin ETFs, you need to track the inflows and outflows to even identify the possible BTC price moves.

And there might also be further dips, depending on how key players dump their assets. Decide in advance if you plan to hold your BTC, take profits, or adjust your portfolio allocation.

Continuously monitor crypto and financial news sources for updates on ETF progress. Be prepared to adjust your strategy based on new information. It is also a good idea to develop a contingency plan for different scenarios. Have exit strategies in place to protect your investments.

Trade-exiting strategies for Bitcoin and Bitcoin ETFs

Periodically review your investment strategy and adapt it based on changing market conditions and regulatory developments.

Here are a few exit strategies that traders often employ:

- Stop-loss orders: Implement stop-loss orders to limit potential losses in case of a significant market downturn. Determine at what price point or percentage loss you’re willing to sell your Bitcoin holdings to protect your capital.

- Take profit targets: Set price targets at which you plan to take profits if the market experiences a significant uptrend. This allows you to lock in gains and reduce exposure to potential price corrections.

- Diversification: Consider diversifying your portfolio by holding a mix of assets beyond Bitcoin. This can help spread risk and reduce the impact of adverse price movements in a single asset.

- Buy the hype and sell the news: Accumulate Bitcoin holdings leading up to the event when anticipation is high, but be prepared to sell or take profits once the news is confirmed to capitalize on short-term price fluctuations. (This moment might have passed, but others still hold).

Also, if you wish to trade Bitcoin ETFs using brokerage platforms, putting alerts or using a watchlist for tracking prices is advisable.

Benefits and risks of investing in and trading a Bitcoin ETF

Many people were excited about the ETF approval and posting it on social media. However, there may be both risks and benefits you should remain aware of.

| Benefits | Risks |

| Easy access to Bitcoin for traditional investors without managing wallets or exchanges. | Bitcoin’s price is highly volatile, which could potentially lead to significant price fluctuations. |

| Regulatory oversight provides security and legitimacy for investors. | ETFs depend on institutions and custodians, and therefore, poses some operational and security risks. |

| Traded on stock exchanges, meaning relatively high liquidity, and smoother buying/selling experience. | Market price may not match the net asset value (NAV), affecting returns. |

| Tax advantages like deferring capital gains until shares are sold. | Reliance on ETF providers means investors don’t control the security of their Bitcoin. |

| Can avoid issues with private keys, relying instead on the ETF’s security measures. | Some platforms may restrict or delay access to Bitcoin ETFs, causing potential missed opportunities. |

Bitcoin ETFs: The icing on the crypto cake

When it comes to investing, there are multiple ways to profit. In other words, the Bitcoin ETF itself is the icing on the cake, but not the cake itself. The ETF approval marks yet another milestone for Bitcoin, cryptocurrency, and web3 as a whole. All of this is important to note as you prepare to trade a Bitcoin ETF.

Remember that nothing is guaranteed in volatile decentralized markets. Thus, you should never invest more than you can afford to lose and always have clear exit strategies in place.

Frequently asked questions

What is the minimum investment required for trading a Bitcoin ETF?

How are bitcoin ETFs different from traditional ETFs?

Are there any restrictions on who can invest in a Bitcoin ETF?

Can I use leverage when trading bitcoin ETFs?

Is a bitcoin ETF risky?

How do I invest in a bitcoin ETF?

Are bitcoin ETFs profitable?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.